Managed Care - Assumptions

advertisement

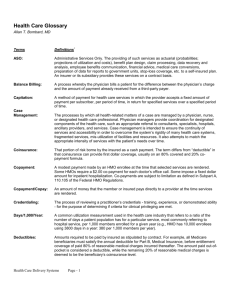

Managed Care - Assumptions • The most appropriate healthcare is not always delivered by professionals who are well-informed • Healthcare services are not always delivered in a suited environment and/or timely manner that best accommodates the patient’s health status Managed Care - Review • A variety of approaches in active coordination and arrangement of the provision of health services and coverage of health benefits – Usually involves 3 key things 1. Oversight of the medical care given 2. Contractual relationships/organization 3. Rules/algorithms tied to covered benefits The Three P’s • Patients - those who receive or need care • Providers - those who give care – – – – Physician Hospitals Pharmacy Laboratory • Purchasers - those who pay for the care – Employers – Government – Insurance organizations Provider Relationships • Primary Care Physicians (PCP) – Goal of managed care is to provide high-quality medical care while limiting costs – Focal point and manager of patient care – Must be public health aware • Assessment of risk factors to facilitate early treatments • Diagnostics and screening understanding Provider Relationships • Physician Extenders – Under MC there is an incentive to shift care to lower cost providers when they are professionally qualified to handle the case – Patients may benefit from interaction with capable professionals who may be able to listen to questions and answer them in detail Provider Relationships • Estimated Provider Costs – PCPs……………………………….$50.00 per visit vs – PA…………………………………..$40.00 per visit – NP…………………………………..$40.00 per visit – Clinical Pharmacist……………..$25.00 per visit – Telephone Triage Nurse…………$5.00 per call – Patient self-care materials………$1.00 each Provider Relationships • Specialist Physicians and Hospitals – Require referral from PCPs • Medical Groups – Physician groups contracted with a purchaser – Organization formed just for the purpose of contracting with health pans (IPA) Key Terms and Concepts • Revenue PMPM ($) • Medical Expense Ratio (%) • Administrative Expense Ratio (%) • Hospital Days per 1,000 Key Terms and Concepts • Members – “Enrollees” or “Covered lives” – Subscribers – Membership is classified by type of MCO, such as HMO, PPO or EPO – Membership is further broken down by purchaser category, including Medicare, Medicaid and Commercial – Employer-based members = group members – “Member-months” Key Terms and Concepts • Medical Management – – – – Quality Management Utilization Management Outcomes Management Demand Management • Unfortunately not the focus • Role of public health professional • Involves patient education materials and resources – Disease Management Sharing Financial Risk • In MC, providers often bear some level of financial risk – FFS = lowest risk – Per case payment = moderate risk – Capitation and/or salaries = highest risk • Capitation = paying a fixed amount of money per member • Contact capitation = where provider is paid an amount per qualifying patient – Risk taken is only cost of referral not number of referrals Sharing Financial Risk • Others – Withholds - a portion of the provider payment is held back and only paid later if certain criteria are met – Shared risk funds - physician groups share in a portion of the financial risk and potential profit of hospital or pharmacy costs • • • • Funds get paid at the capitation rate Medical expenses are paid from this fund Profits or losses are distributed to the participants Incentives - Sullivan article Premium Pricing Cycle • Premiums drive profits (and profits drive premiums) • During profitable periods: 1. 2. 3. 4. Plans want to expand market share Start to lower price to do so Other plans match lower prices Price wars lead to multi-year contract development • A downswing results: 1. Due to insulation of capitating risk to providers and time lag on FFS claims, considerable time elapses before financial pressures know from lowered premium 2. Due to multi-year contracts and price pressures nothing much can be done about the problem as it becomes apparent Premium Pricing Cycle • Eventually enough of the market is losing money so that several major players break rank and begin increasing rates and everyone follows suit • Return to Profits – The increases continue until profits are being generated and the cycle begins anew Managed Care Plans & Products • Health Maintenance Organization (HMO) – Responsible for financing and delivery of care for prepaid premium – Providers are either employed or contracted with HMO – Direct contract model HMO is rare – PCP as gatekeeper – Provider prenatal care, well-baby checks, educational programs, inoculations and smoking cessation programs • Staff Model – Physicians are employed by the HMO, often work in hospital on salary – May receive financial incentives for efficient utilization – Kaiser-Permanente Managed Care Plans & Products • HMO (continued) • Group Practice Model – When HMO contracts with a group of