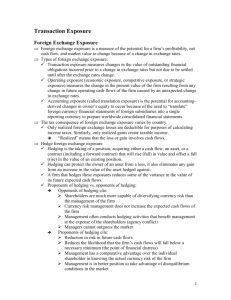

Treasury policies including foreign currency and

advertisement

TREASURY POLICY: - GROUP FOREIGN EXCHANGE RISK MANAGEMENT – SEPTEMBER 2013 Executive Summary 1. The Group is exposed to foreign exchange (FX) risk i.e. the risk of changes in exchange rates affecting the translation of its results, net assets and cash flows reported in sterling. This risk can be categorised into: Long term economic or strategic FX risks which can affect shareholder value if the sterling value of the Group’s expected future cash flows changes as a result of movements in exchange rates. This would apply for example to the Group’s future profit/cash flow streams from Australia and the US which could be worth less in sterling as a result of long term exchange rate movements. Short term transaction FX risks which arises when committed or expected cash flow transactions denominated in foreign currencies are translated into sterling e.g. foreign currency receipts and payments in the Online business and transactions funding or defunding overseas operations from/into sterling. The risk exposure here is short term in that the value of these transactions in sterling could be higher or lower than budgeted due to exchange rate movements prior to settlement of the transaction. Accounting related translation risk which causes volatility in the Group’s consolidated income statement and balance sheet reported in sterling as a result of currency movements. This arises from: Businesses operating with a sterling functional currency but which have monetary assets and liabilities denominated in foreign currencies that are re-translated at period end rates giving rise to exchange gains/losses e.g. WH Online which operates across a number of currencies. Overseas businesses operating with a functional currency other than sterling the accounts of which are translated into sterling for consolidation into the Group’s results e.g. the Group’s operations in Australia, USA, Israel, Philippines and Bulgaria. 2. Given the risk orientation of our review, we are more concerned about the downside risk from FX movements than the potential for upside gain from favourable movements. The Group’s FX risk management objectives are therefore to protect against an adverse material impact on Group EPS and on the Group’s debt covenant metrics. 3. It is not possible to avoid long term strategic FX risk as the Board has implicitly decided to accept such economic risk by expanding the Group’s business and operations internationally. Treasury hedging activity can only delay the impact (e.g. through the use of cross currency swaps). However, our assessment at this time is that the Group’s current strategic FX exposures are unlikely to have a material impact on the Group’s EPS or debt covenant metrics over the course of the next year. Document1 1 4. Transaction risk affects the value of the Group’s cash flows in sterling. Given the amount of the Group’s net foreign currency transaction exposures our assessment is that the Group as a whole is not exposed to FX transaction risks that are likely to have a material impact on the Group’s EPS or debt covenant metrics. Cash flow transaction exposures may, however, be considered significant at the operating unit level. 5. Translation exposures arise as a result of accounting requirements and do not represent realised gains and losses. As they do not represent cash flow exposures they should not affect shareholder value and can therefore in theory be ignored. In practice this may not be the case as the accounting treatment will affect the Group’s EPS and debt covenant metrics which are calculated in sterling. 6. This risk management policy recommends the following approach: Strategic FX risk - accept the FX risk resulting from long term strategic economic exposures as these cannot be avoided permanently given the Group’s decision to operate internationally. Short to medium term hedging of such exposures should be considered when foreign currency profits contribute c. 20% of Group profits (currently less than 10%). The standard FX risk management response would be to match the currency profile of the Group’s borrowings to the currency profile of its profits. This technique is known as net investment hedging. Transaction FX risks – such shorter term exposures should be considered for hedging if they have the potential to result in a realised cash loss of £3m (c. 1% of Group EBIT) over the course of a year. A similar threshold (1% of divisional EBIT) should be considered at the subsidiary level. Transaction exposures below these thresholds may be considered for hedging on a case by case basis depending on a cost benefit analysis of hedging the transaction versus not hedging it. The objective of hedging transaction exposures is to ensure the achieved FX rate for the transaction at settlement is not materially worse than the expected or budgeted FX rate for the transaction. Translation FX risks - these have to be accepted as they arise from accounting requirements. They should be monitored for any potential impact on Group EPS or debt covenants. Net investment hedging as described above will provide some protection at the net profit/EPS level and for debt covenant measures but will not prevent FX accounting related volatility affecting the Group’s reported sterling revenues and operating profits. 