Intro Lecture Slides Class

advertisement

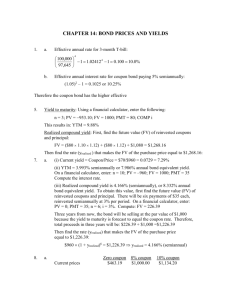

MBA 515 Financial Management Today’s class... • Introductions and house keeping • Review of 507 concepts My Background • NAME: Ken Shah • PhD: University of Oregon • INDUSTRY EXPERIENCE: – 4 yrs Floor Trader / Stock Broker - Bombay Stock Exchange – 3 yrs Quantitative Portfolio Management Research, Portland, Oregon Academic Experience • Taught at – University of Oregon – University of Auckland – Southern Methodist University • Courses in capital budgeting, corporate finance, investments, and money and banking Recent Research • Analyst Forecasts • Bond Returns • Capital Structure • Initial Public Offerings Please Introduce yourself... • Please fill out the student information sheet • Drop by my office! • Information sheet with photo next class Information Sheet • Attach a photo/photocopy of a photo • Tell me about yourself, if you like – present career, goals, etc. • Tell me about any anticipated absences • Any other special concerns/considerations Course Objectives • Build on MBA 507 concepts • How investment and financing decisions affect firm value • Valuation, Sources of financing, and Capital structure Course Prerequisites • Understanding of: – – – – Financial statements Discounting of cash flows Spreadsheets Rudimentary statistics • Pre-requisites: MBA 500-512 Texts • Required: – Class packet at CopyMart – Lecture notes on the class web page • Optional: – Brealey & Myers, Principles of Corporate Finance – Damodaran, Investment Valuation (Advanced reading) Evaluation • • • • Final Exam Homeworks Class Participation TOTAL 300 600 100 1000 Grading Policy • If you attend all classes and diligently complete all required work, you would be assured of a Bgrade • In order to get an A/A-, you must show work of superior quality and make a meaningful contribution to the class discussions – roughly 15% of the class Class Attendance • Mandatory • Please inform me of anticipated absences – First absence will not affect your grade – Each subsequent absence will adversely affect your grade by half grade point for each absence HW Assignments • A group of 3 students turns in one solution – Group work is required • Each member should make copies of assignment prior to turning in to facilitate discussion Review • • • • • • Discounted Cash Flow/Time Value of Money Bond Valuation Stock Valuation NPV CAPM Capital Budgeting DCF/TVM • PV and FV of a lump sum • PV and FV of Annuities • PV and FV combined • Perpetuities PV and FV of a lump sum FVt PV 1 r t • ‘r’ and ‘t’ must match • If t is # of months, r must be a monthly rate TVM example • How many years does it take to double your $100,000 inheritance if you can invest the money earning 11% compounded annually? Answer: 6.64 years PV of Annuity 1 1 (1 r ) t PVofAnnuity C r • Again: ‘r’ and ‘t’ must match • If t is # of months, r must be a monthly rate, and C is the payment per month PV of Annuity: Mortgage payments • • • • House cost $250,000 Mortgage Rate = 7.5% annually Term of loan = 30 years Payments made monthly • What are your payments? • Answer: $1748.04 FV of Annuity 1 r 1 FVofAnnuity C r t • Again: ‘r’ and ‘t’ must match • If t is # of months, r must be a monthly rate, and C is the payment per month FV of Annuity Example • You will contribute $400 per month for the next 35 years into a retirement savings plan. If your money earns 12% interest per year, how much will you have accumulated at retirement? • Answer: $2,572,383 • How much must you contribute in an IRA per month to have an amount in 20 years that will provide an annual income of $200,000 per year for 10 years? Interest rate is 8% per year. • Answer: $2,278.28 Perpetuity C PV r • Note: C and r measured over same interval Perpetuity Example • Preferred stock pays $1.00 dividend per quarter. The required return, r, is 10% per year. • What is the stock value? • Answer: $40.00 Review: Bond Valuation • Fixed periodic coupon payments – Typically semi-annual • Principal payment at maturity • Yield to maturity (YTM) is that discount rate which makes the PV of all cash flows equal to the price Bond Price C C 1 2 F+C T 1 1 C F BondValue C . C. ... 