SYMPOSIUM PROPOSAL ACADEMY OF MANAGEMENT PERSPECTIVES 1. Title:

advertisement

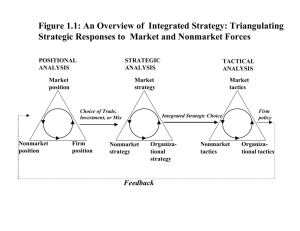

SYMPOSIUM PROPOSAL ACADEMY OF MANAGEMENT PERSPECTIVES Overview of the Symposium 1. Title: New Directions in Nonmarket Strategy: An Integrative Approach to Value Creation 2. Editors Professor Jonathan Doh, Villanova University and Professor Thomas Lawton, EMLYON Business School 3. Articles: (i) Integrating Market and Nonmarket Strategy: Institutional Perspectives in a Multi-Polar World Prof. Jonathan P. Doh Villanova University Lancaster Avenue Villanova, PA 19085 USA T: +1 (610) 519-7798 E: jonathan.doh@villanova.edu 1 Prof. Thomas C. Lawton EMLYON Business School 23 Avenue Guy de Collongue 69134 Ecully Cedex France T: +33 (4) 7833 7800 E: Lawton@em-lyon.com Dr Tazeeb Rajwani Cranfield School of Management Cranfield University Bedford MK43 0AL United Kingdom T: +44 (1234) 751122 E: Tazeeb.rajwani@cranfield.ac.uk (ii) Neoinstitutionalism and Nonmarket Strategy Prof. Witold Henisz The Wharton School The University of Pennsylvania Philadelphia, PA19104 2 USA T: +1 (215) 898-0788 E: henisz@wharton.upenn.edu Prof. Bennet A. Zelner Robert H. Smith School of Business University of Maryland College Park, MD 20742-1815 USA T: (919) 660 1093 E: bzelner@duke.edu (iii) Political Markets and Regulatory Uncertainty: Insights and Implications for Integrated Strategy Prof. Jean-Philippe Bonardi Université de Lausanne Quartier UNIL-Dorigny, Bâtiment Internef 1015 Lausanne Switzerland 3 T: +41 (021) 692 3440 E: Jean-Philippe.Bonardi@unil.ch Prof. Allison F. Kingsley University of Vermont School of Business Administration 55 Colchester Avenue, 205 Kalkin Hall Burlington, VT 05405 USA T: +1 (802) 656.3464 E: allison.kingsley@uvm.edu Prof. Richard G. Vanden Bergh University of Vermont School of Business Administration 55 Colchester Avenue, 207 Kalkin Hall Burlington, VT 05405 USA T: +1 (802) 656.8720 E: vandenbergh@bsad.uvm.edu 4 (iv) The Contingent Value of Corporate Political Ties Prof. Kamel Mellahi Warwick Business School University of Warwick Coventry CV4 7AL UK T: +44 (24) 7615 1393 E: Kamel.Mellahi@wbs.ac.uk Prof. Pei Sun School of Management Fudan University Shanghai China E: sunpei@fudan.edu.cn T: +86 2501 1114 Prof. Mike Wright Imperial College Business School South Kensington campus London SW7 2AZ 5 United Kingdom E: mike.wright@imperial.ac.uk T: +44 (20) 7589 5111 The Basic Idea The domain of nonmarket strategy (NMS)1 suffers from an identity problem. Several traditions and approaches inform the study of NMS, including research on corporate political activity (CPA) (Hillmann and Hitt, 1999; Hillman et al., 2004; Keim and Zeithaml, 1996; Schuler, 1996; Schuler et al., 2002), exploration of firm-environment interactions under varying institutional conditions (Henisz, 2000; Henisz and Delios, 2004; Helisz and Zelner, 2003a), and, more recently, heightened interest in and attention to the social and environmental obligations – and strategies – of business firms as they interact with their external stakeholders (Boddewyn and Doh, 2011; Husted and Allen, 2010; Yaziji, 2010; Yaziji and Doh, 2009). In this symposium, we seek to synthesize and integrate some of this disparate literature to inform contemporary strategic challenges that emanate from political and social actors and environments. The articles that comprise this symposium review some of the relevant strands in the literature to date, emphasizing especially the importance of social and economic institutions in constraining and facilitating nonmarket activity. This emphasize on institutions affords an opportunity 1 We understand nonmarket strategy to mean strategic management activities and actions directed toward political, regulatory, social and cultural environments, influences and actors. 6 to tie together some of the strands of the existing NMS literature while extending that literature in novel and innovative directions. The contributions in this symposium highlight and reinforce the relevance of governmental and nongovernmental actors at multiple levels of analysis. While approaching this challenge differently, each article in this symposium contributes to the notion that strategies for the nonmarket environment are – and should be - inextricably and inexorably linked to “traditional” strategic rationales and approaches, and that many of the theories and perspectives that have been used to inform market-oriented strategies can be adopted and incorporated into understanding strategies for the social and political arena. More broadly, however, the articles collectively propose a wider and more inclusive approach to – and domain of – strategic management than has typically been defined and applied. The guiding principle of this symposium is that corporate political and social activity needs to be embedded in the strategy process if it is to add real value for business. Furthermore, strategy for industry and market competition and strategy for political and social contexts must be equally attuned with corporate vision, values and objectives. Alignment involves adjusting different aspects of a company’s operational and organizational presence to produce a harmonious relationship or orientation. Some firms that appear to be especially effective at such alignment include Stonyfield Farms, Marks and Spencer, Banyan Tree Resorts, Swiss Re, and others. While each approaches this challenge uniquely and have tailored the concept of alignment differently, they have achieved a balance and ensured positive interactions between their commercial and political/social strategies. When we refer to alignment, we have in mind two complementary ideas. First, we 7 explicitly argue for closer integration and coordination between market and nonmarket strategies. Second, and