Positioning

advertisement

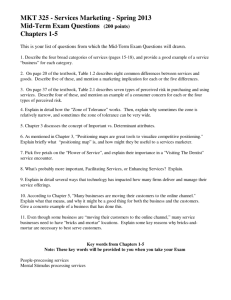

Positioning Process How to position your product and deposition the competition Agenda • • • • Need Company Positioning Product Positioning Validation – 3 Statements that validate your “unique” value proposition • Solidify • Train (memorize) and “become” Positioning • Win Before & After Development – The apex of all strategy is to determine your unique distinctive competence (unique value proposition) – your positioning • At CEO/VP Marketing Level – Product is the “Company” • At Product Management Level – Product line – Positioning – “Why would anyone want to buy ‘us’” – The best way to launch your product, is to position it “before” it is developed—by building your selling hooks (the biggest problem solved) into the product in advance – If you inherited a “me to” product, you MUST find (and articulate) a unique position before the launch materials (or you have nothing to promote!) Need for Positioning • Company/Product Positioning – Answers the questions • Who are you? • What is unique about you—how do you compare? • What do you do? – Test • Who is Panviva? • What is so unique about your company, your product? – Your “unique” value proposition – What is your elevator speech (30 seconds) Company Positioning • What promises do our prospects expect from a company like us? – List top five • What promises can we honestly keep? – Not what are we currently keeping, what can we keep if we decide or want to – Which will give us the competitive advantage • Solidify and wordsmith these – Now – EVERY action, decision, customer interaction, policy both internally and externally follows these promises – You “become” what the market wants (not a person, a “thing” so there is no identify problem Company/Product Tag Lines • Identity (what they make) known – Microsoft – tag line – Sun – tag line • • • • Descriptive (answers, “who are you”) Positioning (#1, most, leader) Rules of thumb – 7-9 words (billboard) Association – Tied to corporation • Tivoli – An IBM Company • Metrowerks – A Motorola Company – Acid test… worth more with, or without – Acquisition – watch out don’t loose existing equity in the transition Product Positioning • The apex of all strategy • How it is positioned within the field of competitors? • What is the unique differentor? • Examples: – Crossfax – a hook was built in – Codewarrior for Windows – no hook, made one • Name reflects positioning – if possible. If not, tagline reflects it. 3 validation statements “prove” it. Positioning - Strategy • “The answer can be right in front of your eyes.” Legend of Bagger Vance (See this movie!) Find the clear path to the hole! All products shown copyright of their respective owners. Positioning - Strategy • How to – Do you homework (previous variables) – Immerse yourself – When you hit the ball 45 degrees to the right, and it turns and goes in the hole – you have seen the strategy (Tiger Woods) – The moment will come, everything else will blur, and you will “see” the answer. It will become clear. You will see the path to the hole! – THIS is the ultimate moment – Your strategy becomes clear – Now… • Articulate it! • Execute Positioning Case Studies • • • • • Dev Tools E-mail Maintenance Advanced Set-top CrossFax Scratch Out Positioning • Case Study #1 – – – – The product manager is the case study--not the software CodeWarrior for Windows (an IDE for software development) Developed by copying Microsoft’s features The Product Manager’s positioning, “Just like Microsoft.” (buzzer goes off, ton of bricks fall) – When challenged, “it is cheaper” came out (bricks…). Lower the price is NOT a differentiator (a difference shouldn’t take seconds to match) – Didn’t work, only 2% market share. Reason? The PMM said, “Missing a few of Microsoft’s features.” (buzzer…) – What is wrong with this product’s positioning? • Hint – it wasn’t determined before it was developed and turned into a “me to” (non-differentiated product) Positioning • Case Study #1 – How do you sell (promote) this software? – You MUST still position it (after the fact) – How? What are the most unique features of the product that are valuable to the user (and that they will PAY for)? – Through homework (research) we found something unique (not brilliant, but unique). • Our product was better at cross-development between Windows and other platforms • For those porting Window apps to Mac, Linux, Nintendo, or any embedded system…we had a unique advantage. Positioning • Case Study #1 – The ability to use a similar IDE interface and to port to multiple platforms was our distinct differentiator. – We were also faster, and had a few unique characteristics, but the cross-platform approach was the most defensible differentiator. – Leveraged with competitive matrix – Offered a “no risk” option – Promoted “sizzle” (more later) Lesson Learned • Position before when possible • Me too positioning isn’t effective – Not differentiated – “why different / better” • Leveraged “family” of products to create the best position Positioning • Case Study #2 – DCA (5th largest software company at the time) • CrossTalk, #1 rated terminal emulation software • CrossFax – Added to CrossTalk for Windows • Competed against Winfax – I had launched 2 prior versions of Winfax so I knew it’s capabilities & weaknesses – Had to determine the unique differentiator to build in (since we “bought the product”, rather than developed it) – Variables to research include a) product features (comprehensive matrix), b) price (especially terms), c) distribution & supply chain (direct, indirect, conflict, reseller loyalty), e) promotions (how well can they promote) – Looking for gapping and subtle holes that are not being addressed – MUST “see” the positioning strategy – a clear path to the money Positioning - Example • Example of CrossFax - Validation – Chrysler wanted to broadcast fax their brochure via local dealers – Winfax had two critical flaws • Could not broadcast faxes w/out crashing • Could not fax grayscale – This is how we positioned ourselves against Winfax… Positioning - Example Positioning - Example Re-creation of the original fax. In contrast, CrossFax has never crashed during a broadcast fax…EVER! Positioning - Example • Did it work? • Yes! Chrysler selected CrossFax for a 20,000 user license! • Similarly, you must find a marketing hook, a unique differentiator that the user values and is willing to PAY for (like Chrysler) • Key takeaway: It is best to do your homework and find out what prospects want in advance, so you can build it into your product. – If you didn’t build valuable differentiators in, you have less leverage to promote later (i.e., CodeWarrior) – Regardless of what you have, it must have a unique position to promote – I am typically called in because there is a PROBLEM • I seldom get to help position a product prior to development. I’m usually stuck trying to find a position (a market) for products that were not positioned and articulated originally. In psychology this is called “Reality Therapy.” Lessons Learned • Do not need ALL the features of a competitor to win • Need the RIGHT features that meet the right needs • Can “de-position” a competitor if you can find something unique that the prospect values (and the competitors are missing) Positioning: Best = Worst Case • Example – E-mail storage • Problem: mandated by law to store it (post Enron). Penalized ($50 million case) if you don’t. • Current Solution: Archive. Backup nightly (every 24 hours) • Major Hole: Avg 81 e-mails received daily (non-spam). Assume ¼ are “important”. Equals 20 / day x 500 person company = 10,000 LOST e-mails between backups! • …and if your backup fails (42% fail), or your Exchange database is corrupted (72% surveyed have had an Exchange disaster)? Question: What is the next phrase out of your mouth after you tell your CEO you lost TEN THOUSAND e-mails? Positioning – Example NEW “Would you like fry’s with that?” • Answer: (Former IT Manager after loosing 10,000 e-mails!) All products shown copyright of their respective owners. De-Positions Alternatives • Problem: Reduce the risk of loosing 10,000 e-mails • Solution: DigiVault (by Lucid8) – Continuous Data Backup (CDP) – Loose 1-4 minutes of e-mail, not 24 hours – Plus, restore takes apx. 20 minutes, not 3-5 hours! – Similar cost, negligible loss, much faster restoration • Benefit: Lose 10,000 e-mails or 17. – Which would you prefer? Lessons Learned • Positioning was NOT in the technical bits and bytes, it was Job Security! • De-positioned entire industry – Best practice was worst practice – Took out dozens of competitors in one pass • Get creative De-Positioning • What does De-Positioning mean? – Articulate your own strength in contrast to your competitor’s weakness (specific or ALL) • CodeWarrior for Windows – best for cross-platform • CrossFax was made to look stronger against Winfax • DigiVault looks much better than ALL of the 24 hour backup alternatives – The strength of your positioning makes the alternatives look foolish in comparison • “Negative” campaigning still works Political positioning, “It’s the Economy, Stupid!” Single in on the most critical differentiator De-Positioning the Competition • How to De-Position the Competition? Basics… – – – – Comparative matrix (Tom Cruise charts) Positioning grids (Gartner’s Magic Quadrant) Associate “them” with Negative imaging Capitalize on Major flaws & Mistakes (actual or perceived) • • • • Intel inside – a warning label, or much slower dual-core SalesForce.com (Ad with Dali Lama) HRW – Competitor’s mistakes in textbooks ($10k/error) Democrats w/Bush (War, Immigration, Wire tapping) – Sometimes your best positioning is the weakness of the competition (you’re not