Eve Carney

advertisement

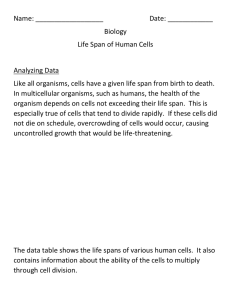

UGG Debriefing & Comparability Summary 2015 ESEA Directors Institute August 2015 Consolidated Planning & Monitoring Eve Carney Executive Director Janine Whited Director of Project Management Eve.Carney@tn.gov Janine.Whited@tn.gov Uniform Grants Guidance UGG Debriefing Uniform Grants Guidance: • Simplicity • Consistency • Obama Executive Order on Regulatory Review – Increase Efficiency – Strengthen Oversight Rationale Most Significant General Changes • Auditors (A-133 + federal OIG) and Monitors (federal and State PassThrough) must look more to “outcomes” than to “process” • The Omni Circular has a MAJOR emphasis on “strengthening accountability” by improving policies that protect against waste, fraud and abuse Required written policies/procedures Allowability – Cost Principles and Items of Cost Cost Principles: Factors Affecting Allowability • §200.403 All Costs Must Be: 1. 2. 3. 4. 5. 6. 7. 8. Necessary, Reasonable, and Allocable In conformance with federal law and grant terms Consistent with state and local policies Consistently treated In accordance with Generally Accepted Accounting Principles (GAAP) Not included as match Net of applicable credits Adequately documented Selected Items of Cost – Conferences • §200.432 (Updated) Allowable conference costs include rental of facilities, costs of meals and refreshments, transportation, unless restricted by the federal award New: Costs related to identifying, but not providing, locally available dependent-care resources New: But 200.474 “travel” allows costs for “above and beyond regular dependent care” Conference hosts must exercise discretion in ensuring costs are appropriate, necessary, and managed in manner than minimizes costs to federal award Selected Items of Cost – Travel • §200.474 (Changed) Travel costs may be charged on actual, per diem, or mileage basis Travel charges must be consistent with entity’s written travel reimbursement policies Grantee must retain documentation that participation of individual in conference is necessary for the project Travel costs must be reasonable and consistent with written travel policy / or follow GSA 48 CFR 31.205-46(a) Time and Effort Participants • All employees paid in part or in full with federal funds • Some employees paid with non-federal funds (state match) • Part-time employees • NOT contractors Part 200.28 Cost Objective – Defined What is a cost objective? • Program, function, activity, award, organizational subdivision, contract, or work unit for which cost data are desired and for which provision is made to accumulate and measure the cost of processes, products, jobs, capital projects, etc. What aren’t cost objectives? • • • • • Federal Programs Title I, Part A Doing my job ESEA Working on initiatives and programs that benefit Students with Disabilities • Director of Federal Programs • IDEA • Educating children in classrooms Multiple Cost Objectives Multiple Cost Objectives §200.430(vii) include working on More than one federal award A federal award and a non-federal award An indirect cost activity and a direct cost activity Two or more indirect activities that are allocated using different allocation bases An unallowable activity and a direct or indirect cost activity A-87 Standards – Current Rule • Semi-Annual Certifications If an employee works on a single cost objective: After the fact Account for the total activity Signed by employee or supervisor Every six months (at least twice a year) • Personnel Activity Report (PAR) If an employee works on multiple cost objectives: After the fact Account for total activity Signed by employee Prepared at least monthly and coincide with one or more pay periods 2 CFR Part 200 Standards – New Rule • Charges for salaries must be based on records that accurately reflect the work performed 1. Must be supported by a system of internal controls which provides reasonable assurance charges are accurate, allowable, and properly allocated 2. Be incorporated into official records 3. Reasonably reflect total activity for which employee is compensated and not exceed 100% 4. Encompass all activities (federal and non-federal) 5. Comply with established accounting polices and practices 6. Support distribution among specific activities or cost objectives New Rule – Compliance • If records meet the standards: the non-federal entity will NOT be required to provide additional support or documentation for the work performed 200.430(i)(2) • BUT, if “records” of grantee do not meet new standards, ED may require PARs 200.430(i)(8) PARs are not defined Questioned costs must be repaid using state/local funds • Recommend maintaining current system of documenting personnel expenses until these new standards have been audited Budget Estimates and Percentages in Documenting Personnel Activities / Reconciliation • Budget estimates alone do not qualify as support for charges to federal awards §200.430(i)(1)(viii) • May be used for interim accounting purposes if: Produces reasonable approximations Significant changes to the corresponding work activity are identified in a timely manner • NEW: Percentages may be used for distribution of total activities §200.430(i)(1)(ix) • NEW: All necessary adjustments must be made such that the final amount charged to the federal award is accurate, allowable, and properly allocated §200.430(i)(1)(viii)(C) • Annually, reconciliation assures allocability – charging the federal award only for the benefit