FINANCIAL CONCEPTS A NOV 2013 - Institute of Bankers in Malawi

advertisement

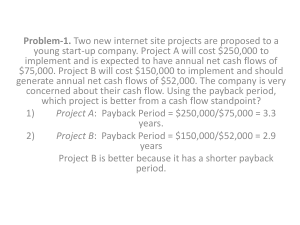

FINANCIAL CONCEPTS A A SOLUTIONS AND MODEL ANSWERS FOR DRAFT EXAMINATION NOVEMBER 2013 Prepared By: Jayi Mlaliki SECTION A Question 1 (15 marks) The Correct answer is: c) 4 years at the interest rate of 9% per year. (3 marks) The calculations are respectively (Remember to subtract the 'one'): a) b) c) d) 1.055 = 1.276282; 1.037 = 1.229874; 1.094 = 1.411582; 1.062 = 1.1236 (3 marks) (3 marks) (3 marks) (3 marks) 3 marks for each correct calculation and another 3 marks for the correct choosing of investment with highest investment Question 2 a) (20 marks) Using Computer (Excel) Select a Cell in Excel, then input: PV (0.19, 4, 600000, 0) Solution:? £1,583,151.31 b) Financial Calculator Inputs: 5 N 10 I Display FV ? NPV HP12C f FIN CLX 10 i 0 10.00 10,000 g CHS CF0, 600,000 g CFj 600,000 g CFj 600,000 g CFj 600,000 g CFj -10,000 600,000 600,000 600,000 600,000 Clear all financial registers Interest rate(cost of capital or required return) expressed in years initial cash flow out (cost of project) Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 1 Press NPV c) 1,583,151.31 Net Present Value Present Value Tables Year Cash flow 0 1 2 3 4 NPV 0 19% discount factors 1.000 600,000 600,000 600,000 600,000 1 2 3 4 Present Values K 0 0.8403 0.7062 0.5934 0.4987 1,583,160.00 Question 3 (15 marks) Rather than use accounting profits, the evaluation of a project must use cash flows, why? There are several advantages of using cash flow accounting: Survival of a company depends on its ability to generate cash. Cash is comprehensive or concrete whereas profit can be manipulated. As bankers (Creditors) we are interested in a company’s ability to repay and Cash is direct. Cash flow provides a better means of comparing between companies. Cash flow satisfies the needs of all users better. o For management. It provides the sort of information on which decisions should be taken. Cash flow forecasts are easier to prepare & more useful than profit forecasts. Auditing is easier with cash flow accounts than accrual basis accounts. Accruals concept is confusing while cash flows are easily understood and there are many ambiguities e.g. various methods of inventory valuation, depreciation and individual judgements when making provisions for bad debts. Question 4 (15 marks) a) Contrasting the following; (i) Compound Interest versus Simple Interest (3 mark) Simple interest is interest that accrues linearly. In other words, it grows by a certain fraction of the principal per time period. Compound interest is interest which is regularly added to the debt (compounded). Interest is then calculated not only over the principal, but also over the interest that has been added to the debt before, in other words, it is calculated over the total amount owed. With compound interest, the frequency of compounding influences the total amount of interest paid over the life of the loan. (ii) Effective annual rate versus Nominal Interest rate (5 mark) A nominal interest rate is the interest rate that does not compensate for inflation and this is the rate that many banks advertise also known as annual percentage yield (APY). It is the return on the principal amount over an entire year. For example, a 5% rate compounded monthly would have an approximate APY of 5.12%. Effective Annual Rate (EAR) This is the actual rate paid (or received) after accounting for compounding that occurs during the year. If you want to compare two alternative investments with different compounding periods you need to compute the EAR and use that for comparison. There is need to distinguish between nominal interest rates and effective interest rates when comparing interest rates. An interest rate is called nominal if the period of time after that the interest is credited (e.g. a month) is not identical to the basic time unit (normally a year). b) Value of investment converting from nominal interest rate to effective interest rate; Display HP12C f FIN 0 Clear all financial registers 2 12 ENTER 4n ÷i 1000000 CHS FV 12.00 4.00 4.00 -100000.00 Nominal rate Compounding period (4 quarters in a year) % quarterly interest rate Investment amount ($1,125,508.81) The FV value of K1,000,000 investment @ 12% compounded quarterly c) Solution Mathematically 100 365 1 0.02736 2.736 % 99 . 27076 98 Financial calculator HP-10b Input 100; Press ENTER; Press ÷; Input 99.27078; Press -; Input 1; Press x; Input 365; Press ÷; Input 98; Display 0.02736 3 SECTION B Question 5 (20 marks) Advantages of the payback method 1. 2. 3. 4. 5. It is simple and easy to apply As a concept it straightforward to understand. The payback period is not open to manipulation since it is calculated using cash flows as opposed to accounting profits which are open to manipulation by managerial preferences for particular accounting policies. If we accept that more distant cash flows are more uncertain and that increasing uncertainty is synonymous with increasing risk, it is possible that another advantage of the payback method is that it takes account of risk, in that implicitly assumes that a shorter payback period is superior to a longer one. If a company is restricted in the amount of finance that it has available for investment, the payback can be argued to be a useful appraisal method, since the sooner cash is returned by a project, the sooner it can be reinvested into other projects. While there is some truth in this argument, it ignores the fact there are better investment appraisal methods available to deal with capital rationing, as will be explained later in this module. Disadvantages of the payback method There are a number of difficulties in using the payback method to assess capital investment projects and these are sufficiently serious for it to be generally rejected by corporate finance theory as a credible method of investment appraisal. 