Chapter VII – MANAGEMENT AND ADMINISTRATION

advertisement

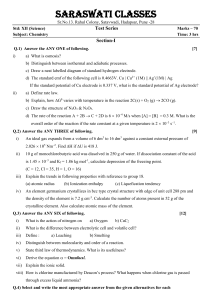

Today’s Overview 1 HIGHLIGHTS OF THE COMPANIES ACT, 2013 2 SALIENT FEATURES OF CHAPTERS VII AND VIII OF THE ACT AND THE RULES NOTIFIED Presentation Title PROVISIONS REGARDING CS PROFESSION, KMP, ANNUAL RETURN AND SECRETARIAL AUDIT AND Your company THE RULES NOTIFIED name Presentation by CS. B. Narasimhan At INDORE HIGHLIGHTS OF THE COMPANIES ACT, 2013 Passed by the Lok Sabha and the Rajya Sabha and obtained Presidential assent on 30th August 2013 COMPANIES ACT 2013 PARTLY NOTIFIED Those sections which are not dependant on the Rules stands notified. Wisdom of notifying the provision of sections partially????? NEW ACT AT A GLANCE 29 Chapters 7 Schedules Facts about the Act 33 New Definitions 470 Sections NEW CONCEPTS Introduction of One Person Company Stipulation of Woman Director Provision of Class Action suits Associate Company Introduction of Registered Valuer Fast Track Merger for Holding & Subsidiary Companies Cross Border Merger Concept of Dormant Company Further Use of electronic mode: Maintenance of Documents, Records, Registers, Books of Accounts, etc. in e-Form Summary Procedure for Winding up of Company Enabling provisions for issue of GDRs PROVISIONS REGARDING CS PROFESSION, BOTH FOR MEMBERS IN PRACTICE AND IN EMPLOYMENT. ANNUAL RETURN CERTIFICATION APPOINTMENT OF KMP SECRETARIAL AUDIT WITH REFERENCE TO THE RULES NOTIFIED Companies between Total Co’s Number of Number of Paid up Capital (in Rs) Private Co’s Public Co’s 0 -50 Lakhs 751230 33405 784635 50 Lakhs - 2 crores 62746 10275 73021 2 crore - 5 Crores 18755 7020 25775 5 Crores - 10 Crores 5938 4331 10269 10 Crores - 25 Crores 3927 3878 7805 25 Crores - 50 Crores 1405 1563 2968 50 Crores - 100 Crores 798 902 1700 100 Crores and Above 820 1244 2064 845619 62618 908237 5112 Source www.tradingeconomics.com > 5 Crores 24806 > 10 Crores 14537 > 100 Crores 2064 > 50 Crores 3764 SOURCE MCA, GOI AS OF SEPTEMBER 2013 No of listed entities Listed entities with > 5 crores capital will be around ………..????????? No. of Listed Companies 5,293 No. of Suspended Companies 1,255 No. of Companies Eligible for Trading 4,038 Source BSE Website Annual Return (Section 92) Annual Return Certification by PCS [Section 92(1)] • Company not having Company Secretaries. • Listed Company or by Company having prescribed paidup capital or turnover. Not required for Small Companies or OPC. Challenges: • Certification of Compliances of All provisions of the Act . • Wrong Certification – from Rs. 50,000/- upto Rs. 5 Lacs. Annual Return…. Annual Return Certification by PCS [Section 92(1)] :- Principal business activities; Particulars of its holding, subsidiary and Associate Companies; Promoters, directors, KMP alongwith changes therein; Meetings of members or a class thereof; Board and its various committees along with attendance details; Remuneration of directors and KMP, penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment. Details of FII including the countries of their origin Matters relating to certification of compliances, disclosures as may be prescribed, Such other matters as may be prescribed. PROVISIONS REGARDING ANNUAL RETURN (AR) Rules Notified PCS certification for: (a) All listed Companies (b) Companies with PUC of Rs. 10 crore or more AND with TO of Rs. 25 crore or more. • Heavy penalty for non-compliance with imprisonment up to 6 months for officials of the Company. • Any wrong certification by PCS – Penalty ranges from not >Rs. 50K – Rs. 5 Lakhs. PROVISIONS REGARDING ANNUAL RETURN (AR) Challenges and Advantages envisaged • Unlike Compliance Certificate it is exhaustive and would require great attention of the PCS • PCS can commence verification of AR immediately thereafter to the extent information is made available by the Company. • What Could be the Final Rules????? Appointment of KMP Section 203 – Appointment of whole-time KMP: (i)Managing director, or CEO or Manager and in their absence, a WTD; (ii)Company Secretary; and (iii)Chief Financial Officer (CFO). All