0324828659_164781

advertisement

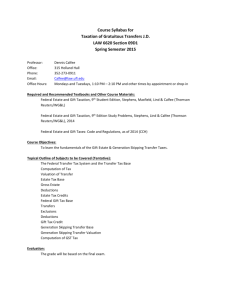

Chapter 1 An Introduction to Taxation and Understanding the Federal Tax Law Individual Income Taxes Copyright ©2010 Cengage Learning Individual Income Taxes C1-1 History of Taxation (slide 1 of 2) • Prior to 1900s income tax financed wars – 1861: First Federal individual income tax enacted • Repealed after Civil War – 1894: New Federal individual income tax enacted • Tax found to be unconstitutional Individual Income Taxes C1-2 History of Taxation (slide 2 of 2) • Other important events – 1909: First Federal corporate income tax enacted – 1913: 16th Amendment ratified • Sanctioned both Federal individual and corporate income taxes Individual Income Taxes C1-3 Federal Budget Receipts—2009 Individual income taxes Corporation income taxes Social insurance taxes and contributions Excise taxes Other Total 46% 12 35 3 4 100% FIGURE 1–1 Individual Income Taxes C1-4 Criteria for Evaluating a Tax Structure (slide 1 of 2) • Adam Smith identified the following canons of taxation to consider when evaluating tax structures: – – – – Equality Convenience Certainty Economy Individual Income Taxes C1-5 Criteria for Evaluating a Tax Structure (slide 2 of 2) • In addition, the AICPA suggests that the tax system should be: – – – – – Simple Neutral in terms of its effect on business Clear and readily understandable Structured to minimize noncompliance Should enable the IRS to predict the amount and timing of revenue, and – Should not reduce economic growth and efficiency Individual Income Taxes C1-6 Tax Structure (slide 1 of 2) • Tax base: amount to which the tax rate is applied • Tax rates: applied to the tax base to determine the tax liability – May be proportional or progressive • Incidence of tax: degree to which the tax burden is shared by taxpayers Individual Income Taxes C1-7 Tax Structure (slide 2 of 2) • Examples: Income $10 $20 $30 Proportional $3 (30%) $6 (30%) $ 9 (30%) Tax Progressive $3 (30%) $7 (35%) $12 (40%) Tax Individual Income Taxes C1-8 Major Types of Taxes • • • • • • • Property Taxes Transaction Taxes Death Taxes Gift Taxes Income Taxes Employment Taxes Other U.S. Taxes Individual Income Taxes C1-9 Property (ad valorem) Taxes • Based on the value of the asset • Generally on realty or personalty • Exclusive jurisdiction of states and their local political subdivisions • Deductible for Federal income tax purposes Individual Income Taxes C1-10 Transaction Taxes • Excise taxes • General sales taxes • Severance taxes Individual Income Taxes C1-11 Excise Taxes • • Imposed at the Federal, state, and local levels Restricted to specific items – • Examples: gasoline, tobacco, liquor Declined in relative importance until recently – Example-two types of excise taxes at the local level have recently become increasingly popular • • – Hotel occupancy tax Rental car surcharge Tax is levied on visitors who cannot vote and often used to fund special projects Individual Income Taxes C1-12 General Sales Taxes • Currently jurisdiction of states and localities • States that impose sales taxes also charge a use tax on items bought in other states but used in their jurisdiction • States without sales or use taxes are Alaska, Delaware, Montana, New Hampshire, and Oregon Individual Income Taxes C1-13 Severance Taxes • Tax on natural resources extracted – Important revenue source for states rich in natural resources Individual Income Taxes C1-14 Death Taxes (slide 1 of 2) • Tax on the right to transfer property or to receive property upon the death of the owner – If imposed on right to pass property at death • Classified as an estate tax – If imposed on right to receive property from a decedent • Classified as an inheritance tax Individual Income Taxes C1-15 Death Taxes (slide 2 of 2) • The value of the property transferred provides the base for determining the amount of the death tax • The Federal government imposes only an estate tax • Many state governments levy inheritance taxes, estate taxes, or both Individual Income Taxes C1-16 Federal Estate Tax (slide 1 of 2) • Federal estate tax is on the right to pass property to heirs – Gross estate includes FMV of property decedent owned at time of death • Also includes property interests, such as life insurance proceeds paid to the estate or to a beneficiary other than the estate if the deceasedinsured had any ownership rights in the policy Individual Income Taxes C1-17 Federal Estate Tax (slide 2 of 2) • Property included in