Chapter 2 - COST TERMS, CONCEPTS, AND CLASSIFICATIONS

advertisement

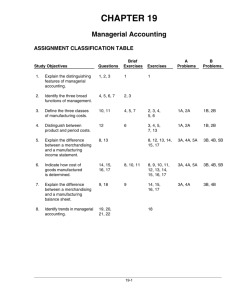

ACCOUNTANCY 2203 REVIEW WORKSHOP SINDHU BALA OVERVIEW OF COST CATEGORIES FOR A MANUFACTURING FIRM All costs incurred by the firm must be accounted for in its financial statements MANUFACTURING COSTS Direct Labor (DL) Direct Materials (DM) Overhead (OH) Indirect Materials Indirect Labor Other NON-MANUFACTURING COSTS Marketing or Selling Costs Administrative Costs MANUFACTURING COSTS 1. Direct Materials (DM) Materials that are consumed in the manufacturing process and physically incorporated in the finished product Materials whose cost is sufficiently large to justify the record keeping expenses necessary to trace the costs to individual products MANUFACTURING COSTS 2. Direct Labor (DL) Labor time that is physically traceable to the products being manufactured Labor time whose cost is sufficiently large to justify the record keeping expenses necessary to trace the costs to individual products Example: Direct labor for manufacturing Honda Accords Line workers, robot operators, painters, assembly workers Any labor probably not included in direct labor? Factory janitors, factory supervisors, factory secretaries KEY ISSUES IN DETERMINING DIRECT LABOR Is idle time generally considered as direct labor? Why or why not? Usually not. It is not usually due to one product, hence it is not traceable What are the typical fringe benefits an assembly line worker receives? Health insurance, pension plan, disability insurance Is the cost of fringe benefits for the assembly line workers generally considered direct labor? Usually yes, the costs can be traced KEY ISSUES IN DETERMINING DIRECT LABOR When an assembly line worker works overtime, he/she is paid a regular wage plus an overtime premium. Would most companies treat his/her regular wage as a direct labor cost? Yes, the amount of time an employee works can be traced to the products. What about the overtime premium? Treated as OH, cannot be traced to a specific product. MANUFACTURING COSTS 3. Manufacturing Overhead (OH) All of costs of manufacturing excluding direct materials and direct labor a. Indirect Materials (IM) – Materials, used in the manufacturing of products, which are difficult to trace to particular products in an economical way Glue, nails, cleaning supplies b. Indirect Labor (IL) – Labor, used in the manufacturing of products, which is difficult to trace to particular products in an economical way Wages for maintenance workers, factory supervisor’s salary, idle time MANUFACTURING COSTS C. All other types of manufacturing overhead Depreciation on machinery, depreciation on factory building, factory insurance, utilities for factory NON-MANUFACTURING COSTS 1. Marketing or Selling Costs – Costs incurred in securing orders from customers and providing customers with the finished product Sales commissions, costs of shipping products to customers, storage of finished goods, depreciation of selling equipment (cash register) 2. Administrative Costs – Executive, organizational, and clerical costs that are not related to manufacturing or marketing CEO’s salary, cost of controller’s office, depreciation on administrative building. CLASSIFICATION EXERCISE Classify the following cost items Depreciation on factory building Depreciation on office equipment Property tax on finished goods warehouse Wages paid to forklift operator in finished goods warehouse Wages paid to forklift operator in factory Wages paid to welders when welding equipment is not working Paper used in textbook production Paper used in central office computer Wages paid to assembly line workers Maintenance cost for machines OTHER COST CONCEPTS Product Costs or Inventoriable Costs – costs assigned to products that were either purchased for resale (merchandising firm or retailer) or manufactured for sale (manufacturing firm) When products are sold, product costs are recognized as an expense (cost of goods sold or COGS). The costs of unsold products remain in inventory and are not expensed (i.e. not deducted from revenue in calculating net income) Period Costs – costs that are not product costs and that are associated with the period in which they are incurred Period costs such as selling and administrative costs are expensed (i.e. deducted from revenue in calculating net income) in the period they are incurred PRODUCT COSTS VERSUS PERIOD COSTS Product costs include direct materials, direct labor, and manufacturing overhead. Cost of Goods Sold Inventory Period costs are not included in product costs. They are expensed on the income statement. Expense Sale Balance Sheet Income Statement Income Statement QUICK CHECK Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. E. Sales