Ch 23: Efficient Allocation

advertisement

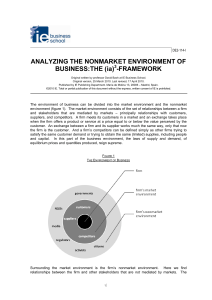

Chapter 23, Ecological Economics, Daly & Farley Economists suggest we find monetary values for these goods and then use the market to efficiently allocate them. Controversy over whether establishing monetary values is appropriate or meaningful. Diamonds-water paradox In the past ecosystem goods/services were so abundant that an extra unit had no appreciable value. As we approach ecological thresholds the values will increase rapidly. Unlike normal market good ecosystem values would have to be continuously recalculated and fed back into the market system at a great expense of time and money. Lack of knowledge of ecosystem function Lack of familiarity with valuing nonmarket goods Example, the contingent valuation method creates a hypothetical market by asking people what they would be willing to pay for a given nonmarket good/service. Problems, Ignorance of all the goods and services provided by healthy ecosystems and people may not respond truthfully. Market Price Method Productivity Method Hedonic Pricing Method Travel Cost Method Damage Cost Avoided , Replacement Cost, and Substitute Cost Methods Contingent Valuation Method Contingent Choice Method Benefit Transfer Method Most ecosystem goods & services can provide benefits in the future Economists generally look to discounting Ignore the ethical decisions of intergenerational distribution Economists argue it is a question of efficient allocation, not distribution. Should the future have a right to resources and if so how do we determine/enforce this? We are constantly forced to make decisions between market and nonmarket goods ◦ More forests or more strip malls? ◦ The differences often make comparisons not only impossible but also undesirable ◦ Putting dollar values on everything does not make decision more objective, but obscures the ethical decisions required to make “objective” valuations. Ecological Economics, rather than trying to find the correct price for everything, espouses that we should act on the knowledge that zero is the wrong price and try to better understand that there is significant (often infinite) value even if we cannot precisely quantify it. Buyer or seller has more information Car sale – Owner knows the state of the car, the buyer does not Buyer will have a lower price to adjust for risk than the seller is willing to accept Daly & Farley provide a few ideas, but “welcome new and better ideas for addressing the market failures associated with advertising”. ◦ Tax Advertising ◦ Full disclosure advertising Direct Subsidy ◦ Compensate the private sector for its provision of positive externalities Tax Relief ◦ Decrease in land taxes for erosion reduction ◦ Tax breaks for businesses investing in personnel training Subsidized Credit ◦ If people under-invest in activities with positive externalities, lower interest payments would stimulate greater investment. Governments could make interest free loans or grants to activities that best promote the public good, including the provision of nonmarket goods This could help in the macro-allocation of resource towards nonmarket goods It could also lead to a financial system whose viability is not based on unending growth. Ecosystems provide services at local, regional, & global levels Causes of degradation are often local while impacts are local, regional, & global Policy making is primarily local and national Scale causes serious problems with regulating and monitoring Individuals get the benefits, we all share the negative impacts. Brazil is making progress on this matter. Individual nations are unlikely to pay for the degradation to ecosystems they cause. We all benefit, so probably we should all pay, but how? Presently, most countries are free riders Beneficiary pays principle Find a way for more developed countries who benefit from ecosystem services to reimburse lesser developed countries for keeping those services viable. This is easier said then done… International Subsidies for Ecosystem Preservation ◦ International Pigouvian subsidy ◦ ICMS ecologico ◦ National Pigouvian tax paired with an international subsidy Must deal with issues of who to pay and the possibility of people taking up a behavior just to get in on the subsidy Typically, allocative efficiency is achieved when we put scarce resources to the use the yields the most monetary values Ignore diminishing marginal utility of wealth and the potential gains of redistribution. Goal of economics is not to maximize production, but to provide service. Production of services from manmade capital requires sacrifice of services from natural capital. An appropriate measure of efficiency is the ratio of services gained from manmade capital stock (MMK) to the services sacrificed from the natural capital stock (NK) 1. Service Efficiency 2. Maintenance Efficiency/ Durability 3. Growth Efficiency 4. Increased by creating more natural capital stock or sacrificing fewer ecosystem services Captures the tradeoffs between services gained and services lost (left hand side) Uneconomic growth invariably reduces efficiency Overall efficiency (right hand side) design, distribution, durability, growth, & harvesting