Mosaic Co. (NYSE:MOS)

advertisement

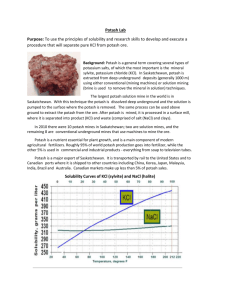

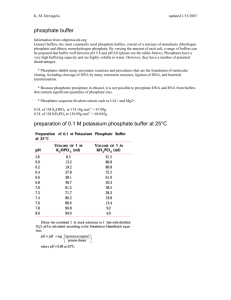

Mosaic Co. (MOS) Presented by: Akrati Johari, Phil Nguyen, Iordanis Thomaidis, Charles Gambino and Michael Bellisario Date: 18th March, 2010 Agenda Industry Overview Financial Ratios Competitor Analysis Multiples Valuation Pro-forma Assumptions DCF and WACC Calculation Macroeconomic Analysis Recommendation Industry Overview Agriculture chemicals industry1 3 main competitors2 Mosaic (phosphate) – $6.1B sales Potash (potash) – $3.7B sales Agrium (nitrogen) – $9.1B sales Consolidation CF Industries to acquire Terra, bidding war with Yara 1from finance.yahoo.com 2data from trailing twelve months Company Overview Based in Plymouth, MN One of the three largest potash producers World’s largest phosphate producer 13% share of global production $10.3B in sales last fiscal year Company Overview Fertilizer – primary macronutrients Improve/add nutrients to soil Phosphorous and potassium Increase crop yield “More from less” Most potash mines are deep shaft mines up to 3,300 feet underground Business Segments Realignment 2Q2010 Phosphates (77% of sales) Combined Offshore segment with Phosphates segment “to more clearly reflect evolving business model” Produce concentrated phosphate crop nutrients and phosphate-based animal feed ingredients Potash (23% of sales) Produce potash-based crop nutrients, animal feed ingredients, and industrial products Strengths High barriers to entry – capital intensive & claim on natural resources and mines 100 years of high-quality ore reserves 40% market share of North American production $2.7B in cash – expansion, additional capacity, acquisitions Products marketed in 40 countries Weaknesses Cross-border risks associated with international operations Seasonality in business that results in needing significant amounts of inventory Cargill’s majority ownership and representation on the Board of Directors Sell a commodity product – difficult to differentiate Threats Decline in oil and other commodity prices Competitors look to add capacity/expand into new markets Governmental policies (subsidies) affecting the agricultural industry Opportunities 75 million more people in the world every year to feed Ethanol production expected to increase ~50% by 2015 Growing middle class in developing countries consuming more protein-rich diets People will always have to eat DuPont Analysis ROE 2.11% -0.88% 2.57% 8.71% 7.16% ROA Decomposition ROA = OIBI,AT / Sales x Sales / Av. Tot. Assets Ratio Analysis – Recent Financial Position Ratios Profitability EBIT Margin Liquidity Current Ratio Leverage Coverage Debt to Equity Payout Policy Dividend Payout 2008 Average 2010 2009 2015 28.6% 23.3% 14.4% 2.2 3.3 3.9 31.0 23.0% 55.4 16.4% 39.4 11.5% NA 3.80% 3.80% Industry Competitors Potash Corp. of Saskatchewan Largest manufacturer of potash fertilizers Third largest producer of nitrogen Third largest producer of phosphate Revenue breakdown: 43% potash, 31% nitrogen, 26% phosphate Claim of production capacity greater than 50% of closest rival Industry Competitors Agrium Second largest producer of nitrogenous fertilizers Third largest North American producer of potash and fifth largest for phosphate Attempted to purchase CF Industries Industry Competitors Terra Industries Leading North American producer of nitrogen based products Accepted takeover bid by CF Industries for $4.7 billion Fertilizer Industry Breakdown Data provided by Relative Sector Performance Financial data provided by Financial Comparison Company Comp Set Company Name