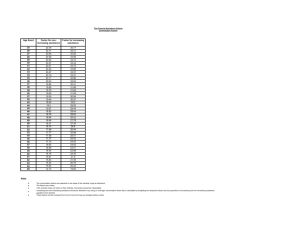

Increasing Cost Individual Cost Methods

advertisement

General Principles of Pension Valuation • Basis for valuation of pension liabilities has similar actuarial mathematics as developed for life insurance • Both create a liability – The defined benefit pension plan is clearly a liability of the plan sponsor – they have made the promise to provide benefits – need to support with appropriate assets – Life insurance benefits are clearly a liability of the insurance company – policy reserves are the measure of that liability on the insurance company’s balance sheet - they have made the promise to provide benefits – need to support with appropriate assets General Principles of Pension Valuation • Mathematics often treated separately – Pension laws have grown to develop specific education standards for actuaries who sign off on pension valuation – United States Pension Law requires and Enrolled Actuary (EA designation) see http://www.beanactuary.org/about/enrolled.cfm – Licensed by a Joint Board of the Department of Treasury & Department of Labor General Principles of Pension Valuation • Other reasons why the mathematics is often treated separately – Number of participants in a pension plan typically less than similar insureds in a life insurance portfolio • As we saw… Can lead to different variances of benefit estimates – Discount rates used for pension valuation have more discretion • Life Insurance valuation interest rate set by the Standard Valuation Law (“SVL”) adopted by the NAIC General Principles of Pension Valuation • Other reasons why the mathematics is often treated separately – Benefit design in pension plans much broader and wider than benefit designs in life insurance plans • Benefits a function of many variables (service, salary, factors, etc) while life insurance benefit is often fixed – “Gains and/or losses” due to experience being “better or worse” than what the actuarial valuation assumptions can be a big part of a sponsor’s income statement • Life insurance statutory valuation done typically on a very conservative basis so that most “bad scenarios” already planned for General Principles of Pension Valuation • Main concepts of pension valuation – Accrued Liability (or Actuarial Liability) – how much being set aside for future benefits – Balance Sheet – Normal Cost – how much to pay in each year to fund benefits – Income Statement – Unfunded Liability – a comparison of the assets and liabilities – Balance Sheet – Actuarial Gain / Loss - how much was made or lost due to actual activity being different than expected – Income Statement General Principles of Pension Valuation • Actuarial Liability calculations will vary depending mainly on… – whether the liability only looks at past service – often called the traditional methods or accrued method – or whether the liability looks at potential future service – often called a projected method – whether the liability is calculated separately for each participant with specific data – often called the “individual method” – or whether blanket assumptions are made – often call the “aggregate method” Actuarial Liability • General description of an “individual accrued” liability: – In words…. • Accrued Benefit that will be paid annually from retirement age forward, times • Factor that pays the Accrued Benefit every year in a monthly annuity, times • Actuarial discount (which takes into account interest, mortality, and completing service) from the retirement age back to the current attained age Actuarial Liability • General description of an “individual accrued” liability: – In mathematical symbols… • ALx = Bx • är(12) • (D(T)r / D(T)x) –where Bx = annual pension benefit that has accrued to age x –(D(T)r / D(T)x) represents the discounting process from the retirement age back to the current age, involving interest and all decrements Actuarial Liability • Concrete Example – COUNTRY Financial DB Plan • Normal Retirement Age = 65 • • Annual Retirement Benefit 1. Calculate A = Average Annual Earnings during five highest consecutive years of income out the ten years immediately preceding retirement 2. Calculate B = Min (Years of Service, 32) 3. Annual Retirement Benefit = 1.65% x A x B • • • What is the Actuarial Liability under an Individual Accrued Method (“Traditional Unit Credit”) for an employee age 40 with 15 years of service where earnings have been constant at $50,000 the last 15 