Risk and Return 1

Risk and Return

Chapter Objectives

• Discuss the concepts of average and expected rates of return.

• Define and measure risk for individual assets.

• Show the steps in the calculation of standard deviation and variance of returns.

• Compute historical average return of securities and market premium.

• Determine Expected Returns and Variances

• Calculating Coefficient of Variation

• Portfolio Risk and Return

• Systematic and Unsystematic

• Risk Diversification

• CAPM

Introduction

An investment is the current commitment of dollars for a period of time in order to derive future payments that will compensate the investor for

• the time the funds are committed,

• the expected rate of inflation, and

• the uncertainty of the future payments

Holding Period Return

• If you commit GHȼ200 to an investment at the beginning of the year and you get back GHȼ220 at the end of the year, what is your return for the period? The period during which you own an investment is called its holding period, and the

return for that period is the holding period return

(HPR). In this example, the HPR is 1.10, calculated as follows

• However, investors generally evaluate returns in percentage terms on an annual basis which is

called holding period yield (HPY): HPY = HPR – 1

Return on a Stand Alone Asset

• Total return = Dividend + Capital gain

Rate of return

Dividend yield

Capital gain yield

R

1

DIV

1

P

0

P

1

P

0

P

0

DIV

1

P

1

P

0

P

0

• Year-to-Year Total Returns on HLL Share

160.00

140.00

120.00

100.00

80.00

60.00

40.00

20.00

0.00

149.70

1992

70.54

1993

16.52

22.71

1994 1995

49.52

92.33

1996 1997

Ye ar

36.13

1998

52.64

1999

7.29

2000

12.95

2001

Return on a Stand Alone Asset

• What is the return on an investment that costs

GHȼ 1,000 and is sold after 1 year for GHȼ 1,100?

• Ghana Return

GHȼ Received - GHȼ Invested

GHȼ1,100 GHȼ1,000 = GHȼ 100 .

• Percentage return

Return/Amount Invested

100/1,000 = 0.10

= 10% .

Average Rate of Return

• The average rate of return is the sum of the various one-period rates of return divided by the number of period.

• Formula for the average rate of return is as follows:

R

1

= [ n

R

1

R

2

R n

]

1 n n t =1

R t

• The rate of return can be calculated for a single asset or a portfolio of assets.

Risk

Risk is the uncertainty that an investment will earn

its expected rate of return. Also, risk refers to the chance that some unfavorable event will occur.

The greater the chance of a return far below the expected return, the greater the risk.

• An asset’s risk can be analyzed in two ways:

1. on a stand-alone basis, where the asset is considered in isolation, and

2. on a portfolio basis, where the asset is held as one of a number of assets in a portfolio.

Risk for a Stand Alone Asset

• Thus, an asset’s stand-alone risk is the risk

an investor would face if he or she held only this one asset.

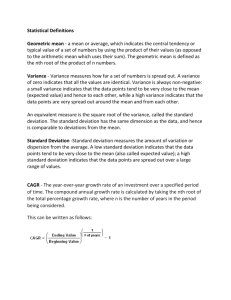

• Two possible measures of risk (uncertainty) have received support in theoretical work on portfolio theory: the variance and the standard deviation of the estimated distribution of expected returns

Risk of Rates of Return: Variance and

Standard Deviation

• Formulae for calculating variance and standard deviation:

Standard deviation = Variance

2

1 n

1 t n

1

R t

R

2

Risk of Rates of Return: Variance and

Standard Deviation

• ABC Ltd, a company traded on the GSE made the following returns over a ten-year period.

Year

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Returns

0.1

0.32

0.12

0.25

0.23

0.09

0.11

0.42

-0.12

0.15

Calculate the average return and the risk of ABC

Risk of Rates of Return: Variance and

Standard Deviation

• Average return = 0.167

2004

2005

2006

2007

2008

2009

Year

2000

2001

2002

2003

Returns (R-Rbar)(R-Rbar)^2

0.1

-0.067

0.0045

0.32

0.153

0.0234

0.12

-0.047

0.0022

0.25

0.083

0.0069

0.23

0.063

0.0040

0.09

-0.077

0.0059

0.11

-0.057

0.0032

0.42

0.253

0.0640

-0.12

-0.287

0.0824

0.15

-0.017

0.0003

0.0219

0.148

Risk of Rates of Return: Variance and

Standard Deviation

• Standard deviation measures the stand-alone risk of an investment.

