variable costs

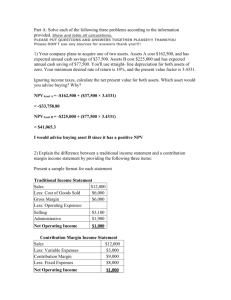

advertisement

Learning Objective 1 Identify the major differences and similarities between financial and managerial accounting. Basics • Managerial accounting concepts are most relevant for manufacturing companies, although it can be applied to merchandising and service companies, as well. • Reports are prepared mainly for internal use and decision-making • No required format; in whatever is desired by management Comparison of Financial and Managerial Accounting Financial Accounting Managerial Accounting External persons who make financial decisions Managers who plan for and control an organization Historical perspective Future emphasis 3. Verifiability versus relevance Emphasis on verifiability Emphasis on relevance for planning and control 4. Precision versus timeliness Emphasis on precision Emphasis on timeliness 5. Subject Primary focus is on the whole organization Focuses on segments of an organization 6. GAAP Must follow GAAP and prescribed formats Need not follow GAAP or any prescribed format Mandatory for external reports Not Mandatory 1. Users 2. Time focus 7. Requirement Learning Objective 2 Identify and give examples of each of the three basic manufacturing cost categories. Manufacturing Costs Direct Materials Direct Labor The Product Manufacturing Overhead Direct Materials Raw materials that become an integral part of the product and that can be conveniently traced directly to it. Example: A radio installed in an automobile Direct Labor Those labor costs that can be easily traced to individual units of product. Example: Wages paid to automobile assembly workers Manufacturing Overhead Manufacturing costs that cannot be traced directly to specific units produced. Examples: Indirect materials and indirect labor Materials used to support the production process. Wages paid to employees who are not directly involved in production work. Examples: lubricants and cleaning supplies used in the automobile assembly plant. Examples: maintenance workers, janitors and security guards. Other cost considerations 1. Product vs period costs 2. Differences in the current assets of a merchandising company and a manufacturing company 3. Presentation of the income statement under various considerations 4. Variable and fixed costs 6. Cost classifications for predicting cost behavior 7. Direct and indirect costs 8. Cost-Volume-Profit analysis 8. Variable costing and absorption costing Product Costs Versus Period Costs Product costs include direct materials, direct labor, and manufacturing overhead. Inventory Cost of Good Sold Period costs include all selling costs and administrative costs. Expense Sale Balance Sheet Income Statement Income Statement Quick Check Which of the following costs would be considered a period rather than a product cost in a manufacturing company? A. Manufacturing equipment depreciation. B. Property taxes on corporate headquarters. C. Direct materials costs. D. Electrical costs to light the production facility. E. Sales commissions. Cost classifications for predicting cost behavior How a cost will react to changes in the level of activity within the relevant range. Total variable costs change when activity changes. Total fixed costs remain unchanged when activity changes. Some costs are semi-variable or mixed. (Relevant range is defined as the range of activity over which a company expects to operate during a year) Cost Classifications for Predicting Cost Behavior Behavior of Cost (within the relevant range) Cost In Total Per Unit Variable Total variable cost changes as activity level changes. Variable cost per unit remains the same over wide ranges of activity. Fixed Total fixed cost remains the same even when the activity level changes. Average fixed cost per unit goes down as activity level goes up. Mixed Costs Costs that have both a variable cost element and a fixed cost element Sometimes called semivariable cost Change in total but not proportionately with changes in activity level Illustration 18-5 Mixed or Semi-variable costs • Methods of breaking the cost down into its fixed and variable components: 1. 2. 3. 4. Scattergraph method High-low method Least-squares regression analysis Multiple regression analysis Quick Check Which of the following costs would be variable with respect to the number of cones sold at a Baskins & Robbins shop? (There may be more than one correct answer.) A. The cost of lighting the store. B. The wages of the store manager. C. The cost of ice cream. D. The cost of napkins for customers. Examples of Variable Costs 1. Merchandising companies – cost of goods sold. 2. Manufacturing companies – direct materials, direct labor, and variable overhead. 3. Merchandising and manufacturing companies – commissions, shipping costs, and clerical costs such as invoicing. 4. Service companies – supplies, travel, and clerical. Quick Check Which of the following statements about cost behavior are true? a. Fixed costs per unit vary with the level of activity. b. Variable costs per unit are constant within the relevant range. c. Total fixed costs are constant within the relevant range. d. Total variable costs are constant within the relevant range. Contribution format income statement The contribution margin format emphasizes cost behavior. All items in the income statement are re-classified as to fixed and variable costs. Starting item (Sales) and the bottom line (Net Income) are the same in both the traditional income statement and a contribution format income statement. The difference is how the costs in between these two items contribute to the analysis. In the latter, after all costs have been re-classified, variable costs are subtracted from total sales to arrive at the contribution margin. This margin covers fixed costs and a certain level of profit, thus the term contribution margin. (Note that some operating expenses may be variable.) As you will see, this is a very powerful analysis tool and answers “what if?” questions. Uses of the Contribution Format The contribution income statement format is used as an internal planning and decision-making tool. This approach will be used for: 1.Cost-volume-profit analysis 2.Budgeting 3.Segmented reporting of profit data 4.Special decisions such as pricing and make-or-buy