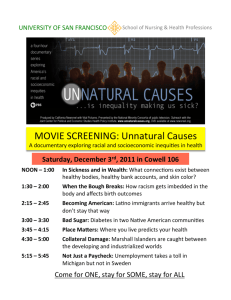

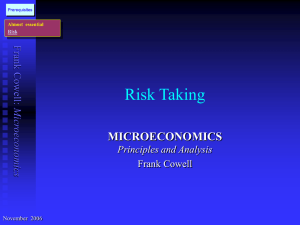

Risk Taking

advertisement

Prerequisites Almost essential Risk RISK TAKING MICROECONOMICS Principles and Analysis Frank Cowell July 2015 Frank Cowell: Risk Taking 1 Economics of risk taking In the presentation Risk we examined the meaning of risk comparisons • in terms of individual utility • related to people’s wealth or income (ARA, RRA) In this presentation we put to this concept to work We examine: • trade under uncertainty • a model of asset-holding • the basis of insurance July 2015 Frank Cowell: Risk Taking 2 Overview Risk Taking Trade and equilibrium Extending the exchange economy Individual optimisation The portfolio problem July 2015 Frank Cowell: Risk Taking 3 Trade Consider trade in contingent goods Requires contracts to be written ex ante In principle we can just extend standard GE model Use prices piw: • price of good i to be delivered in state w We need to impose restrictions of vNM utility An example: • two persons, with differing subjective probabilities • two states-of the world • Alf has all endowment in state BLUE • Bill has all endowment in state RED July 2015 Frank Cowell: Risk Taking 4 Contingent goods: equilibrium trade • b xRED Certainty line for Alf Alf's indifference curves Ob pa RED – ____ paBLUE a xBLUE Certainty line for Bill Bill's indifference curves Endowment point Equilibrium prices & allocation pbRED – ____ pbBLUE Contract curve • b xBLUE Oa July 2015 a xRED Frank Cowell: Risk Taking 5 Trade: problems Do all these markets exist? • If there are states-of-the-world… • …there are n of contingent goods • Could be a huge number Consider introduction of financial assets Take a particularly simple form of asset: • a “contingent security” • pays $1 if state w occurs Can we use this to simplify the problem? July 2015 Frank Cowell: Risk Taking 6 Financial markets? The market for financial assets opens in the morning Then the goods market is in the afternoon Use standard results to establish that there is a competitive equilibrium Instead of n markets we now have n+ But there is an informational difficulty • To do financial shopping you need information about the afternoon • This means knowing the prices that there would be in each possible state of the world • Has the scale of the problem really been reduced? July 2015 Frank Cowell: Risk Taking 7 Overview Risk Taking Trade and equilibrium Modelling the demand for financial assets Individual optimisation The portfolio problem July 2015 Frank Cowell: Risk Taking 8 Individual optimisation A convenient way of breaking down the problem A model of financial assets Crucial feature #1: the timing • Financial shopping done in the “morning” • This determines wealth once state w is realised • Goods shopping done in the “afternoon” • We will focus on the “morning” Crucial feature #2: nature of initial wealth • Is it risk-free? • Is it stochastic? Examine both cases July 2015 Frank Cowell: Risk Taking 9 Interpretation 1: portfolio problem You have a determinate (non-random) endowment y You can keep it in one of two forms: • Money – perfectly riskless • Bonds – have rate of return r: you could gain or lose on each bond If there are just two possible states-of-the-world: • rº < 0 – corresponds to state BLUE • r' > 0 – corresponds to state RED Consider attainable set if you buy an amount b of bonds where 0 ≤ b ≤ y July 2015 Frank Cowell: Risk Taking 10 Attainable set: safe and risky assets Endowment If all resources put into bonds xBLUE All these points belong to A Can you sell bonds to others? Can you borrow to buy bonds? unlikely to be points here If loan shark willing to finance you _ _ y P _ _ y+br′, y+br _ _ [1+r′ ]y, [1+r]y _ P0 [1+rº]y A _ y July 2015 _ [1+r' ]y Frank Cowell: Risk Taking unlikely to be points here xRED 11 Interpretation 2: insurance problem You are endowed with a risky prospect • Value of wealth ex-ante is y0 • There is a risk of loss L • If loss occurs then wealth is y0 – L You can purchase insurance against this risk of loss • Cost of insurance is k • In both states of the world ex-post wealth is y0 – k Use the same type of diagram July 2015 Frank Cowell: Risk Taking 12 Attainable set: insurance Endowment Full insurance at premium k xBLUE All these points belong to A Can you overinsure? Can you bet on your loss? unlikely to be points here _ _ y partial insurance P L–k P0 y0 – L k A _ y July 2015 unlikely to be points here xRED y0 Frank Cowell: Risk Taking 13 A more general