Factors Shaping the Future of Global Agriculture

advertisement

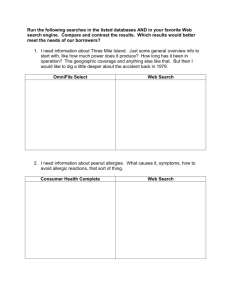

World Agricultural Economic and Environmental Services (WAEES) U.S. Peanut Industry Profile Patrick M. O’Brien December, 2013 Game Plan 2013/14 Summary 2014/15-2020/21 Baseline Make-or-Break Variables Cost of Production Exports 2013/14 Summary Receipts $/ac Returns over Variable $/ac Area Harvested mil/ac Yield lb/ac Production mil/lb Total Use mil/lb Export mil/lb Farm Peanut Price c/lb Peanut Oil Price $/lb 10/11 11/12 12/13 13/14 748 272 1,255 3,312 4,157 4,534 606 22.6 82 1,077 526 1,081 3,386 3,659 4,415 535 31.8 102 1,152 585 1,594 3,832 6,108 4,966 777 30.1 100 836 264 1,304 3,567 4,665 5,097 814 23.4 98 20/21 19/20 18/19 17/18 16/17 15/16 14/15 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 Peanut Receipts (Blue) and Returns (Red) Per Acre ($) 1400.00 1200.00 1000.00 800.00 600.00 400.00 200.00 0.00 20/21 19/20 18/19 17/18 16/17 15/16 14/15 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 Peanut Producer’s Income After Cash Costs ($ million) $1,000,000 $900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $- 2014/15-2020/2021 Baseline Average 2014/15-2020/21 Receipts $/ac Returns over Variable $/ac Area Harvested mil/ac Yield lb/ac Production mil/lb Total Use mil/lb Export mil/lb Peanut Price c/lb Peanut Oil Price $/lb 920 Large Volume/Disappointing Prices 325 Add COP Erosion in Returns 1,300 3,785 Trend Slowing in Percentage Terms 4,950 5,000 Population Growth/Stable Exports 765 Retrenchment at 12/13 & 13/14 Levels 24.3 Large Supplies/Stock Efficiency Gains 105 Spill Over Impact/Premium Position Make-Or-Break Variables--COP Cost of Production Spill Over Input intensive nature of peanut production drives costs of production up faster than producer prices even after adjusting for increases in yield Corn versus Peanut Unit Costs of Production Demonstrate a). spill over of costs from general farm economy and b). impact of slower yield growth for peanuts on unit costs 20/21 19/20 18/19 17/18 16/17 15/16 14/15 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 Peanut Costs of Production Per Acre ($) 650.00 600.00 550.00 500.00 450.00 400.00 350.00 300.00 Make-Or-Break Variables--Exports Exports Most Variable Element in Peanut Accounts Positive Factors: Slowing Growth in Production relative to Growth in Demand abroad Negative Factor: High U.S. prices make the U.S. the residual supplier in the current market setting Options for Expanding Export Growth: Making the U.S. the preferred supplier in the high-end market where quality commands buyer loyalty and price premium 19/20 18/19 17/18 16/17 15/16 14/15 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 99/00 98/99 97/98 96/97 95/96 94/95 93/94 92/93 Peanut Exports (1,000 tons) 1000 900 800 700 600 500 400 e.g…the China Market for Peanut Oil General Chinese Appeal: Income Distribution 1.3 billion with Incomes of $3,388 160 million in Middle Class with Incomes of $9,912 Middle Class Characteristics Interest in Consumer Goods Exploding From 1% of auto sales in 2000 to 13% currently 700 million cell phone subscribers Shopping as Favorite Leisure Activity (9.8 vs 3.6 hours per week) e.g…the China Market for Peanut Oil Middle Class Characteristics Food Quality and Safety Concern 50-75% convinced that food supply is not safe French Hagen Daaz Ice Cream 35 Yuan ($6) for 2 oz. cup (Brand Recognition with Mixed Chinese/English Labeling/No Counterfeits) New Zealand Fresh Milk 36 Yuan (vs 12 Yuan) per liter (New Zealand Package/ 48-hour Freshness Guarantee/Quality-Safety Assurance/No Counterfeits) e.g…the China Market for Peanut Oil “America’s Finest” Brand Sensitivity to Chinese Measures of Quality/Safety Identity Preservation Bulk with Licensed Distributor or Pre-packaged Licensed Distribution/Retail Marketing Stay out of common marketing channels/specialized supermarket channels Expect 3-5 Year Brand Building Effort Consider Cooperative Marketing Effort for “America’s Finest” as umbrella brand