analysis. Here, we will only look at #1 above. The Contribution Format Sales Revenue Less: Variable costs Contribution margin Total $ 100,000 60,000 $ 40,000 Less: Fixed costs Net operating income 30,000 $ 10,000 Unit $ 50 30 $ 20 The contribution margin format emphasizes cost behavior. Contribution margin covers fixed costs and provides for income. The Contribution Format Used primarily for external reporting. Used primarily by management. Basics of Cost-Volume-Profit Analysis The contribution income statement is helpful to managers in judging the impact on profits of changes in selling price, cost, or volume. The emphasis is on cost behavior. Racing Bicycle Company Contribution Income Statement For the Month of June Sales (500 bicycles) $ 250,000 Less: Variable expenses 150,000 Contribution margin 100,000 Less: Fixed expenses 80,000 Net operating income $ 20,000 Contribution Margin (CM) is the amount remaining from sales revenue after variable expenses have been deducted. Basics of Cost-Volume-Profit Analysis The contribution income statement is helpful to managers in judging the impact on profits of changes in selling price, cost, or volume The emphasis is on cost behavior. Example: Racing Bicycle Company Contribution Income Statement For the Month of June 2011 Sales (500 bicycles) Less: Variable expenses Contribution margin Less: Fixed expenses Net Income 250,000 150,000 100,000 80,000 20,000 Basics of Cost-Volume-Profit Analysis Suppose there is a 10% increase in sales, how would it affect net income? Racing Bicycle Company Contribution Income Statement For the Month of June 2011 550 bicycles Sales (500 bicycles) 250,000 $275,000 Less: Variable expenses 150,000 165,000 Contribution margin 100,000 110,000 Less: Fixed expenses 80,000 80,000 Net Income 20,000 30,000 Basics of Cost-Volume-Profit Analysis Suppose the company believes that by increasing advertising by $10,000 next month, sales would increase by 25 bicycles. Should the company spend for the additional advertising? Racing Bicycle Company Contribution Income Statement For the Month of June 2011 Sales (500 bicycles) Less: Variable expenses Contribution margin Less: Fixed expenses Net Income 250,000 150,000 100,000 80,000 20,000 CVP/Profit Graph Prepare and interpret a costvolume-profit (CVP) graph and a profit graph. CVP/Profit/Breakeven Graph Use the contribution margin ratio (CM ratio) to compute changes in contribution margin and net operating income resulting from changes in sales volume. Short problems • Gayne Corporation's contribution margin ratio is 12% and its fixed monthly expenses are $84,000. If the company's sales for a month are $738,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change. • A) $565,440 • B) $654,000 • C) $88,560 • D) $4,560 Short problems • • • • • • Data concerning Kardas Corporation's single product appear below: • The company is currently selling 8,000 units per month. Fixed expenses are $719,000 per month. The marketing manager believes that a $20,000 increase in the monthly advertising budget would result in a 180 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change? (show shortcut). A) decrease of $160 B) increase of $20,160 C) decrease of $20,000 D) increase of $160 • • • • Per Unit Selling price $140 Variable expenses 28 Contribution margin $112 Percent of Sales 100% 20% 80% Variable Costing • What are variable costing and absorption costing? • Absorption costing is what we learned in cost accounting, i.e., consider all costs in determining unit cost ; therefore, fixed overhead manufacturing costs are product costs. • Variable costing considers only variable costs; therefore, all fixed expenses are considered as period costs. • (The difference is in the computation of unit product cost.) Overview of Absorption and Variable Costing Absorption Costing Variable Costing Direct Materials Product Costs Direct Labor Product Costs Variable Manufacturing Overhead Fixed Manufacturing Overhead Period Costs Variable Selling and Administrative Expenses Fixed Selling and Administrative Expenses Period Costs Unit Cost Computations Harvey Company produces a single product with the following information available: Unit Cost Computations Unit product cost is determined as follows: Under absorption costing, all production costs, variable and fixed, are included when determining unit product cost. Under variable costing, only the variable production costs are included in product costs. Income Comparison of Absorption and Variable Costing Let’s assume the following additional information for Harvey Company. – 20,000 units were sold during the year at a price of $30 each. – There is no beginning inventory. Now, let’s compute net operating income using both absorption and variable costing. Absorption Costing Fixed manufacturing overhead deferred in inventory is 5,000 units × $6 = $30,000. Variable Costing Variable manufacturing costs only. Variable Costing Sales (20,000 × $30) Less variable expenses: Beginning inventory $ Add COGM (25,000 × $10) 250,000 Goods available for sale 250,000 Less ending inventory (5,000 × $10) 50,000 Variable cost of goods sold 200,000 Variable selling & administrative expenses (20,000 × $3) 60,000 Contribution margin Less fixed expenses: Manufacturing overhead $ 150,000 Selling & administrative expenses 100,000 Net operating income $ 600,000 All fixed manufacturing overhead is expensed. 260,000 340,000 250,000 $ 90,000 Variable Costing • What is the difference between variable costing and absorption costing? The difference is only in the treatment of fixed manufacturing overhead in inventory. • Why is absorption costing not appropriate in decision making? Absorption costing does not dovetail with CVP analysis, nor does it support decision making. It treats fixed manufacturing overhead as a variable cost. It assigns per unit fixed manufacturing overhead costs to production. • (Explain: “fixed manufacturing overhead deferred in inventory”, and “fixed manufacturing overhead released from inventory”.) • When do the net operating incomes under both approaches equal? Quick Check Which method will produce the highest values for work in process and finished goods inventories? a. Absorption costing. b. Variable costing. c. They produce the same values for these inventories. d. It depends. . .