Outline for LGBtax Calculator Appearance of Calculator Select Year

advertisement

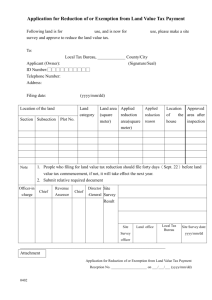

Outline for LGBtax Calculator Appearance of Calculator 1. Select Year a. This needs to be a pull down screen with the choices 2011, 2012, and 2013. We should be able to add 2014 as well. 2. Select Year a. This needs to have a description of the two letter state code. If the state is not CA, NV, OR or WA, then the system can default to “No Refund” for RDP Advantage, but call our office for other advice specific to the LGBT community. 3. Create a split screen one side for partner1 (P1) and the other for partner 2 (P2) 4. Under P2 have a box that can be checked “Did not File.” If this box is checked, then all info (except dependent box) is not visible for P2. 5. Filing Status a. This should be a pull down screen for each partner and the choices are: i. Single ii. Married filing Joint iii. Married filing separate iv. Head of Household 6. Number of exemptions taken on tax return. This can be a fill in box that will accept a number or a drop down list from 1-6. On the P2 side, add a question with a check box, “Taken as a dependent by P1.” 7. Line 37 from 1040 (Adjusted Gross Income [AGI]) 8. Line 45 from 1040 (Taxable Income) 9. Line 48 from 1040 (Tax) Calculations A. Calculate tax (line 9 above) of both partners and add the two partners together, Original Tax. B. Take amount of total income for both partners (Line 7 Above) and add back the amount of exemptions. a. Need a chart of the amount of an exemption deduction by year (I will supply these amounts). b. Multiply the amount of the exemption with the number of exemptions (line 5). c. Total taxable income of both Partners (Line B above) d. Add the exemption amount (both partners) to the total to create the calculated income. e. Take Calculated Income from (Line d. above) and split in half, Split Income. f. Subtract the half of the exemption back to each Split Income (line e. above). If there is an odd # of exemptions, give the partner with the lower income the extra exemption. g. Calculate the filing status for each partner. If one exemption, then the filing status is single, if more than one exemption, then the filing status is Head of Household. h. Calculate the tax for each partner based on the calculated income (line f. above) and the filing status (line g. above), Calculated Tax i. Compare the Calculate Tax (line h. above) with the Original Tax (Line 8 Above) for each partner. j. If the Calculated tax is higher than the original tax, multiply 30% for penalties and interest (P&I) by the amount of extra tax on the Calculated Tax. k. Combine the Calculated tax of each partner and the P&I figure to obtain the total for each partner. l. Combine the two partner’s total tax with P&I (line k above) to get total tax liability for both, Calculated Tax Amount. m. Compare the Calculated Tax Amount (line l. above) and the Original Tax (line A. above), Difference: i. If the Difference (line m. above) is greater than $100, then reduce the difference by 15% and show the remaining 85% as the “Amount of Refund” ii. If the Difference (line m. above) is less than $100, then show “No Refund.”