Power Point Presentation

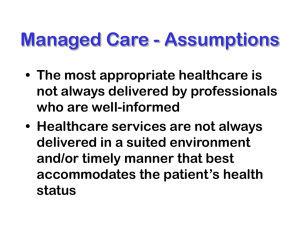

advertisement

Marvel Alder Lucy Aspera Erica Millan Tiffany Suh Introduction Managed Care health insurance offers low cost moderate health care coverage. It’s a system that controls the financing and delivery of health services to members who are enrolled in a specific type of healthcare plan. The goals of managed health care are to ensure that... providers deliver high-quality care in an environment that manages or controls costs. the care delivered is medically necessary and appropriate for the patient’s condition. care is rendered by the most appropriate provider. care is rendered in the most appropriate, leastrestrictive setting. Introduction Cont. The basic concept behind managed health care is to lower cost by means of control, by controlling access to providers the costs are controlled as well Costs Involved Monthly health insurance premium Co-payment Cost depends on whether you’re in-network or out-of-network. Different types of health coverage: 1. 2. 3. 4. Health Maintenance Organization (HMOs) Preferred Provider Plans (PPOs) Medical Savings Plan (MSP) Point of Service Plans (POSs) HMO’s A Health Maintenance Organization (HMO) is an organized system of health care that provides comprehensive services to its members for a fixed, pre paid fee. HMOs are the least expensive form of managed medical care. About HMO’s HMO's account for a significant share of the group health insurance in the market, in 2001, enrollment in HMO's accounted for 33 percent of all employee enrollments in health insurance plans. How HMO’s Work The member picks a provider A list is set up of the physicians that are covered under the HMO plan and from there the member picks their primary care physician. The primary care physician must refer a patient out in order to see a specialist. Types of HMO’s There are four types of HMO’s Staff Model- physicians are employees of the HMO and are paid a salary and possibly and incentive bonus to hold down costs. Group Model -physicians are employees of another group that have a contract with an HMO to provide medical services to its members. The HMO pays the group of physicians a monthly or annual capitation fee for each member. In return, the group agrees to provide all covered services to the members during the year. The group model typically has a closed panel of physicians that requires members to select physicians affiliated with the HMO Cont. Types of HMO’s Network Model -the network contracts with two or more independent group practices to provide medical services to covered members. The HMO pays a fixed monthly fee for each member to the medical group. The medical group then decides how the fees will be distributed among the individual physicians. Individual Practice Association (IPA) -is an open panel of physicians who work out of their own offices and treat patients on a fee for service basis. However, the individual physicians agree to treat HMO members at a reduced fee. Advantages of HMO’s Most services are covered in full with relatively few maximum limits on individual services. Covered services typically include the full cost of hospital care, laboratory and X-ray services, outpatient services, special-duty nursing, and numerous other services Office visits to HMO physicians are also covered, either in full or at a nominal charge for each visit. Some newer HMOs allow insured's to select any physician at higher out-of-pocket costs. Cont. Advantages of HMO’s HMO members pay a fixed, prepaid fee (usually paid once a month) for the medical services provided. Because of this fixed pre-paid fee it is in the providers best interest to make sure that the beneficiaries get basic health care for problems before they become serious. This means that beneficiaries get good preventive care through HMO plans. High deductibles and coinsurance requirements are usually not emphasized. The big advantage of HMO’s is that there is a huge emphasis on controlling costs. Disadvantages of HMO’s A big disappointment to many members is that the selection of physicians is usually limited to physicians who are affiliated with the HMO There is a limit to the amount paid for the treatment of alcoholism and drug addiction and there is now a coinsurance requirement placed for these treatments by HMO’s. When a beneficiary needs to see a specialist the primary care physician, must refer the beneficiary out Cont. of Disadvantages HMOs also tend to operate in a specific geographical area and because HMOs operate in a limited geographical area, there may be limited coverage for treatment received outside the area. Usually only emergencies are covered. In an HMO plan beneficiaries often have to wait longer for an appointment than they would with a fee-for-service plan. X Poor XX Fair XXX Good XXXX Excellent Name of HMO Care (Staying Healthy) Care for Getting Better Care for Living with Illness Member Rating of Health Plan Aetna Health of Ca. XX XXX XXX XX XX XXX XXX XX XX XX XX XXX XXX X X XXX XXX XXX XXXX XXX XXX XXX XXX XXX XXX XXX XX XXX XXX Not willing to report Not willing to report Not willing to report XXX XX XXX XXX XXX XXX XX XXX Inc. Blue Cross HMO Ca. Care Blue Shield of California HMO CIGNA HMO Health Net Kaiser Permanente North Kaiser Permanente South PacifiCare of California Universal Care Western Health Advantage Dental & Vision coverage under HMO’s Dental and Vision Coverage under an HMO plan is usually not through the same provider of the HMO. There is different dental and vision providers that sometimes work with HMO’s