in parallel, we refer to alignment between those activities and actions within the firm that support and underpin strategy, and the acknowledgement, assessment, and incorporation of the external social and political environment into those strategic processes and actions. We consider these two related forms of alignment as constituting a form of strategic fit between commercial and political/ social strategy, and between internal and external factors and variables. In the first paper, Jonathan Doh, Thomas Lawton and Tazeeb Rajwani provide an overview of the concepts and issues, focusing on the themes of “alignment” and “integration” in both senses as described above, using examples and insights from recent research across strategy, political science, sociology and philosophy. They illustrate how institutions have demonstrable effects on the competitive advantage of firms and the competitive dynamics of industries and can contribute to increases or decreases in profitability (MacAvoy, 1992; Kim, 2008). As a discipline, strategic management has offered a variety of theoretical routes to address the role of institutions, particularly those governed by the nation state (Mahoney and Pandian, 1992; Cockburn et al., 2000; SegalHorn, 2004). In addition, strategy scholars have leveraged the neo-institutional perspectives of North (1986; 1993) and the institutional/transaction cost insights of Williamson (1985) to inform a variety of strategy-related phenomena (Bonardi et al., 2006; Frynas and Mellahi, 2003; Henisz and Williamson, 1999; Henisz and Zelner, 2003). In this paper, Doh et al. seek to synthesize and extend this work and to reflect on its implications in a multi-polar world. 8 Henisz and Zelner subsequently examine the influence of the “New Institutionalism” in economics, political science, and sociology on the developing field of non-market strategy in the context of international business. They argue that the application of neoinstitutional theory from economics and political science to the analysis of political risk - which provides the impetus for international nonmarket strategy research in the first place - advanced such research after years of stasis by providing conceptual and empirical rigor. In the third paper of the symposium, Bonardi, Vanden Bergh and Kingsley investigate nonmarket strategy in the context of political markets and regulatory uncertainty. Specifically, they assess the design of nonmarket strategies to manage regulatory uncertainty and discuss ways for firms to integrate this with their market strategies. Bonardi et al. advance a framework for predicting the magnitude of regulatory uncertainty and develop strategic implications for firms to manage regulatory uncertainty in the context of their market investments. They suggest the dimensions of a nonmarket strategy that fit well with the characteristics of the political market to create an integrated strategy. Finally, the authors provide examples from several market entry choices that involve different nonmarket strategies and offer suggestions for future research in this area. In the final paper, Mellahi, Sun, and Wright argue that the value of corporate political ties vary depending upon managerial, organizational, and environmental factors. 9 Specifically, they explore the downside of corporate political ties during periods of institutional transition and upheaval. Using a matched pairs case approach, they argue for a contingency perspective of political ties to develop an integrative framework incorporating managerial, organizational, and environmental factors that condition the value of corporate political ties. They propose operating mechanisms through which network-based political capital may turn into liabilities for a focal firm leading to undesired effects on performance. They suggest their paper deepens our understanding of the network-based corporate political strategy and of its relationship with market strategy. The Audience We seek to reach an audience of scholars interested in contemporary thinking about nonmarket strategy as well as strategic management scholars interested in competitive strategy and strategy process. In addition, scholars outside of strategy have paid even less attention to nonmarket actors in terms of their ability to influence organizational development and success, and so we would like to move beyond the “usual suspects” and speak to scholars on OB, OT and other management areas. This would include scholars interested in social movements, ethics and corporate social responsibility. Finally, we would also like to demonstrate to scholar/teachers that the nonmarket paradigm has much to offer in terms of management learning and development, including some fascinating case studies and other illustrations and examples that may be relevant for broader management learning. 10 Importance of Idea Nonmarket strategy has gained considerable and renewed importance in recent years as a consequence of the resurgent state following the financial collapse and the increasing incidence of Western multinationals operating in emerging market where government play a prominent role in economics and business development. More recently, emerging multinationals – with complex and opaque state and private ownership structures are entering and operating in developed countries, posing challenges for those firms’ interactions with host governments and for competitors who seek to respond to the rise of developing country MNCs. Finally, the sustained interest in – and priority given to – social actors as a result of changes in consumer preferences, investor priorities, and media and popular interest, poses challenges for nonmarket strategists because it suggests different modes and mechanisms for developing and advancing