Box E: Normalisation of Domestic Market Dealing Operations

advertisement

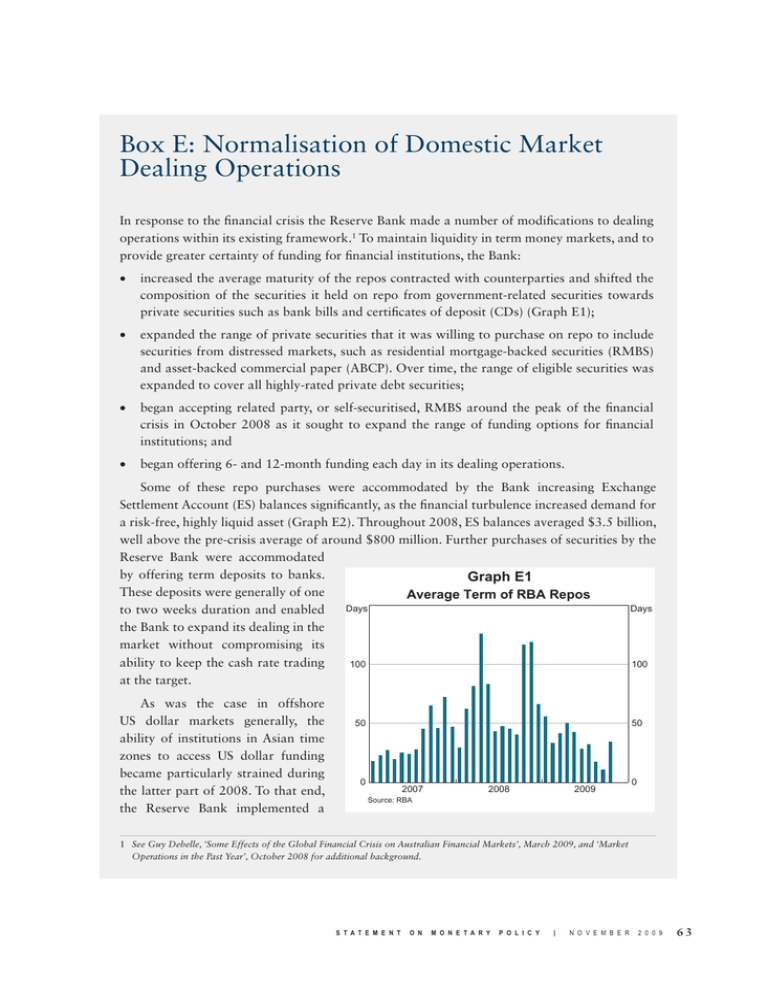

Box E: Normalisation of Domestic Market Dealing Operations In response to the financial crisis the Reserve Bank made a number of modifications to dealing operations within its existing framework.1 To maintain liquidity in term money markets, and to provide greater certainty of funding for financial institutions, the Bank: • increased the average maturity of the repos contracted with counterparties and shifted the composition of the securities it held on repo from government-related securities towards private securities such as bank bills and certificates of deposit (CDs) (Graph E1); • expanded the range of private securities that it was willing to purchase on repo to include securities from distressed markets, such as residential mortgage-backed securities (RMBS) and asset-backed commercial paper (ABCP). Over time, the range of eligible securities was expanded to cover all highly-rated private debt securities; • began accepting related party, or self-securitised, RMBS around the peak of the financial crisis in October 2008 as it sought to expand the range of funding options for financial institutions; and • began offering 6- and 12-month funding each day in its dealing operations. Some of these repo purchases were accommodated by the Bank increasing Exchange Settlement Account (ES) balances significantly, as the financial turbulence increased demand for a risk-free, highly liquid asset (Graph E2). Throughout 2008, ES balances averaged $3.5 billion, well above the pre-crisis average of around $800 million. Further purchases of securities by the Reserve Bank were accommodated by offering term deposits to banks. Graph E1 These deposits were generally of one Average Term of RBA Repos Days Days to two weeks duration and enabled the Bank to expand its dealing in the market without compromising its ability to keep the cash rate trading 100 100 at the target. As was the case in offshore US dollar markets generally, the ability of institutions in Asian time zones to access US dollar funding became particularly strained during the latter part of 2008. To that end, the Reserve Bank implemented a 50 50 0 2007 2009 2008 0 Source: RBA 1 See Guy Debelle, ‘Some Effects of the Global Financial Crisis on Australian Financial Markets’, March 2009, and ‘Market Operations in the Past Year’, October 2008 for additional background. S t a t e m e n t o n M o n e t a r y P o l i c y | N o v e m b e r 2 0 0 9 63 Graph E2 Balances Held at RBA $b $b Term deposits 20 20 15 15 10 10 ES balances 5 0 5 l J l l S D 2007 l M l l J S 2008 l D l M l J l S 2009 D 0 Source: RBA Graph E3 Balances Outstanding on US$ Repos US$b US$b 25 25 20 20 15 15 10 10 5 5 0 l S 2008 l D l M Source: RBA l J 2009 l S D 0 swap facility with the US Federal Reserve, enabling it to distribute US dollars to institutions operating in Australia against the receipt of Australian dollar securities. The amount outstanding under the facility peaked at around US$28 billion in late November 2008 (Graph E3). As conditions in domestic financial markets have progressively improved, the Bank has normalised its dealings with market counterparties, whilst maintaining the range of securities that it accepts in its operations. Although the swap agreement with the Fed remains operative until February 2010, the Bank has not auctioned US dollars since May and all outstanding US dollar repos have matured. Similarly, the Bank has not offered term deposits since March. ES balances have declined, steadying at around $1¼ billion over recent months. This is well below the levels that prevailed for much of 2008. The Bank no longer offers 6- and 12-month funding on a daily basis, although it remains willing to contract for such terms when it suits its own liquidity management purposes. While the Bank has continued to modify its existing dealing framework, the overriding goal of market operations has been to keep the cash rate at the monetary policy target. To that end, the cash rate has continued to trade at the target rate throughout the entire period. R 64 R e s e r v e b a n k o f A u s t r a l i a