Your Career as an EA - National Association of Enrolled Agents

advertisement

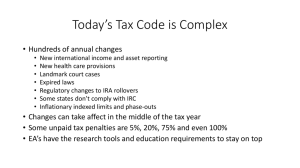

NAEA National Association of Enrolled Agents Your career as an Enrolled Agent www.naea.org POP QUIZ What does EA stand for? Today we are going to talk about What’s an Enrolled Agent? What is the licensing process to become an Enrolled Agent? How does becoming an Enrolled Agent help you in your career goals? What is an Enrolled Agent? Enrolled Agents (EAs) are tax practitioners with technical expertise in taxation and are fully authorized to represent taxpayers before all administrative levels of the Internal Revenue Service (IRS) including audits, collections and appeals. Enrolled Agents can be self employed or work for small or large firms. What License allows you to represent taxpayers before the IRS? Enrolled Agent – Federal – Licensed by the United States Treasury Certified Public Accountant –Licensed by a state Attorney – Licensed by a state How do Enrolled Agents differ from other licensed taxpayer representatives? Enrolled Agents are the only taxpayer representatives who receive their license from the United States Treasury. ◦ CPAs and Attorneys are licensed by each individual state. How will the EA license benefit me? It is a profession with: ◦ Job security Everyone pays taxes and the tax laws are complicated. ◦ Widely useful knowledge Many companies prepare their financials on tax basis accounting and accounting firms expect you to know the tax consequences of accounting decisions. ◦ Structure Adherence to tax law ensures accurate results. ◦ Meaningful work Professionals who are proficient in tax law are held in high regard. How many Enrolled Agents are there? There are approximately 40,000 Enrolled Agents in the United States There are also Enrolled Agents living and working in foreign countries POP QUIZ What % of all jobs in the United States are provided by small businesses? A. B. C. D. 20% 33.3% 55% 1% POP QUIZ What % of all jobs in the United States are provided by small businesses? A. B. C. D. 20% 33.3% 55% Correct 1% How do I become an Enrolled Agent Pass the IRS Special Enrollment Exam -OR Be an employee of the IRS for 5 years – regularly interpreting the provisions of the IRS Code and Regulations What is the Enrolled Agent exam? Comprehensive three-part tax exam which covers taxation issues for: ◦ Individuals ◦ Businesses Corporations, partnerships, estates and trusts ◦ Representation, Practices and Procedures (including Ethics) How comprehensive is the Enrolled Agent exam? You are allowed 3.5 hours to complete each of the three parts Each part contains 100 multiple choice questions Parts can be taken in any order Passed parts of the exam remain active for 2 years POP QUIZ What is the historic pass rate for the Enrolled Agent exam? A. B. C. D. 60% 90% 42% 70% POP QUIZ What is the historic pass rate for the Enrolled Agent exam? A. B. C. D. 60% 90% 42% 70% Correct How can I prepare to take the Enrolled Agent exam? Self study Facilitator-led correspondence courses Intensive review course Specialized prep courses offered through some community colleges and NAEA chapters Any combination of the above I am planning on taking a CPA exam prep course, can I use this material to study for the Enrolled Agent exam? Much of the study material for the regulation (REG) section of the CPA exam will help you pass the Enrolled Agent exam however, you should supplement this with some dedicated Enrolled Agent study material ◦ Many companies that offer CPA review courses also offer Enrolled Agent prep courses Are there any other requirements to be an Enrolled Agent? In addition to the application fee payment, the Treasury Department will conduct a background investigation based on detailed information you must provide after you pass the exam. ◦ The investigation will include an examination (not an audit) of your tax returns for the past 3 years. A college degree is not a requirement to become an Enrolled Agent, making Enrolled Agent an ideal part time career choice for students in the accounting and taxation field. POP QUIZ Who is the largest taxpayer in the United States? A. B. C. D. E. Microsoft ExxonMobil Berkshire Hathaway Apple Chevron POP QUIZ Who is the largest taxpayer in the United States? Microsoft B. ExxonMobil Correct $31 Billion (2013) C. Berkshire Hathaway D. Apple E. Chevron A. Can I get a part time job as an EA or potential EA while I am still a student? Temporary agencies, especially those that specialize in accounting and taxation, allow students to work flexible schedules and gain experience in tax preparation while they are preparing for the Enrolled Agent exam. Employees who have a license, such as an Enrolled Agent, command higher salaries even while working in temporary positions What other employment opportunities are there for an Enrolled Agent? Enrolled Agents are needed in: ◦ ◦ ◦ ◦ ◦ ◦ Small and large public accounting firms Law firms State departments of revenue Investment firms Banks Private practice POP QUIZ The IRS Commissioner is the head of the Internal Revenue Service. The Commissioner is appointed by the President with the consent of the Senate. The Commissioner serves a term of A. B. C. D. 1 year 4 years 5 years Indefinite POP QUIZ The IRS Commissioner is the head of the Internal Revenue Service. The Commissioner is appointed by the President with the consent of the Senate. The Commissioner serves a term of A. B. C. D. 1 year 4 years 5 years Correct Indefinite I have thought about going into private practice. Is that really a possibility? There are several ways to go into private practice; they include: ◦ Building a practice from the ground up using marketing and referrals ◦ Purchasing a tax franchise ◦ Purchasing a portion or all of an existing tax practice How do I find a reputable tax practice to purchase and how much will it cost? Contact a company that specializes in the sale of retiring or downsizing tax and accounting practices Because each firm is different, each sale will be different. Expect 1.0 – 1.3 times the annual gross of the existing firm to be a good opening negotiable amount. Is there financing available to assist in the purchase of an existing practice? Financing is available from: ◦ ◦ ◦ ◦ Small Business Administration Local banks & credit unions Private equity groups Seller financed Most purchases will require a 15% - 20% down payment POP QUIZ In 1862 the first personal and corporate income tax was levied to help pay for the Union effort in the Civil War. This was a graduated tax with 2 tax rates of A. B. C. D. 1% and 2% 10% and 12% 15% and 20% 3% and 5% POP QUIZ In 1862 the first personal and corporate income tax was levied to help pay for the Union effort in the Civil War. This was a graduated tax with 2 tax rates of A. B. C. D. 1% and 2% 10% and 12% 15% and 20% 3% and 5% Correct NAEA National Association of Enrolled Agents Challenges you to begin your career as an Enrolled Agent www.naea.org