defense Clauses Deleted. KMPs to be appointed by Board Resolution. Can become Director of any Company with Board approval. Vacancy to be filled up within 6 months. Penalty – Rs. 1 Lacs to Rs. 5 Lacs, Continuing Rs. 1000 per day. PROVISIONS REGARDING KEY MANAGERIAL PERSONS (KMP) Segregation of office of Chairman and MD or CEO Unless prescribed by AOA or It is a company not carrying on multiple businesses OR where there is multiple business one or more CEO appointed for the business as notified by the Government. Appointment to be done by a Board by a Resolution Containing terms and conditions including remuneration KMP should not hold office of more than 1 company except subsidiaries. KMP can be a Director with explicit permission of the Board. PROVISIONS REGARDING KEY MANAGERIAL PERSONS (KMP) • Provisions given for existing KMP’s in multiple business to discontinue within a period of 6 months. • Company can appoint a person as its MD if he is already a MD or Manager provided appointment is approved by the Board unanimously. • Specific notice given to the proposed appointment. • Any vacancy in the KMP to be filled within a period of 6 months. • Penalty of Rs. 1 Las extend to Rs. 5 Lakhs on all Companies. • Every Director or KMP in default punishable with a fine up to Rs. 50K and if it is a continuing one Rs. 1000 per day. PROVISIONS REGARDING KEY MANAGERIAL PERSONS (KMP) Rules framed for KMP KMP required for all listed entities and all other companies having PUC of Rs. 5 crore or more ( Rule 13.6) Difficulties envisaged Number of CS in an employment may not suffice the requirement especially since heavy penalty is prescribed for contravention. The number required as per table is at least 24806 plus listed entities with >5 Cr PUC THE ROAD AHEAD??????????? Secretarial Audit Compulsory Secretarial Audit for Listed and Class of Companies to be prescribed (Section 204). Board Report to include every qualification, reservation or adverse remark or disclaimer made by Secretarial Auditor in its Report [Section 134(3)(f)]. Power and Duties of Secretarial Auditor similar to Statutory Auditors [Section 143(14)] – shall have access of all records. Power to Report Fraud to CG [Section 143(12)]. Challenge: Wrong Certification, failure to report fraud Sec 143 (12) Penalty – Rs. 1L to Rs. 25L (Sec. 143(15). May be liable for fraud under section 447. Functions of Company Secretaries (Section 205) Report Compliance with the provisions Companies Act, the rules made there under and other laws applicable to the company; To ensure compliance of applicable secretarial standards; • Companies shall observe Secretarial Standard on Board and General Meeting [Section 118(10)]. To discharge such other duties as may be prescribed. SECRETARIAL AUDIT AND THE RULES NOTIFIED THERE UNDER: • Background to Secretarial Audit • Sec. 204 makes provision for carrying out Secretarial Audit for certain companies. • Company to provide all assistance and facility to CS for the Audit. • Secretarial Audit to be part of the Board report. • Board should give explanation in full for any qualification or observation made by the PCS. Any contravention of the provision of this section involves penalty from Rs. 1 Lac up to Rs. 5 Lac on the company, every officer of the company OR the PCS who is in default. Need to examine when and why a PCS can be deemed to be in default SECRETARIAL AUDIT AND THE RULES NOTIFIED THERE UNDER: RULES PRESCRIBED • Rule 13.7 provides for PUC of Rs. 100 crores or more • Lot of importance is attached to non financial disclosures • Several private limited companies are also having paid-up capital beyond Rs. 100 crores. • Rules should obviously look at protecting the stake holders at large whose interest is to be safeguarded • Companies with a large amount of borrowing from banks, or with a huge TO not necessarily having large PUC should also be considered. SECRETARIAL AUDIT AND THE RULES NOTIFIED THERE UNDER: Challenges and Advantages envisaged • SA is very exhaustive and would require great attention of the PCS • Certification for laws applicable to the Company • Time to be devoted will be very high • Specimen of SA Report…… • Guidance note of ICSI • What Could be the Final Rules????? Chapter VII Management & Administration AGM/EGM First AGMs to be conducted within 9 months from close of FY; AGM to be called during Business Hours (9 am to 6 pm); Not allowed on National Holiday; Quorum: <1000 members – 5 members; 1000-5000 members – 15 members; 5000 or more members – 30 members. Voting through electronic mode mandated for certain Companies Chapter VII – MANAGEMENT AND ADMINISTRATION Analysis of Chapter with specific reference to the Rules notified. 