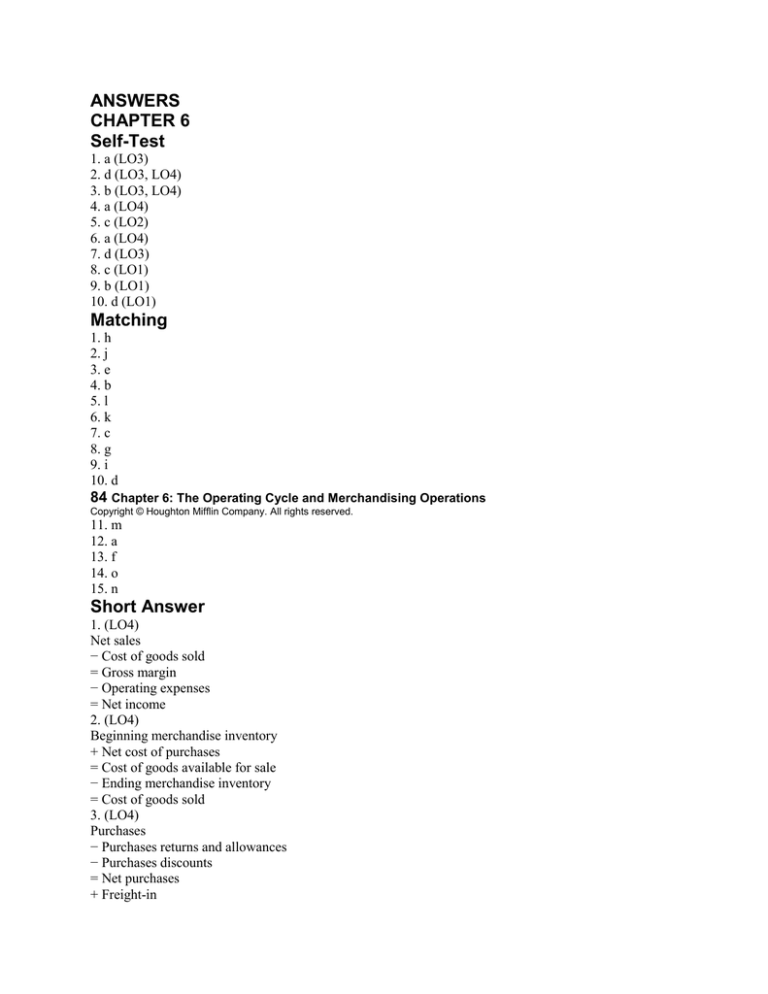

ANSWERS

CHAPTER 6

Self-Test

1. a (LO3)

2. d (LO3, LO4)

3. b (LO3, LO4)

4. a (LO4)

5. c (LO2)

6. a (LO4)

7. d (LO3)

8. c (LO1)

9. b (LO1)

10. d (LO1)

Matching

1. h

2. j

3. e

4. b

5. l

6. k

7. c

8. g

9. i

10. d

84 Chapter 6: The Operating Cycle and Merchandising Operations

Copyright © Houghton Mifflin Company. All rights reserved.

11. m

12. a

13. f

14. o

15. n

Short Answer

1. (LO4)

Net sales

− Cost of goods sold

= Gross margin

− Operating expenses

= Net income

2. (LO4)

Beginning merchandise inventory

+ Net cost of purchases

= Cost of goods available for sale

− Ending merchandise inventory

= Cost of goods sold

3. (LO4)

Purchases

− Purchases returns and allowances

− Purchases discounts

= Net purchases

+ Freight-in

= Net cost of purchases

True-False

1. F (LO4) Beginning inventory is needed.

2. F (LO2) It means that payment is due ten days after the end of the month.

3. T (LO1)

4. T (LO1)

5. T (LO2)

6. F (LO2) It is a contra account to sales.

7. T (LO4)

8. T (LO4)

Chapter 6: The Operating Cycle and Merchandising Operations

85

Copyright © Houghton Mifflin Company. All rights reserved.

