The Benefit of Offering an EA Course

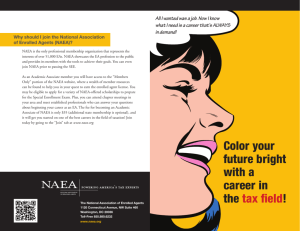

advertisement

The Enrolled Agent: America’s Tax Expert Enrolled agents (EAs) are America's Tax Experts. EAs are the only federally licensed tax practitioners who specialize in taxation and also have unlimited rights to represent taxpayers before the IRS. http://www.naea.org • Unlike attorneys and CPAs, who may or may not choose to specialize in taxes, all Enrolled Agents specialize in taxation. • Enrolled Agents are the only taxpayer representatives who receive their right to practice from the U.S. government (CPAs and attorneys are licensed by the states). • Enrolled Agents are required to pass a comprehensive, three-part exam on tax code (or have equivalent work experience with the IRS). • No degree is required for Enrolled Agents • Enrolled Agents are required to complete 72 hours of continuing education, reported every three years. This ensures that their knowledge remains current. • IRS Examinations are up over 100% - According to enforcement results published by the IRS, examinations of individual returns increased over 100% since year 2000. • Growing need for representation - Given the state of our economy, many people now find themselves in a difficult position financially, and many are delinquent on their tax obligations. • • • Recession proof career - Income taxes are not going away anytime soon, and competent representation is hard to find. Year-round profession (contrary to popular belief) Competitive Salary • While the Special Enrollment Exam is tough, the Enrolled Agent License does not require any degrees, apprenticeship, or road-blocks. • EAs can seek employment from existing firms, or start their own practice. • A self-employed EA has more freedom over fees, hours, and choice of clients. • Offer a SEE prep course as a noncredit course • Provide a local EA to present early in the semester on the EA career path. • Offer support by local EAs for job fairs at the school to further promote the EA career. • Will involve local EAs with your student community, allowing them valuable networking opportunities. • Connect them with current practitioners who can answer specific questions about a career and practice. • Provide a method of enticing students to other classes at the school (some internship offers may require that the intern has taken a bookkeeping or tax course). We hope that you have enjoyed this presentation. We look forward to working with you in offering a tax curriculum to support an Enrolled Agent career.