PowerPoint Presentation - National Association of Enrolled Agents

advertisement

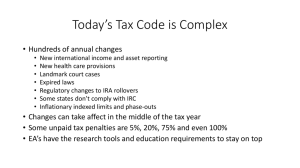

NAEA National Association of Enrolled Agents An Introduction to the Enrolled Agent Profession www.naea.org POP QUIZ What does EA stand for? What is an Enrolled Agent? Enrolled Agents (EAs) are tax practitioners with technical expertise in taxation and are fully authorized to represent taxpayers before all administrative levels of the Internal Revenue Service (IRS) including audits, collections and appeals. Enrolled Agents can be self employed or work for small or large firms. What license allows tax professionals to represent taxpayers before the IRS? Enrolled Agent – Federal – Licensed by the United States Treasury Certified Public Accountant –Licensed by a state Attorney – Licensed by a state How do Enrolled Agents differ from other licensed taxpayer representatives? Enrolled Agents are the only taxpayer representatives who receive their license from the United States Treasury. ◦ CPAs and Attorneys are licensed by each individual state. How many Enrolled Agents are there? There are approximately 40,000 Enrolled Agents in the United States There are also Enrolled Agents living and working in foreign countries POP QUIZ What % of all jobs in the United States are provided by small businesses? A. B. C. D. 20% 33.3% 55% 1% POP QUIZ What % of all jobs in the United States are provided by small businesses? A. B. C. D. 20% 33.3% 55% Correct 1% What are the requirements to obtain an Enrolled Agent license? Pass the IRS Special Enrollment Exam -OR Be an employee of the IRS for 5 years – regularly interpreting the provisions of the IRS Code and Regulations What is the Enrolled Agent exam? Comprehensive three-part tax exam which covers taxation issues for: ◦ Individuals ◦ Businesses Corporations, partnerships, estates and trusts ◦ Representation, Practices and Procedures (including Ethics) How comprehensive is the Enrolled Agent exam? You are allowed 3.5 hours to complete each of the three parts Each part contains 100 multiple choice questions Parts can be taken in any order Passed parts of the exam remain active for 2 years POP QUIZ What is the historic pass rate for the Enrolled Agent exam? A. B. C. D. 60% 90% 42% 70% POP QUIZ What is the historic pass rate for the Enrolled Agent exam? A. B. C. D. 60% 90% 42% 70% Correct POP QUIZ Who is the largest taxpayer in the United States? A. B. C. D. E. Microsoft ExxonMobil Berkshire Hathaway Apple Chevron POP QUIZ Who is the largest taxpayer in the United States? Microsoft B. ExxonMobil Correct $31 Billion (2013) C. Berkshire Hathaway D. Apple E. Chevron A. What employment opportunities are there for an Enrolled Agent? Enrolled Agents are needed in: ◦ ◦ ◦ ◦ ◦ ◦ Small and large public accounting firms Law firms State departments of revenue Investment firms Banks Private practice POP QUIZ The IRS Commissioner is the head of the Internal Revenue Service. The Commissioner is appointed by the President with the consent of the Senate. The Commissioner serves a term of A. B. C. D. 1 year 4 years 5 years Indefinite POP QUIZ The IRS Commissioner is the head of the Internal Revenue Service. The Commissioner is appointed by the President with the consent of the Senate. The Commissioner serves a term of A. B. C. D. 1 year 4 years 5 years Correct Indefinite POP QUIZ In 1862 the first personal and corporate income tax was levied to help pay for the Union effort in the Civil War. This was a graduated tax with 2 tax rates of A. B. C. D. 1% and 2% 10% and 12% 15% and 20% 3% and 5% POP QUIZ In 1862 the first personal and corporate income tax was levied to help pay for the Union effort in the Civil War. This was a graduated tax with 2 tax rates of A. B. C. D. 1% and 2% 10% and 12% 15% and 20% 3% and 5% Correct NAEA National Association of Enrolled Agents Invites you to utilize the services of Enrolled Agents, America’s Tax Experts www.naea.org