7. In order to facilitate the practical execution and control over FX risk management activity across the Group this policy recommends: All FX hedging must be undertaken at Group level unless otherwise agreed by the Group Finance Director/Group Treasurer. Subsidiaries are not permitted to undertake FX hedging without Group Head Office agreement. Document1 2 FX hedging must not be undertaken for speculative purposes but only to hedge real or potential exposures. The instruments to be used for FX hedging should be approved by the Group Treasurer and/or Group Finance Director but may include the standard FX hedging products such as FX forwards, FX options, FX swaps and cross currency swaps Hedging of FX exposures above £50m notional value or equivalent in foreign currency require PLC Board approval Authority is delegated to the Group Finance Director to approve FX hedging in line with this policy upto a notional principal value of £50m Authority is delegated to the Group Treasurer to approve FX hedging in line with this policy upto a notional principal value of £25m Hedging of FX exposures at subsidiary level also requires the agreement of the relevant divisional unit Finance Director. Risk Identification We have identified the following strategic, transaction and translation risk exposures across the Group. Long term strategic FX risks arising from: (i) the Group’s overseas operations in Australia, USA, Israel, Philippines and Bulgaria and (ii) foreign currency profits/losses in the Online business Transaction risks arising from foreign currency cash flows that need to be translated into another currency. The most significant such cash flows are: (i) foreign currency denominated receipts and payments in WH Online that need to be translated to/from sterling and (ii) cash flows in connection with the funding/de-funding of overseas operations from sterling to local currency or vice versa. Transaction risks may also arise from other material ad hoc transactions e.g. foreign currency payments funded from sterling required for overseas acquisitions e.g. WH US and Tom Waterhouse in Australia. Translation exposures in respect of: WH Online that has monetary assets and liabilities denominated in foreign currencies e.g. foreign currency cash balances. Exchange gains/losses on these are reported as income/expenses in the profit and loss account. Overseas operations that maintain their local accounts in foreign currency (i.e. WH Australia, WH US, WH Israel, WH Philippines and WH Bulgaria) which are translated into sterling for the purposes of the Group consolidated accounts. Any exchange gains and losses on translation are reported within other comprehensive income/reserves in the Group consolidated accounts. Strategic FX Risk Strategic FX risk refers to the long term economic FX risk the business has chosen to accept by operating internationally and doing business in foreign currencies. Ultimately such FX risk cannot be Document1 3 eliminated or hedged permanently although it may be possible to manage it over the short term. The Group is exposed to two sources of strategic long term FX risk: (i) that arising from overseas operations and (ii) WH Online profit streams earned in foreign currencies. Overseas Operations We have evaluated the Group’s annual exposure to economic FX risk from overseas operations by estimating the potential financial impact on Group profits from a 10% and a 25% adverse change in exchange rates over the course of a year – shown in the table below. Approximate quantum of annual economic exposure Sterling impact of 10% adverse change in exchange rate Sterling impact of 25% adverse change in exchange rate WH Australia WH US WH Israel WH Philippines WH Bulgaria Total Forecast operating profits of c. AUD 40m (£23.5m) Forecast operating profits of c. USD 7m (£4.5m) Operating profit of c. ILS 10m (£1.8m) Operating profit of c. PHP 37m (£0.5m) Operating profit of c. BGN 0.2m (£0.1m) (£2.0m) (£0.4m) (£0.2m) (<£0.1m) (<£0.1m) (£2.7m) (£4.7m) (£0.9m) (£0.4m) (£0.1m) (<£0.1m) (£6.1m) The table shows that the total cost of a 10% adverse movement in exchange rates across the Group is only £2.7m and a 25% adverse movement is £6.1m. This is equivalent to a 0.3p (1%) and 0.7p (2%) respectively reduction in forecast 2013 EPS. This level of exposure is not considered to be material. A 10% exchange rate movement over the course of a year is not uncommon but a 25% movement would be unusual for developed market (although not emerging market) currencies. Having said this, the GBP/AUD