Exemption - Eventsential

advertisement

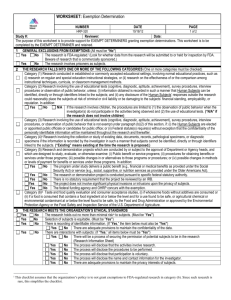

2013 COST SALT BASICS SCHOOL Module 13: Exempt & Non-Taxable Transactions Donna-Marie Daday Jeff Lemmons PricewaterhouseCoopers LLP 1 Council On State Taxation Exemptions and Exclusions - Introduction Exclusions - Exemption - - transactions not included within the state’s tax base; Burden on the government transactions normally subject to tax, but conditions exist which create exemption Burden on the taxpayer 2 Council On State Taxation Exemptions and Exclusions – Representative Exclusions Real Property - generally nontaxable Services- generally nontaxable Note: But every states taxes at least one service, e.g., hotel and motel accommodations, repairs, data processing or information services, security, personal services (hair dressers, barbers, etc.), and many others 3 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Entity Based Exemptions Exempt Organizations – IRC Section 501(c)(3) − Religious, Charitable, Educational Government Agencies – U. S. Constitution − Federal Government/Chartered Institutions − State and Local Government − Government Contractors 4 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Product Based Exemptions Food for Home Consumption (generally excludes prepared meals) Clothing Prescription Drugs Other Medical (Durable Medical Equipment, etc.) Newspapers 5 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Use Based Exemptions Sales for Resale Occasional, Isolated, or Casual Sales − Business Reorganizations − Bulk Sales Manufacturing − Pollution Control − Research and Development Interstate Commerce Foreign Commerce 6 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Sales for Resale - “food for thought” Is the sale of napkins and straws to a fast food restaurant a sale for resale or a taxable sale? Is the sale of paper to an attorney who uses the paper to draft contracts and other legal documents turned over to the client a sale for resale or a taxable sale? 7 Council On State Taxation Assume that admissions to sporting events are subject to sales tax The Dallas Mavericks distribute hats with the team’s logo on them to the first 10,000 people who enter the arena with a ticket for the game. Is the team’s purchase of the hats from a local vendor a sale for resale or a taxable sale? 10 A. Sale for resale B. Taxable Sale Sa le 0% Ta xa bl e Sa le fo rr es al e 0% 8 Exemptions and Exclusions – Types of Exemptions Occasional, Isolated or Casual Sales – Business Transfers The occasional sale exemption often covers the transfer of tangible personal property in a reorganization, merger or consolidation. The exemption may also apply to the transfer of property to a commencing corporation. 9 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Occasional, Isolated or Casual Sales Successor Liability Requires a purchaser of a business to withhold certain amount of purchase price to cover any potential outstanding tax owed by seller, until the seller produces document evidencing no tax is due. 10 Council On State Taxation Exemptions and Exclusions – Types of Exemptions Manufacturing Property used or consumed “directly” in the manufacturing process Concept is to exempt production inputs in order to avoid “pyramiding” of the tax Exemption may also cover similar production activities like processing or mining or research and development 11 Council On State Taxation Manufacturing Exemption Concepts – Direct Use Most states require exempt property to be “used directly” in production Definitions of direct use tend to stress that the property is essential to the production process and actually touches the in-process product Direct use items typically include raw materials, machinery and tools, repair parts, process-related materials handling equipment (conveyers, etc.), computerized production systems, etc. 12 Council On State Taxation Manufacturing Exemption Concepts – Direct Use Indirect use (taxable) items typically include structural materials (bricks/mortar/steel), administrative items (furniture, non-manufacturing computers, etc.); distribution-related items, and depending on state may include routine maintenance items Mixed-use items: Many states require that the item be used primarily in exempt production activities (>50%); some require that the item be used exclusively in production to be exempt 13 Council On State Taxation Manufacturing Exemption Concepts – Integrated Exemption Many states apply the “integrated plant site concept” to define the parameters of the exemption Integrated exemptions frequently cover all production-related activities on the plant site, starting with the handling and storage of raw materials and ending with the conveyance of finished products to initial storage at the