YORK UNIVERSITY

Faculty of Liberal Arts and Professional Studies

School of Administrative Studies

AP/ADMS 4551 - Section N

Auditing and Other Assurance Services

Winter 2013

COURSE OUTLINE

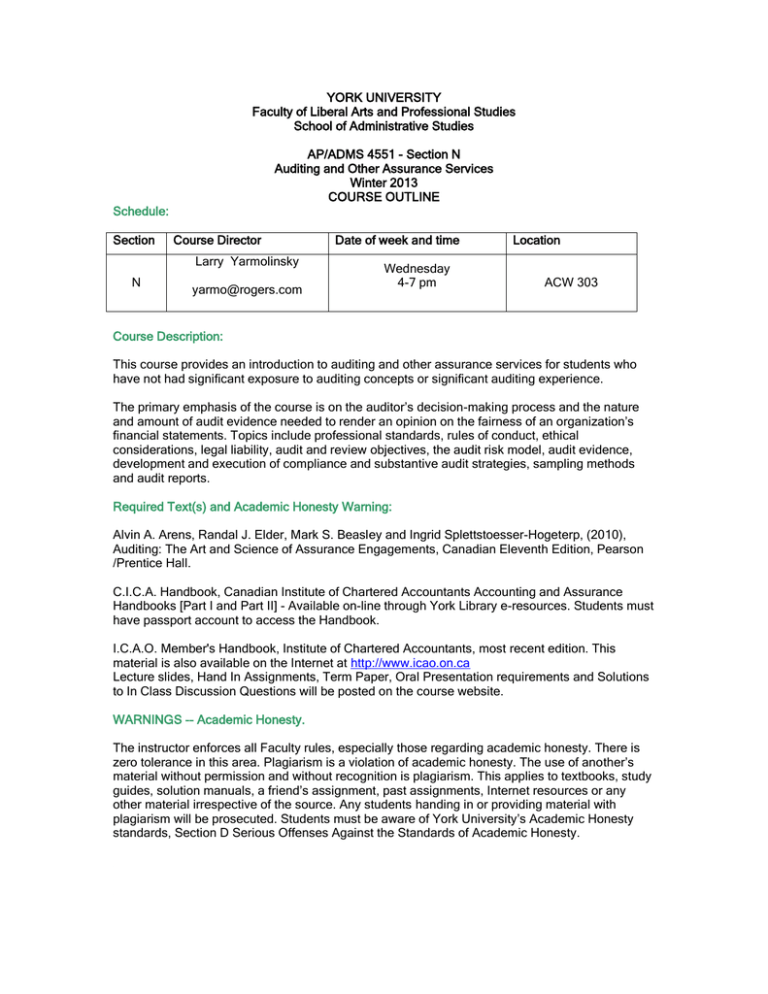

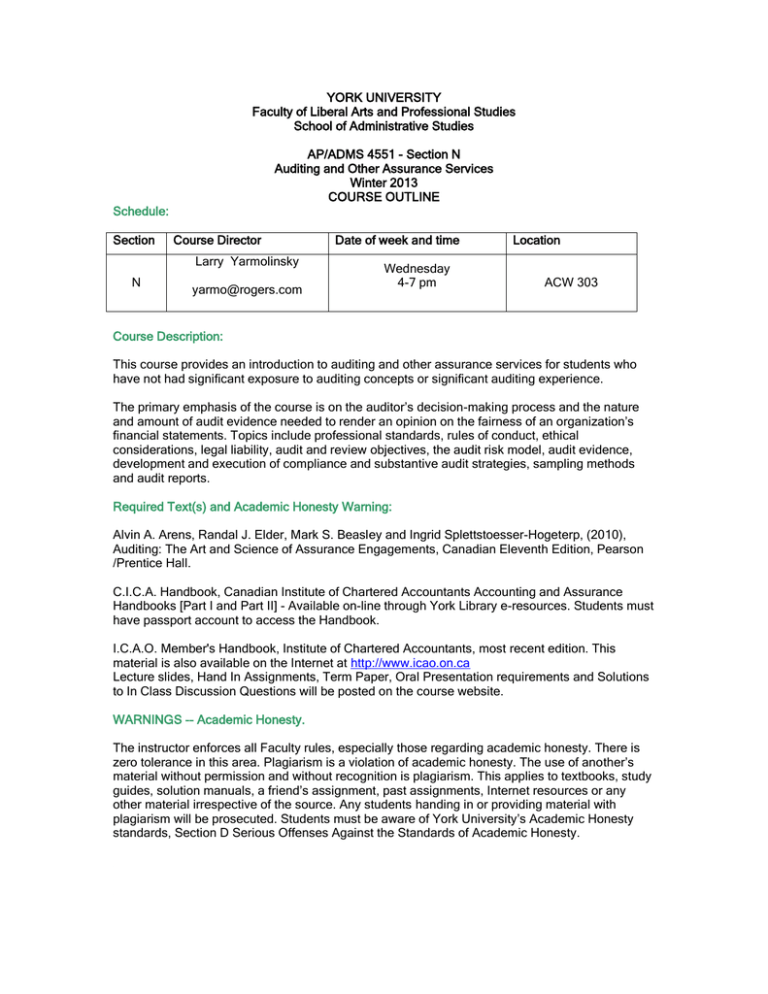

Schedule:

Section

Course Director

Larry Yarmolinsky

N

yarmo@rogers.com

Date of week and time

Wednesday

4-7 pm

Location

ACW 303

Course Description:

This course provides an introduction to auditing and other assurance services for students who

have not had significant exposure to auditing concepts or significant auditing experience.

The primary emphasis of the course is on the auditor’s decision-making process and the nature

and amount of audit evidence needed to render an opinion on the fairness of an organization’s

financial statements. Topics include professional standards, rules of conduct, ethical

considerations, legal liability, audit and review objectives, the audit risk model, audit evidence,

development and execution of compliance and substantive audit strategies, sampling methods

and audit reports.

Required Text(s) and Academic Honesty Warning:

Alvin A. Arens, Randal J. Elder, Mark S. Beasley and Ingrid Splettstoesser-Hogeterp, (2010),

Auditing: The Art and Science of Assurance Engagements, Canadian Eleventh Edition, Pearson

/Prentice Hall.

C.I.C.A. Handbook, Canadian Institute of Chartered Accountants Accounting and Assurance

Handbooks [Part I and Part II] - Available on-line through York Library e-resources. Students must

have passport account to access the Handbook.

I.C.A.O. Member's Handbook, Institute of Chartered Accountants, most recent edition. This

material is also available on the Internet at http://www.icao.on.ca

Lecture slides, Hand In Assignments, Term Paper, Oral Presentation requirements and Solutions

to In Class Discussion Questions will be posted on the course website.

WARNINGS -- Academic Honesty.

The instructor enforces all Faculty rules, especially those regarding academic honesty. There is

zero tolerance in this area. Plagiarism is a violation of academic honesty. The use of another’s

material without permission and without recognition is plagiarism. This applies to textbooks, study

guides, solution manuals, a friend’s assignment, past assignments, Internet resources or any

other material irrespective of the source. Any students handing in or providing material with

