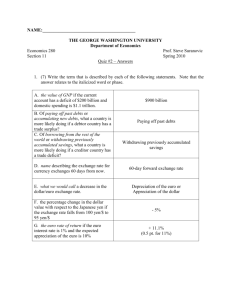

Balance of Payments

advertisement

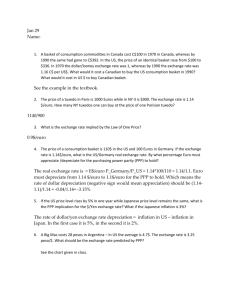

Balance of Payments Current Account data is for 1998 Balance of Payments Accounting current acct + nonofficial capital acct + official capital acct + ) SDR + SD / 0 • Two important Rules – Credit sales of U.S. goods, services, and assets to foreigners. Debit purchases of foreign goods, services and assets by U.S. residents. – Every transaction involves a simultaneous credit and debit => identity: sum of the credits and debits = 0. Current Account • Includes transactions dealing with: – goods – services = royalties, license fees, traveling, shipping, banking, insurance, consulting fees – transfer payments – income receipts = dividends, interest earnings, repatriated profits, compensation of employees • sub-accounts: – merchandise trade balance – balance on goods and services – income account (old investment income account + compensation of employees) • Depends on: – – – – – Domestic versus foreign prices Exchange rate movements Foreign income Domestic income Market impediments Current Account for North and South American Countries -50 -100 -150 Venezuela Columbia Chile Brazil Argentina Mexico -250 Canada -200 USA Billions of U.S. $ 0 -20 China Vietnam (97) Indonesia Thailand Singapore Philippines (97) New Zealand Malaysia (97) Korea Japan India Hong Kong (97) Australia Billions of U.S. $ Current Account for Asian Countries 50 40 30 20 10 0 -10 -10 South Africa Sweden (97) Switzerland UK Sweden Spain Portugal Netherlands (97) Italy Germany France Finland Beligium Billions of U.S. $ Current Account for European Countries and South Africa 25 20 15 10 5 0 -5 0 -1 -2 -3 -4 Venezuela Columbia Chile Brazil Argentina Mexico -6 Canada -5 USA Current Acct % of GNP Current Account as a percent of GNP for North and South American Countries Current Acct % of GNP 12 10 8 6 4 2 0 -2 -4 -6 -8 China Vietnam (97) Indonesia Thailand Singapore Philippines (97) New Zealand Malaysia (97) Korea Japan India Hong Kong (97) Australia Current Account as a percentage of GNP for Asian Countries -8 South Africa Sweden (97) Switzerland UK Sweden Spain Portugal Netherlands (97) Italy Germany France Finland Beligium Current Acct % of GNP Current Account as a percentage of GNP for European Countries and South Africa 10 8 6 4 2 0 -2 -4 -6 Investment Income Account • Positive from 1946 to 1993, but started to decline in 1983 • Negative in 1994: U.S. owned $2.6 trillion (market value) of foreign assets and foreigners owned $3.5 trillion of U.S. assets • In 1999, investment income receipts on U.S. assets abroad = $274 billion and income payments to foreigners = $287 billion => $13 billion dollar deficit Are Deficits a Problem? • • • • • • Deficit with Japan: Japanese import more per capita from U.S. than U.S. does from Japan. According to Kenneth Kasa (San Francisco Fed) As U.S. baby boomers come to age saving will increase and as Japanese retire their spending will increase => U.S. current account deficit will shrink. (Modigliani Life-Cyle model). Twin deficit problem? William Branson of Princeton: The U.S. government deficit causes an inflow of capital from abroad, which in turn leads to a negative current account balance. Current Acct deficits => capital account surpluses => foreigners have a claim on future real resources in the United States. True, but it is only a problem to the extent that investments are portfolio investments used to finance unproductive government deficits. Should focus on Trade Deficit/U.S. GDP instead of size of deficit. Deficits are positively correlated to real GDP growth and negatively correlated to unemployment rates (4.1% as of 10/99 lowest u rate in 29 years). From 1992 to 1997, U.S. trade deficit almost tripled but industrial production increased 24% and manufacturing output was up 27%. In Japan, the IPI was up only 8% and in Germany, the IPI was up only 1%. Nonofficial Capital Account 1999 in billions$ Nonofficial U.S. assets abroad, net (-, increase/capital outflow) Direct Invest (10% min ownership) Portfolio (securities) Claims by U.S. banks Claims by nonbanking concerns other U.S. government -430.2 -150.9 -128.6 -69.9 -92.3 +2.8 Nonofficial Foreign Assets in U.S., net (+, increase/capital inflow) +753.6 Direct investment 275.5 U.S. Treasury Securities -20.5 U.S. currency 22.4 U.S. Sec. other than treasuries 331.5 Liabilities reported U.S. banks 67.4 Liabilities reported by U.S. nonbanks 34.3 Points of Interest 1. From 1983 to present, nonofficial K acct > 0. Why? - High savings rate abroad - U.S. government deficit - Since 1986, the best and safest place to invest - 1987 U.S. became a net debtor nation (Humpage, Cleveland Fed) (See U.S. external debt/GDP), note Canada and Australia debt burden is 3 to 5 times that of the U.S. 2. Direct depends on -availability of raw materials, skills, infrastructure -political risks (Russia in Oct 99, nationalized a firm 54% foreign owned) -tax incentives -diversification gains -cost savings with respect to transportation 3. Portfolio -Difference in E(returns) -E(percentage change in the exchange rate) -Risk of default (Ecuador’s Sept 30 default on Brady Bonds)—they were collateralized U.S. BOP Accounts U.S. Current Account 1960 2.8 1970 2.3 1981 5.03 1994 -118.6 1998 -217.1 1999 -331.5 Non official K Acct Official K Acct -5 3.6 -12 9.4 -25.8 -.22 85 44.9 173.8 -26.9 271.8 51.6 SD )SDR -1 -.2 .867 25 1.093 -10.9 69.7 11.6 Have we lost manufacturing jobs because of trade? • The U.S. Department of Commerce in 1991 completed a 2 ½ year study. Their results revealed that during the 1980s, U.S. manufacturing growth tripled and was then on par with Japan. In 1994, our manufacturing growth was twice that of both Japan and Germany. The manufacturing share of GDP increased to the level of output achieved in the 1960s. A study by Andre Warner of Harvard and another study by the Federal Reserve confirmed these results • From 1959 to 1995, durable goods accounted for between 12 to 18% of GDP. As of the 2nd quarter of 1999, the durable goods/GDP ratio was 17.4%. • Total workers employed in manufacturing today are about the same as the 1960s. • 1980s and 1990s, 34 million jobs were created. Have we lost manufacturing jobs because of trade? • From 1987 to 1993, U.S. manufacturing X to the world increased 95% and increased 138% to Latin America and the Caribbean. • From 1993 to 1998, manufacturing jobs increased by 600,000. • U.S. leads in audio & video equipment, air conditioners, building and construction hardware, computers and computer software, environmental technology, medical equipment, chemicals, navigational & survey equipment, telecommunications equipment, semiconductors, and has 90% of the market for advanced processors. • Jeffrey Sachs and Andre Warner: reviewed dozens of countries between the years 1970 to 1990 and found those open to trade had average growth rates of 4.7% and those that were closed 1%. Macroeconomic Determinants of Spot Exchange Rate Movements • Interest rates (short run) – Expectation that the CB of Europe will increase interest rates is supporting the euro (10-18 and 10-25) – Lower wage pressures in the UK reduced pressure on the Bank of England to raise interest rates and thus reduced the value of the pound relative to the dollar (10-25) – Czech koruna was boosted when the Czech National Bank cut its twoweek repurchase agreement rate today to a record low of 5.5% from 5.75% (10-27) – Expectations of higher interest rates caused the dollar to slump (10-18) • Inflation (long run, PPP theory) – Inflationary pressures caused dollar to slump (10-18) – If the employment cost index shows more than an expected 1.1% increase in 3rd Q wages and salaries, renewed fears of inflation will cause the dollar to drop (10-25) Central Bank Influence • Monetary Policy – Bank of Japan’s plan to increase their money supply is being scrutinized by the market (10-18) – Bank of Japan is now expected not to change monetary policy on Wednesday helped to stabilize exchange expectations about the yen => dollar dropped (10-26,27) • Central Bank Intervention and CB announcements – Analysts anticipate that the Bank of Japan may intervene to stop depreciation of dollar below 102-104 range (10-18) Yen/$ = 102.3 as of 12/13/99. – Euro CB chief Otmar Issing supported the Euro when he said he saw upside risks changing interest rates from the downside to the upside => likely to raise interest rates on Nov 4. Euro’s muted action gave weight to speculation that there is no broad-based demand for the euro ahead of the year end (10-26) – Euro CB president, Wim Duisenberg was not mincing words in touting the case for tighter monetary policy in the euro zone, but euro was sold heavily despite expectations that today’s M3 figures would indicate inflation => interest rates are likely to be increased and E(euro) to rise in value. (10-27) – Brazil’s CB intervened selling $ first time since Aug 18 => real increased (10-28) More Determinants • Capital Flows (short run if portfolio movement) – Investors are moving assets out of U.S. markets => depreciates $ (10-18) • Expected changes in real output – U.S. expansion coming to an end at the same time Europe and Japan are growing caused the dollar to drop (10-18) • Current Account influence – Investors in Japan are bringing money back to Japan because they are panicking