ECON 311

advertisement

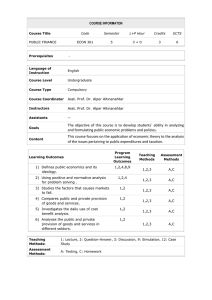

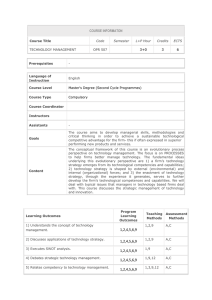

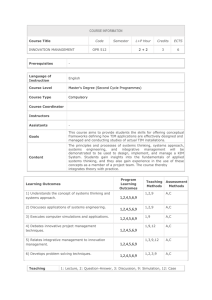

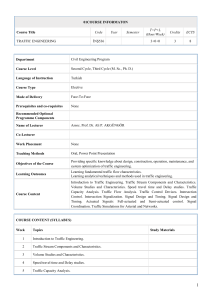

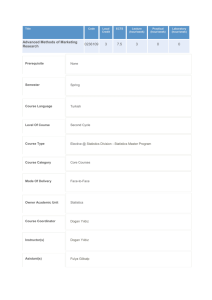

COURSE INFORMATON Course Title PUBLIC FINANCE Code Semester L+P Hour Credits ECTS ECON 311 5 3+0 3 6 Prerequisites - Language of Instruction English Course Level Undergraduate Course Type Compulsory Course Coordinator Asst. Prof. Dr. Alper Altınanahtar Instructors Asst. Prof. Dr. Alper Altınanahtar Assistants -- Goals The objective of this course is to develop students` ability in analyzing and formulating public economic problems and policies. Content This course focuses on the application of economic theory to the analysis of the issues pertaining to public expenditures and taxation. Program Learning Outcomes Teaching Methods Assessment Methods 1) Defines public economics and its ideology. 1,2,3 A,C 2) Using pozitive and normative analysis for problem solving . 1,2,3 A,C 3) Studies the factors that causes markets to fail. 1,2,3 A,C 4) Compares public and private provision of goods and services. 1,2,3 A,C 5) Investigates the daily use of cost benefit analysis. 1,2,3 A,C 6) Analyses the public and private provision of goods and services in different sektors. 1,2,3 A,C Learning Outcomes Teaching Methods: 1: Lecture, 2: Question-Answer, 3: Discussion, 9: Simulation, 12: Case Study Assessment Methods: A: Testing, C: Homework COURSE CONTENT Week Topics Study Materials 1 Public Finance and Ideology Chapter 1 2 Tools of Positive Analysis Chapter 2 3 Tools of Normative Analysis Chapter 3 4 Tools of Normative Analysis cont’d 5 1st MID-TERM EXAMINATION 6 Public Goods Chapter 4 7 Externalities Chapter 5 8 Externalities cont’d 9 Education 10 2nd MID-TERM EXAMINATION 11 Cost Benefit Analysis 12 Cost Benefit Analysis cont’d 13 The Health Care Market 14 Review Chapter 6 Chapter 7 Chapter 8 RECOMMENDED SOURCES Public Finance by Harvey S. Rosen and Ted Gayer, McGraw-Hill, 9th ed Textbook Additional Resources MATERIAL SHARING Documents Lecture notes and Chapter slides Assignments End of Chapter problems and Homework Assignments Exams Quiz questions ASSESSMENT IN-TERM STUDIES NUMBER PERCENTAGE Mid-terms 2 75 Quizzes 5 10 Assignment 5 15 Total 100 CONTRIBUTION OF FINAL EXAMINATION TO OVERALL GRADE 40 CONTRIBUTION OF IN-TERM STUDIES TO OVERALL GRADE 60 Total COURSE CATEGORY 100 Expertise/Field Courses COURSE'S CONTRIBUTION TO PROGRAM Contribution No Program Learning Outcomes 1 2 3 4 5 When students have completed the Public Administration Undergraduate Program, they will be able to; 1 understand and have universal principles of public administration as well as gain knowledge of the structure and process of Turkish Public Administration, 2 gain knowledge of superiority of law and believe in universal principles of law and also know Turkish legal System, 3 behave environmentally sensitive and responsible and develop public policies on this issue, 4 5 6 7 8 9 10 11 x x understand the importance of Atatürk thought within the guidance of science x be executive and administrative candidates who know well Turkish socio-politic history and structure, x integrate technological developments and implement technology in an efficient and effective manner in both public and private sectors, improve communication and leadership skills, improve ability of expressing in English and Turkish, gain knowledge of EU legislation (acquis communataire), appraise global and regional developments, realize / recognize the importance of art, prepare their career also in private sector - apart from government executives, 12 such the flexibility of the program and on the facilities of double major and minor, as compare and select the professional opportunities in the field related to the 13 international relations and administrative law. x ECTS ALLOCATED BASED ON STUDENT WORKLOAD BY THE COURSE DESCRIPTION Quantity Duration (Hour) Total Workload (Hour) Course Duration (Including the exam week: 16x Total course hours) 16 3 48 Hours for off-the-classroom study (Pre-study, practice) 16 5 80 Mid-terms 2 3 6 Homework 5 2 10 Final examination 1 3 3 Activities Total Work Load 147 Total Work Load / 25 (h) 5.88 ECTS Credit of the Course 6