model? We have considered only two assets Take the case where there are m assets (“bonds”) Bond j has a rate of return rj Stochastic, but with known distribution Individual purchases an amount bj July 2015 Frank Cowell: Risk Taking 14 Consumer choice with a variety of financial assets Payoff if all in cash Payoff if all in bond 2 Payoff if all in bond 3, 4, 5,… Possibilities from mixtures Attainable set The optimum xBLUE 1 only bonds 4 and 5 used at the optimum 2 3 A 4 P* 5 6 7 July 2015 Frank Cowell: Risk Taking xRED 15 Simplifying the financial asset problem If there is a large number of financial assets many may be redundant • which are redundant depends on tastes… • … and on rates of return In the case of #W = 2, a maximum of two assets are used in the optimum So the two-asset model of consumer optimum may be a useful parable Let’s look a little closer July 2015 Frank Cowell: Risk Taking 16 Overview Risk Taking Trade and equilibrium Safe and risky assets comparative statics Individual optimisation The portfolio problem July 2015 Frank Cowell: Risk Taking 17 The portfolio problem We will look at the equilibrium of an individual risk-taker Makes a choice between a safe and a risky asset • “money” – safe, but return is 0 • “bonds”– return r could be > 0 or < 0 Diagrammatic approach uses the two-state case But in principle could have an arbitrary distribution of r… July 2015 Frank Cowell: Risk Taking 18 Distribution of returns (general case) f (r) plot density function of r loss-making zone the mean r Er July 2015 Frank Cowell: Risk Taking 19 Problem and its solution Agent has a given initial wealth 𝑦 If he purchases an amount b of bonds: • Final wealth then is y = 𝑦 – b + b[1+r] • This becomes y = 𝑦 + br, a random variable The agent chooses b to maximise Eu(𝑦 + br) FOC is E(ruy(𝑦 + b*r)) = 0 for an interior solution • where uy(•) = u(•) / y • b* is the utility-maximising value of b But corner solutions may also make sense… July 2015 Frank Cowell: Risk Taking 20 Consumer choice: safe and risky assets Attainable set, portfolio problem xBLUE Equilibrium -- playing safe Equilibrium - "plunging" Equilibrium - mixed portfolio _ _ y P P* P0 A xRED _ y July 2015 Frank Cowell: Risk Taking 21 Results (1) Will the agent take a risk? Can we rule out playing safe? Consider utility in the neighbourhood of b = 0 Eu(𝑦 + br) | ———— | = uy(𝑦) E r b |b=0 uy is positive So, if expected return on bonds is positive, agent will increase utility by moving away from b = 0 July 2015 Frank Cowell: Risk Taking 22 Results (2) Take the FOC for an interior solution Examine the effect on b* of changing a parameter For example differentiate E(ruy(𝑦 + b*r)) = 0 w.r.t. 𝑦 E(ruyy(𝑦 + b*r)) + E (r2 uyy(𝑦 + b*r)) b*/𝑦 = 0 b* – E (ruyy(𝑦 + b*r)) —— = ——————— 𝑦 E(r2 uyy(𝑦 + b* r)) Denominator is unambiguously negative What of numerator? July 2015 Frank Cowell: Risk Taking 23 Risk aversion and wealth To resolve ambiguity we need more structure Assume Decreasing ARA Theorem: If an individual has a vNM utility function with DARA and holds a positive amount of the risky asset then the amount invested in the risky asset will increase as initial wealth increases July 2015 Frank Cowell: Risk Taking 24 An increase in endowment Attainable set, portfolio problem DARA Preferences xBLUE Equilibrium Increase in endowment Locus of constant b New equilibrium _ y+d _ y P* o ** P A try same method with a change in distribution _ y July 2015 xRED _ y+d Frank Cowell: Risk Taking 25 A rightward shift original density function f (r) original mean shift distribution by t Will this change increase risk taking? r t July 2015 Frank Cowell: Risk Taking 26 A rightward shift in the distribution Attainable set, portfolio problem xBLUE DARA Preferences Equilibrium Change in distribution Locus of constant b New equilibrium _ _ y P Po* P** P0 A What if the distribution “spreads out”? xRED _ y July 2015 Frank Cowell: Risk Taking 27 An increase in spread Attainable set, portfolio problem Preferences and equilibrium Increase r′, reduce r xBLUE P* stays put So b must have reduced You don’t need DARA for this _ _ y P P* _ _ y+b*r′, y+b*r P0 A xRED _ y July 2015 Frank Cowell: Risk Taking 28 Risk-taking results: summary If the expected return to risk-taking is positive, then the individual takes a risk If the distribution “spreads out” then risk taking reduces Given DARA, if wealth increases then risk-taking increases Given DARA, if the distribution “shifts right” then risk-taking increases July 2015 Frank Cowell: Risk Taking 29