that good, just better than “them”) – Art of War. MUST be honest and ethical, but it is war. Compete against the product and company—not the people (will need to recruit them (part of your counterstrike campaign)) De-Positioning the Competition • Comparative matrix (Tom Cruise charts) De-Positioning the Competition • Positioning Grids (deposition competition) De-Positioning Case Study • Price positioning – always an objection – Arm sales with product price positioning (set-top box example) • • • • Companies set-top was $800 Competition was $200 Q. How can you “promote” your price? A. Change the perception. Switch the criteria from price to “cost” or “revenue potential” and promote how much more they will make. “Our” system produced up to $129/mo In revenue. Competitors generated only $59. It required $79 for their business model to work. We produced over $3,600 more revenue/5 years—after the difference! 150 100 Local Toll 4% Internet 7% 50 2001 Calling Card 2% Local Phone 29% Cellular 12% 0 1999 Paging 2% 2005 E-Commerce PPV T-Commerce I-TV Interactive Services HIS Enhanced Services High Speed Internet Standard ISP Long Distance Features Local Voice Long Distance 20% Cable/DBS TV 24% De-Positioning the Competition • Positioning Grids (Negative Imaging) Sometimes it takes creativity to “see” the absolute killer positioning. This one took over 6 months to see… and then was irrefutable. All products shown copyright of their respective owners. Lessons Learned • Positioning was NOT the product, it was the business model – Took out every competitor that did not make their business model work (ALL!!) De-Positioning Alternatives • Two existing approaches to repair – Chemical Softeners • Maxell, Memorex – Repair minor read errors only – A majority of the online reviews are negative – Mechanical Grinders • Opti Fix Pro – Memorex • SkipDr Advanced or AutoMax – Works for minor scratches, but deep scratches require grinding the entire disk multiple times and can take a LONG time to remove—if at all – Versus taking seconds to repair with Scratch Out Why Order ScratchOut? • First – it works! – Unlike existing products that claim to repair, but don’t work on anything but the smallest scratch, ScratchOut restores a disc to 100% playable, 100% of the time – Uses commercial grade polishing agent to remove unseen microscopic damage to optical disc – It’s not the “mountains” that cause the laser to misread the disk - it’s the ridges within the mountains – These ridges are polished smooth with ScratchOut Product Positioning • The undisputed Price/Performance leader - and the product actually works! • NEW approach – completely unique microscopic polish (not a filler, cleaner, or grinder) • GUARANTEED 100% playable, 100% of the time (if it can be fixed, we can fix it) • ONLY product to repair light to severe scratches* • OPTIMIZED for impulse buying (price, packaging, location options) • Undisputed Price / Performance LEADER * SkipDr (disclaimer on packaging) “…will not repair severe damage, such as gouges and deep scratches” De-Positioning Specifics • SkipDr - Mechanical Grinders – The mechanical grinders look techy, but they sand the entire disk. They cannot fix just a “single” scratch. – Would you wash your favorite shirt 10 times in a row just to get a single area clean? – Why spend all the time to grind and sand an entire disk numerous times just to remove a single scratch… that takes seconds to fix with ScratchOut. De-Positioning Specifics #2 • Opti Fix - Chemical “Softeners” – Typically a diluted Acetone-based chemical that softens the top layer of the optical disc to “smooth out” the scratches. – Only works on minor scratches – if at all – Does more to clean the disc than to actually repair it – Does not repair moderate to severe scratches – VERY bad online reviews – Few return purchases – bad for “consumable” – Old technology, old approach, poor results Lessons Learned • Positioning was the price/performance leader – Best performance for the best price • De-positioned alternatives as “old school” or “wrong technology” • Leveraged strengths built-into the product in ADVANCE (done right) Marketing Tools • • • • Competitive matrix Positioning Quadrants Venn Diagrams Help us to visualize the strength of our positioning • Create 3-5 key differentiators from this exercise – Forms the main points for your persuasive argument Exercise • Create a competitive matrix – – – – Internal vs external Shows your strengths and your weaknesses Shows gaping holes or wedge points Must know more than the prospect (you’re supposed to be the expert—not them) – Covers pricing, distribution, features, support— anything that might differentiate – Format competition in RED (sea of red) Competitive Matrix Comparative Matrix Acme Tires Most competing applications are missing critical features for end-to-end tire maintenance and tracking. Acme