Market Cap Revenue Net Income EPS EBITDA Margin % LTM Mosaic Co. (NYSE:MOS) 28,401.3 6,135.9 414.1 0.9 16.4 6.7 Potash Corp. (NYSE:POT) 37,092.3 3,657.6 987.8 3.2 32.7 27.0 Agrium Inc. (TSX:AGU) 11,354.9 9,129.0 366.0 2.3 8.3 4.0 CF Industries (NYSE:CF) 4,699.0 2,608.4 365.6 7.4 32.1 14.0 Terra Industries (NYSE:TRA) 4,637.9 1,581.4 152.6 1.5 23.5 9.7 Financial data provided by Net Income Margin % LTM Multiples Valuation Company 03/12/10 Stock Price Market Cap (MM) Forward P/E Price/Sales Price/ Book Trailing P/E Mosaic Co. (NYSE:MOS) 63.80 28401.31 18.73x 4.43x 4.39x 68.5x Agrium Inc. (TSX:AGU) 72.19 11354.90 15.28x 1.33x 5.21x 30.97x Potash Corp. of Saskatchewan, Inc. (NYSE:POT) 125.27 37092.32 23.99x 11.14x 5.81x 38.55x Terra Industries Inc. (NYSE:TRA) 46.33 4637.91 15.59x 3.06x 9.43x 30.58x CF Industries Holdings, Inc. (NYSE:CF) 96.73 4698.95 14.24x 1.47x 2.72x 13.02x Multiples Valuation Stock Price Calculation Forward P/E P/S P/B Trailing P/E Min 37.99 18.34 75.79 163.12 Mean 48.82 85.96 80.11 183.08 Max 59.65 153.58 84.43 203.04 21.67 135.24 8.64 39.92 Management Assessment In 2006 Management Claimed: Sales volumes for Potash will improve due to a supply contract with a key customer in China. Result: Sales Volumes for next 3 years: 2007: 1478.9 2008: 2251.2 2009: 2817.2 The Phosphates business will show increased gross margins due to increased industry supply and demand fundamentals and our Phosphates restructuring actions Result: Gross Margins for next 3 years: 2007: 13.5% 2008: 36.5% 2009: 22.0% Mosaic will begin restructuring the Phosphate segment Result: Mosaic combined the Nitrogen segment into their Phosphate segment in 2008 and the Offshore segment into their Phosphate segment in 2009 Revenue Assumptions Revenues Phosphate % of Total Revenue Potash % of Total Revenue Nitrogen % of Total Revenue Offshore % of Total Revenue Other % of Total Revenue Total Revenues Revenue Growth 2007 2008 2009 2010 2011 2012 3203.9 5706.2 5780.6 5730.837 6561.62815 7564.70484 55.49% 58.15% 56.13% 79.50% 82.75% 79.50% 1478.9 2251.2 2817.2 1712.0425 1645.36295 2307.47286 25.61% 22.94% 27.36% 23.75% 20.75% 24.25% 129.1 N/A N/A N/A N/A N/A 2.24% N/A N/A N/A N/A N/A 1355.6 2223.8 2349.2 N/A N/A N/A 23.48% 22.66% 22.81% N/A N/A N/A (393.80) (368.60) (649.00) (234.28) (277.53) (356.83) -6.82% -3.76% -6.30% -3.25% -3.50% -3.75% 5773.70 9812.60 10298.00 7208.6 7929.46 9515.352 8.82% 69.95% 4.95% -30.00% 10.00% 20.00% Revenue Assumptions-Potash Summarized from 10K: By the start of the 3rd quarter in 2010, Potash demand improving but still below historical levels. Potash segment still operating at reduced production volumes. Despite the improved demand however, Potash selling prices in 3rd quarter will be below 2nd quarter levels Revenue Assumptions-Potash Recovery in Potash segment reflects recovery of selling prices and worldwide demand. Higher % of revenues is a result of management's plan: “We continued the expansion of capacity in our Potash segment, in line with our views of the long-term fundamentals of that business. The planned expansions are expected to increase our annual capacity for finished product over the next eleven years” Revenue AssumptionsPhosphate Mosaic’s results for the second quarter of fiscal 2010 compared to the prior year period reflected a recovery in Phosphates segment volumes and significant declines in phosphate selling prices. Although the Phosphates segment’s prices stabilized in the first quarter of fiscal 2010, they have not returned to the historical highs of the prior year period that resulted from strong demand for crop nutrients. Revenue AssumptionsOffshore In 2010 Mosaic has again realigned their business segments and moved from three total segments to two by merging the Offshore segment into the Phosphate segment Other Assumptions COGS: Increase sharply in 2009 due to higher fixed costs as a result of decreased production. After production increases, COGS will start returning to historical levels. SGA: Sharp increase in 2009 due to same reasons as COGS. 