received. De Minimis Benefit • Limited work on another cost objective does not need to be captured in time and effort records. • Employees may work 5% or less on another cost objective. • The worked performed on these limited duties cannot deprive a benefit from the intended beneficiaries. • EXAMPLE: A teacher works on a single cost objective but also has limited other responsibilities, such as cafeteria or bus duties. – As long as these additional responsibilities do not exceed 5% over a twelve-month period, then the teacher can still complete a semi-annual certification (single cost objective) Financial Management Controls: Key Components Internal Controls • §200.303 – Internal Controls must ensure compliance with federal statutes, regulations, and terms of the award. • Entities must: Evaluate and monitor compliance Take prompt action when instances of non-compliance are identified; and Safeguard protected personally identifiable information (PII) • Effective control over and accountability for: 1. All funds 2. Property 3. Other assets NEW: Written Cash Management Procedures • Written Procedures required to implement the requirements of 200.305 • Written procedures must include a description of the method the district uses (Tennessee is a reimbursement state) • Must minimize time elapsing between reimbursement request and disbursement to comply with Cash Management Improvement Act (CMIA) New: Written Allowability Procedures • Written procedures required for determining allowability of costs in accordance with Subpart E – Cost Principles • Procedures can not simply restate the Uniform Guidance Subpart E • Should explain the process used throughout the grant development and budget process • Someone familiar with the program requirements should be involved with the allowability determinations, and the written procedures should include this (position, not name of employee) Financial Management Controls: Procurement Open Competition • §200.319 • All procurement transactions must be conducted with full and open competition (in Tennessee over 10,000) • T.C.A. states that the threshold of $10,000 or more for purchases. – Cumulative purposes anticipated to exceed $10,000 must be competitively bid • To eliminate unfair advantage, contractors that develop or draft specifications, requirements, statement of work, and invitations for bids or RFPs must be excluded from competing for such procurements Conflict of Interest • §200.112 • Must maintain written standard of conduct, including conflict of interest policy • A conflict of interest arises when any of the following has a financial or other interest in the firm selected for award: – – – – Employee, officer, or agent Any member of that person’s immediate family That person’s partner An organization which employs, or is about to employ, any of the above or has a financial interest in the firm selected for award Conflict of Interest • §200.112 • NEW: All non-federal entities must establish conflict of interest policies, and disclose in writing any potential conflict to federal awarding agency in accordance with applicable federal awarding agency policy Cost/Price Analysis • §200.323 • Must perform a cost or price analysis in connection with every procurement action, including contract modifications • NEW: Only required for costs in excess of the simplified acquisition threshold ($150,000) – Cost analysis generally means evaluating the separate cost elements that make up the total price (including profit) – Price analysis generally means evaluating the total price – However, TN has a lower limit of $10,000 Vendor Selection Process • §200.320 • Methods of procurement: 1. 2. 3. 4. 5. NEW: Micro-purchase Small purchase procedures – N/A to Tennessee Competitive sealed bids Competitive proposals Non-competitive proposals Vendor Selection Process: 1) MicroPurchase • §300.320(a) • NEW: Acquisition of supplies and services under $3,000 or less • May be awarded without soliciting competitive quotations if nonfederal entity considers the cost reasonable • To the extent practicable must distribute micro-purchases equitably among qualified suppliers Vendor Selection Process: 2) Small Purchase Procedures – N/A to TN • Good or service that costs $100,000 or less (NEW: $150,000 under 200.88) TN has a lower threshold, $10,000; therefore this procurement method is Not Applicable • Must obtain price or rate quotes from an adequate number of qualified sources • “Relatively simply and informal” Vendor Selection Process: 3) Noncompetitive Proposals • Appropriate only when: – The good or services is available only from a single source (sole source) – There is a public emergency – The awarding agency authorizes – NEW: awarding agency or pass-through must expressly authorize noncompetitive proposals in response to written requires from nonfederal entity - 200.320(f)(3) – After soliciting a number of sources, competition is deemed inadequate • Cannot contract with vendor who has been suspended or debarred: http://www.sam.gov Contract Administration • §200.318 • Revised: Nonfederal entities, such as TDOE, must maintain oversight to ensure that contractors perform in accordance with the terms, conditions, and specifications of the contract – Contractors bound by terms of contract – Important to include appropriate terms and conditions – Manage for performance Use and Disposition of Grant-Acquired Equipment • §200.313 • Clarification: shared use is allowed if such use will not “interfere”: 1st preference – other projects supported by the federal awarding agency 2nd preference – project funded by other federal agencies 3rd preference – use for non federally funded programs • When property no longer needed, must follow disposition rules: Transfer to another federal program Over $5,000 – pay federal share Under $5,000 – no accountability Requirements of the Pass-Through Entity Federal awarding agency review of risk posed by applicants • §200.205 • NEW: ED and “Pass-Through” must have in place a framework for evaluating risks before applicant receives funding 1. 