Financial Statements Financial Analysis Financial Planning

advertisement

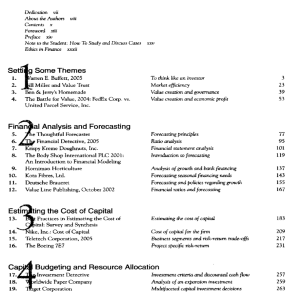

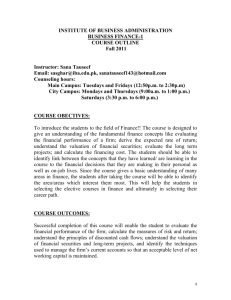

Financial Management Ing. Zuzana Čierna, PhD. Department of Finance 037/641 41 40 zuzana.cierna@uniag.sk 1 Course objectives • • • • • • • • • • • • An overview of financial management Financial statements, Cash Flow and Taxes Financial analysis Financial Planning and Forecasting Financial markets and institutions of the Financial market Risk and Rates of Return Time value of Money Securities valuation The cost of capital Capital structure and Leverage Working Capital Management Exchange rates and Exchange Rate risk 2 Texts and Materials • • • • • Fundamentals of Financial Management Course web page materials Seminary works www.nbs.sk www.finance.gov.sk 3 Requirements and classification • Evaluation – total 100 points: – Activity and attendance – max. 5 points, – Test 1 – max. 20 points, – Presentation of a project – max. 15 points, – Exam – max. 60 points. • At the end of semester minimum points obtained -25 • The minimum requirement (totally) is to obtain at least 64 points in accordance with presented evaluation. 4 Evaluative scale Level of knowledge Classification Grade • Excellent 93-100 % A Excellent 1 • Above standard 86-92 % B Very good 1,5 • Average 79-85 % C Good 2 • Acceptable 72-78 % D Satisfactory 2,5 • Minimal criteria 64-71 % E Sufficient 3 • Less than minimal criteria 63 % FX Fail 4 5 Presentations of projects • Structure (.doc): – Title page – topic, authors, faculty – Content – Introduction – Body – 10 pages, citations directly in the text – Conclusion – Bibliography – books, articles and interne • Presentation (.ppt): - 15 Minutes 6 Topics 1. 2. 3. 4. 5. 6. 7. Financial statements, structure and basic relations Financial analysis, procedure, basic ratios Financial planning, types of plans in a company Risk valuation and risk quantification Financial resources acquirement, own capital and liabilities, external and internal funds, cost of capital Modern portfolio theory, risk diversification Multinational financial management and exchange rate risk 7 Financial management • Financial Management entails planning for the future for a person or a business enterprise to ensure a positive cash flow. It includes the administration and maintenance of financial assets. • Besides, financial management covers the process of identifying and managing risk. 8 Scope of Financial Management • Money and capital markets - which deals with securities markets and financial institutions; • Investments - which focuses on the decisions made by both individual and institutional investors as they choose securities for their investment portfolios; • Financial management - or ‘business finance’, which involves decisions within firms. 9 THE FINANCIAL STAFF’S RESPONSIBILITIES • • • • • Forecasting and planning. Major investment and financing decisions. Coordination and control. Dealing with the financial markets. Risk management. 10 An agency problem • is a potential conflict of interests that can arise between a principal and an agent. Two important agency relationships are • (1) those between the owners of the firm and its management and • (2) those between the managers, acting for stockholders, and the debtholders. 11 12 13 Direct and Indirect financing 14 Than you for your attention! 15