presentation

advertisement

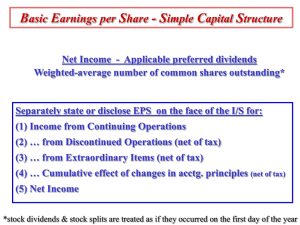

Chapter 19 Illustrated Solution: Problem 19-28 Diluted Earnings Per Share—Complex Capital Structure 19-1 Weighted Average Shares Outstanding 19-2 Weighted average shares outstanding are computed by multiplying the number of shares outstanding for each month by 1/12 and adding up the total for twelve months. Weighted Average Shares Outstanding 19-3 Weighted average shares outstanding are computed by multiplying the number of shares outstanding for each month by 1/12 and adding up the total for twelve months. Weighted-average common shares outstanding: Jan. 1 to Sept. 1—280,000 x 8/12……….. 186,667 Sept. 1 to Dec. 31—336,000 x 4/12……… 112,000 298,667 Net Income Applicable to Common Stock 19-4 Net income applicable to common stock is computed by adjusting the net income reported on the income statement by any dividends paid on preferred stock. Net Income Applicable to Common Stock 19-5 Net income applicable to common stock is computed by adjusting the net income reported on the income statement by any dividends paid on preferred stock. Net income……………………………………………… $860,000 Less: Dividends on preferred stock (10,000 x $5) …. 50,000 Net income applicable to common stock……………. $810,000 Basic Earnings Per Share 19-6 Basic Earnings Per Share is computed by dividing the net income applicable to common stock by the weighted average of common shares outstanding for the period. Basic Earnings Per Share 19-7 Basic Earnings Per Share is computed by dividing the net income applicable to common stock by the weighted average of common shares outstanding for the period. Net income applicable to common stock……………… $810,000 Weighted-average shares outstanding……………….. $298,667 Basic EPS ($810,000 298,667)……………………… $2.71 Dilutive Securities 19-8 A convertible security is dilutive if the incremental earnings per share that would result from conversion to common stock is lower than the basic earnings per share without conversion. Convertible Bonds--Dilutive 19-9 Interest, net of tax, per $1,000 bond ($1,000 x .10 x .70)…….. $70.00 Convertible Bonds--Dilutive 19-10 Interest, net of tax, per $1,000 bond ($1,000 x .10 x .70)…….. $70.00 Number of shares…………………………………………………. 40.00 Convertible Bonds--Dilutive 19-11 Interest, net of tax, per $1,000 bond ($1,000 x .10 x .70)…….. $70.00 Number of shares…………………………………………………. 40.00 Incremental Earnings Per Share ($70 $40)………………….. $ 1.75 Convertible Bonds--Dilutive 19-12 Interest, net of tax, per $1,000 bond ($1,000 x .10 x .70)…….. $70.00 Number of shares…………………………………………………. 40.00 Incremental Earnings Per Share ($70 $40)………………….. $ 1.75 Because the $1.75 incremental EPS is less than the $2.71 basic EPS, the convertible bonds are dilutive. This means that when Diluted EPS is computed, the total shares that would be issued on conversion will be added to the denominator. It also means that the interest expense (net of taxes) that was paid on the bonds will be added to the numerator. Net Income for Diluted EPS 19-13 Net income for basic EPS……………………………………… $810,000 Net Income for Diluted EPS 19-14 Net income for basic EPS……………………………………… $810,000 Add interest expense net of taxes on convertible bonds ($1,000,000 x .10 x .70)……………………………………… 70,000 Net Income for Diluted EPS 19-15 Net income for basic EPS……………………………………… $810,000 Add interest expense net of taxes on convertible bonds ($1,000,000 x .10 x .70)……………………………………… 70,000 Net income for diluted EPS……………………………………. $880,000 The “If Converted” Method 19-16 Since the options have an option price of $22.50 and the average price for Carrizo’s stock during the year was $36, the options are dilutive. The “If Converted” Method 19-17 Since the options have an option price of $22.50 and the average price for Carrizo’s stock during the year was $36, the options are dilutive. However, even though the options are for 30,000 shares of common stock, the incremental shares of common stock issued by Carrizo will be less than this number. The “If Converted” Method 19-18 Since the options have an option price of $22.50 and the average price for Carrizo’s stock during the year was $36, the options are dilutive. However, even though the options are for 30,000 shares of common stock, the incremental shares of common stock issued by Carrizo will be less than this number. To find the incremental shares to be issued that would be issued if the options were exercised, we assume Carrizo will use the proceeds from the options to repurchase as many shares as possible at the average market price. The “If Converted” Method 19-19 Shares assumed issued on exercise of options……………… 30,000 The “If Converted” Method 19-20 Shares assumed issued on exercise of options……………… 30,000 Less: Shares assumed repurchased from proceeds of options (30,000 x $22.50 = $675,000; $675,000 $36 average price)………………………………………………… 18,750 The “If Converted” Method 19-21 Shares assumed issued on exercise of options……………… 30,000 Less: Shares assumed repurchased from proceeds of options (30,000 x $22.50 = $675,000; $675,000 $36 average price)………………………………………………… 18,750 Incremental shares assumed issued on exercise of options .. 11,250 Computation of Diluted EPS 19-22 Weighted-average shares outstanding for basic EPS……………………………………………… 298,667 Incremental shares: Shares assumed to be issued on conversion of bonds……………………………… 40,000 Computation of Diluted EPS 19-23 Weighted-average shares outstanding for basic EPS……………………………………………… 298,667 Incremental shares: Shares assumed to be issued on conversion of bonds……………………………… On assumed exercise of options…………………. 40,000 30,000 Less: Shares assumed repurchased from proceeds of options………………………………. 18,750 Shares assumed outstanding for diluted EPS………. 11,250 349,917 Computation of Diluted EPS 19-24 Weighted-average shares outstanding for basic EPS……………………………………………… 298,667 Incremental shares: Shares assumed to be issued on conversion of bonds……………………………… On assumed exercise of options…………………. 40,000 30,000 Less: Shares assumed repurchased from proceeds of options………………………………. 18,750 Shares assumed outstanding for diluted EPS………. 11,250 349,917 Net income for diluted EPS ………………………………… $880,000 Shares assumed outstanding for diluted EPS …………… 349,917 Diluted Earnings Per Share ($880,000 $349,917)……… $ 2.51 19-25 End of Problem