exchange rate is expected to move against the Group by about 25% from the beginning to the end of 2013 so it is not impossible. WH Online Foreign Currency Profits WH Online conducts business in a number of different currencies and over time expects to earn profits in these different currencies which expose the Group to FX risk when these profit streams are valued in sterling. It is not possible to hedge the long term (i.e. over a period of years) strategic exposure to these foreign currency profit streams cost effectively. Currently WH Online foreign currency profits are not material so the Group and the Online division do not have a significant FX exposure. The main Online foreign currency revenue streams are in Euros (c. €75m annually) and US Dollars (c. $20m annually). In practice nearly all of these Euro and US Dollar currency receipts are expended in settlement of Euro and US denominated marketing and other expenses leaving the Group with a small net exposure. WH Online profits in other foreign currencies are also immaterial at this stage. Document1 4 Transaction Risk Transaction risk is short term FX risk which arises from committed or potential transactions that involve the conversion of one currency into another. If the exchange rate moves between when the transaction is entered into/contemplated and when it is settled the sterling value of cash flow could be adversely affected resulting in a realised loss of value for the Group. The aim of transaction FX risk management is to ensure the actual exchange rate applied to the transaction on settlement is not materially worse than the expected or budgeted rate when the transaction was entered into. Risk management theory suggests all such transaction exposures should be hedged otherwise the Group is technically speculating on exchange rate movements between when the transaction is entered into and when it settles. However, as hedging has a cost in practice it should only be undertaken when the cost/benefit analysis stacks up. Over the long run there should be no benefit in hedging. Derivatives price in the current market expectations of future exchange rates plus a margin for the bank selling the derivative. As the future is uncertain there will be as much a chance of a gain as a loss by hedging, as future exchange rates may be better or worse than the current market expectations built into the FX hedge. This should average out over time and there should be no net financial benefit to hedging over the long term. Hedging transaction exposures can be useful, however, if: One has a different view on the future path of exchange rates to the market view at the time the derivative is entered into and wishes to lock into this view. Generally we do not have the expertise to form a view different to the market consensus. The impact of an adverse change in FX rates is so significant that we wish to protect against this eventuality occurring. Our assessment is that at Group level FX transaction exposures are not material enough to justify extensive use of hedging as a matter of course. At divisional level hedging of transaction exposures may be warranted. This policy recommends that cash flow transaction exposures should be considered for hedging when they have the potential to result in a loss of value of £3m (c. 1% of Group EBIT). A similar percentage test should be applied at the divisional unit level. The major cash flows transaction exposures across the Group are: 1. In WH Online – net foreign currency receipts that need to be translated into sterling. As noted above the Online’s expected net foreign currency receipts are not considered material as the main Euro and US Dollar foreign currency revenue streams are matched against almost equivalent Euro and US denominated marketing and other expenses leaving the Group with a small net exposure. We therefore do not propose hedging this exposure at this time, although we will keep the net cash flows under review and consider hedging if deemed appropriate to do so by the Online Finance Director and Group Treasurer. Revenue receipts in other currencies not required to meet currency liabilities are translated into sterling periodically through the year. Therefore although not technically hedged we achieve an average rate on translation into sterling across the course of the year. Given the Document1 5 relatively small size of these profit streams in a Group and Online context and the difficulty in accurately forecasting such foreign currency net receipts we believe this is an appropriate and acceptable approach to managing this exposure. 