years? • ALx = Bx • är(12) • (D(T)r / D(T)x) • ALx = [1.65% (50000) min(15,32)] • ä65(12) • (D(T)65 / D(T)40) • ALx = [12,375] • ä65(12) • (D(T)65 / D(T)40) Commutation Functions • Commutation Functions – A long time ago, in an actuary’s office, far, far away…. An actuary got tired of writing out all the different summations to indicate insurance and annuity benefits – So…commutation functions were invented – Basic idea: take the most common terms in insurance and annuities and create shorthand for them Commutation Functions • Commutation Functions – Today’s dilemma: The latest version of the Actuarial Mathematics textbook used to teach actuarial principles does not have any reference to commutation functions – But…you can’t avoid them in other texts or more importantly, insurance laws and regulations – And…Defined Benefit Pension Funding formulas make use of them – So…we’ll review briefly Commutation Functions • Commutation Function Initial Definitions – qx = probability of dying during a year • Mortality tables all are written in terms on qx’s – px = probability of surviving during a year – px = 1 – qx – lx = number of people out of original group surviving to age x = p0 * p1 * p2 * …. * px-1 – vx = 1 / (1 + i)x = interest discount for x years Commutation Functions • Natural extensions of these definitions – ly / lx = probability of surviving from age x to age y = (y-x)px – Often, y is described in relative terms to x, such as y = x +n, and therefore the notation becomes lx+n / lx = npx Commutation Functions • The next steps in definitions – Actuaries realized that a lot of what they needed to do involved discounting future payments for mortality and interest – “How much do I need to invest today at a given interest rate and assuming a given mortality to provide a benefit down the road?” – Thus… the birth of the Dx function – Dx = vx lx Commutation Functions • The next steps in definitions – More appropriately, the discounting needed to be done from a future attained age to a known attained age today – “How much do I need to invest today at a given interest rate and assuming a given mortality to provide a benefit at known point in time down the road given that the beneficiary has already survived to a known age?” – Answer? Simple. Divide one Dx function into another – Dz / Dx = vz lz / vx lx = vz-x * lz / lx = vz-x *(z-x)px – Read this as “discounted with interest for (z-x) years, times probability of surviving from x to z” – Example…. Commutation Functions • The next steps in definitions – More appropriately, the discounting needed to be done from a future attained age to a known attained age today – “How much do I need to invest today at a given interest rate and assuming a given mortality to provide a benefit at known point in time down the road given that the beneficiary has already survived to a known age?” – Answer? Simple. Divide one Dx function into another – Dz / Dx = vz lz / vx lx = vz-x * lz / lx = vz-x *(z-x)px – Read this as “discounted with interest for (z-x) years, times probability of surviving from x to z” – Example…. Commutation Functions Interest Rate Age 60 61 62 63 64 65 5.00% l x 1,000,000 990,000 970,200 941,094 903,450 858,278 Fund per life BOY Fund with Interest 67.25 71.32 76.42 82.72 90.48 70.61 74.89 80.24 86.86 95.00 qx px Fund per life EOY 0.0100 0.0200 0.0300 0.0400 0.0500 0.9900 0.9800 0.9700 0.9600 0.9500 71.32 76.42 82.72 90.48 100.00 Commutation Functions • Breaking down the lz / lx part so it makes logical sense…. – Recall that lx = number of people out of original group surviving to age x = p0 * p1 * p2 * …. * px-1 – lz / lx = (p0 * p1 * p2 * …. * px-1 * px * px+1 * …. * pz-1) / (p0 * p1 * p2 * …. * px-1) – What happens? All the terms from 0 to x-1 fall out – So… lz / lx = px * px+1 * …. * pz-1 = (z-x)px Commutation Functions • Same thing but with hard and fast numbers!!! – Let z = 65, x = 35 – For example, discounting a retirement benefit from age 65 for someone currently age 35 – D65 / D35 = v65 l65 / v35 l35 = v65-35 * l65 / l35 = v30 * 30p35 – Read this as “discounted with interest for 30 years, times probability of surviving from 35 to 65” Commutation Functions • Take a look at a general D65 / Dx – What do you see happening at very young employee ages, say age 25 – 35? – Even as x nears 65, does D65 / Dx get close to 1? – And this would just consider mortality – not including employees leaving the company Commutation Functions • General