Chapter4-Quantitative analysis

advertisement

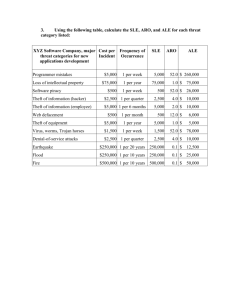

Chapter(4) Quantitative Risk Analysis Risk Model Quantitative Analysis • Quantitative analysis utilizes techniques such as simulation and decision tree analysis to provide data on: – The impact to cost or schedule for risks – The probability of meeting project cost and/or schedule targets – Realistic project targets on cost, schedule, and/or scope • Qualitative analysis should occur prior to conducting quantitative analysis. • Not every risk needs to go through quantitative analysis. Quantitative Analysis • If quantitative analysis is to be used, then this section should contain information on: – Defined criteria for which risks go through quantitative analysis – Technique(s) to be utilized – Expected outputs of quantitative analysis Advantages of Quantitative Analysis • Although a qualitative risk analysis may be easier to do at times; a quantitative risk analysis offers the following distinct advantages: 1. More objectivity in its assessment 2. More powerful selling tool to management 3. Offers direct projection of cost/benefit of proposal 4. Can be fine-tuned to meet the needs of specific situations 5. Can also be modified to fit the needs of specific industries 6. Much less prone to arouse disagreements during management review 7. Analysis is often derived from some irrefutable facts Quantitative Analysis Process • After you’ve gathered a considerable amount of data to this point, you will need to analyze this information to: – Determine the probability of a risk occurring, – What is affected, – The costs involved with each risk. • Assets will have different risks associated with them, and you will need to correlate different risks with each of the assets inventoried in a company. • Some risks will impact all of the assets of a company, such as the risk of a massive fire destroying a building and everything in it, while in other cases; groups of assets will be affected by specific risks. Quantitative Analysis Process • Assets of a company will generally have multiple risks associated with them. • Equipment failure, theft, or misuse can affect hardware. • While viruses, upgrade problems, or bugs in the code may affect software. • By looking at the weight of importance associated with each asset: – You should then prioritize which assets will be analyzed first. – Determine what risks are associated with each. Quantitative Analysis Process • Once you’ve determined what assets may be affected by different risks, • you then need to determine the probability of a risk occurring. • While there may be numerous threats that could affect a company, not all of them are probable. • For this reason, a realistic assessment of the risks must be performed. Annualized Rate of Occurrence (ARO) • Historical data can provide information on how likely it is that a risk will become reality within a specific period of time. • Research must be performed to determine the likelihood of risks within a locality or with certain resources. • By determining the likelihood of a risk occurring within a year, you can determine what is known as the Annualized Rate of Occurrence (ARO). Annualized Rate of Occurrence (ARO) • Information for risk assessment can be acquired through a variety of sources. • Police departments may be able to provide crime statistics on the area your facilities are located, allowing you to determine the probability of vandalism, break-ins, or dangers potentially encountered by personnel. • Insurance companies will also provide information on risks faced by other companies, and the amounts paid out when these risks became reality. • Other sources may include news agencies, computer incident monitoring organizations, and online resources. Single Loss Expectancy (SLE) • Once the ARO has been calculated for a risk, • you can then compare it to the monetary loss associated with an asset. • This is the dollar value that represents how much money would be lost if the risk occurred. • You can calculate this by looking at the cost of fixing or replacing the asset. • For example, if a router failed on a network, you would need to purchase a new router, and pay to have the new one installed. • In addition to this, the company would also have to pay for employees who aren’t able to perform their jobs because they can’t access the network. • This means that the monetary loss would include the price of new equipment, the hourly wage of the person replacing the equipment, and the cost of employees unable to perform their work. • When the dollar value of the loss is calculated, this