Microinsurance as a Risk Management Strategy by Mosleh U

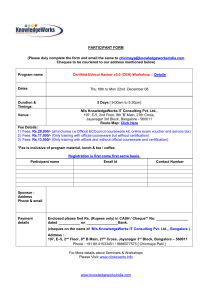

advertisement

MICROINSURANCE a presentation at the 5th Annual Microfinance Conference and Entrepreneurship Award For the Central Bank of Nigeria by: Mosleh U Ahmed FCA GIZ Consultant mosleh.ahmed@btinternet.com MATS SCHOOL OF BUSINESS, BANGALORE 1 Outline Microinsurance basics The demand side of microinsurance The supply side of microinsurance Some innovative microinsurance programmes A few cautions World Bank/GIZ Microinsurance Survey in Lagos and Kano OF BUSINESS, Regulatory issues MATS SCHOOL BANGALORE 2 Microinsurance is not…….. Charity Prevents risk Provided by only small insurance companies Down-scaled existing product A “MAGIC BULLET” and a cure for all problems of the poor people MATS SCHOOL OF BUSINESS, BANGALORE 3 Microinsurance is………. Risk management tool Loss protection mechanism MATS SCHOOL OF BUSINESS, BANGALORE 4 Introduction to Microinsurance Microsavings Microfinance Microcredit MICROINSURANCE Emergence of microinsurance is an important development within the field of microfinance and challenges the widely held belief of the "non-insurability" of the poor. 5 Defining Microinsurance Microinsurance refers to the insurance products that are designed to be beneficial and affordable to low-income individuals or groups. Microinsurance can help to improve a person’s quality of life by allowing that person to better manage potential problems while empowering that person to be more proactive as to the future. 6 Defining Microinsurance Insurance for low-income people. Insurance involving low levels of premiums. Insurance with small benefits. Insurance with: Simple, easily understood contracts; Little underwriting; Few if any exclusions; Simple claim process while still controlling for fraud; Innovative premium collection’ and policy delivery models; Multi-task intermediaries; Often community or group pricing; 7 Microinsurance Basics The microinsurance business model is ‘social’ business where solving social problems is motivating the business instead of maximizing profits. It is a contract to prevent low income people from facing severe financial problems when faced with unexpected risks events. Microinsurance products typically have a low return on equity 8 Microinsurance Basics In exchange for insurance protection, the lowincome people pay a small premium. The government or the donors would not subsidise any part of the premium. 9 Risk Pooling Risk Pooling is bringing together resources from a large number of people to share in the losses of a few In case of an MFI the cost to the insured is the average loss experienced by its “risk pool” In case of an insurance company the cost to the insured is the premium calculated actuarially for its “risk pool” MATS SCHOOL OF BUSINESS, BANGALORE 10 Why Microinsurance Microfinance helps people to move out of poverty: Credit Savings Leasing Microinsurance helps people to protect the gains they make through microfinance MATS SCHOOL OF BUSINESS, BANGALORE 11 Life Cycle Need of the Poor C = Credit; E = Education; H = Healthcare; I = Insurance; S = Savings; Sc = Social Marriage (C, S, Sc) Death Working Capital (C) (C,I, Sc) Fixed Asset Acquisition (C) Health Old Age Investments