Lecture 23: Choice under Risk

advertisement

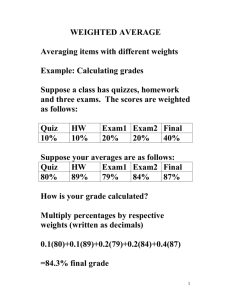

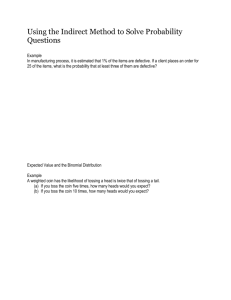

Microeconomics Corso E John Hey Chapters 23, 24 and 25 • CHOICE UNDER RISK • Chapter 23: The Budget Constraint. • Chapter 24: The Expected Utility Model. • Chapter 25: Exchange in Insurance Markets. • (cf. Chapters 20, 21 and 22) Bet 1 • Will you bet with me? • We toss a fair coin... ... If it lands heads I give you 100 euros ... If it lands tails you give me 100 euros • Note... this is a risky choice problem • ... we know the probabilities... • ... but we do not know which “state of the world” will happen. Bet 2 • Will you bet with me? • We toss a fair coin... ... If it lands heads I give you 100 euros ... If it lands tails you give me 50 euros • Note... this is a risky choice problem • ... we know the probabilities... • ... but we do not know which “state of the world” will happen. Bet 3 • • • • • I intend to sell this bet to the highest bidder. We toss a fair coin... ... if it lands heads I give you 100 euros ... If it lands tails I give you nothing. We will do an “English Auction” – the student who is willing to pay the most wins the auction, pays me the price at which the penultimate person dropped out of the auction, and I will play out the bet with him or her. Contingent Goods • • • • A bet, for example: ... if it lands heads I give you 100 euros ... If it lands tails I give you nothing. If you buy this bet, you do not buy something certain, but something whose value depends upon the “state of the world” (heads or tails). • This is exactly what insurance is. Bet 1 • We toss a coin... ... if it lands heads (State 1) I give you 100 euros ... if it lands tails (State 2) you give me 100 euros • Let us denote by m your income. • If you do not take the bet m is your income... • ...if you do take the bet then m+100 in State 1 and m-100 in State 2. • Hence your income is contingent on the state. Chapter 23 • Description of the situation... • There are two possibilities – we call them State 1 and State 2. • Only one state will happen ... but we do not know which ex ante. • We know the probabilities – π1 and π2 • π1 + π2 = 1 • We have to decide ex ante. Contingent Goods • • • • • • • Notation: m1 and m2: incomes in the two states. c1 and c2: consumption in the two states. Good 1: income contingent on state 1. Good 2: income contingent on state 2. p1 and p2: the prices of the two goods. For every unit of Good i that you have bought you receive an income of 1 if state i occurs. • For every unit of Good i that you have sold you have to pay 1 if state i occurs. Insurance • Consider insurance, for example, against the theft of your car. • If no-one steals your car you have to pay to the insurance company the premium. • If a thief steals your car the insurance company pays to you the value of your car • Insurance provides contingent income (contingent on the theft of your car). An example • • • • • • • • Two states of the world: 1 an accident (theft, etc.): 2 no accident (theft, etc.) Let us suppose each has probability 0.5. Suppose m1 = 30 and m2 = 50 e p1 = 0.5 and p2 = 0.5 Let us go to Maple.... Il Vincolo di Bilancio • p1c1 + p2c2 = p1m1 + p2m2 Prices in a perfect insurance market • If you buy a unit of income contingent on state 1... • ...with probability π1 you receive 1, ...with probability π2 you receive 0. • Your expected income = π1 .1 + π2 .0. = π1 • Hence a fair price is p1 = π1 • Similarly a fair price for Good 2 is p2 = π2 Expected Value • Consider a variable (income) which takes the value m1 with probability π1 and the value m2 with probability π2 • The expected value of the income (or the expected income) is given by… ... m1π1 + m2π2 Chapter 23 • The budget constraint in a perfect insurance market is... ... p1c1 + p2c2 = p1m1 + p2m2 ... ...where p1 = π1 and p2 = π2 • Hence… … π1c1 + π2c2 = π1m1 + π2m2 • Expected consumption is equal to expected income. • Has slope = -π1/π2 Chapter 23 • Goodbye!