physicians representing multiple specialties to provide care – Similar to staff, but physicians are not employees of the HMO, but rather members of a medical group • Network Model – When the HMO contracts with several different physicians and physician groups to construct a network of providers from which the patient member can choose Managed Care Plans & Products • IPA Model – An Independent Practice Association (IPA) is a group of physicians who contract with HMOs, PPOs, and others to provide care to those companies’ members at a reduced rate – The IPA will contract with more than one HMO, which differentiates it from the group practice model – HMO IPA Example • Physicians at City Memorial Hospital feel their practices are shrinking because so many patients are now members of competing HMOs • They band together to form an alliance call City Memorial Physicians Group, an IPA • The administrators of the IPA then market the group to HMOs and others Managed Care Plans & Products • Preferred Provider Organization (PPO) – An organization which creates a network of healthcare providers by contracting with them for discounted rates – Providers can be physicians, hospitals, labs, transportation companies, DME suppliers, home health agencies, pharmacies or others – Providers sign a contract with the PPO to provider their services to PPO members at a lower rate, in exchange for the advantage of having more clients – When the patient sees a physician, the patient’s percentage of costs is much lower when using a PPO physician than a non-PPO physician – This contrasts with the HMO where the patient is not given the choice of non-member providers Managed Care Plans & Products – PPO Example • John Smith is working in his home workshop when he cuts his hand, which appears to require suturing • His wife, Mary, looks in the PPO directory and sees that there is a nearby family physician. • With John’s plan, if he sees the PPO physician, John will pay only a $5 office visit charge (called a co-pay) and the PPO will pay the physician the remainder of the fee. • If John chooses to go to his long-time family doctor who is not a member of the PPO, John will be reimbursed 75% of the cost, providing he has already me the yearly out-ofpocket deductible charge of $500 Managed Care Plans & Products • Exclusive Provider Organization (EPO) – Similar to both PPOs and HMOs – Member is given a directory of providers and are limited to choosing these providers – Similar to HMO, but differences in legality/regulations – 100% Access to network physicians - no PCP referrals • Point of Service (POS) – HMOs where the patient/subscriber is given the option of going to out-of-network providers at a reduced reimbursement rate – Usually a PCP is acting as a gatekeeper in the HMO Managed Care Plans & Products • Provider Sponsored Organization (PSO) – Many health care futurists feel that PSOs are the next step in creating a health plan that meets the goals of the patients and the providers – Such a system is owned and operated by a network of physicians and hospitals rather than by an insurance company – Usually the product of a large multi-service hospital which can provide care any subscriber may need – Gives better control and eliminates the middleman • More opportunity to put excess premium dollars into healthcare and public health initiatives Managed Care Plans & Products • Super IPAs – Management companies that function as administrators for several smaller IPAs • Physician-Hospital Organizations – Similar to a PSO, but is a part physician owned and part hospital owned • Administrative Organizations – – – – Third-party administrators (TPA) Utilization Review Organization (URO) Managed Services Organization (MSO) Physician Practice Management Companies (PPMC) Kip Sullivan Article • Compares quality of care provided by MCs to FFS • Major themes – – – – Financial Incentives of Physicians Patient Behavior Preventive Services Access Fairfield et al. Article • Evolution of Managed Care – Fifth Generation Managed Care and Public Health • Anticipatory case management – Risk assessment – Epidemiological Studies • Community based needs assessment – Integrated efforts with department of public health • Targeted disease management – Behavioral epidemiology, health education/promotion • Integration of clinical services • Outcomes based reimbursement – Ongoing public health studies • Informed consumers - education programs – Public health educational interventions Population-based Medicine • Attacking disease across its entire spectrum by treating well people with “preventive medicine” and all symptomatic patients, from minimally afflicted to serious ill • Healthcare resources have traditionally been reserved for the more acutely and seriously ill • Potential to reduce number of severely ill • Discourages unlimited resources for the few Population-based Medicine Tools • Earlier health assessments • Health behavior education and management • Home environmental assessments • Home health services • Practice guidelines