• The larger the standard deviation, the higher the probability that returns will be far below the expected return and therefore the higher the risk

Expected Return Vrs Risk

• Although the analysis of historical performance is useful, selecting investments for your portfolio requires you to predict the rates of return you expect to prevail. An investor who is evaluating a future investment alternative expects or anticipates a certain rate of return. This may be a point estimate or range.

Expected Return Vrs Risk

• An investor determines how certain the expected rate of return on an investment is by analyzing estimates of expected returns. To do this, the

investor assigns probability values to all possible returns. These probability values range from zero, which means no chance of the return, to one, which indicates complete certainty that the investment will provide the specified rate of return. These probabilities are typically subjective estimates based on the historical performance of the investment or similar investments modified by the investor’s expectations for the future.

Expected Return Vrs Risk

• The expected return from an investment is defined as

Expected Return Vrs Risk

• Below are forecasts of the various economic conditions in Ghana with the likely returns for

Zee Ltd.

Calculate the expected return for Zee Ltd

Expected Return Vrs Risk

Economic Conditions Prob Returns (P*R)

Strong Economy

Waek Economy

Normal Economy

0.15

0.15

0.7

0.2

-0.2

0.1

0.03

-0.03

0.07

Expected return= 0.07

Expected Return Vrs Risk

• We can then calculate the variance and standard deviation of the returns as follows;

Expected Return Vrs Risk

• We can calculate the variance and standard deviation for Zee Ltd as;

Economic Conditions Prob Returns (P*R) R- E(R)[R-E(R )]^2P[R-E(R )]^2

Strong Economy 0.15 0.2 0.03 0.13 0.0169

0.002535

Waek Economy 0.15 -0.2 -0.03 -0.27 0.0729

0.010935

Normal Economy 0.7

0.1 0.07 0.03 0.0009

0.00063

Variance =0.0141

𝑺𝒕𝒂𝒏𝒅𝒂𝒓𝒅 𝑫𝒆𝒗 = 𝟎. 𝟎𝟏𝟒𝟏 = 0.1187

Relative Measure of Risk

• In some cases, an unadjusted variance or standard deviation can be misleading. If conditions for two or more investment alternatives are not similar—that is if there are major differences in the expected rates of return—it is necessary to use a measure of relative variability to indicate risk per unit of expected return. A widely used relative

measure of risk is the coefficient of variation

(CV), calculated as follows:

Relative Measure of Risk

The CV for the preceding example would be;

Relative Measure of Risk

Consider the following two investments;

Expected Return

Standard Deviation

Stock A Stock B

0.07

0.12

0.05

0.07

Expected Return : Incorporating

Probabilities in Estimates

• The expected rate of return [E (R)] is the sum of the product of each outcome (return) and its associated probability:

RETURNS UNDER VARIOUS ECONOMIC CONDITIONS

Economic Conditions Share Price

(1) (2)

Dividend

(3)

Dividend Yield Capital Gain

(4) (5)

Return

(6) = (4) + (5)

High growth

Expansion

Stagnation

Decline

305.50

285.50

261.25

243.50

4.00

3.25

2.50

2.00

0.015

0.012

0.010

0.008

0.169

0.093

0.000

– 0.068

0.185

0.105

0.010

– 0.060

Economic Conditions

(1)

Growth

Expansion

Stagnation

Decline

RETURNS AND PROBABILITIES

Rate of Return (%)

(2)

Probability

(3)

18.5

10.5

1.0

– 6.0

0.25

0.25

0.25

0.25

1.00

Expected Rate of Return (%)

(4) = (2)

(3)

4.63

2.62

0.25

– 1.50

6.00

Expected Risk and Preference

• A risk-averse investor will choose among investments with the equal rates of return, the investment with lowest standard deviation.

Similarly, if investments have equal risk (standard deviations), the investor would prefer the one with higher return.

• A risk-neutral investor does not consider risk, and would always prefer investments with higher returns.

• A risk-seeking investor likes investments with higher risk irrespective of the rates of return. In reality, most (if not all) investors are risk-averse.