1. ROM also requires UID No, email address, PAN apart from other normal requirements. 2. Depository to modify data base for provision of UID no. 3. Similarly for shares held in physical 4. Sec. 89 relates to declaration of beneficial interest specific format prescribed under the Rule “refer Rule 7.7” filing also required with ROC. 5. Maintenance of ROM under sec. 88 Chapter VII – MANAGEMENT AND ADMINISTRATION Company can keep ROM other than the registered office where more than 1/10th of the total members resides. Members residing in a city is a variable and can change and hence a challenge Sub-Rule 7 of Rule 7.3 provides for attaching the interest in the securities based on intervention of judicial or revenue authority to be recorded in ROM. The depository to record such attachment in respect of shares held in electronic form. Provision made for maintenance of Foreign Register of members. Rules 7.5 provides for such maintenance in relation to those residing in particular country Chapter VII – MANAGEMENT AND ADMINISTRATION Company maintaining foreign register to intimate ROC in the prescribed format. Foreign register to be maintained in same format as ROM – Challenges for getting the information for foreign holders as well. Closing of ROM would also apply for foreign register and would be applicable Mutatis Mutandis. Chapter VII – MANAGEMENT AND ADMINISTRATION Changes in the foreign register to be intimated within 15 days. The company to maintain duplicate register of every foreign register duly updated. Need for foreign register not really clear– some company have listed their shares in foreign countries , some companies have issued ADR’s and/or GDR’s. ADR/GDR are held by a global depository and they are held by the custodians – challenges relating to compliance? Chapter VII – MANAGEMENT AND ADMINISTRATION Rule 7.6 also provides for authentication by the CS or a person to be authorized by the Board - requires appending signatures to each entry. Similar provision also for foreign register. Rule 7.11 provides for filing with ROC in specific format with respect to changes in shareholding position of the promoter and top 10 shareholders of the Company within 15 days of such changes – Currently quarterly filing is done with Stock Exchanges and the information is available in the public domain. The need for such requirement is therefore not clear. Chapter VII – MANAGEMENT AND ADMINISTRATION Rule 7.13 maintaining the ROM and AR –and index of ROM a permanently. Register to be held in the custody of CS or a person to be authorized by the Board. – Appointment of RTA/STA to be approved by the Board with specific authority to maintain ROM. • Register of Debenture holders to be maintained for 15 years from the date of redemption of debenture. • AR under sec. 92 to be preserved for 8 years. • Foreign Register to be maintained permanently. • Rule 7.14 Copies of ROM and AR to be provided to members as prescribed in AOA but not exceeding Rs 10/- per page Chapter VII – MANAGEMENT AND ADMINISTRATION • Notice of Meeting • Recognition under Rule 7.1 for sending through electronic mode – Company should be capable of processing the confirmation for delivery, which has to be safely kept. • Notice may be sent through email as a text or as an attachment or providing electronic link for accessing the notice. • Opportunity to be given to the member to register his email Chapter VII – MANAGEMENT AND ADMINISTRATION • Sub-rule (v) of Rule 7.16 3 