Capital Budgeting and Cost Analysis Chapter 21 21 - 1

advertisement

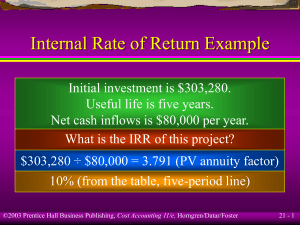

Capital Budgeting and Cost Analysis Chapter 21 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 1 Learning Objective 1 Recognize the multiyear focus of capital budgeting. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 2 Two Dimensions of Cost Analysis 1. A project dimension 2. An accounting-period dimension The accounting system that corresponds to the project dimension is termed life-cycle costing. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 3 Two Dimensions of Cost Analysis Project D Project C Project B Project A 2002 2003 2004 2005 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 2006 21 - 4 Learning Objective 2 Understand the six stages of capital budgeting for a project. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 5 Capital Budgeting Capital budgeting is the making of long-run planning decisions for investments in projects and programs. It is a decision-making and control tool that focuses primarily on projects or programs that span multiple years. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 6 Capital Budgeting Capital budgeting is a six-stage process: 1. Identification stage 2. Search stage 3. Information-acquisition stage 4. Selection stage 5. Financing stage 6. Implementation and control stage ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 7 Capital Budgeting Example One of the goals of Assisted Living is to improve the diagnostic capabilities of its facility. Management identifies a need to consider the purchase of new equipment. The search stage yields several alternative models, but management focuses on one particular machine. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 8 Capital Budgeting Example The administration acquires information. Initial investment is $245,000. Investment in working capital is $5,000. Useful life is three years. Estimated residual value is zero. Net cash savings is $125,000, $130,000, and $110,000 over its life. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 9 Capital Budgeting Example Working capital is expected to be recovered at the end of year 3 with an expected return of 10%. Operating cash flows are assumed to occur at the end of the year. In the selection stage, management must decide whether to purchase the new machine. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 10 Learning Objective 3 Use and evaluate the two main discounted cash-flow (DCF) methods: the net present value (NPV) method and the internal rate-of-return (IRR) method. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 11 Time Value of Money Compound Growth, 5 periods at 6% Year 5: $1.338 Year 4: $1.262 Year 3: $1.91 Year 2: $1.124 Year 1: $1.06 Year 0: $1.00 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 12 Discounted Cash Flow There are two main DCF methods: Net present value (NPV) method Internal rate-of-return (IRR) method ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 13 Net Present Value Example Only projects with a zero or positive net present value are acceptable. What is the the net present value of the diagnostic machine? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 14 Net Present Value Example Year in the Life of the Project 0 1 2 3 $(250,000) $125,000 $130,000 $115,000 Net initial investment Annual cash inflows ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 15 Net Present Value Example Net Cash Year 10% Col. Inflows 1 0.909 $125,000 2 0.826 130,000 3 0.751 115,000 Total PV of net cash inflows Net initial investment Net present value of project NPV of Net Cash Inflows $113,625 107,380 86,365 $307,370 250,000 $ 57,370 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 16 Net Present Value Example The company is considering another investment. Initial investment is $245,000. Investment in working capital is $5,000. Working capital will be recovered. Useful life is three years. Estimated residual value is $4,000. Net cash savings is $80,000 per year. Expected return is 10%. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 17 Net Present Value Example Net Cash Years 10% Col. Inflows 1-3 2.487 $80,000 3 0.751 9,000 Total PV of net cash inflows Net initial investment Net present value of project NPV of Net Cash Inflows $198,960 6,759 $205,719 250,000 ($ 44,281) ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 18 Internal Rate of Return Investment = Expected annual net cash inflow × PV annuity factor Investment ÷ Expected annual net cash inflow = PV annuity factor ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 21 - 19