BBA 241

advertisement

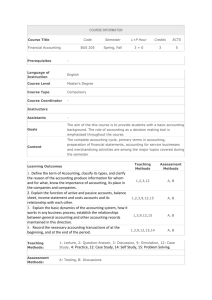

COURSE INFORMATON Course Title Financial Accounting Code Semester L+P Hour Credits ECTS BBA 241 4 3+1 3 5 Prerequisites - Language of Instruction English Course Level Bachelor's Degree (First Cycle Programmes) Course Type Compulsory Course Coordinator - Instructors Assistants A.Engin ERGÜDEN - Phd in. Accounting & Finance The aim of the this course is to provide students with a basic accounting background. The role of accounting as a decision making tool is emphasized Goals throughout the course. The complete accounting cycle, preparation of financial statements, accounting for merchandising activities are among the major topics covered during the semester. To comprehend the importance accounting department for the top management Content in a firm structure, To have knowledge about the nature of assets, liabilities, expense and reveneu, prepare the balance sheet, income statement Teaching Methods Assessment Methods 1. Define the term of Accounting, classify its types, and clarify the reason of the accounting produce information for whom and for what, know the importance of accounting, its place in the companies and companies. 1,2,3,12 A 2. Explain the function of active and passive accounts, balance sheet, income statement and costs accounts and its relationship with each other. 1,2,3,9,12,15 A 3. Explain the basic dynamics of the accounting system, how it works in any business process, establish the relationships between general accounting and other accounting records maintained in this direction. 1,3,9,12,15 A,C 4. Record the necessary accounting transactions of at the beginning, and at the end of the period. 1,3,9,12,15,14 A,C Learning Outcomes Teaching Methods: 1: Lecture, 2: Question-Answer, 3: Discussion, 9: Simulation, 12: Case Study, 4: Practice, 12: Case Study, 14: Self Study, 15: Problem Solving Assessment Methods: A: Testing, C: Homework COURSE CONTENT Week Topics Study Materials 1 The basic equation of accounting 2 Account concept and their working rules 3 Accounting Flow and Recording Materials 4 General Accepted Accounting Principles, Turkish Unıform Chart of Account 5 Cash Transactions and securities transaction in accounting 6 Inventory transaction and cost of trade goods 7 Prepayment and deposit transaction 8 Calculation and journalising tha wages 9 Mid-term exam 10 Non-current assets and depreciaiton 11 Closing the revenues and expenses account 12 Quiz 13 Case study 14 Final Exam RECOMMENDED SOURCES Textbook Principles of Accounting (19th Edition) Wild, Shaw, Chiappetta Additional Resources - MATERIAL SHARING Documents Assignments Exams ASSESSMENT IN-TERM STUDIES Mid-terms Quizzes NUMBER PERCENTAGE Assignment Total 100 CONTRIBUTION OF FINAL EXAMINATION TO OVERALL GRADE CONTRIBUTION OF IN-TERM STUDIES TO OVERALL GRADE Total COURSE CATEGORY 100 Expertise Courses COURSE'S CONTRIBUTION TO PROGRAM No Contribution Program Learning Outcomes 1 When students have completed the Public Undergraduate Program, they will be able to; 1 gain knowledge of superiority of law and believe in universal principles of law and also know Turkish legal System, 3 behave environmentally sensitive and responsible and develop public policies on this issue, 4 understand the importance of Atatürk thought within the guidance of science 6 7 8 9 10 11 12 13 3 4 5 understand and have universal principles of public administration as well as gain knowledge of the structure and process of Turkish Public Administration, 2 5 2 Administration be executive and administrative candidates who know well Turkish socio-politic history and structure, integrate technological developments and implement technology in an efficient and effective manner in both public and private sectors, x improve communication and leadership skills, improve ability of expressing in English and Turkish, gain knowledge of EU legislation (acquis communataire), appraise global and regional developments, realize / recognize the importance of art, prepare their career also in private sector - apart from government executives, as such the flexibility of the program and on the facilities of double major and minor, compare and select the professional opportunities in the field related to the international relations and administrative law. x ECTS ALLOCATED BASED ON STUDENT WORKLOAD BY THE COURSE DESCRIPTION Quantity Duration (Hour) Total Workload (Hour) Course Duration (Including the exam week: 16x Total course hours) 16 3 48 Hours for off-the-classroom study (Pre-study, practice) 16 3 48 Mid-terms 1 10 10 Homework 1 3 3 Final examination 1 10 10 1 2 2 Activities Total Work Load 111 Total Work Load / 25 (h ECTS Credit of the Course 4,44 5