but operate separately. PPO Preferred Provider Organization (PPO) is a plan that contracts with health care providers to provide certain medical services to its members at a discount fee. A health benefit plan with contracts between the sponsor and health care providers to treat plan members. A PPO can also be a group of health care providers who contract with an insurer to treat policyholders according to a predetermined fee schedule. PPO PPOs can range from one hospital and its practicing physicians that contract with a large employer to a national network of physicians, hospitals and labs that contract with insurers or employer groups. PPO contracts typically provide discounts from standard fees, incentives for plan enrollees to use the contracting providers, and other managed care cost containment methods. PPO PPOs can range from one hospital and its practicing physicians that contract with a large employer to a national network of physicians, hospitals and labs that contract with insurers or employer groups. PPO contracts typically provide discounts from standard fees, incentives for plan enrollees to use the contracting providers, and other managed care cost containment methods. History of PPO 1. PPO highlights PPO insurance is a relatively new type of managed care plan. It was developed to combine the lower cost of managed care with the great degree of choice found in traditional health care. According to the American Association of Preferred Provider Organization, 54 percent of all Americans with health insurance now receive their health care through a preferred provider organization History of PPO Currently, nearly 112 million individuals are enrolled in a PPO program. This growth has been primarily the result of the fact that PPOs have delivered exactly what the public has called for zero choice, flexibility and a balance between the delivery of appropriate care and cost control. Latest Study Over the past few years, PPOs have steadily risen in popularity among employers and have experienced an increase in overall enrollment. According to the American Association of Preferred Provider Organizations, PPO enrollment in eligible employees rose from 98.3 million in 1998 to 106.8 million in 1999. The number of PPO plans operating in the U.S. in 2000 was 1,050, covering over 133 million lives. Average Employee Costs For Health Care 2000-2003* 2000 2003 Employee Portion of Annual Premium Single Coverage $334 $508 Family Coverage $1,619 $2,412 PPO Deductibles Preferred Provider $175 $275 Non-Preferred Provider $340 $561 Prescription Drug Co-Payments Preferred Drugs $13 $19 Non-Preferred Drugs $17 $29 % Increase 52% 49% 57% 65% 46% 71% Consumers Assessment of Health Plans Survey (CAHPS) for PPO plans Percentiles N Mean 10th 25th 50th (Media n) Getting Needed Care - % not a problem 24 88.36 83.08 85.36 89.84 91.78 92.60 Getting Care Quickly - % usually or always 25 83.79 79.37 81.36 84.80 86.63 88.40 Doctor Communicates Well - % usually or always 27 93.19 90.92 92.53 93.36 94.39 94.80 Claims Processing - % usually or always 27 88.27 81.79 86.28 89.01 92.41 94.79 Customer Service - % not a problem 26 69.02 59.09 63.65 68.50 75.17 79.59 Office Staff Helpful and Courteous - % usually or always 27 94.82 93.03 93.47 94.82 95.94 97.06 Composites 75th 90th Advantages of PPO Patients are not required to use a preferred provider but have freedom of choice every time they need care Costs are lower if you stay within the network of providers The level of benefits is higher for services from participating providers Advantages of PPO The freedom to seek medical care outside the network • Payment at 100 percent for most covered services once you’ve met your out-of-pocket maximum • No referrals needed or pre authorization for specialists Disadvantages of PPO • Co-payments are higher compared to HMOs however, some employers and consumers are willing to sacrifice the higher level of cost savings of more structured managed-care plans for the increased flexibility. • PPO is generally the most expensive type of managed care plan Disadvantages of PPO • If patients go outside the network, they will have to pay co-payments based on higher charges and they will need to meet the deductible • Members can expect paying co-insurance (co-insurance is usually waived and can be replaced with a low co-payment.) Dental coverage under PPO The costs involved in a PPO A define plan with a higher level of coverage if services are provided by a preferred provider. Discounts are negotiated and passed on to plan sponsors. Dental coverage under PPO What specifics are involved Most managed dental insurance plans work under a Preferred Provider Organization, which means that policyholders must choose a primary dentist from a list of approved dentists. And to maintain full coverage for all procedures, any specialist you see will have to be approved by this primary dentist. Medical Savings Plan (MSP) History of MSA The Health Insurance Portability and Accountability Act (HIPAA) was passed in Congress and signed by the President in 1996. As a result of this legislation a 4-year pilot program was created. This project was the Medical Savings Accounts (MSA). It began on January 1, 1997 and was restricted to the selfemployed and small groups. The pilot project was extended until December 31, 2003. Introduction The Medical Savings Account or MSA, is a special tax-sheltered personal savings or investment account that is maintained in conjunction with a high-deductible health insurance policy. The funds in the account may be used for medical