Tire App —The Most Complete & Easy-To-Use Tire Maintenance Software Positioning Quadrant Gartner Magic Quadrant Exercise • Print five copies of the positioning quadrant—you’ll create five samples • Plot the variables from competitive matrix on the bottom and the right • Your product should be at the top right (best) • Adjust the name of the variables to make the top right the best spot • The further you are from the competitors, the stronger your positioning – If the prospect values those variables Fast to Implement & Affordable (uses competitors names, plus one category) Speed to Implement Fast • Acme Tire App • Tyre Check• eTyre • Arsenault Slow • Cetaris • Fleet Maintenance • Control Ban•Thread Stat Expensive Affordable Cost of Ownership Product Positioning (Mistake: Want top Right) One-to-many One-to-one Classroom Training Subject Matter Experts Web Conferencing Knowledge Management (Sharing desktop, training or support) LMS / LCMS and Simulation Tools Documentation Tools YOUR COMPANY Online Help Performance Support E-Learning Formal training (soft skills) Formal training (hard skills) Informal training (support ) Positioning against the alternatives (Change “terms” to put you in top right) Training Support One-to-many E-Learning Performance Support Documentation Tools LMS / LCMS and Simulation Tools YOUR COMPANY Enterprise CMS One-to-one Web Conferencing Online Help Instructor Led Training Memorization Subject Matter Experts On Demand Integrated The Most Complete Tire Application Non-Integrated Start Acme Tire App The #1 Most Complete & Easy-To-Use Tire Maintenance Software Mobile/Portal Software Hardware Supply (Gauges, Pressure) Mobile/PDA Reader Reports Tyre check Alerts Inspection Tyre check Cetaris Cetaris Cetaris Arsenault IMI/B udini Arsenault Arsenault IMI/Budini IMI/Budini Incomplete IMI/Budini IMI/Budini vs. Complete Tracking End Exercise • Determine your top 3-5 best positioned variables and list them • Now, list features beneath them that support the main strengths – PROVE it! • These features VALIDATE your positioning • Form the thesis for your persuasive argument • Beginning of the Persuasive Document Analogies • Show analogies that put competitive applications in perspective – Motorola • Hyundai vs. Camry – Lucid8 • Want Fry’s with That – Project • Little dog vs Horse (power) Alternatives - Compared “Perceived” Security Fast/Accurate Inventory Management Alternatives 1. Fixed RFID 1. Fixed RFID 1. Fixed RFID 2. Mobile RFID 2. Mobile RFID 2. Mobile RFID 3. Bar Code 3. Manual 3. Bar Code 4. Manual 4. Bar Code 4. Manual Alternatives to capture data, and increase security (reduce shrinkage). Bar code is not an effective alternative—and is often slower than manual. Made for fast checkout—high volume. Not lower volume and definitely not for fast inventory counting. Mobile vs. Fixed RFID Low Cost – Medium Cost – High Cost Cost 90% of Market Mobile RFID Ideal for Low End to High End High perceived security* * 0% actual shrink with 2.3 million items! Super High 10% of Market Fixed RFID Super High End Highest perceived security Fixed RFID – OVERKILL! Mobile RFID Wall/Floor Safe Not “as safe” as Fort Knox Protects 100% of the time The “right” amount of protection * Mobil RFID 0% actual shrink with 2.3 million items! Fixed RFID Fort Knox Protects 100% of the time WAY too expensive WAY overkill! Two Categories of Project Mgmt Basic Project Management Notepad Enterprise PPM No matter how much you dress the dog, it’s still a dog…. Enterprise needs more horsepower! MS Word Tired of Beating a Dead Horse? Oracle: Primavera P6 HP: PPM Center CA: Clarity • Existing Enterprise PMM’s • Old legacy interfaces • Steep learning curves • Usability problems • • Horror stories of 6 month installs Outrageous prices “After six months…we just gave up!” Introducing… AcmeProject Tag Line Here Positioning Dialogues • One • Two • Three Unfortunately… • E-mail has problems – It is not always the best way to communicate—at times it is the worst! – It has a high productivity and IT cost—and that cost is increasing exponentially – It carries a potential legal and litigation risk Advantages of VaporStream 1. Most of the advantages of a verbal conversation—but much more convenient 2. It reduces the growing expense of e-mail 3. Minimizes the risk & high cost of miscommunication and litigation Validation • Prove it! • List 3 validations for your company • List 3 validations for your product – Validate with features/benefits – what makes your product so unique that your prospects MUST buy it? – 1,2,3 • These valuators now go into your elevator speech, your collateral, your website, your discussions with the press. You are on your way. Deliverables • • • • • • Competitive matrix Venn Diagram Analogies Positioning Statement Top 3 Supporting Statements Start the “Persuasive Document” – Foundation document for everything else