2 T 1 r (1 r ) (1 r ) (1 r ) T T C BondValue t t 1 (1 r ) F (1 r ) T Example • $1000 par bond maturing 15 years from today has an annual coupon rate of 53/4 % paid semiannually. Required return on bond (r) is 7.5% per year compounded semiannually. • • • • What is the value today? Answer: $843.99 If price is 104% of par, what is its YTM? Answer: 5.36% Coupon Rate • Coupon Rate = Annual Coupon Payment Face Value • Coupon rate is always quoted annually • Example: 4 3/4% ATT 09 – 4 3/4% is the coupon rate Yield to Maturity (YTM) • It is the yield ‘r’ calculated when market price of bond is known • If – bond is held to maturity, AND – bond does not default, AND – bond is not called • then, – YTM is the return an investor earns on the bond – YTM is the ‘best guess’ of an investor’s expected return Current Yield • An approximation of YTM Curr. Yld. = Annual Coupon Payment Market Price • Reported for Corporate bonds in the WSJ Important to... • Distinguish between: – Yield To Maturity – Coupon Rate – Current Yield • They are not all the same!! Bond Rates and Yields • Suppose a bond currently sells for $932.90. It pays a semi-annual coupon of $35, and it matures in 10 years. It has a face value of $1000. What are its coupon rate, current yield, and yield to maturity (YTM)? 1. The coupon rate (or just “coupon”) is the annual dollar coupon expressed as a percentage of the face value: Coupon rate = $____ /$_____ = 7.00% 2. The current yield is the annual coupon divided by the current market price of the bond: Current yield = $___ _/_____ = 7.50% 3. The yield to maturity is = 7.99% Review Stock Valuation • Residual ownership • Uncertain dividends – Dividends must be estimated • Voting rights • CAPM gives us a way to estimate the required return on a stock Dividend Discount Model (DDM) Dm D1 D2 P0 ... ......... 2 m 1 r (1 r ) (1 r ) • r = required rate of return on stock • ALL future dividends must be estimated – “ from here to eternity!!!” • Of little practical importance Note • Stock value is the PV of all future expected dividends • Stock value is NOT the PV of all future expected earnings or EPS – Unless a company pays out all earnings as dividends • Which implies that there is no growth Constant Growth DDM D1 P0 rg • Notice it is much simpler to estimate: • You need only THREE inputs: D1, r, g Caution • Constant growth model is simple but inappropriate model to use for many or most companies that have abnormal growth phases • Constant growth model is appropriate only for stable, mature companies like utilities • Constant growth model is often used to estimate the steady-state terminal values in a multi-stage growth model of valuing stocks Example • Kinesis Keyboard: D0 = $0.50 Super growth in years 1 to 5: 55% Thereafter, constant growth of 11% r = 18% What is the current stock price? • Answer: ________ Calculate dividends and terminal value 0 1 2 3 4 5 + • Now you have all the numbers needed • Fill in the boxes • Show all the dividends and P5 on the time line 6 Using your calculator (HP 10B/12B) • Enter CF0 as: Enter CF1 as: • Enter CF2 as: • Enter CF3 as: • Enter CF4 as: • Enter CF5 as D5 + P5: • Enter interest rate • Hit • Answer: $ 49.68 $0.0000 $0.7750 $1.2013 $1.8619 $2.8860 $75.4071 11 Shift CFj CFj CFj CFj CFj CFj I/YR NPV Review of NPV • NPV is the dollar value added to the enterprise – it’s the amount by which the enterprise is richer! • For public companies, NPV is the increase in total market value of equity • Managers should not take negative NPV projects since it reduces the firm value NPV Formula CF1 CF2 CF3 CFn NPV CF0 .... 