services that aren’t covered by the participant’s high deductible policy. How it works Instead of purchasing expensive insurance with a low deductible and low co-pays, the participant buys a low cost insurance policy with a high deductible. The amount saved from using the low cost insurance plan is then deposited in a MSA to cover the small bills that aren’t covered under the policy. The money in the MSA is 100% tax deductible. It can be accessed by check or debit card. What ever is not used for medical expenses will remain in the account and keep growing on a tax-favored basis. It can be used to cover future medical bills or supplement retirement, in this sense it is similar to an IRA. Advantages of MSA’s Tax deductible Balance can be rolled over No minimum contribution Works with other health care coverage Disadvantages of MSA’s Coverage changes Coverage limitations Restricted MSA plan Other Coverage Vision Care and MSA Dental Care and MSA Employee costs associated with MSA plan TYPE OF COVERAGE DEDUCTIBLE* MAXIMUM MSA DEPOSIT** SINGLE $1700 $1105 FAMILY $2500 $1625 HUSBAND / WIFE $3350 $2512.50 PARENT + CHILDREN $5050 $3787.50 There are no income limits at this time that prevent wealthy people from making tax-deductible contributions to the MSA and using it as a way to accumulate tax-free earnings on investments. Therefore, the higher the individual’s tax bracket, the greater the tax benefit an MSA provides. Although, there is no income limit there is an annual limit to the amount that can be invested. Breaking News President Bush signed the new Health Savings Account legislation on December 8, 2003. The new HSA have been referred to as the "next generation" of MSA plans. Many aspects of the program remain the same, however there are some important changes. One of the most significantly and arguably the most important is that ALMOST EVERYONE qualifies for the new HSA plans! Key Changes in the new HSA 1. Lower deductibles are available (1,000 single/2,000 family) 2. Up to 100% of the deductible amount can be contributed to the HAS **MSA IS NOW HSA** Point of Service, POS Definition Offers a full range of health services through a combination of HMO and PPO features. Members can elect to receive services under the defined managed care program or can go outside the network for care. If patients see a preferred provider, they pay little or nothing. Outside provider care is covered, but at a substantially higher deductible and co-payments. Introduction to POS The lesser known health care plan that combines the freedom of a PPO and offers the low cost of an HMO. When you enroll in a POS you choose your primary care physician to monitor you health. This physician has to be within the health care network and is considered your “point of service” Is built into all managed health care plans and allows the individual the option. Advantages of POS Freedom to choose physicians in network or out of network Emergency care coverage is covered no matter where you are in the US or worldwide If you have to relocate temporarily because of a job assignment or a divorce, you will be covered under the Guest Privileges Program Seeing a physician in network, you do not have to fill out any paper work, co-payments are low & there is no deductible Annual out-of-pocket costs are limited Advantages of POS Cont. Benefits of the Designated Provider Program General services In-Network Benefits Out-Of-Network Benefits Individual annual deductible N/A $300 Family deductible N/A $900 Coinsurance N/A 70%* Individual out-of-pocket maximum N/A $3,300 (including deductible) Family out-of-pocket maximum N/A $9,900 (including deductible) Lifetime maximum Unlimited Unlimited $10 per visit Specialty physician services Office Visits not covered $10 per visit 70% coinsurance* $10 per visit Not covered Specialist care and consultations Well-woman exam (one per year) Associated medical services · Laboratory and x-ray · Allergy testing and treatment · Casting and dressing No charge 70% coinsurance* Costs of POS Costs consists of a monthly premium and a co-payments Less than a PPO because the health insurance company regulates most of your health care Example, if you want to see a specialist, you must get a referral from your primary doctor If your primary care physician chooses, they will probably choose from a specialist that works within the network These controls reduces the overall cost of a POS health insurance plan Disadvantages of POS Seeing specialists may be difficult Referrals to see physicians out of network may become difficult Hospital visits charges by the physicians are considered out of network and charges by the hospital are covered in network. When seeing physician out of network Keep track of all information Fill out all necessary paper work High costs Payments of deductibles must be taken care of before coverage can begin Co-payments are based on usual, customary and reasonable charges Vision Care In network Coverage You can go through the VSP in-network or any other non-network provider When making an appointment You must select a VSP provider Must make sure that it is time for an appointment, you can only get one check up a year If glasses picked are not covered, you pay the full difference No annoying forms to fill out Vision Care Cont. Out of Network Coverage VSP will reimburse you the amount allowed under your plan Does not guarantee a full refund or satisfaction You have to mail the bill Must include VSP ID Personal information Relationship to the VSP member, if not a member Example of Vision Care Benefits If you use an in-network provider, you pay... If you use a nonnetwork provider, you pay... An eye exam, costing $65 $0 $40 A pair of lenses, costing $80 $0 $55 You pay $0 $95 $145 $50 For this expense The plan pays Cost Savings $95 Dental Care Charges are based on reasonable and customary charges, according to the Employee Books of Benefits, “based on the usual fees charged in your geographic areas by dentist with similar training and experience and the insurance company takes into account any unusual circumstances or complications that require special skills, experience or additional time.” Dental Care Cont. Types of dental services 1. 