1. Importantly, it ignores the time value of money, so that it gives equal weight to cash flows whenever they occur. 2. The payback method also ignores the size and timing of cash flows within the payback period. From our example, we can see the payback period remains 3.5 years even if the project generates no cash inflows in the first and second years of operation, but then a cash inflow of K400 in the third year. In fact, any combination of cash flows in the first three years which total K400 would have given the same payback period. The problem of ignoring the time value of money is partly remedied by using the discounted payback method discussed in later in this chapter (see next page). 3. Another serious disadvantage of the payback method is that it ignores all cash flows outside of the payback period and so does not consider the project as a whole. If a company rejected all projects with payback periods greater than three years, it would reject the project given in our earlier example. Suppose that this project, in year 4, had been expected to generate a cash inflow of K1,000. This expected cash inflow would have been ignored if the sole investment appraisal method being applied was the payback method, and would have been rejected. 4 Question 6 a) (20 marks) For Deferred Annuities due, payments are commenced at some time in future with the last payment being made at a specific point in time (when payments commence they are made at the beginning of period). b) c) Question 7 i. Mutually Exclusive Investments In most cases companies must choose between two or more alternatives that can do the same job or using the same facility. Thus, the organisation can only undertake one project in favour of the other project (s). Using the IRR method can result in a wrong choice of project: ii. Non conventional cash flows If an investment has cash flows of different signs in successive periods (e.g. a cash inflow followed by a cash outflow, followed by a further cash inflow), it may have more than one IRR. Such cash flows are called non-conventional cash flows, and presence of multiple IRRs may result in incorrect decisions being taken if the IRR decision rule is applied. iii. Changes in the discount rate If there are changes in the cost of capital over the life of an investment project the NPV method can easily accommodate. However, the IRR, however, cannot take into account the change in discount rate in different years. iv. Reinvestment assumptions Instead of assuming, as basic IRR calculation does, that every surplus Kwacha earns a positive return at the same rate as has to be paid for every Kwacha invested (i.e. the same IRR of return for positive and negative cash flows). In other words, IRR implicitly assumes that the cash inflows that are received say half-way through a project, can be reinvested elsewhere at a rate equal to the IRR until the end of the project’s life. This is intuitively unacceptable. In 5 the real world, if a firm invested in a very high yielding project and some cash was returned after a short period, this firm would be unlikely to be able to deposit this cash elsewhere until the end of the project and reach the same extraordinary high yield, and yet this is what the IRR implicitly assumes. The more likely eventuality is that the intraproject cash inflows will be invested at the ‘going rate’ or the opportunity cost of capital. In other words, the firm’s normal discount rate is the better investment rate. The effect of this erroneous reinvestment assumption is to inflate the IRR of the project under examination. Not so with NPV, which assumes that, cash inflows arising during the life of the project are reinvested at the opportunity cost of capital. Question 8 First find Net present values of the different projects: NPVA = -1000 + (3000 x 0.467) = K401 NPVB = -800 + (200 x 0.909) + (300 x 0.826) +.... = K451 NPVC = -750 + (300 x 3.791) = K387 NPVD = -500 + (150 x 4.868) = K230 NPVE= -800 + (350 x (4.868-0.909) ) = K586 Find profitability index formula is: Initial investm ent PV of Future Cash in flows : PV of initial investm entoutflows PROJECT A Profitability Index 1.401 B 1.564 C D E 1.516 1.462 1.732 a) The company is not in a capital rationing position; Accept all projects (Full marks only applicable after above calculations) b) The company is in a capital rationing position, the projects are divisible and only K2, 500 is available. Investment schedule: K800 in Project E K800 in Project B K750 in Project C K150 in Project D TOTAL NPV = K1, 493 The company is in a capital rationing position, the projects are not divisible and only K2, 500 is available. c) Investment schedule: K800 in Project E K800 in Project B K750 in Project C TOTAL NPV = K1, 424 SURPLUS FUNDS = K150 6 7