or suffering from increased risk aversion. WSJ says this is typical of investors from countries with current account surpluses like yen, euro, Swiss franc (10-18) – UK trade deficit narrowed => dollar down (10-26) – Sept trade stats for Japan showed current account surplus shrinking 10% => consumers are buying more => Japanese economy is doing better => dollar down (1026) – Ignores capital account influence More Determinants • Stock market fluctuations – “The dollar will remain the slave of U.S. equity markets . . .” Strong performance in U.S. equities is supporting the dollar’s relative value. (10-25) – The dollar lost ground against the yen as markets declined in the U.S. (10-26) – Mexican peso and Brazilian real dropped relative to the $ mostly tracking losses in U.S. stock and bond markets (10-26) • Macro leading indicators and macro fundamentals – positive euro-zone data continues to pile up => stronger euro (10-25) • Fiscal Policy – Pork-barreling agreements in Japan fueled expectations of a fiscal boost for the yen => dollar down (10-26) • Political events – Indonesia rupiah traded higher as market welcomed the country’s new cabinet and the new ties established to the IMF. (10-27) • Contagion – Thai baht and Singapore dollar shadowed the rupiah’s higher move (10-27) • Regulations inhibiting imports => appreciate the domestic currency Impact of exchange rate movements • Price competitiveness position – 12/10/99, the Yen is currently at 102.48 and up 17.57% relative to the dollar over the last year. – 12/10/99, the Euro is at 1.0209 and has decreased in value about 13.68% relative to the dollar over the last year. • • • • Cost competitiveness position J curve effects on the Current Account PPP Theory Balance sheet and cash flow effects J-curve effect: associated with the devaluation or depreciation of a currency • Current Account = PxX - PzZ • If we devalue or depreciate the domestic currency, the domestic price of imports rises immediately, the price of exports will rise with a lag as our products attract a higher demand because they are cheaper in terms of the foreign currency. The physical quantity of exports will not increase immediately because it will take time add to plant capacity to satisfy increased demand. We cannot cut back on all imported goods immediately–we need time to find domestic substitutes or inferior but cheaper foreign substitutes. In the short run the elasticity of quantity movements is small (inelastic). Thus the price of the import good rising dominates causing the BOT to become a larger deficit or a smaller surplus. Eventually quantities adjust and the BOT will become less of a deficit or a bigger surplus. PPP Theory: 1920s–Gustav Cassell • The Exchange rate between two currencies is the relative value of their monies. • Law of one Price: adjusted for transactions, transportation costs and market impediments, the common currency price of traded goods should be equal among countries. • Absolute form S = Pf/Pus somewhat worthless • Relative form %)S = %)Pf - )%Pus PPP Problems • PPP does not fit data well–there are many other factors that influence exchange rates • Problem measuring inflation rates–for nontraded goods there is no commodity arbitrage • Differential pricing by MNEs--they increase prices in inelastic D countries and lower in elastic D countries (depending on dumping laws) • Restrictions on movements of goods--transportation costs, tariffs, quotas Germany: 12-9-99, DM/$ = 1.9159 DM/$ 3.5 3 2.5 Spot 2 PPP 1.5 Real Exchange Rate 1 0.5 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 0 Thailand 12-9-99, Bhat/$ = 38.625 Fixed Bhat/$ 45 40 35 30 25 20 15 10 5 0 Spot PPP 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 Real Exchange Rate Indonesia: 12-9-99, Rupiah/$ = 7225 Rupiah/$ 12000 10000 8000 Spot 6000 PPP Real Exchange Rate 4000 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 0 Malaysia: 12-9-99, Ringgit/$ = 3.8 Ringgit/$ 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 Spot PPP 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 Real Exchange Rate South Korea: 12-9-99, Won/$ = 1130 Won/$ 1600 1400 1200 1000 Spot 800 PPP 600 Real Exchange Rate 400 200 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 0 Mexico: 12-9-99, Peso/$ = 9.435 Peso/$ 12 10 8 Spot 6 PPP 4 Real Exchange Rate 2 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 0 Venezuela: 12-9-99, Bolivar/$ = 642.4 Bolivar/$ 800 700 600 500 400 300 200 100 0 Spot PPP 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 Real Exchange Rate India: 12-9-99, Rupee/$ = 43.425 Rupee/$ 45 40 35 30 25 20 15 10 5 0 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 Spot PPP Real Exchange Rate