Corporate Finance: MBAC 6060

advertisement

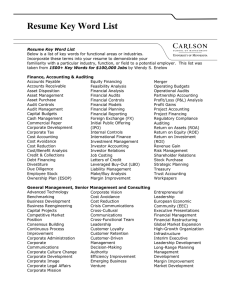

Course Introduction Corporate Finance Corporate Finance Decisions Financial analysis and planning. Assess the strengths and weaknesses of the firm via the Financial Statements, ratio analysis, and common sized financial statements. Pro forma financial statements. Cash flow for valuation. Corporate Finance Decisions Capital budgeting. Decisions that involve what fixed assets the firm should acquire. “Investment” or “Left-hand side” decisions. The value of any asset is a function of: Size of its future cash flows. Timing of its future cash flows. Risk of its future cash flows. How do we make an investment decision? Corporate Finance Decisions Capital structure. Decisions that determine how to raise $ to buy assets. Financing or “Right-hand side” decisions. (Liabs + Eqty). Capital structure: blend of debt and equity to finance firm’s portfolio of assets used to operate the business. (Goal: minimize total financing cost. Financial claims of a firm are contingent claims, their value derives solely from “left-hand side” of firm. (Assets) Dividend decision part of this? Corporate Finance Decisions Risk versus return. An important and difficult question is exactly how to measure risk. Once have handle on measuring risk, need to explain how measured risk relates to required or expected returns. Corporate Finance Decisions Working capital management. Subset of investment and financing decisions of the firm. Both sides of B/S affected. Focuses on current assets and liabilities. Net working capital is an asset that must be financed from some source of funds. It is an easy and dangerous thing to lose control of. Valuation Basics Assets currently have value due to the future “value” (CFs) provided to those who buy them. The price you are willing to pay for an asset depends upon value received from owning it. Timing matters – a concept called “time value of money.”