Health Law Survey 2: Access, Regulation and Enterprise

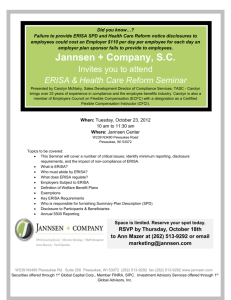

advertisement