Asset Protection (C,S,I) (H, I, S, Sc) Birth (S) Religious Ceremony (C,S, Sc) (C, H, I, S) Training & Education MATS SCHOOL OF BUSINESS, BANGALORE (I) (E, Sc) 12 Impact of Microcredit and Losses Economic Levels Wealthy Non-poor Vulnerable non-poor Poverty Line Moderate poor Extreme poor Destitute Loan Cycles and Impact of Losses MATS SCHOOL OF BUSINESS, BANGALORE 13 14 Microinsurance Clients Destitute Extreme Poor Not insured by anyone Moderate Poor MicroInsurance Clients P O V E R T Y Vulnerable Non- Poor L I N E MATS SCHOOL OF BUSINESS, BANGALORE Non- Poor Wealthy Traditional Insurance Clients 15 Delivery Channels Existing and new channels of delivery for microinsurance products Adopted from a presentation made by Dr. B Helms, CGAP Insurance Companies Cr. Unions Insurance Agents On-line, ATM Mobile Phones MFIs NBFIs Banks Self-help Groups Volunteers Health Workers Field Workers Employees Low-income Households MATS SCHOOL OF BUSINESS, BANGALORE 16 Different Microinsurance Models Community-Based Model (UPLIFT, India) Insurer/Limited Provider Model (GRET, Cambodia) Owned and Managed by Members GRET insures, and provides primary medical care Insurer/Full Provider Model (Grameen, Bangladesh) MFI is the insurer and owns healthcare clinics Bundled Insurance Package (SEWA, India) Partnership Model (AIG-FINCA, Uganda) Full Insurer Model (Delta Life, Bangladesh) PPP Model (GOP, Insurer and MFI, Pakistan) MATS SCHOOL OF BUSINESS, BANGALORE 17 Different Microinsurance Products Life/Endowment/Credit Life India, Bangladesh, Sri Lanka, Nepal, Vietnam, Pakistan, Indonesia, Laos, East Africa, South Africa, West Africa Colombia, Guatemala, Mexico, Nicaragua India East Africa, North Africa Mexico, Nicaragua Health/Critical Illness India, Bangladesh, Philippines, Cambodia, China East Africa, South Africa, West Africa Colombia, Mexico Georgia, Russia Group Personal Accident West Africa Unemployment East Africa Property/Livestock/Assets India, Mongolia, Nepal East Africa Albania Funeral Insurance East Africa, South Africa, West Africa Colombia, Mexico Crop/Weather Bundled Insurance Package India Colombia Rural Insurance Schemes India Flood Insurance China, Indonesia, Vietnam 18 Relative Complexity of Microinsurance Products More Complex More Simple Crop/Weather Insurance Integrated Insurance Packages Health/Disability Insurance Annuities/Endowment Property/Livestock Insurance Indemnity/Personal Accident Life/Credit Life Insurance MATS SCHOOL OF BUSINESS, BANGALORE 19 Vimo SEWA – INDIA a Bundled Insurance Package SEWA offers three different bundled insurance packages Covers life, healthcare and loss of assets Premiums are paid annually or through fixed deposit account MATS SCHOOL OF BUSINESS, BANGALORE 20 Vimo SEWA – an Integrated Insurance Package SPECIAL BENEFITS FOR FIXED DEPOSIT PREMIUM MEMBERS (Eligible after 1 year of membership) Maternity: $ 20.0 Dentures: $ 20.0 Hearing Aid: $ 20.0 Eye glasses: $ 10.0 MATS SCHOOL OF BUSINESS, BANGALORE 21 Life Insurance with Flexibility Amparar Policy by La Equidad, Colombia Monthly premium US$ 1.00; basic coverage US$ 1,250.00 50% payout for treatment in case policy- holder contracts incurable disease while insured After policyholder’s death Child education expenses for 2 years Medical