Ch9Risk

advertisement

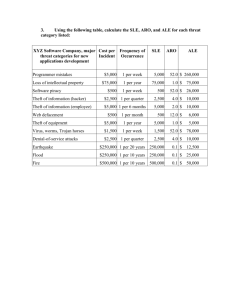

INFORMATION SECURITY MANAGEMENT LECTURE 8: RISK MANAGEMENT CONTROLLING RISK You got to be careful if you don’t know where you’re going, because you might not get there. – Yogi Berra Managing Risk (cont’d.) Figure 9-1 Residual risk Source: Course Technology/Cengage Learning Managing Risk – Risk Control • Risk control involves selecting one of the four risk control strategies Should the organization ever accept the risk? Risk Control Cycle Figure 9-3 Risk control cycle Source: Course Technology/Cengage Learning Cost Benefit – Asset Valuation Asset value: replacement cost and/or income derived through the use of an asset Exposure Factor (EF): portion of asset's value lost through a threat (also called impact) Single Loss Expectancy (SLE) = Asset ($) x EF (%) Cost Benefit – Asset Valuation Annualized Rate of Occurrence (ARO) Probability of loss in a year, % Annual Loss Expectancy (ALE) = SLE x ARO Example of Quantitative Risk Assesment Theft of a laptop computer, with the data encrypted Asset value: $4,000 Exposure factor ? SLE, ARO, ALE ? Example of Quantitative Risk Assesment Dropping a laptop computer and breaking the screen Asset value: $4,000 Exposure factor ? SLE, ARO, ALE ? Cost-Benefit Analysis Calculation CBA = ALE(prior) – ALE(post) – ACS – ALE (prior to control) is the annualized loss expectancy of the risk before the implementation of the control – ALE (post-control) is the ALE examined after the control has been in place for a period of time – ACS is the annual cost of the safeguard Example of Cost-Benefit Analysis Calculation Dropping an iPad and breaking the screen Asset value: $700 Exposure factor: 50% SLE = ARO = 25% chance of damaging ALE (prior) = ALE (post) = CBA (cost of case = $30) CBA = ALE(prior) – ALE(post) – ACS CBA = Example of Cost-Benefit Analysis Calculation Unprotected customer database Asset value: $200,000 Exposure factor: 50% SLE = ARO = 75% chance of occurring ALE (prior) = ALE (post) = CBA (ACS = $5,000) CBA = ALE(prior) – ALE(post) – ACS CBA = Recommended Risk Control Practices • Qualitative/Quantitative Approach • Octave Methods • Microsoft Risk Management Approach • FAIR Qualitative and Hybrid Measures • Quantitative assessment • Qualitative assessment • Hybrid assessment OCTAVE Method • The Operationally Critical Threat, Asset, and Vulnerability Evaluation (OCTAVE) Method • Variations of the OCTAVE method – – – The original OCTAVE method OCTAVE-S OCTAVE-Allegro www.cert.org/octave/ Microsoft Risk Management Approach • Four phases in the Microsoft InfoSec risk management process: – – – – Assessing risk Conducting decision support Implementing controls Measuring program effectiveness www.microsoft.com/technet/security/topics/complianceandpolicies/secrisk/default.mspx Microsoft Risk Management Approach Figure A-1 Security Risk Management Guide Source: Course Technology/Cengage Learning Factor analysis of Information Risk (FAIR) • Basic FAIR analysis is comprised of four stages: • • • • Stage 1 - Identify scenario components Stage 2 - Evaluate loss event frequency Stage 3 - Evaluate probable loss magnitude(PLM) Stage 4 - Derive and articulate Risk • Unlike other risk management frameworks, FAIR relies on the qualitative assessment of many risk components using scales with value ranges, for example very high to very low http://fairwiki.riskmanagementinsight.com FAIR (cont’d.) Figure 9-4 Factor analysis of information risk (FAIR) Management of Information Security, 3rd ed. Source: Course Technology/Cengage Learning (Based on concepts from Jack A. Jones) HEALTH FIRST CASE STUDY Analyzing Risk Step 1: Define Assets Step 1: Define Assets Consider Consequential Financial Loss Asset Name $ Value Direct Loss: Consequenti al Financial Loss Replaceme nt Medical DB Daily Operation (DO) Medical Malpractice (M) HIPAA Liability (H) Notification (NL) $ Value Law Liability Confidentiality, Integrity, and Availability Notes C? I? A? Step 1: Define Assets Consider Consequential Financial Loss Asset Name $ Value $ Value Direct Loss: Consequential Replacement Financial Loss Medical DB DO+M_H+NL Daily Operation (DO) $ Medical Malpractice (M) $ HIPAA Liability (H) $ Notification Law Liability (NL) $ Confidentiality, Integrity, and Availability Notes C IA HIPAA Criminal Penalties $ Penalty Imprisonment Offense Up to $50K Up to one year Wrongful disclosure of individually identifiable health information Up to $100K Up to 5 years …committed under false pretenses Up to $500K Up to 10 years … with intent to sell, achieve personal gain, or cause malicious harm Then consider bad press, state audit, state law penalties, civil lawsuits, lost claims, … Step 2: Estimate Potential Loss for Threats Step 3: Estimate Likelihood of Exploitation Normal threats: Threats common to all organizations Inherent threats: Threats particular to your specific industry Known vulnerabilities: Previous audit reports indicate deficiencies. Step 2: Estimate Potential Loss for Threats Step 3: Estimate Likelihood of Exploitation Slow Down Business 1 week 2 1 year Temp. Shut Down Business Threaten Business Threat (Probability) Hacker/Criminal Loss of Electricity Snow Emergency 1 Malware Pandemic Failed Disk Tornado/Wind Storm Stolen Laptop 5 years (.2) Stolen Backup Tape(s) 10 years (.1) Vulnerability (Severity) Flood 20 years (.05) 4 50 years (.02) Earthquake Social Engineering Intruder Fire 3 Step 4: Compute Expected Loss Step 5: Treat Risk Step 4: Compute E(Loss) ALE = SLE * ARO Asset Threat Single Loss Annuali Annual zed Rate Loss of Expecta Expecta Occurre ncy ncy nce (ALE) (SLE) (ARO) Step 5: Treat Risk Risk Acceptance: Handle attack when necessary Risk Avoidance: Stop doing risky behavior Risk Mitigation: Implement control to minimize vulnerability Risk Transference: Pay someone to assume risk for you Risk Planning: Implement a set of controls