plagiarism will be prosecuted. Students must be aware of York University’s Academic Honesty

standards, Section D Serious Offenses Against the Standards of Academic Honesty.

Course Learning Objectives:

To understand the purposes, benefits and disadvantages of auditing and assurance

engagements, and the responsibilities of both management and the auditor.

Be able to explain the environment within which audit and assurance engagements are

conducted, and the impact that the environment has upon such engagements; identify

and discuss relevant standards and legislation that are part of this environment.

To describe and assess the processes involved in conducting a financial statement audit,

including risk assessment, planning, execution and reporting.

To understand the objectives of the financial statement audit, and to design audit

procedures for specific audit objectives, in the context of risks (analytical review, control

procedures, tests of details, sampling).

To develop analytical and communication skills.

Organization of the Course:

This course outline will provide a broad overview of the content, structure and other aspects of the

course. The course content and structure is, however, subject to change.

This course requires substantial group work. Groups will be formed and group work will start in

the first class.

Learning Objectives and Required Readings

Session 1 – Jan 9

The Demand for Auditing / The Public Accounting

Profession

Assignments and Class Work

Learning Objectives:

-Define and explain auditing

-Distinguish between accounting and auditing

-Identify the factors that affect the demand for audits

-Describe the types of auditors and types of audits

-Explain the various standards under generally accepted

auditing standards (GAAS)

-Identify quality control standards

Form Groups

Discussion/practice questions:

Textbook 1-13, 2-20

In-class group exercises: Textbook 116 (Consumers’ Union) Please bring

questions posted to course website

Read:

Chapter 1 – The Auditing Profession

Chapter 2- The Public Accounting Profession

CICA Handbook:

CAS 200 - Overall Objective of the Independent Auditor

and the Conduct of an Audit in Accordance with

Canadian Auditing Standards

CAS 220 - Quality Control for an Audit of Financial

Statements

Session 2 – Jan 16

Overview of the Audit Process

Discussion/practice questions:

Textbook 5-22, 5-24, 5-25

Learning Objectives:

- Understand the objective of conducting an audit of

financial statements

- Understand the difference between management and

auditor responsibilities relating to the financial statements

- Understand the financial statement cycles approach to

segmenting the audit

- Understand the relationship among financial

In-class group exercise: Kingston

Company (Course Website)

statements, management assertions, audit objectives,

and audit procedures

- Identify the major phases of the audit process

- Grasp the basic elements of audit reporting

Read:

Chapter 5 - Audit Responsibilities and Objectives

Chapter 22 -Auditor Reporting, p. 714-720

CICA Handbook:

CAS 500 - Audit Evidence

Session 3 – Jan 23

Materiality, Risk, and Developing the Client Risk Profile

Discussion/practice questions:

Textbook 7-18, 7-19, 7-20, 8-23, 8-24

Learning Objectives:

-Understand materiality and its purpose

-Explain the relationship between materiality, risk and

audit evidence

-Identify the various bases for determining materiality

-Understand how to assess business risk and its

relationship to the audit risk model

_ Understand the type of evidence used in developing a

client risk profile

Understand how to develop and apply analytical review in

developing the client risk profile

-Understand when need to rely on the work of a specialist

Read:

Chapter 7 - Materiality and Risk

Chapter 8 – Client Risk Profile and Documentation p. 239253

Chapter 6 – Purpose and timing of analytical procedures

(p. 182-189) and Appendix 6A

In-class group exercises:

Materiality – Who’s Right? (Course

Website)

HighTech Software & Games Inc.

(Course Website)

Epoch Jeans (Course Website)

Linking risk factors (Course Website)

Individual Hand-In Assignment #1

(Course Website)

CICA Handbook:

CAS 200 (see Session 1)

CAS 315 - Identifying and Assessing the Risks of

Material Misstatements through Understanding the Entity

and its Environment

CAS 320 - Materiality in Planning and Performing an

Audit

CAS 210 - Agreeing the Terms of audit Engagements

CAS 300 - Planning an Audit of Financial Statements

CAS 510 - Initial Engagements – Opening Balances

CAS 520 - Analytical Procedures

CAS 620 - Using the Work of an Auditor’s Expert

Session 4 – Jan 30

Corporate Governance, Internal Controls, and Control

Risk

Learning Objectives:

- Describe internal control and understand its role in

developing the client risk profile

-Understand the importance of internal control for

management and the auditor

-Understand the four components of internal control

-Identify the components of the control environment

Discussion/practice questions:

Textbook 9-22, 9-24,

Segregation of Duties (Course

Website)

In-class group exercises:

Northern Frontier Park (Course

Website)

Little City Payroll – Identifying Control

Weaknesses (Course Website)

-Understand how to assess control risk

-Understand the different approaches used to understand

the client’s internal control

-Link internal control to audit objectives and audit

procedures

-Discuss the purpose of a management letter

-Understand the relationship between corporate

governance strategies and risk management.

Acco (course website)

Read

Chapter 9 Internal Controls and Control Risk

Chapter 10 – Corporate governance and entity level

controls (pp. 311-323)

Chapter 14 -- Methodology for Designing Tests of

Controls for Sales (pp. 455-468)

Chapter 18 -- Test of Controls, for the audit of the

acquisition and payment cycle (pp. 600-605)

CICA Handbook:

CAS 265, Communicating Deficiencies in Internal Control

to Those Charged with Governance and Management

CAS 260, Communications with Those Charged with

governance

Session 5 – February 6

Audit Evidence, Evidence Mix, and Audit Strategy

Learning Objectives

Explain the purposes of working papers and identify the

various types of working papers

Understand the factors that influence audit evidence

decisions

Evaluate the quality of evidence

Understand the relationship between analytical

procedures, test of controls and test of details

Understand how to develop an audit strategy that is

efficient and effective

Discussion/practice questions:

Textbook, 6-22, 6-23, 6-26, 12-18,

12-22 and 12-23

In-class group exercises:

Epoch Jeans – cont’d (course

website)

Lernout & Hauspie (course website)

Individual Hand-in Assignment #2 –

Course Website

Read

Chapter 8 – The Nature of Working Papers (p. 253-260)

Chapter 6 – Audit Evidence

Chapter 12 – Overall Audit Plan and Audit Program

CICA Handbook:

CAS 230 - Audit Documentation

CAS 330 - The Auditor’s Responses to Assessed Risks

CAS 500 - Audit Evidence

Session 6 – February 13

Fraud Auditing

Discussion/practice questions:

Textbook 11-23, 11-30

Learning Objectives

Understand the fraud and the fraud triangle

Understand the difference between fraudulent financial

reporting and misappropriation of assets

Understand the features of corporate governance and of

the control environment that that could reduce fraud risk

Understand the auditor’s responsibility for assessing and

detecting fraud

In-class group exercises:

Little City Payroll – Fraud Risk

Assessment (course website)

Lola Whole Foods (course website)

Group Assignment #1 Due – See the

course website for the posted

assignment

Read

Chapter 11

CICA Handbook:

CAS 240-The auditor’s responsibilities relating to fraud in

an audit of financial statements

Reading Week - NO CLASSES

February 20

Session 7 –

pm)

Sunday February 24th at (12 – 2

Location TBD

MIDTERM EXAM INATION

(covers materials from session 1-6)

There will be no class on Wednesday February 27- as

the midterm was on the previous Sunday

Session 8 – March 6

Audit Sampling

Discussion/practice questions:

Learning Objectives:

- Explain why sampling is important in auditing

-Explain the concept of representative sampling

-Distinguish between statistical and non statistical

sampling

-List the advantages and disadvantages of statistical

versus non statistical sampling

-Describe the steps in planning, selecting and evaluating

a sample

-Identify the steps to conduct attribute sampling

In-Class Group Exercises:

Textbook 13-22, and 13-26

Packet Corporation (website)

Dan Scribner (website)

Read:

Chapter 13 -- Audit Sampling Concepts

Chapter 14 -- Audit of the Sales and Collection Cycle –

Tests of Controls Application of Attribute Sampling (pp.

481-486)

CICA Handbook:

· CAS 530, Audit Sampling

Session 9 – March 13

Application of the Audit Process: The Sales/Receivable

Cycle

Learning Objectives:

-Identify the typical records and transactions in the sales

cycle

- Understand the relationship between overall audit

planning risks and risks for sales and collections cycle

assertions

- Identify and describe the processes for designing

control tests and test of details for the sales and

collection cycle

Discussion/practice questions: 15-29,

15-31, Adecco Employment Services

(Course Website)

In-class group exercise

Fisher Boats (Course Website)

Verona Shoe (Course Website)

Group Assignment #2 Due - See the

course website for the posted

assignment

- Identify the various analytical procedures used in the

audit of the sales and collection cycle

-Comparison of positive and negative confirmations

-Discuss the process for confirming accounts receivable

confirmations and following up non replies

Read:

Chapter 14 - Audit of the Sales and Collection Cycle –

Tests of Controls (p. 443-455 and 464Chapter 15 – Designing Tests of Details of Balances for

Accounts Receivable

Session 10 – March 20

Application of the Audit Process: The Inventory and

Warehousing Cycle And Acquisition and Payment Cycle

Learning Objectives

- Explain the components of the inventory and

warehousing cycle to the auditor

- Explain the components of the Acquisition and

Payment cycle to the auditor

-Identify the various types of analytical procedures

relating to the inventory and warehousing cycle

-Identify the various types of analytical procedures

relating to the Acquisition and Payment cycle.

-Discuss the physical observation and pricing/compilation

audit tests for inventory

- Understand the relationships among the tests of

different cycles

Discussion/practice questions: 19-18,

Hillmart Retail (Course Website),

Consumer Electronics (Course

Website)

In-class group exercise

Harris and the Auditors (Course

Website)

Individual Hand-in Assignment # 3

Read:

Chapter 18, 19

Session 11 – March 27

Professional Relationships and Legal Liability

Learning Objectives:

- Explain what ethics are and why they are important to

auditors

-Understand the six fundamental statements of accepted

conduct

-Understand the various facets of independence

-Understand confidentiality as it applies to a public

accountant

-Understand advertising and solicitation from the

perspective of a public accountant

-Discuss how public accountants become associated with

information and their responsibilities

-Compare the auditor’s responsibilities with respect to

errors, fraud, and other irregularities

-Distinguish between a business failure and an audit

failure

-Describe the accountant’s liability to third parties under

common law and the related defenses

Discussion/practice questions:

Textbook 3 -16, 3-17, 3-24, 4-13, 416, and 4-18

In-class group exercises:

Textbook 4-17

Lance Popper (course website)

-Discuss the profession’s response to legal liability

-Examine the impact of Sarbanes Oxley and Bill 198

Readings:

Chapter 3 -- Professional Relationships: The role of

ethics and independence

Chapter 4 –Legal Liability

CICA Handbook

Section 5020 - Association

CAS 240 - The Auditor’s Responsibilities Relating to

Fraud in an Audit of Financial Statements

CAS 250 - Consideration of Laws and Regulations in an

Audit of Financial Statements

· ICAO Handbook - Rules of Professional Conduct

(available from www.icao.on.ca. Click on Site Map, scroll

down to Resources and click on Member’s Handbook.