seems to suggest that a shareholder should be given opportunity specifically for receiving notice electronically – in the current age of going green need of positive confirmation is regrettable. • Company should retain confirmation of the recipients email sent. • Details of failed transmission – to send notice physically within 72 hours in the event of failed transmission. Chapter VII – MANAGEMENT AND ADMINISTRATION PROXIES • There is restriction on appointment of proxies. • Proxy cannot have authority beyond 50 numbers and holding in aggregate not exceeding 10% of the total paid-up capital with voting rights. Chapter VII – MANAGEMENT AND ADMINISTRATION Voting through electronic means • For the first time, the Act and Rules have mandated for voting through electronic means in addition to voting in meetings. This is applicable for • All Listed Companies; • All Companies having 500 or more shareholders • Voting of electronic means would be through an agency approved by MCA through a SECURED SYSTEM. Chapter VII – MANAGEMENT AND ADMINISTRATION • Company can also do it by registering with MCA or appoint an authorized agency. • Although sec. 20 recognizes serving of documents by courier service, sub-rule (i) of Rule 7.18 (3) allows sending of notice only by Registered Post or Speed Post with AD. This is incomprehensible – • alternate can be through electronic means against registered email ID. Chapter VII – MANAGEMENT AND ADMINISTRATION • Importantly companies who are providing electronic voting can facilitate the process at other places in the country where there are large number of shareholders. This is only an option and not mandatory. • With emphasis on governance this seems to be good suggestion to be implemented as against circular earlier issued by MCA for video link allowing shareholder participation in meeting across the country. • Voting to remain for at least 7 days but not exceeding 10 days. Chapter VII – MANAGEMENT AND ADMINISTRATION Scope of PCS to be appointed as Scrutinizer for their clients for E-voting • The results of the shareholders in the general meeting will be considered along with E-voting carried out by the members in other cities based on which results will be declared. Chapter VII – MANAGEMENT AND ADMINISTRATION Postal Ballot under sec. 110 • Sub-Rule (2) of Rule 7.20 specifically mentions that Postal Ballot could be sent by Registered Post or Speed Post acknowledgment due or by electronic means against registered email ID. • Note: The existing provision for sending Postal Ballot provides for sending through secured mode and companies have been sending by ordinary post by obtaining acknowledgment from the Post Office for article delivered. With UPC being disbanded even first class mail would not be allowed as per the new Act. Chapter VII – MANAGEMENT AND ADMINISTRATION • Post Ballot will be applicable for the following as per subrule 16 of Rule 7.20: • Alteration of object clause of existing company and main object of company formed under the new Act. • Alteration of article in relation to insertion or removal of provision of a Private Company as per Sub section (68) of Section 2. • Change in place of registered office outside cities, town or village limits. – sec. 12(5). • Change in the object for a company which has raised money from public through prospectus and intends to use the unutilized amount for the purpose. Refer sec. 13(8) Chapter VII – MANAGEMENT AND ADMINISTRATION • • • • • • Issue of shares with DVR as to voting or dividend or otherwise. Refer sec. 43(a)(ii) Variation in rights attached to a class of shares or debentures. Refer sec. 48 Buy-back of shares- sec. 68(i) Election of Directors under sec. 15(1) – elected by small shareholders. Sale of whole or substantially the whole of undertaking of a Company – sec. 180(1) (a) Giving loans or extending guarantees in excess of limit prescribed under sec. 186(3) Chapter VII – MANAGEMENT AND ADMINISTRATION • Postal Ballot not applicable to OPC or Company with less than 50 shareholders. In other words for Private Companies having in excess