9. T (LO1)

10. T (LO4)

11. F (LO3, LO4) It normally has a debit balance.

12. F (LO4) It requires a debit to Office Supplies (office supplies are not merchandise).

13. T (LO3)

14. F (LO2) They treat it as a selling expense.

15. F (LO4) Both are done at the end of the period.

16. F (LO2) A trade discount is a percentage off the list or catalogue price; 2/10, n/30 is a sales

discount, offered for early payment.

17. F (LO2) Title passes at the shipping point.

Multiple Choice

1. d (LO2) According to the terms, Bob would be entitled to a 2 percent purchases discount of

$10. In this example (after allowing for the purchase returns), the discount would be entered as a

credit to balance the journal entry, which would also include a debit to Accounts Payable for the

balance due ($500) and a credit to Cash for the balance due less the discount ($490).

2. c (LO4) Purchase Returns and Allowances is a contra account to the Purchases account.

Purchases has a normal debit balance. Its corresponding contra accounts have normal credit

balances.

3. b (LO4) Delivery Expense is a selling expense; it is not an element of cost of goods sold.

4. d (LO1) Exchange gains and losses arise when the exchange rate changes between the date a

purchase or sale has arisen and the ultimate acquisition of a foreign currency.

5. c (LO3) Under the perpetual inventory system, purchases of merchandise are recorded in the

Merchandise Inventory account, not in a Purchases account.

6. b (LO1) When operating expenses are paid for has no bearing on the length of the operating

cycle.

7. d (LO2) The entry would also include a debit to Credit Card Discount Expense for $50 and a

credit to Sales for $1,000.

8. a (LO1) The financing period equals the number of days taken to sell inventory, plus the

number of days to make collection, minus the number of days the company takes to pay its

suppliers for the goods (45 + 60 – 30 = 75).

Exercises

1. (LO4)

General Journal

Date Description Debit Credit

May 1 Purchases 500

Accounts Payable 500

Purchased merchandise on credit, terms n/30.

3 Accounts Receivable 500

86 Chapter 6: The Operating Cycle and Merchandising Operations

Copyright © Houghton Mifflin Company. All rights reserved.

Sales 500

Sold merchandise on credit, terms n/30.

4 Freight-In 42

Cash 42

Paid for freight charges

5 Office Supplies 100

Accounts Payable 100

Purchased office supplies on credit

6 Accounts Payable 20

Office Supplies 20

Returned office supplies from May 5 purchase

7 Accounts Payable 50

Purchases Returns and Allowances 50

Returned merchandise from May 1 purchase

9 Accounts Receivable 225

Sales 225

Sold merchandise on credit, terms n/30

10 Accounts Payable 450

Cash 450

Paid for purchase of May 1

14 Sales Returns and Allowances 25

Accounts Receivable 25

Accepted return of merchandise from customer of

May 9

22 Cash 200

Accounts Receivable 200

Received payment from customer of May 9

26 Cash 500

Accounts Receivable 500

Received payment from customer of May 3

2. (LO2, LO4)

Mammoth Merchandising Company

Partial Income Statement

For the Year Ended December 31, 20xx

Gross sales $100,000

Less sales discounts $ 300

Less sales returns and allowances 200 500

Chapter 6: The Operating Cycle and Merchandising Operations 87

Copyright © Houghton Mifflin Company. All rights reserved.

Net sales $ 99,500

Less cost of goods sold

Merchandise inventory, January 1 $10,000

Purchases $50,000

Less purchases discounts 500

Less purchases returns and allowances 500

Net purchases $49,000

Freight-in 2,000

Net cost of purchases 51,000

Cost of goods available for sale $61,000

Less merchandise inventory, December 31 8,000

Cost of goods sold 53,000

Gross margin $ 46,500