plant site, including product packaging activities 14 Council On State Taxation Manufacturing Exemption Concepts – Integrated Exemption Integrated exemptions also may include activities that do not actually touch in-process products or “one-step removed” activities, such as: Production line product testing / quality control activities Generation of power, steam, and the like, used in the production process Other sub-processing activities such as fabrication of equipment or tools used directly in the production process Specialized cleaning / maintenance activities that ensure product integrity 15 Council On State Taxation Manufacturing Exemption Concepts – Related Exemptions R&D: Some states exempt research and development activities, some as part of the manufacturing process, others exempting the activity even if conducted independent of manufacturing Pollution Control: Most states exempt pollution control equipment; statutes may or may not require that the equipment be used by a manufacturer “Specialized” Exemptions: Some states have enacted narrowly focused exemptions for certain projects, e.g., pharmaceutical or semiconductor clean rooms, shipyards, auto assembly plants, etc., which may even include exemptions for real property components 16 Council On State Taxation Exemptions and Exclusions – Exemption Certificates Burden of proof is on the seller to demonstrate that a transaction is exempt unless the seller receives an exemption certificate from the customer Exemption certificates must be accepted in good faith. Failing to exercise due care could result in the seller being held liable for tax But Streamlined Sales Tax states apply a more relaxed good faith requirement Certificates must be fully completed Some states place time limits on obtaining certificates 17 Council On State Taxation Exemptions and Exclusions – Exemption Certificates MTC – Uniform Certificate Used by wholesalers, retailers, manufacturers, lessors and others Includes purchases for resale, lease, or use in manufacturing Thirty-eight states accept the multi-jurisdiction certificate (45 states impose sales tax) 18 Council On State Taxation Exemptions and Exclusions – Exemption Certificates Direct Pay Permits Purchasers acquire property for many reasons, including for both taxable and exempt purposes Normally, the administrative burden to figure out when to collect/pay tax is on the vendor Direct pay permit allows purchasers to self-assess use tax on taxable transactions rather than pay sales tax to the vendor Direct pay permits often used in conjunction with single rate agreements 19 Council On State Taxation Exemptions and Exclusions – Exemption Certificates No certificate? All is not necessarily lost Exemption certificate simply relieves the seller from the burden of proving the transaction exempt Seller can still present evidence that the purchaser was exempt (e.g., a governmental or nonprofit organization) or that the transaction itself was exempt (e.g., a sale for resale) 20 Council On State Taxation Exemptions and Exclusions – True Object Test Mixed Transactions Sale of ordinarily taxable tangible personal property bundled with ordinarily nontaxable services is typically governed by the “True Object Test” True Object Test seeks to determine the purchaser’s motive in engaging in the transaction – did the purchaser intend to purchase the tangible personal property itself or was the purchaser really seeking the expertise of the service provider? The entire transaction is taxable if the true object is the tangible personal property; conversely, the transaction is exempt if the true object is the service 21 Council On State Taxation Exemptions and Exclusions – True Object Test True Object? What did the parties bargain for? What did the buyer actually want? What did the buyer actually get? Would the buyer have purchased the service without the tangible personal property provided by the service provider? Is the tangible personal property consequential to the transaction? 22 Council On State Taxation Exemptions and Exclusions – True Object Test True Object Test– taxable or exempt? Artist paints a portrait on canvas Attorney drafts a contract on paper Equipment lease with an operator Rental of “customized” mailing list on CD 23 Council On State Taxation How do you determine the true object? Artist paints a portrait on canvas 10 1. Taxable 2. Exempt pt 0% Ex em Ta xa bl e 0% 24 How do you determine the true object? Attorney drafts a contract on paper 10 1. Taxable 2. Exempt pt 0% Ex em Ta xa bl e 0% 25 How do you determine the true object? Equipment lease with an operator 10 1. Taxable 2. Exempt pt 0% Ex em Ta xa bl e 0% 26 How do you determine the true object? Rental of “customized” mailing list on CD 1. Taxable 2. Exempt 10 pt 0% Ex