2. The cost of funding WH Online overseas cost centre operations in Israel, Philippines and Bulgaria. Online does not generate matching revenues in the local functional currencies of these operations so has to purchase the required currency using other currencies (either sterling, Euros or US Dollars). This creates a cash flow currency risk exposure. a. Israel - Currently the annual cost of funding this operation is ILS 83m (£15.2m). A 10% adverse exchange rate movement increases the sterling equivalent cost by £1.5m and a 25% adverse exchange rate movement increases the sterling equivalent cost by £4.9m. This magnitude of transaction risk exposure is considered significant at divisional level and therefore the cash flow cost of the Israeli operation is hedged on a rolling 3 months to 9 months forward basis to ensure the actual cost is not materially worse than the budgeted cost in sterling. b. Philippines – The annual cost of funding this operation is PHP 468m (£7.8M). A 10% adverse exchange rate movement would increase this cost by £0.8m and a 25% adverse FX movement by £2.6m. This exposure is not currently hedged but will be monitored and hedged if thought appropriate by the Online Finance Director and Group Treasurer. c. Bulgaria – The annual cost of this operation is BGN 10m (£4.4m). A 10% adverse exchange rate movement will cost £0.5m and a 25% adverse movement £1.5m. There is a commercial hedge in place for this exposure in that the Bulgarian Lev is pegged to the Euro and so the cost is funded from matching Euro receipts. This matching of Euro costs with Euro receipts effectively hedges the FX cash flow risk. 3. De-funding of overseas profit centres i.e. WH Australia and WH US. For efficient Group treasury management we intend to repatriate profits and surplus cash generated in WH Australia and WH US back to the Group centre in the UK in order to service and pay down central debt and fund dividends. As these operations’ functional currency is Australian Dollars and US Dollars respectively this will create a FX exposure when these cash flows are translated into sterling. a. WH Australia – Over the course of the next year this business is currently forecast to generate around c. A$40m (£23.5m) in operating profits. Assuming a 10% adverse exchange rate movement this would reduce the sterling value of this cash flow by £2.1m and a 25% adverse movement would reduce it by £4.7m. This is a significant enough exposure to warrant hedging. However, given the uncertainty around the near term profit performance of the Australian business and the uncertainty around the cash requirement to fund working capital and investment plans in Australia we currently lack clarity over the timing of the repatriation of any profits. In light of this uncertainty of timing and amount of the cash flow we do not propose hedging this Document1 6 exposure in the short term. We will keep this under review and will consider hedging any material individual cash flows repatriating profits from the Australian business if deemed appropriate to do so by the Group Finance Director and Group Treasurer. This will be reviewed again before half year 2014. b. WH US – This operation is currently expected to generate around $7m (£4.5m) annually. A 10% adverse exchange rate movement would reduce the sterling value of this cash flow by £0.4m and a 25% adverse exchange rate movement would reduce it by £0.9m. In practice the level of exposure is lower than this because most of the cash profit generated must be retained in the US to fund capital expenditure or seasonal increases in gaming reserve requirements. Hence this level of exposure is not currently material enough to warrant hedging. But as with the Australian business individual cash flows may be hedged in line with this policy if deemed appropriate to do so by the Group Finance Director and Group Treasurer. c. Although we hope over overseas operations will be profitable and generate surplus cash for repatriation back to the UK there may be requirements to fund these businesses with additional capital e.g. for working capital, capital expenditure or acquisitions. For example since acquisition the US business has required approximately $10m of additional funding for working capital, capital expenditure and to meet regulatory gaming reserve requirements. We have funded the required cash flow from the Group’s existing US dollar cash resources which has therefore not resulted in any FX exposure for the Group. Going forward we will adopt a similar approach to the hedging the FX cash flow exposures on funding and de-funding transactions as outlined above. 