FMGT 1100 Accounting Level 1

advertisement

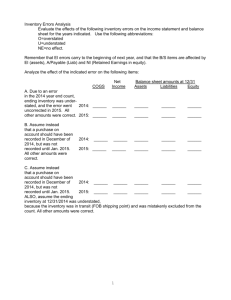

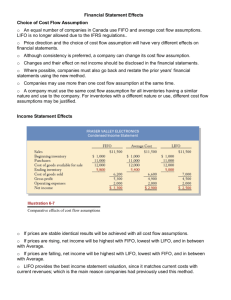

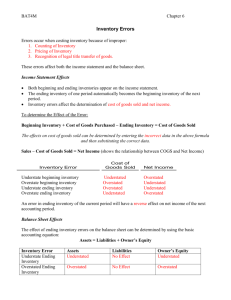

Exam Prep FMGT 1100 ACCOUNTING LEVEL 1 Format Multiple Choice (~50% of exam) Short answers (~50% of exam) How to practice multiple choice questions: Tracy Oh (The most awesome accounting instructor) has provided us with 10 practice multiple choice questions from each chapter. Here is how to access it: Go to shareout Click on FMGT1100 Click on Traceyoh Download Finalpractice folder to your computer. I would highly suggest doing these questions, because some of them may be on the final. This is the best way to get an idea of how they are going to ask you m/c questions on the final. Sample Chapter 3 M/C On September 1, 2010, Two Sisters Company pays $36,000 cash for six months' rent. The balance in prepaid rent on December 31, 2010, after adjustment, would be: A) $6,000 B) $24,000 C) $12,000 D) $0 Sample Chapter 4 The owner's capital account has a January 1, 2010, balance of $59,000. The owner's withdrawals account has a balance of $25,600 for the year ending December 31, 2010. The income summary account contains a debit for $20,500 and a credit for $56,900. The balance in the owner's capital account on December 31, 2010, is: A) $69,800 B) $10,800 C) $95,400 D) $90,300 Sample Chapter 5 A company makes a purchase of $2,000 of inventory, subject to credit terms of 3/10 n/45 and returns $500 of inventory prior to payment. What is the amount of the payment assuming payment is made within the discount period? A) $1,500 B) $1,455 C) $1,440 D) $1,560 Sample Chapter 6 Refer to Table 6-1. Assume a periodic inventory system. Under the weightedaverage method, cost of goods sold on the income statement would be: A) $396 B) $294 C) $389 D) $420 Sample Chapter 7 The three stages of data processing are: A) inputs, outputs, and processing B) source documents, processing, and decision making C) processing, reports, and decision making D) inputs, decision making, and outputs What I think will be on short answer portion Statement of Owner’s Equity Classified Balance Sheet Journalizing PERIODIC transactions FIFO, Moving Weighted Average (myaccountinglab #6, E 6.9 ) Sales and Purchasing Journal Entries (myaccountinglab #7, P7-1A) Concepts you should know P 5-14A Adjusting and closing – periodic P5-15A Classified Balance Sheet – report E6-9 Computing ending inventory – periodic E6-11 Effects of income E6-14 Inventory errors E6-18 Gross margin method E6-19 Retail Method P7-1A Using journals and subsidiary ledgers Statement of Owner’s Equity Classified Balance Sheet Journalizing Periodic Entries Specific Unit | FIFO | Weighted Average Effects of Inventory Errors (P.314) COGAS (Cost of Goods Available for Sale) -Ending Inventory = COGS (Cost of Goods Sold) Sales Revenue -COGS = Gross Margin -Operating Expense = Net Income Period 1 Period 2 Inventory Error Cost of Goods Gross Margin Sold and Net Income Cost of Goods Gross Margin Sold And Net Income Period 1 ending inventory is overstated Understated Overstated Overstated Understated Period 1 ending inventory is understated Overstated Understated Understated Overstated What more can you do? Do the practice final (solutions are in shareout) Review all questions assigned for homework Also in TraceyOh’s folder are study guides for each chapter