the gross estate is valued at either: – Date of death, or – If elected, the alternate valuation date • Generally 6 months after date of death – Certain deductions and credits allowed • Examples - marital deduction, funeral and admin. expenses, certain taxes, debts of decedent Individual Income Taxes C1-18 Unified Transfer Tax Credit • Unified credit reduces or eliminates the estate tax liability for modest estates • For 2009, credit is $1,455,800 – Offsets tax on $3,500,000 of the tax base Individual Income Taxes C1-19 Phaseout of Estate Tax • The estate tax has been criticized for the hardship it imposes on small businesses and family farms • Tax Relief Reconciliation Act of 2001 included the phase out of the estate tax – Unified transfer credit is scheduled to increase over a 10 year period – Estate tax is due to be eliminated in 2010 • Sunset provision reinstates estate tax as of January 1, 2011 Individual Income Taxes C1-20 State Death Taxes • State death taxes may be estate tax, inheritance tax, or both – Inheritance tax is on the right to receive property from a decedent – Tax is generally based on relationship of heir to decedent • The more closely related, the lower the tax Individual Income Taxes C1-21 Federal Gift Tax (slide 1 of 3) • Tax on the right to transfer assets during a person’s lifetime – Applies only to transfers that are not supported by full and adequate consideration • Taxable gift = FMV of gift less annual exclusion less marital deduction (if applicable) • Federal gift tax provides an annual exclusion of $13,000 per donee (in 2009) – Amount is adjusted for inflation Individual Income Taxes C1-22 Federal Gift Tax (slide 2 of 3) • Married persons can make a special election to split gifts – Allows 1/2 of a gift made by a donor-spouse to be treated as having been made by a nondonorspouse (gift splitting) – Effectively increases the number of annual exclusions available and allows the use of the nondonor-spouse’s unified transfer tax credit Individual Income Taxes C1-23 Federal Gift Tax (slide 3 of 3) • The unified transfer tax credit is available for gifts (as well as the estate tax) • Despite the proposed repeal of the estate tax, the gift tax has been retained with the unified transfer tax credit frozen at $345,800, covering $1,000,000 of taxable gifts Individual Income Taxes C1-24 Gift and Estate Unified Tax Schedule • Gift and estate taxes are unified under a single tax rate schedule – Since tax rates are progressive, prior years’ transfers must be considered when calculating the current year’s gift or estate tax Individual Income Taxes C1-25 Income Taxes • Imposed at the Federal, most state, and some local levels of government – Income taxes generally are imposed on individuals, corporations, and certain fiduciaries (estates and trusts) • Federal income tax base is taxable income (income less allowable exclusions and deductions) • Most jurisdictions attempt to assure tax collection by requiring pay-as-you-go procedures, including – Withholding requirements for employees, and – Estimated tax prepayments for all taxpayers Individual Income Taxes C1-26 Formula for Federal Income Tax on Individuals (Slide 1 of 3) Income (broadly conceived) $xx,xxx Less: Exclusions (x,xxx) Gross income $xx,xxx Less: Certain deductions for AGI (x,xxx) Adjusted Gross Income $xx,xxx Individual Income Taxes C1-27 Formula for Federal Income Tax on Individuals (Slide 2 of 3) Adjusted Gross Income Less: The greater of: Itemized deductions, or The standard deduction Less: Personal and dependency exemptions Taxable income Individual Income Taxes $xx,xxx (x,xxx) (x,xxx) $xx,xxx C1-28 Formula for Federal Income Tax on Individuals (Slide 3 of 3) Tax on taxable income (see Tax Rate Schedules in Appendix A) $ x,xxx Less: Tax credits (including Federal income tax withheld and other prepayments of Federal income taxes) (xxx) Tax due (or refund) $ xxx Individual Income Taxes C1-29 Corporate Income Tax Corporate Taxable Income = Income Deductions – Does not require the computation of adjusted gross income – Does not provide for the standard deduction or personal and dependency exemptions – All allowable deductions are business expenses Individual Income Taxes C1-30 State Income Tax (slide 1 of 3) • All but the following states impose an income tax on individuals: – Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming Individual Income Taxes C1-31 State Income Tax (slide 2 of 3) • Some characteristics of state income taxes include: – With few exceptions, all states require some form of withholding procedures – Most states use as the tax base the income determination made for Federal income tax purposes • Some states apply a flat rate to Federal AGI • Some states apply a rate to the Federal income tax liability – Referred to as the piggyback approach to state income taxation Individual Income Taxes C1-32 State Income Tax (slide 3 of 3) • Some states ‘‘decouple’’ from select tax legislation enacted by Congress – State may not be able to afford the loss of revenue resulting from such legislation • Because of tie-ins to the Federal return, states may be notified of changes made by the IRS upon audit of a Federal return – In recent years, the exchange of information between the IRS and state taxing authorities has increased Individual Income Taxes C1-33 Employment Taxes (slide 1 of 3) • FICA taxes – Paid by both an employee and employer – In 2009, Social Security rate is 6.2% on a maximum of $106,800 of wages, and Medicare rate is 1.45% on all wages • A spouse employed by another spouse is subject to FICA • Children under the age of 18 who are employed in parent’s unincorporated trade or business are exempt from FICA Individual Income Taxes C1-34 Employment Taxes (slide 2 of 3) • FICA taxes – Sole proprietors and independent contractors may also be subject to Social Security taxes • Known as the self-employment tax • Rates are 12.4% for Social Security and 2.9% for Medicare – Twice the rates applicable to an employee • The tax is imposed on net self-employment income up to a base amount of $106,800 for 2009 Individual Income Taxes C1-35 Employment Taxes (slide 3 of 3) • FUTA (unemployment) taxes – Provides funds for state unemployment benefits – In 2009, rate is 6.2% on first $7,000 of wages for each employee – Administered jointly by states & Fed govt. • Credit is allowed (up to 5.4%) for FUTA paid to the state – Tax is paid by employer Individual Income Taxes C1-36 Other Taxes • Federal customs duties – Tariffs on certain imported goods • Franchise taxes – Levied on the right to do business in the state • Occupational taxes – Applicable to various trades or businesses • e.g., liquor store license, taxicab permit, fee to practice a profession Individual Income Taxes C1-37 Proposed Taxes • Flat tax – Would replace the current graduated income tax with a single rate • Value added tax – Taxes the increment in value as goods move through production & manufacturing stages to the market • Paid by the producer and reflected in the sales price of goods • National sales tax – Levied on the final sale of goods and services • Collected from consumer, not from businesses as with VAT Individual Income Taxes C1-38 Tax Administration (slide 1 of 4) • Internal Revenue Service (IRS) – Responsible for enforcing the Federal tax laws – Audits small percentage of returns filed using mathematical formulas and statistical sampling • To update selection criteria, the IRS selects a cross section of returns, which are subject to various degrees of inspection • Results highlight areas of taxpayer noncompliance and enable the IRS to use its auditors more productively Individual Income Taxes C1-39 Tax Administration (slide 2 of 4) • Types of audits: – Correspondence audit – Office audit • Usually restricted in scope and conducted in facilities of IRS – Field audit • Involves examination of numerous items reported on the return and is conducted on premises of taxpayer or taxpayer's representative Individual Income Taxes C1-40 Tax Administration (slide 3 of 4) • After the audit, a Revenue Agent’s Report (RAR) is issued summarizing the findings which can result in a: – Refund (tax was overpaid) – Deficiency (tax was underpaid), or – No change (tax was correct) finding Individual Income Taxes C1-41 Tax Administration (slide 4 of 4) • If an audit results in an assessment of additional tax – Taxpayer may attempt to negotiate a settlement • An appeal is available through the Appeals Division of the IRS – Appeals Division is authorized to settle all disputes based on the hazard of litigation (i.e., probability of favorable resolution, if litigated) – If a satisfactory settlement is not reached on administrative appeal, the taxpayer can litigate in: • Tax Court • Federal District Court, or • Court of Federal Claims – Litigation is recommended only as a last resort because of • Legal costs involved • Uncertainty of the final outcome Individual Income Taxes C1-42 Statute of Limitations (slide 