4. Occasionally the Group enters into other material foreign cash flow transactions that give rise to an FX cash flow exposure e.g. acquisition of WH US (US Dollars) and acquisition of Tom Waterhouse (Australian Dollars) both of which were largely met by purchasing the required foreign currency from the Group’s sterling cash resources. Such transactions will be assessed for hedging on a case by case basis in line with the principles laid out in this policy – i.e. potential to cause a loss in value equivalent to £3m or 1% of Group operating profit. In respect of both of the US and Tom Waterhouse acquisitions the Board took the decision not to hedge the exposure – mainly due to the cost of hedging. Translation Risk Translation risk refers to the risk of changes to accounting values reported in the Group’s income statement and balance sheet as a result of changing exchange rates. As this is an accounting exposure rather than a real economic exposure it does not require hedging. However, it does need to be monitored and managed because of the potential impact on Group financial metrics including EPS and debt covenants reported/calculated in sterling. Document1 7 Translation risk arises from two sources: (i) companies that account in sterling but have monetary assets and liabilities denominated in foreign currencies and (ii) overseas subsidiaries that maintain their accounts in foreign currency that are translated into sterling for consolidation into the Group accounts. Our assessment is that neither of these exposures is currently material in a Group or divisional context. Translation Risk Arising From Monetary Assets and Liabilities Denominated In Foreign Currencies For businesses that operate with sterling as their functional currency but conduct business in other currencies there is a translation risk in respect of foreign currency denominated monetary assets and liabilities. For the Group this mainly applies to WH Online which accounts in sterling but operates across a number of currencies so will have assets and liabilities denominated in these foreign currencies, the most significant of which are foreign currency client liabilities and foreign currency cash balances. These balances are translated into sterling at the period end rate. Any changes in value due to fluctuations in exchange rates from one period to the next are recorded as gains or losses in the profit and loss account. These gains and losses occur as a result of accounting process and are unrealised until the foreign currency monetary assets and liabilities are physically converted into sterling. In practice the Group and WH Online does not run significant exposures in respect of these foreign currency assets and liabilities: 1. A significant proportion of the foreign currency cash balances are held to match equivalent and offsetting foreign currency client liabilities. This provides a natural hedge with FX gains and losses on the currency client liabilities being offset by opposite gains/losses on the foreign currency client cash balances resulting in no net FX exposure. 2. The Online business will also hold a certain amount of surplus funds in the various currencies it transacts business in usually to fund day to day operational requirements. The largest currency balances, other than sterling, will be in Euros and US Dollar. These are retained as floats to settle future expenses denominated in these currencies. So whilst there may be an accounting translation exposure in respect of these balances they are providing a cost effective commercial hedge to future cash flow exposures. Translation Risk Arising From Overseas Subsidiaries The accounting for overseas subsidiaries whose accounts are in local currency results in exchange gains/losses when these accounts are translated into sterling for incorporation into the Group’s consolidated accounts. These exchange gains or losses are recorded in the statement of other comprehensive income and taken to reserves and can affect the Group’s net asset value either positively or negatively. As Group net asset value is not a KPI for the Group or its shareholders this accounting volatility is deemed acceptable. Net investment hedging would serve to mitigate the net asset accounting volatility. Document1 8 FX Risk Management Execution In order to facilitate the practical execution and control over FX risk management activity across the Group this policy recommends: All FX hedging must be undertaken at Group level unless otherwise agreed by the Group Finance Director/Group Treasurer. Subsidiaries are not permitted to undertake FX hedging without Group Head Office agreement. FX hedging must not be undertaken for speculative purposes but only to hedge real or potential exposures. The instruments to be used for FX hedging should be approved by the Group Treasurer and/or Group Finance Director but may include the standard FX hedging products such as FX forwards, FX options, FX swaps and cross currency swaps Hedging of FX exposures above £50m notional value or equivalent in foreign currency requires PLC Board approval Authority is delegated to the Group Finance Director to approve FX hedging in line with this policy upto a notional principal value of £50m Authority is delegated to the Group Treasurer to approve FX hedging in line with this policy upto a notional principal value of £25m Hedging of FX exposures at subsidiary level also requires the agreement of the relevant divisional unit Finance Director. Policy Approval Board approval is requested for the FX risk management policy described above. APPROVED BY THE BOARD OF WILLIAM HILL PLC ON 2ND OCTOBER 2013 Document1 9