expense for dependents Monthly food vouchers Utility bills MATS SCHOOL OF BUSINESS, BANGALORE 22 Pre-paid Health Card – JAMII BORA In-patient Health Insurance with Photo ID in Kenya Mandatory for all borrowers Costs US$ 10 per year Covers borrower and up to 6 family members Named hospitals/clinics Up to secondary level treatment and surgeries Medicines and lab tests covered MATS SCHOOL OF BUSINESS, BANGALORE 23 World Bank/GIZ Microinsurance Survey in Lagos and Kano Objectives: To identify the potential microinsurance clients’: • Socioeconomic status • Perception and understanding of insurance risks • Risk mitigation measures • Income and expenditure patterns • Affordability of insurance premiums • Constraints on access to microinsurance services • Supply side • Delivery channels MATS SCHOOL OF BUSINESS, BANGALORE 24 Methodology Quantitative and qualitative survey carried out by Centre for Microenterprise Development (CMD) 604 urban households in Lagos state 405 rural households in Kano state 4 FGDs in Lagos state 5 FGDs in Kano state MATS SCHOOL OF BUSINESS, BANGALORE 25 Survey area KANO 405 Households LAGOS 604 Households MATS SCHOOL OF BUSINESS, BANGALORE 26 Sample distribution - Lagos № Survey areas No of household 1 Agege-Iyanpaja-Ogba 119 2 Badagry 20 3 Ikorodu 71 4 Ikeja 65 5 Ketu 43 6 Mushin 28 7 Orile Iganmu 44 8 Oshodi 93 9 Oworoshoki 54 10 Surulere TOTAL MATS SCHOOL OF BUSINESS, BANGALORE 68 604 27 Sample distribution - Kano № Survey areas No of household 1 Zango 45 2 Gwale 70 3 Kano Municipal 5 4 Nassarawa 17 5 Fagge 22 6 Dala 22 7 Kawo 76 8 Kabuga 28 9 Kofar Nassarawa 16 10 Ungogo Sub-total MATS SCHOOL OF BUSINESS, BANGALORE 1 302 28 Sample distribution - Kano № Survey areas No of household 11 Ungwar Uku 22 12 Mariri 27 13 Tarauni 25 14 Badawa 8 15 Kofar Mazugal 1 16 Tudu Wada 3 17 Wudil 6 18 Danbata 7 19 Jambulo 4 TOTAL 405 MATS SCHOOL OF BUSINESS, BANGALORE 29 Demography of households Criteria Gender Marital status Education level Household Heads Lagos % Kano % Male 94.8 86.9 Female 5.2 13.1 Single 24.0 11.1 Married/with partner 68.9 85.4 Separated/divorced 3.3 1.5 Widowed 3.8 2.0 No schooling 6.6 14.3 Primary 5.3 16.8 Incomplete Secondary 6.6 9.9 Completed Secondary 31.3 26.7 Vocational/Special Secondary 20.7 4.2 Higher 29.5 28.1 MATS SCHOOL OF BUSINESS, BANGALORE 30 Demography of households Criteria Age Disability Chronic illness Household size (continued) Household Heads Lagos % Kano % 18 to 34 34.4 35.3 35 to 44 36.4 30.1 45 to 65 25.8 31.9 Over 65 3.4 2.7 Household heads 0.7 3.2 All members 0.6 1.6 Household heads 17.4 32.6 All members 25.4 30.9 4 or less 62.0 32.5 5 18.0 23.9 More than 5 SCHOOL OF BUSINESS, 20.0 MATS 43.6 BANGALORE 31 Source of income Lagos % Kano % 38.1 Permanent Temporary 35.7 29.4 6.3 Trade Activities Skilled Labour Agriculture Services Livestock Manufacturing 53.8 41.3 5.7 2.4 3.4 0.6 0.4 57.4 36.5 6.2 9.3 2.6 2.3 0.5 Pensioners 1.7 1.9 Social benefits/grants 0.6 1.2 Employed Self employed Remittances 8.4 External 4.4 Internal 4.0 MATS SCHOOL OF BUSINESS, BANGALORE 30.9 7.2 14 0.7 0.7 32 Poverty level – by poverty scoring Lagos % Kano % - 2.0 Poor 13.4 44.4 Vulnerable poor 66.6 52.4 Vulnerable non-poor 20.0 1.2 Extreme poor MATS SCHOOL OF BUSINESS, BANGALORE 33 Monthly earning