DOC 311K - Reserve Bank of Australia

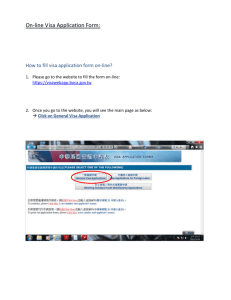

advertisement