2004-2005 fafsa - Longview Independent School District

advertisement

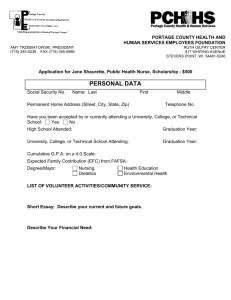

Student Financial Aid Applying for Financial Aid Presented by the Texas Association of Developing Colleges East Texas Educational Opportunity Center A Federal TRIO Program funded by the US Department of Education How Will You Pay for College? What is Financial Aid? Money/Resources to pay for college oGrants and Scholarships oWork Study employment – work for a paycheck oLoans – repay with interest oTax Credits and Deductions Federal Financial Aid Programs • Need based – Pell Grant – Supplemental Educational Opportunity Grant (SEOG) – Academic Competiveness Grant (ACG) – Science/Math Access to Retain Talent Grant (SMART) – Work Study – Subsidized Direct Loan – Perkins Loan • Non-need based – Unsubsidized Direct Loan/Parent Loan State Financial Aid Programs • Towards Excellence, Access and Success (TEXAS Grant) • Texas Educational Opportunity Grant (TEOG) • Texas Public Education Grant (TPEG) • Texas Equalization Grant (TEG) • Texas Work Study • State Tuition Waivers/Exemptions • Various State Scholarships • Texas B-on-Time Loan • College Access Loan (CAL) • Health Education Loan Program (HELP) 2007 – 2008 Financial Aid Distribution Undergraduate Students (Latest Data Available) Source: Institute of Education Sciences US Department of Education – NCES 2009 Scholarships Financial Need Artistic Talents Academic Excellence Athletic Talents Scholarship Scams • Victims of scholarship scams lose more than $100 million annually • Paying money to get money is generally a scam • Duplicates what you can find out for free • Beware of: – Scholarships with application fee – Scholarship services who guarantee success – Sales pitches disguised as financial aid “seminars” • Website: www.finaid.org/finaid/scams.html Start Scholarship Search Early Cost of Attendance • Tuition and fees • Room and board • Books, supplies, equipment, transportation, and miscellaneous personal expenses Expected Family Contribution Parent’s contribution from income/ assets Student’s contribution from income/assets Expected Family Contribution (EFC) Comparing Need 1 X Y 2 3 Z EFC Cost of Attendance (Variable) Expected Family Contribution (Constant) EFC Need (Variable) FREE Application for Federal Student Aid (FAFSA) FAFSA on the Web (FOTW) www.fafsa.ed.gov To Complete the 2012 – 2013 FAFSA Social Security Number Driver’s License Number Selective Service Registration Date of Parents’ Marriage, Remarriage, Separation, Di-vorce, Widow Status, if applicable Date of Birth/Social Security Number for Parents, if applicable Number in Parents’ Household, if applicable 2011 Tax Form (1040, 1040A or 1040 EZ) along with W-2s and Schedules for both Student and Parents Records of Child Support, Veterans Benefits, Workers Comp, etc. received or paid in 2011 Value of stocks, bonds, CDs, real estate, businesses, etc. Cash on hand and in Checking and Saving accounts. Name/Address/SSN/DOB Citizenship/Marital Status/Residency/Gender/Selective Service First Generation and High School Graduation Status High School/College Enrollment Information Student’s Income and Tax Information Student’s Asset Information Dependent students will not report INVESTMENT amounts on line #41 but will add their INVESTMENTS with parents’ INVESTMENTS on line #89 Student’s Income Reduction Information Student’s Additional Income Information Questions to Determine Student’s Dependency Status PARENTS are birth or adoptive mother and father/ stepmother and stepfather, if applicable. Grandparents, siblings, guardians, other relatives or friends cannot be reported in this section. More about “Parents” in Completing the FAFSA 58-59 Parent’s Household Information Parent’s Tax Status and “Dislocated Worker” Status Parent’s Income and Asset Information Dependent students will not report INVESTMENT amounts on line #41 but will add their INVESTMENTS with parents’ INVESTMENTS on line #89 Parent’s Income Reduction Information Parent’s Additional Income Information This section is for INDEPENDENT STUDENTS only! (When Parent Information Is Not Required on FAFSA) List of Colleges to Receive FAFSA Information (Up to 10 Colleges Can Be Listed Online) LIST SCHOOLS IN ORDER OF PREFERENCE The College Financial Aid Office (FA0) has the discretion to provide a “Dependency Override” (D/O) if a student proves that he/she should not be required to report parent information or is a Homeless Youth. WHAT’S NEXT? You will receive a SAR (Student Aid Report)—either postal or electronic delivery. The Financial Aid Office of the college(s) you listed will receive an Electronic SAR (ISIR). If required to verify the information you reported on the FAFSA (the process is called “VERIFICATION”), you will be asked to forward copies of signed Tax Returns, printouts of Child Support, Workers Comp, Veterans Benefits, etc. to show that the FAFSA was properly completed. The Financial Aid Office will provide an “Award Letter” either by mail or through their on-line services to specify the source(s) and the amount(s) of financial aid you will receive. BE SURE TO RESPOND QUICKLY TO REQUESTS FOR ADDITIONAL INFORMATION OR FORMS COMPLETION. KNOW HOW TO ACCESS INFORMATION Once you’re accepted for admission, you’ll receive information about accessing student information. This allows you to: • Check your admission status for missing documentation • Sign up for Testing/Orientation, if applicable • Check your financial aid status for missing documentation • Accept or Decline your Financial Aid Offers CONTACT OUR OFFICE 2009-C South Mobberly ( Located between Manly’s Furniture Store & Tex-Mex Restaurant and across the street from LeTourneau University) Longview, Texas 75602 Phone: 903.757.9660 Fax: 903.757.9663 www.txadc.org