Capitalization - Gretchen Hurt

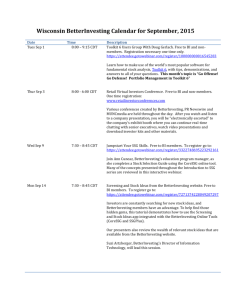

advertisement

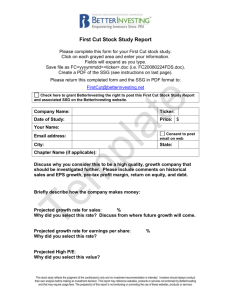

CLASSES TO GO Capitalization Gretchen Hurt BIVA Board Director BETTERINVESTING NATIONAL CONVENTION Disclaimer • The information in this presentation is for educational purposes only and is not intended to be a recommendation to purchase or sell any of the stocks, mutual funds, or other securities that may be referenced. The securities of companies referenced or featured in the seminar materials are for illustrative purposes only and are not to be considered endorsed or recommended for purchase or sale by BetterInvesting™ National Association of Investors Corporation (“BI”) or the BetterInvesting Volunteer Advisory Board, its volunteer advisory board (“BIVA”). The views expressed are those of the instructors, commentators, guests and participants, as the case may be, and do not necessarily represent those of BetterInvesting™ or BIVA. Investors should conduct their own review and analysis of any company of interest before making an investment decision. • Securities discussed may be held by the instructors in their own personal portfolios or in those of their clients. BI presenters and volunteers are held to a strict code of conduct that precludes benefiting financially from educational presentations or public activities via any BetterInvesting programs, events and/or educational sessions in which they participate. Any violation is strictly prohibited and should be reported to the President of BetterInvesting or the Manager of Volunteer Relations. BETTERINVESTING NATIONAL CONVENTION Capitalization • Companies have three ways of obtaining money to grow – Retained earnings – Leverage – Selling additional shares of stock • Information about Capitalization is found on the front side of the Stock Selection Guide BETTERINVESTING NATIONAL CONVENTION Preferred Stock Common Shares Total Debt % Insiders % Institutional Holdings % debt to capitalization % Potential Dilution BETTERINVESTING NATIONAL CONVENTION Capitalization • This section identifies the risk level – Volatility – Debt – Dilution BETTERINVESTING NATIONAL CONVENTION Volatility Debt Dilution BETTERINVESTING NATIONAL CONVENTION VOLATILITY • Too few shares: sizable trades can affect price • Too high institutional ownership: price fluctuations or stampede on institutional selling • Too much insider ownership BETTERINVESTING NATIONAL CONVENTION Common Shares • Should be large enough to carry buy and sell orders • Represents ownership in a company. • On the bottom of the priority ladder in the ownership structure. BETTERINVESTING NATIONAL CONVENTION PREFERRED STOCK • Convertible • Redeemable • Participating • Cumulative BETTERINVESTING NATIONAL CONVENTION PREFERRED STOCK • May entitle shareholders to specific dividend rates • Entitle shareholders to “first rights” to payment if the company fails • Common shares may become worthless if preferred shareholders are paid first. BETTERINVESTING NATIONAL CONVENTION Why issue preferred stock? • To avoid dilution • For option of suspending the dividend • To attract a conservative investor • To use in mergers and acquisitions as a “guaranty” to the seller BETTERINVESTING NATIONAL CONVENTION WHAT IS INSTITUTIONAL OWNERSHIP? • Blocks of shares held by investing groups such as insurance companies, mutual funds, banks, and pension plans BETTERINVESTING NATIONAL CONVENTION INSTITUTIONAL OWNERSHIP • Can make a stock price volatile since funds have a short-term view • Caution: Institutional ownership may be misleading! BETTERINVESTING NATIONAL CONVENTION INSIDER OWNERSHIP • Officers and directors within the company • Original founders of the company BETTERINVESTING NATIONAL CONVENTION % INSIDER OWNERSHIP • Large companies- insiders may own as little as 1% • Small companies – insiders may own as much as 30% BETTERINVESTING NATIONAL CONVENTION DEBT • % of debt to capitalization • Remember that interest payments must be met regularly BETTERINVESTING NATIONAL CONVENTION Dilution • Reduces value of the shareholders’ portion of earnings • May come from conversion of preferred stock or issuing of new stock BETTERINVESTING NATIONAL CONVENTION REVIEW Capitalization section identifies the risk level • Volatility • Debt • Dilution BETTERINVESTING NATIONAL CONVENTION Volatility Debt Dilution BETTERINVESTING NATIONAL CONVENTION Information derived from: • The Stock Selection Handbook by Bonnie Biafore • The Motley Fool: Power of Preferred Stocks by Todd N. Lebor April 24, 2001 • Investopedia. com BETTERINVESTING NATIONAL CONVENTION Make A Difference In Someone’s Life If you have benefited from BETTERINVESTING, Please pick up some BETTERINVESTING materials and introduce others to this opportunity.