MONTHLY HOUSEHOLD INCOME Lagos % Kano % Below N 20,000 6.5 8.4 N 20,000 to N 30,000 5.3 40.8 N 30,001 to N 40,000 1.2 19.5 N 40,001 and N 50,000 2.0 13.8 Above N 50,000 4.0 17.5 81.0 - Did not answer/could not decide MATS SCHOOL OF BUSINESS, BANGALORE 34 Monthly disposable income MONTHLY DISPOSABLE INCOME Lagos % Kano % Below N 1,000 0.7 9.0 N 1,001 to N 2,000 1.3 10.9 N 2,001 to N 3,000 4.0 19.3 N 3,001 to N 4,000 2.5 11.1 N 4,001 to N 5,000 1.8 6.4 N 5,001 to N 6,000 1.2 2.2 N 6,001 to N 7,000 1.2 3.7 N 7,001 to N 8,000 0.5 4.0 N 8,001 to N 9,000 0.5 4.2 N 9,001 to N 10,000 0.5 3.0 Above N 10,000 MATS SCHOOL OF BUSINESS, 4.8 BANGALORE 26.2 35 Risk events faced – in past 3 years RISK EVENTS FACED IN PAST 3 YEARS 100.0 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 - 92.1 70.2 39.8 15.9 Lagos 18.3 5.8 Kano 14.3 10.3 8.8 8.1 7.0 8.6 5.2 3.0 3.7 3.5 4.1 2.7 ty er op pr of ry be ob d t/r te ef ec Th xp ne r -u ne th in w ea d D ea e br om of nc th fi y o ea er D ce rg ur su so d an of n ss io Lo at li s b a t i jo t sp of en ho ss m ng Lo at i ri t re qu d re an ss n io ne l at Il l ra u li s at i ta -n sp th ho ea ng D i ri qu re ss ne Il l s es il ln or in M MATS SCHOOL OF BUSINESS, BANGALORE 36 Risk events faced more than once – in past 3 years RISK FACED MORE THAN ONCE IN PAST 3 YEARS 60.0 49.9 50.0 43.7 40.0 Lagos 30.0 Kano 22.7 17.9 16.5 20.0 7.9 10.0 1.7 3.2 2.0 2.0 M in or il ln es s Il ln es s re qu i ri Il ln es s ng re qu i ri ho sp i ta li s at io n MATS Il ln es s ng ou t -p at ien tv an d re qu i ri is i t Th ef t/r ng ho sp i ta li s at io n t re t m BUSINESS, SCHOOL aOF en t BANGALORE ob be ry an d of pr op er ty su rg er y 37 - Risks most difficult to cope with in past 3 years RISK EVENTS MOST DIFFICULT TO COPE WITH 19.8 4.3 3.3 5.9 5.1 4.4 4.20 1.66 Death of the bread-winner 8.9 Damage to property/assets Illness requiring hospitalisation and treatment Illness requiring out-patient treatment 7.8 Lagos Death - natural 22.5 16.3 Illness requiring hospitalisation and surgery 29.8 26.4 Minor illness 35.0 30.0 25.0 20.0 15.0 10.0 5.0 - MATS SCHOOL OF BUSINESS, BANGALORE Kano 38 Minor illness – number of times faced in past 3 years MINOR ILLNESS - NO OF TIMES FACED BY HOUSEHOLDS IN PAST 3 YEARS 45.7 39.9 50.0 40.0 42.2 29.8 26.5 30.0 Kano 20.0 10.0 Lagos 7.9 3.0 4.0 0.8 0.2 None Upto 10 times 11 to 20 times Above 20 times MATS SCHOOL OF BUSINESS, BANGALORE Hard to say 39 Source of funds - in past 3 years WHERE DID YOU FIND THE MONEY 80.5 78.8 Lagos 1.8 4.2 0.8 3.7 1.7 2.2 10.9 2.2 Insurance Getting Additional Job No coping action taken Selling Animals,fruits and others 1.3 6.9 Donation from relatives and friends Kano Using own fund,depleting savings 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 - MATS SCHOOL OF BUSINESS, BANGALORE 40 Knowledge about insurance products KNOWLEDGE OF INSURANCE PRODUCTS 36.5 33.4 49.4 34.9 Lagos 22.8 3.6 0.5 Life Kano 4.0 5.7 Accident/Disability Property - vehicle Health 7.4 Do not know any of insurance product 60.0 50.0 40.0 30.0 20.0 10.0 - MATS SCHOOL OF BUSINESS, BANGALORE 41 Name of Insurers LAGOS KANO 1 AIICO 1 Capital 2 Niger Insurance 2 Law and Rock 3 IGI 3 Finin 4 Leadway 4 Nicon 5 Nicon 5 Union 6 Standard Alliance 6 Trustway 7 Royal Exchange 7 Leadway 8 