Partnership-Notes2015-11-10 00:1721 KB

Partnership

(Textbook – Topic 8 pg. 337-377, Topic 19 pg.699-719)

Partnership Definition

Statutory definitions

Partnership Act 1891 -

Partnership is the relation which subsists between persons carrying on a sec 5 (1) business in common with a view of profit. Requires following elements:

1.

Existing relationship

2.

Relationship between persons who are (2 or more, can be people, company, etc)

3.

Carry on business in common – share rights and obligations

Kang v Paine (restaurant owner husband does nothing)

4.

View to make profit – Cribb v Korn (Korn paid Cribb half of proceeds of sale – which was Gross Profit. ie Gross profit is not enough to constitute a partnership, must be NET

Page #

339,701

Rules in determining partnership

Statutory definitions

Partnership Act 1891 -

Co-ownership rule – if two people own a business does not sec 6 (1a) necessarily constitute a partnership

Partnership Act 1891 - sec 6 (1b)

Partnership Act 1891 - sec 6 (1c)

Sharing of gross returns – if two people own a business does not necessarily constitute a partnership

Sharing of profits and losses – there is on “prima facie evidence” that a partnership exists

Lecture slide &

702

Lecture slide &

702

Lecture slide &

702

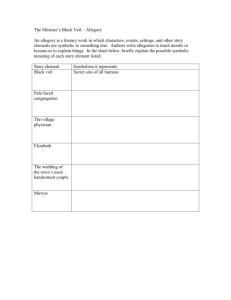

Liability of Partners to Outsiders – Power of partner to bind to firm

Statutory definitions

Partnership Act 1891 - sec 8

Each partner is BOTH a principle and an agent of the firm

Transactions entered by one partner will bind other partners into transaction, unless:

1.

The partner was acting without authority and the other party is aware of this, OR

2.

The other party does not know or believe that he or she is a partner is the business

Liability of Partners to Outsiders – In Contract

Statutory definitions

Partnership Act 1891 -

In contracts each partner is liable JOINTLY with all other partners for sec 12 (1) debts incurred by the firm while he or she is a partner

Partners are responsible for not just her share of debt but the whole amount

Liability of Partners to Outsiders – In Tort

Statutory definitions

Partnership Act 1891 - sec 13 (1)

In Tort each partner is JOINTLY and SEVERALLY liable

Partners bound by tortious acts:

1.

In the ordinary course of business

2.

With the authority of co partners

Page #

703

704

704

Company as a separate legal person

Salomon v Salomon

Salomon set up a business and was very successful. He then incorporated into a company limited by shares with his family and he was entitled to 20 000 shares as a secured creditor

He continued to make all decisions however eventually the business went bankrupt

Decision ruled that the business was a separate legal entity to

Salomon and he was entitled to be paid out by liquidators

365

Rights of Partners - Subject to individual partnership agreements

Sections

Sec 27 (1e)

Every partner has the right to take part in the management of the firm

Lecture notes

Sec 27 (1g)

Sec 27 (1i)

No person may be introduced as a partner without the consent of all existing partners

Lecture

Notes

Every partner has the right to inspect and copy the partnership accounts

Lecture

Notes

Corporate Veil

Corporate Veil ‘exists’ once a company is registered and it separates company from people who formed it

Assets

COMPANY

Separate legal entity with own:

Liabilities

Contracts

VEIL

MEMBERS & DIRECTORS

Members:

Own shares but not a proprietary interest in the company’s assets

May also be a creditor, debtor, or director of company

Have their own assets which are not in companies control

Directors:

Employed by the company

Owe duties to company alone

Lifting the Corporate Veil

Statue

Insolvent trading – ss588G -588M)

Uncommercial transactions – ss588FB-

588FF

Unreasonable director related transactions

Financial Assistance

When company continues to trade even though there were reasonable grounds for suspecting that it would not be able to pay its debts, the holding company can be liable.

Certain transactions that occur prior to a company going into liquidation are voidable. Where uncommercial transactions occur

(usually by a director) who receives benefit and the company incurs a debt, the corporate veil can be lifted

Transactions including payments, transfer of property or issue of securities made in favour of a director where a reasonable person would not have entered into the transaction, the corporate veil can be lifted

If the company provides “financial assistance” for the purchase of its shares, it is the person “involved in” the company’s contravention who is liable for a breach, not the company.

367

368

368

368

Lifting the Corporate Veil

Common Law

Fraud or Improper

Conduct/Purpose

Re Darby

Company formed to evade an existing obligation

Gilford Motor v Horne

Company is agent of the controller

Smith Stone Knight

(SSK) v Birmingham

Facts: Darby and another controlled Newco, which controlled Welsh

Slate. Newco sold a license to Walsh Slate for a manipulated lower price, which then led to others investing in Welsh Slate. Welsh Slate later went bust, still owing money to Newco for the license, and the liquidator tried to recover money from Darby personally

Held: the whole scheme was for fraudulent purposes; thus it is permitted in this circumstance to lift the corporate veil. The fraud was in sale price of license from Newco to Welsh, but also interference with contractual relations/improper conduct.

Facts: Gilford was a car manufacture business and Horne worked for it. He had a restraint of trade clause in his employment contract, but he ignored it after he left Gilford and started a competitor business.

He then set up a company in his wife’s name and tried to rely on the corporate veil to protect himself personally.

Held: the second company was ultimately held to be used by Horne to conduct his business in violation of the restraint of trade clause.

An equitable injunction was granted against Horne.

Facts: SSK was a paper manufacturer who also owned a factory which was being rented out to a subsidiary, Birmingham Waste. The

Council decided to compulsorily acquire the land and SSK lodged a claim for compensation (initially on behalf of BW, but then on their own claiming that BW were agents for SSK and that the loss will fall on SSK). The issue was whether SSK could claim compensation in this way (since a statutory ruled meant that BW couldn't claim since they were in the factory for less than a year).

Held: All 3 Elements must be satisfied.

369

369

369

1.

Holding Corporation controls, the board of subsidiary

2.

Holding Corporation controls more than half of the members of the subsidiary

3.

Holding Corporation controls more than half of the subsidiary assets

If all of these are met, there is no separation between holding and subsidiary.

Corporate Social

Responsibility

Briggs v James Hardie

In this case, the court found that all these questions were answered to the favour of SSK, so BW were deemed an agent and SSK were able to have the veil lifted and claim compensation.

Facts: Briggs was poisoned with asbestos and sued his former

employers’ holding company, James Hardie for negligence

Held: Case was settled before issue of veil being lifted. Important to talk about director duties of duty care and diligence.

369