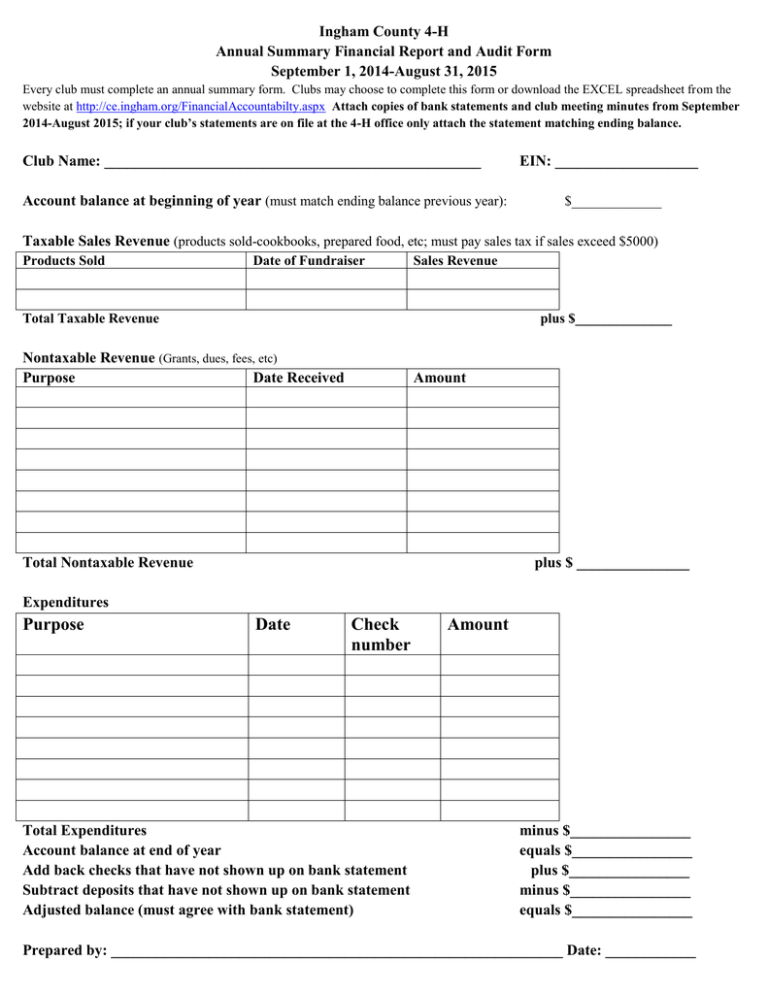

Annual Financial Report & Audit Form

advertisement

Ingham County 4-H Annual Summary Financial Report and Audit Form September 1, 2014-August 31, 2015 Every club must complete an annual summary form. Clubs may choose to complete this form or download the EXCEL spreadsheet from the website at http://ce.ingham.org/FinancialAccountabilty.aspx Attach copies of bank statements and club meeting minutes from September 2014-August 2015; if your club’s statements are on file at the 4-H office only attach the statement matching ending balance. Club Name: __________________________________________________ Account balance at beginning of year (must match ending balance previous year): EIN: ___________________ $_____________ Taxable Sales Revenue (products sold-cookbooks, prepared food, etc; must pay sales tax if sales exceed $5000) Products Sold Date of Fundraiser Sales Revenue Total Taxable Revenue plus $______________ Nontaxable Revenue (Grants, dues, fees, etc) Purpose Date Received Amount Total Nontaxable Revenue plus $ _______________ Expenditures Purpose Date Check number Total Expenditures Account balance at end of year Add back checks that have not shown up on bank statement Subtract deposits that have not shown up on bank statement Adjusted balance (must agree with bank statement) Amount minus $________________ equals $________________ plus $________________ minus $________________ equals $________________ Prepared by: ____________________________________________________________ Date: ____________ 4-H Club Audit Review All 4-H groups must review their financial records once a year (before submitting their Annual Summary Financial Report to the county MSU Extension office). The person who conducts the financial record review cannot be the treasurer, an account signatory, or a parent or guardian of the treasurer or of an account signatory. Name of club Treasurer: ___________________________________________________________________ Additional Account signatories: _____________________________________________________________ Please answer the following questions regarding this audit: YES NO YES NO YES NO YES NO YES NO YES NO YES NO 1. When you added up the receipts from the receipt book did the amounts match the bank deposits? If no, were you able to determine reasons for differences? Please explain: ____________________________________________________________________________ 2. Were there events that took in cash? a. If yes, is there evidence of a witnessed cash count by individuals other than the person who made the deposit? b. Do the witnessed cash counts equal the amounts of the deposits? c. Do the cash deposits show up on the bank statements? 3. Do the bank deposit amounts match the amounts that show up on the bank statements for each month? If no, were you able to determine the reasons for the differences? Please explain: _____________________________________________________________________________ 4. Was the bank account reconciled monthly? a. Can you compare the reconciled bank account balances to figures in the check register? 5. Were there any cash withdrawals from the bank account? a. If yes, is there documentation as to why this is legitimate? b. Are there any other transactions in the bank account that need further explanation? Please explain: ____________________________________________________________________ 6. Were all expenditures approved either through an approved budget or a vote? a. Were there expenditures that seemed out of place? If yes, please explain: _________________________________________________________________________ 7. Review the annual financial report. a. Was Michigan Sales Tax paid if the group sold more than $5000 worth of tangible personal property? b. Does the annual report reflect all of the fund raising activities that happened during the year? c. Does it reflect all of the expenditure for the year? d. Does it reconcile easily to the closing balance of the last bank statement for the year? The above items are a test of the group’s financial accountability. If the group was not able to pass one or more the tests, please list recommendations for correcting the situation for the future here. Financial Auditor: _____________________________________________ Date: ____________________ Approved by MSU Extension: ____________________________________ Date: ____________________