Oasis 8 Access 9 Cornerstone 9 Royal Exchange 10 Great Nigeria 10 AIICO MATS SCHOOL OF BUSINESS, BANGALORE 42 Did you have any insurance – in past 5 years INSURANCE USAGE IN PAST 5 YEARS 100.0 88.6 81.1 80.0 60.0 Lagos 40.0 Kano 20.0 10.9 8.4 7.1 2.5 0.9 0.5 - No Used to have Have now Hard to say MATS SCHOOL OF BUSINESS, BANGALORE 43 What type of insurance you had – in past 5 years WHAT TYPE OF INSURANCE YOU USED TO HAVE/HAVE NOW 10.0 8.0 8.9 6.8 6.9 6.0 Lagos 3.2 4.0 Kano 2.3 2.0 0.5 0.5 - Health Property vehicle Life Livestock MATS SCHOOL OF BUSINESS, BANGALORE 44 Which concept product will you buy - % LAGOS % KANO % Health 73.2 69.6 Property 25.8 31.4 Life 29.1 14.6 Funeral 22.5 7.2 MATS SCHOOL OF BUSINESS, BANGALORE 45 Priority PRIORITY IN SELECTING INSURANCE PRODUCT 70.0 61.7 60.0 50.0 40.6 40.0 Lagos 24.9 30.0 23.1 20.0 Kano 22.0 10.6 12.5 4.6 10.0 Health Property Life Funeral/Burial MATS SCHOOL OF BUSINESS, BANGALORE 46 Preferred frequency of payment FREQUENCY OF PREMIUM PAYMENT 60.0 53.1 51.1 50.0 40.0 Lagos 27.8 27.4 30.0 Kano 20.0 7.9 10.0 10.4 5.0 7.7 6.1 3.5 Monthly Quarterly Half-yearly Yearly Hard to say MATS SCHOOL OF BUSINESS, BANGALORE 47 Health insurance – how many people HEALTH INSURANCE - HOW MANY PERSONS TO BE INCLUDED 30.0 25.0 20.0 15.0 10.0 5.0 - 27.7 9.0 6.4 13.5 11.5 13.8 19.9 22.2 18.1 18.4 16.7 Lagos 13.3 7.2 Kano 2.1 1 Person 2 Persons 3 4 5 Persons Persons Persons 6 and above Persons MATS SCHOOL OF BUSINESS, BANGALORE Hard to say 48 Attitude towards insurance WHY DIDN'T YOU BUY INSURANCE 35.0 30.0 25.0 20.0 15.0 10.0 5.0 - 31.1 31.6 23.5 13.1 8.3 I never though I don't know of insurance how insurance works; I need more information 14.1 I never heard about insurance Lagos 5.1 8.6 Kano No body approached me to buy insurance MATS SCHOOL OF BUSINESS, BANGALORE 49 Attitude towards insurance - Kano 2.7 Insurance too expensive, no trust in insurers, long and difficult to collect claims from insurance company Believes in the benefits of insurance Insurance is a waste of money 4.2 Unaware Misinformed Uneducated Never thought about insurance, would like to know more about insurance, does not know where to buy insurance 93.1 MATS SCHOOL OF BUSINESS, BANGALORE 50 Attitude towards insurance Insurance is a waste of money Insurance too expensive, no trust in insurers, long and difficult to collect claims from insurance company Believes in the benefits of insurance 11.4 - Lagos Other reasons for not buying insurance 0.3 11.1 Never thought about insurance, would like to know more about insurance, does not know where to buy insurance Unaware Misinformed Uneducated Other reasons 77.2 MATS SCHOOL OF BUSINESS, BANGALORE 51 Market development projection MARKET DEVELOPMENT PROJECTIONS 60.0 50.0 40.0 30.0 20.0 10.0 - 55.1 44.2 32.6 23.2 15.1 Market available now Lagos 20.5 8.1 Market ready Market that can for expansion be created in future through awareness building Kano 1.2 Market not available MATS SCHOOL OF BUSINESS, BANGALORE 52 Regulatory issues Insurance regulations in Nigeria How regulations can help growth of microinsurance MATS SCHOOL OF BUSINESS, BANGALORE 53 Thank you… for the Central Bank of Nigeria Mosleh U Ahmed FCA GIZ Consultant Mosleh.ahmed@btinternet.com MATS SCHOOL OF BUSINESS, BANGALORE 54