Download the pdf file titled “Rules of Professional

Conduct.”)

Session 12 – April 3

Contingent Liabilities, Audit Completion and

Modifications to the Auditor’s Standard Report

Read:

Chapter 21 - Completing the Audit

Chapter 22 - Audit Reporting p.720-737

CAS 260 - Communications with Those Charged with

governance

CAS 560 - Subsequent Events

CAS 570 - Going Concern

CAS 580 - Written Representations

CAS 450 - Evaluation of Misstatements Identified during

the Audit

CAS 700 - listed in S1

CAS 705 - Modifications to the Opinion in the

Independent Auditor’s Report

CAS 710 - Comparative Information – Corresponding

Figures and Comparative Financial Statements

CAS 706 - Emphasis of Matter Paragraphs and Other

Matter

CAS 720 - The auditor’s responsibility in relation to other

information in documents containing audited financial

statements

Session 13 – FINAL EXAMINATION (covers the entire

course-during regular examination schedule: April 10th –

April 26th)

Discussion/practice questions: 21-17,

In-class group exercises:

Textbook 22-22,

Report Qualifications (Course

Website)

Gabby – review question (course

website)

Individual Hand-in Assignment # 4

Weighting of Course:

Class Attendance, Participation, and

Hand in Assignments (4)

15% Various Sessions

Midterm Examination (Sessions 1-6)

25% Session 7

Group Assignments(2)

20% Various Sessions

Final Examination

40% During exam schedule (April

10-26th)

TOTAL

100%

(1) Break-down of Attendance, Hand-in assignment and Class Participation:

Mark Allocation

8

5

2

15

Description

Hand-in assignments (4 assignments)

In-class group and individual participation

Attendance

TOTAL % OF FINAL GRADE

Instructions for the “Hand In Assignments” will be posted on the course website.

(2) The four individual assignments and two group assignments

are to be posted to

turnitin.com using Moodle – details will be given at the first session.

Missed Midterm

If a midterm examination is missed due to a valid reason such as illness or other reason approved

by the Course Director the midterm mark of 25% will be added to the final examination

percentage.

The documentation required to support this reallocation are as follows:

1. For illness, a completed medical form (physician's statement) provided by the Registrar’s

Office, OR for another valid reason, the documentation requested by the Course Director, AND

2. A signed statement stating that you are aware that your final examination will be worth 65%.

This signed statement is to be attached to the documentation provided in (1) above.

An email notification of the missed midterm must be sent to the course director within 2 days of

the missed midterm and the required documentation must be delivered to the course director/

Room 282 Atkinson within 7 days of the missed midterm.

Deferred Examination Policy

Deferred standing may be granted to students who are unable to write their final examination at

the scheduled time or to submit their outstanding course work on the last day of classes. In order

to apply for deferred standing, students must register at

http://apps.eso.yorku.ca/apps/adms/deferredexams.nsf then subsequently

hand in a completed DSA (Deferred Standing Agreement) form with supporting documentation

directly to the main office of the School of Administrative Studies (282 Atkinson). Write your ticket

number from the online registration system directly onto the DSA form. The DSA and supporting

documentation must be submitted no later than five (5) business days from the date of the exam

to the main office of the School of Administrative Studies (282 Atkinson), NOT to the Course

Director.

These requests will be considered on their merit and decisions will be made on a case by case

basis. Decisions will be made available by logging into the following link:

http://apps.eso.yorku.ca/apps/adms/deferredexams.nsf. No individualized communication will be

sent by the School to the students (no letter or e-mails).

Students with an approved DSA will be able to write their deferred examination during the

School's deferred examination period. No further extensions of deferred exams shall be

granted. The format and covered content of the deferred examination may be different from that of

the originally scheduled examination. The deferred exam may be closed book, cumulative and

comprehensive and may include all subjects/topics of the textbook whether they have been

covered in class or not. Any request for deferred standing on medical grounds must include an

Attending Physician's Statement form; a “Doctor’s Note” will not be accepted.

DSA Form: http://www.registrar.yorku.ca/pdf/deferred_standing_agreement.pdf

Attending Physician's Statement

form: http://www.yorku.ca/laps/council/students/documents/APS.pdf

The deferred examinations for the Winter 2013 term shall be held in the period May 24-26, 2013.