2. 3. 4. Type A: Preventative and diagnostic services, covers 100% expenses and include oral examination Type B: Oral Surgery and restorative services, covers 80% of expenses and includes root canal therapy and extractions and oral surgery. Type C: Prosthodontic services. Covers 50% of expenses and includes dentures and gold fillings. Type D: Orthodontic services covers children through age 23 and covers braces and surgical extractions. Questions to ask about POS health insurance • How many doctors are there to choose from? • Are doctors in the network private or group practice physicians? • Where are the offices and hospitals in the POS network located? • How are referrals to specialists handled? • What hospitals are available through the plan? • What arrangements does the plan have for emergency care? • What health care services are covered? • What preventive services are covered? • Are there limits on medical treatments or other services? • How much is the health insurance premium? • What, if any, are the co-payments for specific services? • How much more will it cost to use non-network physicians? • What is the deductible and coinsurance for non-network care? • Is there a out of pocket maximum? Problems & Solutions/Suggestions Problems with HMO the primary care physician are a "gatekeeper" so you need to get refers to see a specialist this takes a long time so people have to wait so long to see a specialist. A recommendation could be that members need not go to the primary care physician but have a group of specific specialist that are also affiliated with the Plan their in to choose from. Problem with MSA Information on MSA plans can be hard to find Tax rules concerning MSA are difficult to understand High number of Applications are rejected. First year medical problems can be costly IRS and insurance company have different expense approval. The issue of tax relief Suggestions/Solutions Have central website and/or publications that explain the plan IRS and insurance companies work together to sponsor a hotline for MSA/HSA questions and answers. This would also decrease the amount of rejected applications Adding a rider to cover major expenses during the first year or two while the account balance is low. Each insurer should include a list of expenses the IRS covers, so customers can compare to insurance coverage. Proposed neutral tax policy Major Problem The Commerce Department’s Census Bureau reported in October 2002 • The number of people without health insurance rose by 1.4 million, to 41.2 million • 15% of the total population in 2003 There are more than 8 million uninsured children in the United States Children at risk: 25% of all Hispanic children 13% of all African-American children 14% of all Asian and Pacific Islander children 7% of all non-Hispanic white children 20% of all children in low-income families Problems Cont. New reports indicate that one of every seven Americans is going without healthcare coverage--more than 41 million of us Nearly 45 million Americans under the age of 65 without health insurance Malpractice insurance rates are soaring Medicaid is becoming a huge burden on state governments Increasing unemployment Baby-boom generation about to flood the Medicare ranks Solutions Changing delivery of health care from a physician-driven to an outcome-driven care model Continue education and infrastructure developments Offer tax credit or deductions to help offset the cost of health insurance Tax provisions to the low-income Alternative financing for health care New taxes More taxes The Cancer Detection Programs: Every Woman Counts Gives low-income women access to screening and diagnostic services for breast and cervical cancer. Signed on October 24, 2000 Eligibility: Women with income at or below 200 percent of the federal poverty level Age 40 or over for breast cancer screening Age 25 or over for cervical cancer screening Not covered by Medi-Cal, Medicare, or other health insurance or can't afford share of cost (co-payment) Must live in California Proposals President Bush proposed budget includes a tax-credit provision that would give a $1,000 credit to individuals with incomes under $15,000. The tax credit would decrease to zero when the individual's income reached $30,000. The president's proposal would give families with incomes up to $25,000 a tax credit of $1,000 per adult and $500 per child, up to a maximum of $3,000. The Relief, Equity, Access, and Coverage for Health (REACH) Act of 2001 (S.590) proposes tax credits of up to $1,000 for individuals without access to employersponsored health insurance and adjusted gross incomes below $35,000 in 2002. Families with incomes below $55,000 would receive tax credits of $2,500. Tax-credit amounts would decline as income increased. Future Programs Expanding coverage through existing public health coverage programs: Some candidates propose further expansions of these programs to a broader group of