em Ta xa bl e 0% 27 Exemptions and Exclusions – Real Property Real Property Transactions The transfer of Real Property is excluded from sales/use tax in most states (no need for exemption since the tax generally applies to TPP and select services) As such, construction contractors and others performing services with regard to real property (e.g., HVAC contractors, electricians, plumbers, etc.) generally do not charge sales tax on their invoices – instead they are the taxable users or consumers and should build the tax into their bid prices 28 Council On State Taxation Exemptions and Exclusions – What Is Real Property? Three-part test: The nature of the object annexed -- is it an integral, necessary and expected part of real property? The mode of annexation -- is it permanently affixed and would its removal cause significant damage to the underlying real property? The purpose for which it was annexed – was it intended to serve a temporary purpose or does it have a long term use by a future tenant? “Trade fixtures” and specialized equipment often remain tangible personal property as they are merely adapted to the present use of the building 29 Council On State Taxation Exemptions and Exclusions – Cross-Border Transactions The Constitution places limitations on states to impede interstate or foreign commerce and most states provide exemptions to reflect these Constitutional limitations Interstate Commerce: when goods shipped from seller in state A to a customer in state B, generally by common carrier, mail, etc. (state A cannot tax the transaction because it crosses state lines; only state B has the right to tax) Foreign Commerce: treated similarly to transactions in interstate commerce 30 Council On State Taxation Exemptions and Exclusions – Government Transactions Government Transactions Constitution prohibits states from taxing the federal government Most states also exempt sales to their own state agencies and local governments 31 Council On State Taxation Exemptions and Exclusions – Government Contractors Government Contractors Construction contractors for the government usually do not enjoy any exemptions, but there are exceptions in some states Contractors reselling TPP to the government may enjoy a resale exemption Overhead or other items consumed by a contractor are normally taxable to the contractor Exceptions: California 32 Council On State Taxation Exemptions and Exclusions – Miscellaneous Issues Sales Tax Incentives Stimulate economic activity by offering full or partial exemptions on the purchase of specified property and services Example: Call Centers, Manufacturing plants 33 Council On State Taxation Case Study Sales Tax Exempt and Non-Taxable Transactions Case Study 34 Council On State Taxation Please select a Team. 1. Team 1 2. Team 2 5 2 0% Te am Te am 1 0% 35 It is primarily the responsibility of the taxpayer to prove that an exclusion from the tax exists on a particular transaction. 1. True 2. False 5 0% Fa ls e Tr ue 0% 36 In a state where the definition of a taxable service includes repairs to tangible personal property, which by definition excludes aircraft; would the repair of the aircraft be: Subject to the tax Exempt from the tax Excluded from the tax Both answer 2 and 3 3 er 2 an d ta x th e an sw m Bo th fro Ex cl ud ed Ex em pt f o ro m th e th e ta x ta x 0% 0% 0% 0% Su bj ec tt 1. 2. 3. 4. 5 37 In a state that considers the true object of the transaction and does not tax any services, but taxes the sale of tangible personal property, would a separately stated charge for ink that is used to address a customer-provided envelope as a part of a mailing service most likely be subject to tax? 5 1. Yes 2. No 0% No Ye s 0% 38 Team Scores 0 0 Team 1 Team 2 39 Food is always exempted from the tax 1. True 2. False 5 0% Fa ls e Tr ue 0% 40 In states that exempt food products they will typically exempt food sold in restaurants as well. 1. True 2. False 5 0% Fa ls e Tr ue 0% 41 The sale of a cash register by a jewelry store could possibly qualify for an occasional sale exemption for which of the following reasons: an er d 2 an sw er s 1 or 2 Ne ith an sw er s 1 so ld Bo th st or e is no ti ... al l. . 0% 0% 0% 0% Je w el ry 3. 4. st or e 2. 5 Jewelry store is not in the business of selling cash registers Jewelry store sold all of their assets including the cash register Both answers 1 and 2 Neither answers 1 or 2 Je w el ry 1. 42 Would the purchase of a screwdriver by a contractor who uses the screwdriver to provide a taxable real property contractor service be tax free for resale? 5 1. Yes 2. No 0% No Ye s 0% 43 Team Scores 0 0 Team 1 Team 2 44 It is primarily the responsibility of the taxpayer to prove that an exemption from the tax applies to a transaction. 