of 50 shareholders Postal Ballot would be applicable. Chapter VII – MANAGEMENT AND ADMINISTRATION Maintenance and Inspection of documents in electronic form • • • • • For the first time recognition has been given for maintain records in Electronic form. Sec. 120 provides for maintenance of documents in electronic form. Rule 7.25 provides for the manner in which records will be maintained and inspection will be provided. Rule 7.25 (3) gives authority to the management to secure the records so maintained in electronic form. Note : While this is a welcome move, the Company has to take extreme care to comply with the Rule specified in Rule 7.25(3)(ii) where activities has been outsourced. Company has to ensure undertaking is obtained from those agencies. Rule 7.26 provides for the report of the proceedings of all AGM’s in a specified manner. This report has to be filed with the ROC and in respect of listed companies as per the Listing Agreement with respective Stock Exchanges. Chapter VIII DECLARATION AND PAYMENT OF DIVIDEND Chapter VIII- DECLARATION AND PAYMENT OF DIVIDENDS Broadly the provisions are very much within the existing framework of the Companies Act 1956 • Recourse has been made for the investor to claim monies which is transferred to the IEPF • Process framed is lengthy • This is a welcome move • Monies moved to IEPF for non encashment due to disputes and or Court cases. • Unclaimed and Unpaid dividends to be put up on the website in PDF format. Certification for transfer by PCS CA and ICWA Chapter VIII- DECLARATION AND PAYMENT OF DIVIDENDS Transfer of shares of unclaimed or Unpaid dividend amounts by the shareholders The origin of this perhaps lies in the changes made by SEBI by introduction clause 5A in the LA of SE • Sub section (6) of Section 124 reads as follows. – – – • All shares in respect of which unpaid or unclaimed dividend has been transferred to IEPF u/s 125 (1) shall also be transferred to the IEPF However Rule 8.5 provides that it will be applicable only if all the dividend during the 7 year period is not encashed If dividend encashed fro even 1 year then it is not applicable. However the Rules have gone overboard in the matter by seeking companies to do this by some draconian provisions in the rules. Chapter VIII- DECLARATION AND PAYMENT OF DIVIDENDS Transfer of shares of unclaimed or Unpaid dividend amounts by the shareholders Shares required to be transferred to IEPF suspense Ac of the Company • Board to authorize CS or such to sign some documents. – – DIS slips if held in Depository If held in physical form CS to make application on behalf of the shareholder and obtain duplicate????????? – Legend on the Certificate”………for purpose of transfer to IEPF”???? – Sign transfer form and Board to effect transfer – Voting rights stands frozen and benefits like bonus split etc also transferred……..Not Rights? Could be merger, demerger etc Transfer to be certified by PCS CA or ICWA • In the event of delisting IEPF to surrender and get money?. Chapter VIII FURTHER SCOPE FOR PCS OR CS AS PER THE PROVISIONS OF THE ACT Registered Valuer Section 247 read with Draft Rules: Valuation of any property, stocks, shares, debentures, securities or goodwill or any other assets or net worth of a company or its liabilities; Central Government to maintain Register of Valuer; Following person having 5 years exp. shall be eligible: CA/CS/CWA/Person having equal Indian / Foreign qualification(IC); Merchant Banker; Engineers /Architect (only for technical valuation); Notified persons. Application to be filed F17.1/F17.2. Company Secretary as Insolvency Practitioner Section 259: Company Secretary in practice recognized as one of the professional to be appointed as Interim Administrator or the Company Administrator for Revival or Rehabilitation of SICK Companies. Professionals at NCLT/NCLAT Section 409 : CA/CS/CMA in Practice can become Technical Member of NCLT/NCLAT, if practising for atleast 15 Years/ 25 Years, respectively. Section 432: Legal Representation of Aggrieved person before NCLT / NCLAT by professional. THANK YOU