ch 25-29 credit & budgets (ppt)

advertisement

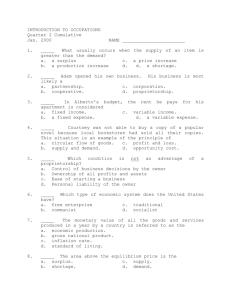

PERSONAL FINANCE/BANKING CREDIT, BUDGET, AND CHECKING ACCOUNTS Chapters 25, 26, 28, 29 What is Credit? Chapter 25 • Credit - an agreement to get money, goods, or services now in exchange for a promise to pay later. • Creditor – Person who lends money or provides credit. • Debtor – The one borrowing money or using credit. • Interest – A fee that creditors charge for using their money. Who uses Credit? Chapter 25 • Consumer Credit - A type of credit used by people for personal reasons. • Commercial Credit – Credit used by businesses. • Credit Rating – The measure of a person’s ability and willingness to pay debts on time. Types of Credit Chapter 25 • Charge Account - Common type of short-term and medium-term credit often offered by dealers or stores. • Revolving Account – Allows you to borrow or charge up to a certain amount of money, such as $3,000, and pay back a part of the total or the entire balance for each month. • Installment Loans – Loans repaid in regular payments over a period of time. (student loans, personal loans, and home improvement loans) Short Answer • What are the factors that determine a person’s credit rating? • How can using credit cards be very costly to the consumer? Applying for Credit Chapter 26 • Credit Bureau - An agency that collects information about you and other credit consumers. • Credit Limit – The maximum amount you can spend or charge on a credit account. • Cosigner – Is responsible for a loan if you don’t make the payments. Using Credit Chapter 26 • Down Payment - A portion of the total cost that you pay when you purchase a product. • Principal – The amount of money you still owe and on which the interest is based. • Secured Loan – The loan is backed by collateral. • Unsecured Loan – The loan is not backed by collateral. • Annual Percentage Rate (APR)– Determines the cost of your yearly credit. Using Credit (cont.) Chapter 26 • Finance Charge - The total amount it costs you to finance the loan stated in dollars and cents. • Variable Rate – The rate will change when interest rates in the banking system change. • Cash Advance – Borrowing money on a credit card rather than use it to make a purchase. • Grace Period – Amount of time you get to pay off a debt. • Garnishment of Wages – When a creditor takes all or part of your paycheck. • Repossess – To take back collateral. Short Answer • What are the five C’s of credit (explain each)? • Why is having good credit necessary in today’s economy? Planning a Budget Chapter 28 • Money Management - The process of planning how to get the most from your money. • Budget – A plan for using your money in a way that best meets your wants and needs. • Income – The actual amount of money you earn during a given time period. • Deductions – Amounts that are taken out of your pay before you receive your paycheck. Lifestyle Costs Chapter 28 • Gross Pay - The total amount of money you earned for a specific time. • Net Pay – Your gross pay minus deductions. • Withholding – Subtracting taxes from a paycheck to be forwarded to the government. • Expenditures – Food, rent, clothing, ect. Lifestyle Costs (cont.) Chapter 28 • Fixed Expenses – Expenses occurring regularly and are regularly paid. • Variable Expenses – Expenses that fluctuate or are inconsistent. • Budget Variance – The difference between how much you planned to spend and how much you actually spent. Short Answer • List the 5 steps in creating a budget. Checking Account Basics Chapter 29 • Demand Deposits - Another term for checking accounts because each check demands a that bank release money on demand. • Interest-bearing Account – Account that earns interest on your account’s balance. • Signature Card – A record of your signature used by the bank to verify your identity. • Overdrawing – Writing checks for more money than you have in your account. Account Services Chapter 29 • Overdraft Protection – A line of credit for overdrawn checks. • Stop Payment – An order for a bank not to cash a particular check. • Debit Card – Similar to a credit card but money is taken directly from your checking account. • Check Register – A checkbook log where you keep track of all transactions. • Endorsement – The signature of the payee on the back of the check. Bank Reconciliation Chapter 29 • Bank Statement - The bank’s record of all your transactions in your checking account. • Canceled Checks – Checks you’ve written that have been cashed. • Bank Reconciliation – The process of seeing whether your records agree with the bank’s records. • Outstanding Checks – Checks that have been written but not yet cashed.