2 3 1 r (1 r ) (1 r ) (1 r ) n • ‘r’ has many names: – ‘r’ is called the discount rate or – ‘r’ is called the required return or – ‘r’ is called the cost of capital Computing NPV on calculator • Use the CFj key – First entry is at time 0 – Subsequent entries are time 1, 2, 3, ... and so on – make sure the cash flows have the proper signs • Enter ‘r’ as the I/YR NPV • Use the keys Discounting Cash Flows • ALWAYS USE A DISCOUNT RATE THAT REFLECTS THE RISK OF THE CASH FLOWS THAT YOU ARE DISCOUNTING • ‘r’ in the denominator should reflect the risk of the CFt in the numerator • ‘r’ reflects the risk of the investment, not the risk of the investor! CAPM • The main contribution of CAPM is to derive an exact relation between risk and return • The main message of CAPM is that – Investors hold fully diversified (market) portfolio – Diversified portfolios have no unsystematic risk – Therefore, for individual securities, risk is measured by the contribution that security makes to the risk of the (market) portfolio, i.e., systematic risk or beta Portfolio Diversification Average annual standard deviation (%) 49.2 Diversifiable risk 23.9 19.2 Non-diversifiable Risk 1 10 20 30 40 1000 Number of stocks in portfolio CAPM Equation E ( Ri ) R f E Rm R f i • [E(Rm) – Rf] = Market Risk Premium (MRP) • Rf = Risk Free rate • βi = stock beta Asset expected return E (Ri) The Security Market Line (SML) = E (RM ) – Rf E (RM) Rf Asset beta 0 M = 1.0 Review of Compounding • To compound or not to compound - that is the question!! • Compounding means reinvesting the proceeds • SEC requires funds and investment managers to report returns that account for compounding EAR m (QuotedRate) EAR 1 1 m m = number of compounding periods in a year EAR on Calculator • What is the EAR for quoted rate of 15% per year compounded quarterly? • Set number of periods per year: 4 P/YR I/YR • Enter quoted annual rate: 15 EFF% • Compute EAR: • Answer: 15.865% EAR Example • Compute EAR for 12% compounded – – – – Annually Quarterly Monthly Daily • Answers: ____ , ____ , ____ , ____ Holding Period Return • A measure of how you did as a result of investing at P0, selling at Pt and receiving a cash flow of Dt (e.g. dividends, interest) Pt P0 Dt HPR P0 • Can be measured over any interval Example • Purchased ITT March 5, 2000: • Sold ITT June 5, 2002: • Total Dividends: • HPR = _________% • Note: This is a 9-quarter return $46.00 $68.25 $ 6.00 Average Return (from large to small interval) • Average Return: R 1 HPR 1/ n 1 ITT Example (contd.) • What is the average quarterly return? Ans:_________% • What is the average annual return? Ans:_________% Total Return (from small to large interval) • Example: 1st year return: 2nd year return: +100% -50% • What is the average annual return? • What is the terminal value of $100 investment above? Example shows... • Simple averages are misleading • Simple averages do not take into account the effect of compounding Total Return (from small to large interval) HPR1ton n (1 R1 )(1 R2 )(1 R3 )...(1 Rn ) 1 (1 Ri ) 1 i1 PERIOD 1998 1999 2000 2001 2002 HPR -0.31 0.96 0.19 0.41 0.55 SIMPLE AVG 0.14 PRODUCT OF (1+R) CMPD AVG ANNUALLY CMPD AVG QTRLY CMPD AVG MNTHLY 1+Ri 0.69 1.96 1.19 1.41 0.45 VALUE OF $100 INVESTMENT $69.00 $135.24 $160.94 $226.92 $102.11 = 14% 1.0211 = 2.11% HPR OVER 5 YEARS 0.004192 = 0.4% ANNUALLY 0.001046 = 0.1% QUARTERLY 0.000349 = 0.03% MONTHLY Capital Budgeting • A transportation company is considering the replacement of several trucks to reduce down-time, thus providing better on-time delivery service. The existing trucks were purchase three years ago for $75,000 and are depreciated straight-line over their 8-year life to a book value of 15,000. They could be sold today for $35,000. New trucks would cost $100,000, have a five-year life and be depreciated for tax purposes to a $20,000 book value, also using straight-line depreciation. The company forecasts that the new trucks would reduce operating costs by $5,000 per year, in addition, increased customer satisfaction would add $20,000 per year to cash revenues. As long as the new trucks are around, the company must increase its inventory of spare parts which would cost $2,5000. At the end of five years, the new trucks would be sold for $25,000. The appropriate discount rate is 12 percent and the firm is in the 35% tax bracket. Should they invest in the new trucks? Cash flow calculation • • • • • Only incremental after-tax cash flows matter Ignore sunk costs, non-cash expenses Include all opportunity costs Include tax implication of depreciation Include inflow/outflow due to change in net working capital