commissions. COSTS RELATED TO DECISION MAKING Opportunity Costs - costs when taking one action requires giving up the opportunity to earn profits from a different action Nike Inc. has limited production capacity. What would be Nike’s opportunity cost of accepting a special order from the military for combat boots? If Nike accepts the special order, they may not be able to produce enough product for other sales. So, Nike would lose the profit from the other sale. COSTS RELATED TO DECISION MAKING Incremental Costs or Differential Costs – additional costs incurred when choosing a certain course of action over another (Note that incremental costs can include opportunity costs) What would be Macy’s incremental costs of expanding its fragrance department and shrinking its accessories department? The costs of stocking and staffing the new fragrance area, opportunity costs of lost profit from the decrease in sales of accessories COSTS RELATED TO DECISION MAKING Incremental Benefits or Differential Benefits – additional benefits reaped when choosing a certain course of action over another What would be Macy’s incremental benefits of expanding its fragrance department and shrinking its accessories department? Profits Macy’s expects to earn on the new fragrances it displays/stocks Sunk Costs – Costs that have been incurred and that are not affected by any current/future action What would be considered sunk cost if Macy’s decides to expand its fragrance department and shrink its accessories department? Depreciation on the building, cost of the building COST FLOWS IN A MANUFACTURING COMPANY 3. 4. Inputs such as labor and capital equipment are also incurred to make the product. The costs of all the inputs used in the manufacturing facilities are recorded in WORK IN PROCESS INVENTORY As products are finished, they are moved to finished goods warehouse and their costs are recorded in FINISHED GOODS (FG) INVENTORY COST FLOWS IN A MANUFACTURING COMPANY RAW MATERIALS INVENTORY Beg. Bal. - RM Materials used in Production (DM) Materials Purchased End. Bal. - RM WORK IN PROCESS INVENTORY Beg. Bal. - WIP Cost of Goods Manufactured DM (COGM) DL OH End. Bal. - WIP Beg. Bal. - FG COGM End. Bal. - FG FINISHED GOODS INVENTORY Cost of Goods Sold (COGS) THE INVENTORY EQUATION Beginning Inventory + Additions to Inventory = Ending Inventory + Items Removed from Inventory The inventory equation allows us to put together the following schedules: Schedule of Total Manufacturing Costs (of the period) Schedule of Cost of Goods Manufactured QUICK CHECK If your inventory balance at the beginning of the month was $1,000, you bought $100 during the month, and sold $300 during the month, what would be the balance at the end of the month? A. $1,000. B. $ 800. C. $1,200. D. $ 200. $1,000 + $100 = $1,100 $1,100 - $300 = $800 QUICK CHECK Beginning raw materials inventory was $32,000. During the month, $276,000 of raw material was purchased. A count at the end of the month revealed that $28,000 of raw material was still present. What is the cost of direct material used? A. B. C. D. $276,000 $272,000 $280,000 $ 2,000 QUICK CHECK Beginning work in process was $125,000. Manufacturing costs incurred for the month were $835,000. There were $200,000 of partially finished goods remaining in work in process inventory at the end of the month. What was the cost of goods manufactured during the month? A. B. C. D. $1,160,000 $ 910,000 $ 760,000 Cannot be determined. VARIABLE AND FIXED COSTS Activity – a quantitative measure of a firm’s output of goods or services Number of Chrysler vans Pairs of Nike shoes Tons of cement produced Variable Costs – costs that change proportionately (in total) with the activity level within a relevant range of activity Fixed Costs – costs that do not change in total as activity level changes within a relevant range of activity Example: Publishing a magazine Variable costs Fixed Costs Cost of paper Rent on building Cost of ink Salaries to reporters Sales Commissions Depreciation on printing equipment Cost of lubricants for machine Cost of operating press TOTAL VARIABLE AND FIXED COSTS Total Variable Cost Total Fixed Cost Number of units Number of units VARIABLE AND FIXED COSTS PER UNIT Per Unit Variable Cost Per Unit Fixed Cost Number of units Number of units RELEVANT RANGE The range of activity within which the firm’s cost structure (i.e. variable cost per unit and total fixed cost) remains unchanged Publishing a small number of magazines (cost structure of a small publisher) Total Variable Cost Relevant Range Total Fixed Cost Number of units Relevant Range Number of units TOTAL COSTS To get total costs you need to add variable costs and fixed costs Total Cost Fixed costs The Slope is the variable cost per unit Number of units