notation for multiple decrements – In pension valuation you have several decrements to the employee population • Employees die • Employees leave the company – So it is common to distinguish the “mortality only” Dx from the “total decrement” D(T)x – (T) denotes that all forces of decrement are being considered Commutation Functions • In pension valuation you have several decrements to the employee population • Employees die • Employees leave the company • An example with multiple decrements… • Assume 1000 people in a cohort, mortality rate of 10% throughout each year, and 5% of the surviving members leave the cohort at the end of the year Commutation Functions • Expansion on Dx – After inventing Dx, actuaries realized that often times they needed to discount a whole series of future payments – So Nx came next – Nx = Dx + Dx+1 + Dx+2 + … (goes on until the end of the mortality table) – We can prove that an annuity due (where payments begin immediately) = Nx / Dx Commutation Functions • For defined benefit pension funding, Dx and Nx are used quite frequently • You are constantly talking about discounting future benefits to the current point in time • Most pension funding notation, and especially that which is used on the current SOA exams, are written in this format Commutation Functions • Monthly versus Annual – Often times, pension benefits are talked about in terms of monthly payments – So annuities due are often the monthly versions of the more common annual notation – Example: • äx is used to describe an annuity of 1 beginning at age x and paid annually • äx(12) is used to describe an annuity of 1/12 beginning at age x and paid monthly Commutation Functions • Combining äx and Dx – Remember, we proved that äx = Nx / Dx – And often times, we are talking about discounting an annuity stream from retirement age, r, to current age, x – So the factor…. Dr / Dx times är … often enters into the discussion – Well… (Dr * är) / Dx = Nr / Dx … so that is a common way to write it – Or perhaps most frequently … N(12)r / D(T)x Increasing Cost Individual Cost Methods • Individual cost methods calculate the cost that a company should pay to fund a pension benefit by looking at each participant one at a time • Increasing cost means that costs typically increase as participants age and are not levelized across the earnings period • Each year, the “slice” of the benefit that is earned is funded in that year Traditional Unit Credit (TUC) Method • Liability under TUC is the value of the accrued pension benefit as of the valuation date • Also called Unit Credit Cost Method (by ERISA) and Accrued Benefit Cost Method • No consideration is given to what salary increases or years of service might occur in the future – strictly look at what has happened before the valuation date Traditional Unit Credit (TUC) Method • Actuarial Liability for each participant: – ALx = Bx • (D(T)r / D(T)x) • är(12) – where Bx = annual pension benefit that has accrued to age x – Perhaps we can read this as “Accrued Benefit, times discount from r back to x, times annuity forward from r” Traditional Unit Credit (TUC) Method • Normal Cost for each participant: – NCx = bx • (D(T)r / D(T)x) • är(12) – where bx = annual pension benefit earned during employment at age x – Perhaps we can read this as “earned benefit this year, times discount from r back to x, times annuity forward from r” Traditional Unit Credit (TUC) Method • Need to do some examples…. • Pull out your handy Commutation Function sheet Traditional Unit Credit (TUC) Method • There’s a clear relationship between Bx and the bx’s – bx’s are the slices of the accrued total benefit, Bx – Many times bx is constant across all years – Recall in some plans, benefits are a fixed amount per year of service – So Bx changes every year, but by the same amount all the time – NCx = bx • (D(T)r / D(T)x) • är(12)… and next year… – NCx+1 = bx+1 • (D(T)r / D(T)x+1) • är(12) – But if bx = bx+1, then the only thing different is the discount factor Traditional Unit Credit (TUC) Method • An interesting twist on this… – If bx = bx+1, then take a look at NCx+1 / NCx – NCx+1 / NCx = [bx+1 • (D(T)r / D(T)x+1) • är(12)] / [bx • (D(T)r / D(T)x) • är(12)] – NCx+1 / NCx = D(T)x / D(T)x+1 = vx lx / vx+1 lx+1 – NCx+1 / NCx = 1 / (v • px) – That boiled down to something pretty simple…which means that exam constructors can make a problem look really difficult and have it be solved fairly quickly!