5 1. True 2. False 0% Fa ls e Tr ue 0% 45 If a question exists as to the applicability of an exclusion to a particular transaction, the courts should apply the statute liberally in favor of the taxing authority. 5 1. Yes 2. No 0% No Ye s 0% 46 Team Scores 0 0 Team 1 Team 2 47 If a question exists as to the applicability of an exemption to a particular transaction, the courts would likely apply the statute strictly against the application of the exemption. 5 1. True 2. False 0% Fa ls e Tr ue 0% 48 Services are generally subject to tax unless specifically excluded or exempt. 5 1. True 2. False 0% Fa ls e Tr ue 0% 49 Tangible personal property is generally subject to tax unless specifically excluded or exempted. 5 1. True 2. False 0% Fa ls e Tr ue 0% 50 An example of an “entity based status exemption” would be: p. .. of a pt s An ex em al e pt s Ex em al e of m a to al e pt s an uf ... no t-. .. bo y. .. a by Ex em 4. 0% 0% 0% 0% al e 3. pt s 2. 5 Exempt sale by a boy scout troop to the general public Exempt purchase by a notfor-profit hospital Exempt sale of manufacturing machinery and equipment to a chemical plant An exempt sale of a prescription drug to a physician practice Ex em 1. 51 An example of a “use based exemption” may include manufacturing equipment. 5 1. True 2. False 0% Fa ls e Tr ue 0% 52 Team Scores 0 0 Team 1 Team 2 53 Resale certificates are always required to be collected at the time of purchase in order to be valid. 5 1. True 2. False 0% No Ye s 0% 54 What is a term commonly used for a certificate that will cover more than one exempt purchases? 10 A good one A big one Complete Blanket 0% Bl an ke t Co m on e bi g A go od 0% pl et e 0% on e 0% A 1. 2. 3. 4. 55 Every state accepts a “Uniform Sales and Use Tax Certificate - Multi-jurisdiction”. 5 1. True 2. False 0% No Ye s 0% 56 A seller accepts a resale or exemption certificate in “good faith” and is typically relieved from further sales tax collection responsibilities. 5 1. True 2. False 0% No Ye s 0% 57 Which are common elements required for a valid resale certificate in most states? Signature Contemporaneous Renewable Notarized ed 0% No ta riz Re ne w Co nt em 0% ab le 0% po ra ne ou s 0% Si gn at ur e 1. 2. 3. 4. 5 58 Team Scores 0 0 Team 1 Team 2 59 Most taxpayers would qualify for a direct pay permit. 5 1. True 2. False 0% Fa ls e Tr ue 0% 60 The sale of an intangible like common stock is generally: Subject to sales tax Exempt from sales tax Excluded from sales tax None of the above ab ov e of th e No ne m fro pt f Ex cl ud ed ro m sa le s sa le s ta x ta x sa le s o Ex em ta x 0% 0% 0% 0% Su bj ec tt 1. 2. 3. 4. 5 61 Enterprise zones always includes exemptions at both the state and local level: 1. True 2. False 0% Fa ls e Tr ue 0% 5 62 Team Scores 1800 1150 Team 2 Team 1 63 Enterprise zone exemptions are enacted to restrict economic development. 5 1. True 2. False 0% Fa ls e Tr ue 0% 64 Real property is generally taxable unless a specific exemption is available. 5 1. True 2. False 0% Fa ls e Tr ue 0% 65 Tangible personal property that is purchased for resale is generally excluded from tax. 5 1. True 2. False 0% Fa ls e Tr ue 0% 66 The true object of the transaction addresses whether the object of the transaction is an excluded service or an enumerated service. 5 1. True 2. False 0% Fa ls e Tr ue 0% 67 Team Scores 0 0 Team 1 Team 2 68 Interstate transactions are typically excluded due to constitutional restrictions on state governments. 5 1. True 2. False 0% Fa ls e Tr ue 0% 69 Local jurisdictions are precluded from allowing enterprise zone exemptions. 5 1. True 2. False 0% Fa ls e Tr ue 0% 70 Which of the following is most likely to be excluded from tax: 5 1. The sale of an item for resale 2. The sale of an item in interstate commerce 3. The sale of a service 4. The sale of an enumerated service e. .. sa le of an of a Th e sa le Th e en um in ... i te m fo ... of an i te m Th e sa le of an sa le Th e se rv ic e 0% 0% 0% 0% 71 Which of the following is likely to be exempt from tax: 5 1. The sale of common stock 2. The sale of an entire business 3. The sale of real property 4. The sale of preferred stock only ... of re al Th pr e op sa er le ty of pr ef er re d. .. en tir e Th e sa le of an sa le Th e Th e sa le of co m m on ... 0% 0% 0% 0% 72 Team Scores 0 0 Team 1 Team 2 73 Resale exemptions protect taxpayers from: 5 1. An undue administrative burden 2. Undue cost of taxation 3. Double taxation 4. All of the above An un du e ad m in Un is du tra e ti . co . st of ta xa ti o Do n ub le ta xa tio Al n lo ft he ab ov e 0% 0% 0% 0% 74 Entity based exemptions are based upon who the seller is 5 1. True 2. False 0% Fa ls e Tr ue 0% 75 Use based exemptions address who the purchaser is 5 1. True 2. False 0% Fa ls e Tr ue 0% 76 And the winner is….! 0 0 Team 1 Team 2 77