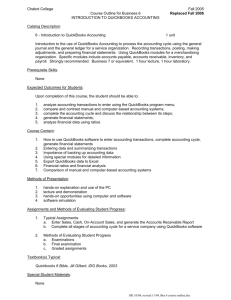

FTD Mercury and QuickBooks

advertisement

FTD Mercury Accounting Module 1 4 Basic Concepts What kind of data is transferred\exported to Quickbooks. How FTD Mercury exports sales data to Quickbooks. How the FTD Mercury sales data appears in Quickbooks. How to handle the payment of wire orders from your monthly clearinghouse statement. 2 What is eligible for export? EVERYTHING ENTERED INTO THE SYSTEM THAT MEETS THE CRITERIA!!! 3 Criteria For Data: • Only completed Order Entry & Point Of Sale transactions • Only POS sales in a closed POS session (z-out) • House account payments • Transactions entered from ‘Manual Ticket’ window (Credit & debit memo) • Finance charges 4 Chart of Accounts Setup 5 Chart of Accounts • Chart of accounts creates the Quickbooks company file where data will be exported. • COA also transfers any changes made in FTD Mercury that will affect the structure of the Quickbooks company file. i.e. creating a new product category. • You must make decisions on how you want certain types of information to transfer to Quickbooks 6 Chart of Accounts Setup: What You Must Consider Multi Store Setups: Single company file for all vs. separate company file for each Cash Deposits: Bank account vs. cash holding account Credit Card deposits: Bank account vs. credit card holding account (Accounts Rec.) Paid Outs & In from POS: Operating expense vs. Cost of Goods Sold 7 Chart of Accounts: Additional Features • Add additional bank accounts. • Set beginning date for the export. • Edit\change GL account numbers. 8 Exporting to Quickbooks Data is exported (transferred) to Quickbooks through the Balance Wizard option from Accounting. 9 Exporting to Quickbooks •Select start and end date for export •Select how balance report shall be printed, Summary vs. Detail 10 Exporting to Quickbooks 11 Exporting to Quickbooks 12 Data in Quickbooks • OE sales are exported by sale date of transaction. • POS sales are export by z-out date if the z-out date is different than the sale date. • Individual sale data is not exported to Quickbooks. • Data is exported only as daily totals for each day in the date range selected. Detail is found in FTD Mercury Reports (Mercury Forms) • Daily totals include: – Cash & checks received – Credit cards activity – House account activity – Delivery & service charges on orders – Product category of the items on orders 13 Journal Entries in Quickbooks Entries for Aug 20 Entries for Aug 21 14 Journal Entries in Quickbooks Explained On a $100 order: FTD Mercury Quickbooks Flowers $59.99 Chocolate $12.95 Delivery $20.00 Tax $7.06 Cash Paid $100 Perishables $59.99 Candy $12.95 Delivery Income $20.00 Sales Tax Payable $7.06 Bank $100 Flowers are part of the ‘Perishables’ product category. Chocolate is part of the ‘Candy’ product category. 15 Handling Wire Orders in Quickbooks Generally on wire orders… Sending florist: Keeps selling commission of 20% Filling florist: Paid for product & delivery less the sending florist commission and wire service commission of 7% 16 How Wire Orders Appear in Quickbooks • Incoming orders: – 100% payment of wire order is transferred into Accounts Receivable FTD – 100% of sales of product category filled • Outgoing orders: – 100% Payment from customer – (20%) Product & Delivery (Outgoing sales) – (80%) Accounts Payable FTD Represents 80% that is paid to FTD on outgoing orders. 17 Quickbooks & Clearing House Statement You must make journal entries in Quickbooks to account for what you are actually paid on wire orders. What entries are already made in Quickbooks? • Sales Income • Accounts Payable (80% paid to FTD on outgoing) • Accounts Receivable (100% of amount received over the wire on incoming orders) 18 Quickbooks & Clearing House Statement What entries will you have to make in Quickbooks? • Wire Commissions Expense (20% kept by sending florist on an incoming order). • Marketing Advance Expense (7% commission to FTD taken on an incoming order). • Adjustments and other charges for wire order. • Other wire service expenses and credits. 19 Quickbooks & Clearing House Statement Let’s look at an FTD Clearing House Statement! • Use Section B from the Clearing House Statement page labeled ‘ FTD Member Activity Statement’. • You cannot use the amount listed for Section B from the Statement Summary Page. • The summary page does not show the amounts that you need to enter for ‘Commission Expense’ and ‘Wire Service Commission’. 20 Member Activity Statement – Section B 21 Section B – Incoming Orders •Add all 20 % commissions given for incoming orders. This is your ‘Commissions Expense. •Clearing House & Marketing Advance is the ‘ Wire Service Commission” 22 Section B – Incoming Orders • In this example, FTD wire service commission equals $100.61 • Total ‘Wire Commission Expense’ is 243.47 +44.00 $287.47 23 Quickbooks Journal Entries Incoming Orders: Debit Accounts Receivable FTD FTD Clearing Account Paid to Sending Florist FTD Clearing Account FTD Wire Commission FTD Clearing Account Credit 1437.33 1437.33 287.47 287.47 100.61 100.61 24 Section B – Outgoing Orders •Subtract all 20 % commissions earned for the amount listed above for outgoing orders. This is the 80% paid to FTD on outgoing orders. This amount has already been calculated for you. 25 Section B – Outgoing Orders • In this example FTD accounts payable total is $1992.60 28.00 – 5.60 = 22.40 2409.00 - 481.80 = 1972.2 26 Quickbooks Journal Entries Outgoing Orders: Debit FTD Accts Payable FTD Clearing Account Credit 1992.60 1992.60 27 Section B Adjustment & other charges • You may have to additional entries for adjustments, taxes or Retrans charges. • These entries should be made to the appropriate accounts of your choice. 28 Other Wire Expenses & Credits • Non order related expenses and rebates will appear in other sections of the clearing house statement. • These should be entered into Quickbooks to accounts of your choice. • You may need to create additional accounts in Quickbooks to track these expenses and credit 29 Using a Clearing Account What is a Clearing Account? • A clearing account can be used to ensure all entries you make in Quickbooks are accurate. • Quickbooks follows GAAP Generally Accepted Accounting Principles. • This requires that you make an offsetting journal entry when entering in expenses and credit. • Use a clearing account for this. 30 Using A Clearing Account For Example: • When you make an entry for 20% commissions given on incoming orders you would offset this entry against the clearing account. • If all expenses and credit are offset to the same clearing account this ensures the entries are made correctly. • Once all activity has been entered from the clearing house statement and offset to the clearing account, the remaining balance on the clearing account will represent a amount that is owed to FTD or a check received from FTD. 31 Using a Clearing Account • The amount that remains in the clearing account received should match the amount showing on the clearing house statement. • Finally once a check has been deposited from FTD or and check written to FTD that entry will be made against the clearing account. • This entry will clear the balance in the clearing account. 32 Thank You!! Questions??? 33