provides total cost of the risk, or the Single Loss Expectancy (SLE). Annual Loss Expectancy (ALE) • • • • • • • • To plan for the probable risk, you would need to budget for the possibility that the risk will happen. To do this, you need to use the ARO and the SLE to find the Annual Loss Expectancy (ALE). To illustrate how this works, let’s say that the probability of a Web server failing is 30 percent. This would be the ARO of the risk. If the e-commerce site hosted on this server generates $10,000 an hour and the site would be estimated to be down two hours while the system is repaired, then the cost of this risk is $20,000. In addition to this, there would also be the cost of replacing the server itself. If the server cost $6000, this would increase the cost to $26000. This would be the SLE of the risk. By multiplying the ARO and the SLE, you would find how much money would need to be budgeted to deal with this risk. Annual Loss Expectancy (ALE) • This formula provides the ALE: • • • • ARO x SLE = ALE When looking at the example of the failed server hosting an e-commerce site, this means the ALE would be: .3 x $26,000 = $7,800 To deal with the risk, you need to assess how much needs to be budgeted to deal with the probability of the event occurring. The ALE provides this information, leaving you in a better position to recover from the incident when it occurs. Exercise: Determining the Annual Loss Expected to Occur From Risks • A widget manufacturer has installed new network servers, changing its network from a peer-to-peer network to a client/server-based network. • The network consists of 200 users who make an average of $20 an hour, working on 100 workstations. • Previously, none of the workstations involved in the network had anti-virus software installed on the machines. • This was because there was no connection to the Internet, and the workstations didn’t have floppy disk drives or Internet connectivity, so the risk of viruses was deemed minimal. • One of the new servers provides a broadband connection to the Internet, which employees can now use to send and receive email, and surf the Internet. Exercise – Cont. • One of the managers read in a trade magazine that other widget companies have reported an 80 percent chance of viruses infecting their network after installing T1 lines and other methods of Internet connectivity, • and that it may take upwards of three hours to restore data that’s been damaged or destroyed. • A vendor will sell licensed copies of anti-virus software for all servers and the 100 workstations at a cost of $4,700 per year. • The company has asked you to determine the annual loss that can be expected from viruses, and determine if it is beneficial in terms of cost to purchase licensed copies of anti-virus software Exercise – Cont. 1. What is the Annualized Rate of Occurrence (ARO) for this risk? 2. Calculate the Single Loss Expectancy (SLE) for this risk. 3. Using the formula ARO x SLE = ALE, calculate the Annual Loss Expectancy. 4. Determine whether it is beneficial in terms of monetary value to purchase the anti-virus software by calculating how much money would be saved or lost by purchasing the software. ANSWERS TO EXERCISE QUESTIONS 1. The Annualized Rate of Occurrence (ARO) is the likelihood of a risk occurring within a year. The scenario states that trade magazines calculate an 80% risk of virus infection after connecting to the Internet, so the ARO is 80% or .8. ANSWERS TO EXERCISE QUESTIONS 2. The Single Loss Expectancy (SLE) is the dollar value of the loss that equals the total cost of the risk. • In the case of this scenario, there are 200 users who make an average of $20 per hour. • Multiplying the number of employees who are unable to work due to the system being down by their hourly income, this means that the company is losing $4,000 an hour (200 x $20 = $4000). • Because it may take up to three hours to repair damage from a virus, this amount must be multiplied by three because employees will be unable to perform duties for approximately three hours. • This makes the SLE $12,000 ($4,000 x 3 = $12,000). ANSWERS TO EXERCISE QUESTIONS 3. The ALE is calculated by multiplying the ARO by the SLE (ARO x SLE = ALE). In this case, this would mean that you would multiply $12,000 by 80 percent (.8) to give you $9,600 (.8 x $12,000 = $9,600). Therefore, the ALE is $9,600. ANSWERS TO EXERCISE QUESTIONS 4. Because the ALE is $9,600, and the cost of the software that will minimize this risk is $4,700 per year, this means that the company would save $4,900 per year by purchasing the software ($9,600 - $4,700 = $4900).