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Cost Of Goods Sold 3840.90 4668.40 4847.60 6652.10 7531.30 6163.35 6660.75 7707.44 8268.84 9509.17 10797.12 % of Total Revenue 87.36% 87.99% 83.96% 67.79% 73.13% 85.50% 84.00% 81.00% 79.00% 79.00% 78.00% SG&A 207.00 241.30 309.80 323.80 321.40 346.01 380.61 428.19 471.01 565.74 622.91 % of Total Revenue 4.71% 4.55% 5.37% 3.30% 3.12% 4.80% 4.80% 4.50% 4.50% 4.70% 4.50% WACC Calculation Cost of Equity: Return on Equity Investment CAPM Beta 1.48 Risk-free 3.70% Equity Premium 5.00% CAPM 11.11% ROE S&P500 59.48% 1.93% WACC Calculation Cost of Debt: As of May 31, 2009 Rate % of Debt Weighted Average Term Loans 3.92% 1.01% 0.04% Industrial Revenue Bonds 6.64% 3.18% 0.21% Other Secured Notes 7.32% 1.37% 0.10% Unsecured Notes 7.46% 71.62% 5.34% Unsecured Debentures 7.15% 19.72% 1.41% Capital Leases and Other 6.94% 3.11% 0.22% Cost of Debt 7.32% WACC Calculation Weight of equity Weight of debt Tax rate 91.79% 8.21% 21.60% Rate CAPM WACC 10.67% 90% ROE WACC 55.07% 10% Goal Post WACC DCF Valuation PV of FCF 13,519.27 Less: Debt 2,540.40 Equity Value 10,978.87 # of shares 444.54 Intrinsic Value $29.20 Value +/-10% $26.28 Wt $32.12 15.11% Triangulation Triangulation Forward P/E Price/Sales Price/Book Trailing P/E DCF Price 48.82 Weight 30% 85.96 80.11 20% 30% 183.08 0% 29.20 20% $57.51 Football Chart Macroeconomic Review Gross Domestic Product GDP of countries that MOS exports its goods Sensitive to fluctuation in prices of raw materials→ Adversely affect Sales Inputs = Natural Gas, Phosphate rock , Ammonia , Sulfur Outputs = Phosphate , Potash , Nitrogen Strong International Presence 70% of net sales from customers located outside the US. Brazil – Argentina – Chile – China - India Macroeconomic Review Regulations + Transportation costs Further restriction on greenhouse gas emissions → increase operating costs. Cost of delivery → adversely affect sales volume and prices Currency Risk Most significant impact from CAD and BRL → Periodically hedge against exposure to foreign currency risk Raw Material and Products Projected Prices 2010 - 2020 2008 2009 2010 2011 2015 2020 DAP, $/mt 967 323 300 310 360 400 Potash, $/mt 570 630 400 300 255 220 Source : World Bank ( www.worldbank.org) Fertilizer Consumption Source : Potash Corp.com Gross Domestic Product Source : Bloomberg GDP vs Sales Growth Source : Bloomberg Oil Prices lead to rising fertilizer prices Source : FAO State of Commodities markets Oil Prices – Mosaic’s Stock Price : Highly Correlated 160 140 Oil Prices Mosaic 120 100 80 60 40 20 0 Source : U.S. Energy Information Administration Forecasted Crude Oil Prices Source : Source : U.S. Energy Information Administration Portfolio Correlation MOS American Eagle -0.2104 Diamond Offshore 0.8553 Jack Henry 0.4721 McDonalds 0.6805 Walgreens -0.4337 MEMC Electronics 0.4998 Recommendation We currently own 200 shares bought at $55 on 12/18/2009 DCF Intrinsic Value = $29.20 Triangulated Value = $57.51 Current Stock Price @ 3/17 = $61.91 Hedge against inflation Growth in emerging markets such as India and Brazil will drive sales growth => We recommend a HOLD for the 200 shares