children and adults. In the case of Medicaid and SCHIP, proposals to expand coverage to the parents of eligible children or including poor, childless adults have been put forward by some states and are now a part of the national debate. Some policymakers suggest that Medicare can serve as the vehicle for coverage expansions, especially for the near-elderly, many whom increasingly face losing employer-based health coverage and find it difficult or prohibitively expensive to buy health insurance in the private market. Could reach many low-income people The American Association of University Women (AAUW) The American Association of University Women (AAUW) supports access to quality health care for all women and their families. Today, 75 percent of privately insured Americans are enrolled in managed care health plans, yet many consumers report widespread problems: denial of access to medical specialists refusal to pay for emergency room visits lack of information about policies and procedures and arbitrary limits on medical care. The American Association of University Women (AAUW) Cont. AAUW believes that Congress should enact enforceable federal standards to assure a minimum level of quality and protections for every consumer covered by private managed care health plans. These standards must address the unique health care needs of women, including reproductive health. Any managed care reform legislation enacted into law should do the following Improve the accountability of health plans by: Ensuring that when care is denied or limited, patients have access to adequate legal recourse and a genuinely independent external review of their claim Allowing individuals to sue their health plan if they are harmed by the failure of their plan to comply with an external reviewer’s decision Ensuring that women have direct access to ob-gyn services from any obstetrics and gynecological specialist participating in the health plan Requiring that insurance companies pay for emergency services if a reasonable person would consider the situation an emergency Guaranteeing access to clinical trials that may save lives Improve access to health care services for women and their families by: (Cont) Ensuring that pregnant women can continue to see the same health care provider throughout pregnancy even if their provider leaves their health plan or their employer changes plans Requiring plans to allow doctors to disclose to patients all available medical options and to advocate on behalf of their patients Ensuring that managed care plans incorporate genderspecific and pediatric-specific medicine when they develop written clinical review criteria Requiring that managed care plans provide important information to consumers regarding their health plans’ policies, procedures, benefits, and other requirements Make sure to consider these before you buy insurance Comparison shop! Call the California Department of Insurance to verify if the agent and the insurer are properly licensed. Decide what you need and want before you sit down with the agent. Do not be rushed into buying insurance. Set the place, the beginning, and the ending time of your meeting. Get a second opinion before you buy or replace insurance. Do not buy anything you did not intend to purchase or do not want. Do not replace an existing policy unless you can not afford it or the benefits no longer meet your needs. Do not pay cash. Do not be intimidated. If you feel unsure or uncomfortable DON’T DO IT! Your Rights in a Group Plan Once an employer health plan is issued, a carrier generally may not use the health-related factors of any insured as a basis for canceling or refusing to renew the plan. The health factors may still be used to determine the plan’s premium rates, however. A carrier may not "cherry pick" individuals within a group to offer or deny coverage to, nor may a carrier charge different individuals within the group different rates. When deciding whether to cover a group, the carrier must accept or reject the group as a whole. Large employers establish the criteria to determine employees who are eligible for enrollment. Such criteria may not be based on health factors. A large employer carrier must accept or reject the entire group of individuals who meet the participation criteria established by the employer and who choose coverage. Carriers must allow new employees to have at least 31 days from their start date to decide to enroll in a plan. Carriers must also offer a 31-day "open enrollment period" each year, during which any existing employees who are not yet covered may join. There are special enrollment periods for certain employees and dependents. For example, a dependent for which an employee must provide medical child support under a court order may be enrolled before the next annual enrollment period. Carriers must provide the employer with at least 60 days advance notice before premium increases take effect, and 90 days notice before discontinuing a plan. If a plan is discontinued, the carrier must offer each employer the option to purchase other employer-sponsored health Conclusion For further information on Health Care plans check with the Department of Managed Health Care. This department offers a lot of information on every health plan that is licensed by the Department. It can also help resolve problems that participants are having with their health plan, including issues about medical care, prescriptions, preventive testing and mental health services. In addition assistance is also for complaints and the health care rights of the consumer.