1 of 3) • Statute of limitations offers a defense against a suit brought by another party after the expiration of a specified period of time – Purpose is to preclude parties from prosecuting stale claims • The passage of time makes defense of such claims difficult since witnesses may no longer be available or evidence may have been lost or destroyed • For Federal income tax purposes, the two categories involved relate to the statute of limitations applicable to: – The assessment of additional tax deficiencies by the IRS, and – The period that deals with claims for refunds by taxpayers Individual Income Taxes C1-43 Statute of Limitations (slide 2 of 3) • For a deficiency assessment by IRS – Generally 3 years from the later of the due date or the filing date of the return – For material (more than 25%) omissions of gross income, time period is 6 years – No statute if no return filed or fraudulent return filed Individual Income Taxes C1-44 Statute of Limitations (slide 3 of 3) • For a refund claim by taxpayer – Generally 3 years from date return filed or 2 years from date tax paid, whichever is later Individual Income Taxes C1-45 Interest and Penalties (slide 1 of 2) • Interest accrues on the taxes due starting from the due date of the return and interest is paid on refunds if not received within 45 days of when the return was filed – Current rate for January 1–March 31 of 2009 is 6% (determined quarterly by the IRS) Individual Income Taxes C1-46 Interest and Penalties (slide 2 of 2) • Tax law provides various penalties for lack of compliance including penalties for: – Failure to file • Penalty is 5% per month up to a max of 25% on the amount of tax shown as due on the return – Any fraction of a month counts as a full month – Failure to pay • Penalty is 0.5% per month up to a max of 25% – Penalties may also apply to underpayment of estimated taxes, negligence, etc. Individual Income Taxes C1-47 Tax Practice (slide 1 of 4) • Area of tax practice is largely unregulated – Members of professions must follow certain ethical standards (CPAs, Attorneys) – Various penalties may be imposed upon preparers of Federal tax returns who violate proscribed acts and procedures Individual Income Taxes C1-48 Tax Practice (slide 2 of 4) • Ethical guidelines issued by AICPA: – Do not take questionable position on client’s tax return in hope of it not being audited – Client’s estimates may be used if reasonable – Try to answer every question on the tax return (even if disadvantageous to client) – Upon discovery of an error in prior year tax return, advise client to correct Individual Income Taxes C1-49 Tax Practice (slide 3 of 4) • Statutory penalties may be levied on tax return preparers for: – Procedural Matters-Failure to: • • • • Provide copy of return to taxpayer Sign the return as preparer Keep copies of returns Maintain a client list Individual Income Taxes C1-50 Tax Practice (slide 4 of 4) • Statutory penalties may be levied on tax return preparers for: – Understatement of tax liability based on a position that lacks a realistic possibility of being sustained – Willful attempts to understate tax – Failure to exercise due diligence in determining eligibility for, or the amount of, the earned income tax credit Individual Income Taxes C1-51 Understanding the Federal Tax Law (slide 1 of 3) • The Federal tax law is the vehicle for accomplishing many objectives of the nation such as: – Raising revenue: the major objective of the tax system but not the sole objective – Economic: increasingly important objective is to regulate the economy and encourage certain behavior and businesses considered desirable Individual Income Taxes C1-52 Understanding the Federal Tax Law (slide 2 of 3) • Federal tax objectives – Social: encourage socially desirable behavior that provides benefits that government might otherwise provide – Equity: equity within the tax laws (e.g., wherewithal to pay concept) and not necessarily equity across taxpayers Individual Income Taxes C1-53 Understanding the Federal Tax Law (slide 3 of 3) • Federal tax objectives – Political: a large segment of the tax law is created through a political process; thus, compromises and special interest dealings occur – Ease of administration: many provisions are meant to aid the IRS in the collection of taxes – Courts: influence tax law and sometimes cause it to change Individual Income Taxes C1-54 If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu SUNY Oneonta Individual Income Taxes C1-55