strategies and a new set of influencers which firms must consider. As noted above, we believe these social and political strategies must be integrated with nonmarket strategies targeted toward government and that nonmarket strategies should be aligned with overall commercial strategies. Communication of Idea We draw upon our considerable collective research in the nonmarket strategy domain to construct a conceptual roadmap for managers striving to develop integrated strategies. Our approach is not normative in nature but instead is premised on the practical assumption that how managers approach and configure their social and political strategies 11 is optimally determined by their corporate vision and values, business objectives and market positions. In particular, we will synthesize and extend the argument and evidence that a consistent, integrated approach to market and nonmarket strategy is essential to organizational success, particularly in a multi-polar world where institutions vary in their scope and impact on business activities. Moreover, we argue that companies based in advanced economies risk being at a competitive disadvantage relative to competitors from emerging markets in the quest for international market success. Corporations such as Haier from China, Dr Reddy’s from India and Kaspersky from Russia have experience from the outset in managing institutional voids and factoring institutions into their strategic decisions and actions. As a consequence, their approach to nonmarket forces, particularly institutions, is proactive, engaged and rooted in pragmatism. U.S.-based companies and their peers in the developed world vary in their approach to integrated strategy, often depending on the industry and existing international footprint. Often nonmarket variables and institutional influence is approached reactively with a tactical rather than a strategic response. We argue that in the new multi-polar world, an aligned approach to strategic management is the optimal method for senior managers seeking international growth and foreign market success. Building on existing theory and advancing fresh insights, the papers in our Symposium collectively argue and illustrate why an aligned approach to integrated strategy is needed, how it can be formulated and add value, and the challenges to overcome in implementing an integrated strategy in a multi-polar world. 12 References Baron, D.P. (1995). The nonmarket strategy system. Sloan Management Review (Fall):73-85. Bonardi, J.P., Holburn, G.L.F. and Vanden Bergh, R.G. (2006). Nonmarket strategy performance: evidence from U.S. electric utilities. Academy of Management Journal, 38:288-303. Cockburn, I. M., Henderson, R.M. and Stern, S. (2000). Untangling the origins of competitive advantage. Strategic Management Journal, 21: 1123-1145. Coen, D. (1998). The European business interest and the nation state: large-firm lobbying in the European Union and member state. Journal of Public Policy, 18: 75-100. De Figueiredo, J.M., and Tiller, E.H. (2001). The structure and conduct of corporate lobbying: an empirical analysis of corporate lobbying at the federal communications commission. Journal of Economics and Management Strategy, 10: 91-122. De Figueiredo J.M. (2009). Integrated political strategy, Advances in Strategic Management, 26: 459 - 486. Doh, J. P. and J. A. Pearce (2005). The high impact of collaborative social initiatives. 13 Sloan Management Review, 46: 30-39. Frynas, J. G, and Mellahi, K. (2003). Political risks as firm-specific (dis) advantages: evidence on transnational oil firms in Nigeria. Thunderbird International Business Review, 45: 541-565. Frynas, J. G, Mellahi, K. and Pigman, G.A. (2006). First mover advantages in international business and firm-specific political resources. Strategic Management Journal, 27: 321-145. Getz, K. A. (1997). Research in corporate political action: integration and assessment. Business and Society, 36: 32-72. Henisz W.J. and Williamson O.E. (1999). Comparative economic organization – within and between countries, Business and Politics, 1: 261-277. Henisz, W.J. and Zelner, B.A. (2003). Legitimacy, interest group pressures and change in emergent institutions: The case of foreign investors and host country governments. Academy of Management Review, 30: 361-382. Hillman, A.J., Hitt, M.A. (1999). Corporate political strategy formulation: a model of approach, participation and strategy decisions. Academy of Management Review, 24: 825-842. 14 Holburn, G. and Vanden Bergh, R. G. (2008). Making friends in hostile environments: political strategy in regulated industries. Academy of Management Review, 33: 521-540. Husted, B.W. and Allen, D.B. (2011) Corporate social strategy: stakeholder engagement and competitive advantage. Cambridge: Cambridge University Press. Kim, J. (2008). Corporate lobbying revisited. Business and Politics, 10: 1-23. Lawton, T.C. and Rajwani, T. (2011). Designing lobbying capabilities: managerial choices in unpredictable environments. European Business Review, 23: 167-189. MacAvoy, P. W. (1992). Industry Regulation and the Performance of the American Economy. New York: W.W. Norton and Co. Mahoney, J. T. and J. R. Pandian (1992). The resource-based view within the conversation of strategic management. Strategic Management Journal, 13: 363-380. North D. (1986). The new institutional economics. The Journal of Institutional and Theoretical Economics, 142: 230-237. North DC. (1993). Institutions and credible commitment. Journal of Institutional and Theoretical Economics, 149: 11-23. 15 Segal-Horn, S. (2004). The modern roots of strategic management. European Business Journal, 16: 133-142. Williamson, O. E. (1985). The economic institutions of capitalism: firms, markets and relational contracting. New York: Free Press. 16