2. 3. 4. 5. Financial Stability Quality of Management System History of Performance Audit Reports Applicant’s Ability to Effectively Implement Program Federal awarding agency review of risk posed by applicants • §200.205 • ED or “Pass Through” May Impose “additional federal award conditions”: Require reimbursement; Withhold funds until evidence of acceptable performance; More detailed reporting; Additional monitoring; Require grantee to obtain technical or management assistance; or Establish additional prior approvals Monitoring and reporting program performance • §200.328 • NEW: Monitoring by the “Pass Through” • Monitor to assure compliance with applicable federal requirements and performance expectations are achieved • Must cover each program, function or activity (see also 200.331) • Must submit “performance reports” at least annually Resources • Uniform Grants Guidance: http://www.gpo.gov/fdsys/pkg/FR-2013-1226/pdf/2013-30465.pdf • COFAR: https://cfo.gov/cofar/ • OCFO Time and Effort Guidance: http://www2.ed.gov/policy/fund/guid/gposbul/time-and-effortreporting.html Resources • 2 CFR 200: http://www.ecfr.gov/cgi-bin/textidx?SID=6214841a79953f26c5c230d72d6b70a1&tpl=/ecfrbrowse/Titl e02/2cfr200_main_02.tpl – FAQs: http://www2.ed.gov/policy/fund/guid/uniform-guidance/faqed.pdf • EDGAR: http://www2.ed.gov/policy/fund/reg/edgarReg/edgar.html – Title 34, Code of Federal Regulations (CFR), Parts 75-79, 81 to 86 and 97-99. For awards made prior to 12/26/2014, EDGAR Parts 74 and 80 still apply. – For awards made on or after 12/26/2014, 2 CFR Part 200, which includes the substance formerly in parts 74 and 80, applies. Resources • ePlan: https://eplan.tn.gov/ Uniform Grants Guidance Training Videos: https://onedrive.live.com/?cid=4e040e5a9ca9cbb4&id=4E040E5A9CA9CBB4!121&Bsrc= Share&Bpub=SDX.SkyDrive&sc=Photos&authkey=!AmuTdskCXMWsAvc NOTE: The videos are not to be used for any other purpose nor shared with anyone outside of the department or LEA. Comparability Summary: Clarifications Basic Premise of Comparability The basic premise of comparability is to ensure the LEA can demonstrate that state and local funds used to provide services at Title I schools are at least comparable to the services at non-Title I schools. Comparable State & Local Funds with Supplemental Title I Funds SUPPLEMENTAL Title I Funds are Like the Cherry On Top of State & Local Funds Title I Title I Title I Non-Title Non-Title Non-Title Basic Premise of Comparability • Remember, the basic premise of comparability is to ensure the LEA can demonstrate that state and local funds used to provide services at Title I schools are at least comparable to the services at non-Title I schools. • For this reason, the grade span groupings used for comparing schools to demonstrate comparability are very important. • Grade span groupings must match the basic organization of schools in the LEA. Grade Span Grouping • Defined grade span groupings for comparability must take into consideration which grades the LEA serves with Title I funds. • For instance, if the Title I schools in the LEA serve only grades K-8, but not grades 9-12, the comparability calculations only need to include the Title I and/or non-Title I elementary and middle schools, but not the non-Title I high schools. • However, if a school crosses multiple grade span groupings where any grades in the LEA are served with Title I funds, it must be included in one of the grade span groupings of the basic organizations of the LEA. Grade Span Grouping • If the LEA has multiple schools serving grades that cross more than one of the basic grade span grouping configurations, and at least one of those schools is a Title I school, those schools may be compared as a separate grade span grouping. • For example, if the LEA's basic organization primarily includes schools serving grades K-5, 6-8, and 9-12, the LEA would have three grade span groupings. • Additionally, if the LEA also has two schools serving K-8, and at least one of those schools is a Title I school, the LEA would have four grade span groupings – the fourth being K-8. Schools Crossing Grade Span Groupings • No school may be excluded from comparability simply because it crosses multiple grade span groupings. • For instance, if the LEA's basic organization primarily includes schools serving K5, 6-8, and 9-12, the LEA would have three grade span groupings. • If the LEA also has only one K-6 school, the school could be included in the K-5 grade span grouping but K-6 could not be identified as a separate grade span grouping. • Likewise, if the LEA has two K-8 schools, but both are non-Title I schools, the LEA would still have only three grade span groupings for comparability because at least one of those K-8 schools is not a Title I school. Options for Schools Crossing Grade Span Groupings • If a school serves grades that cross more than one grade span grouping, the LEA has the following options for including the school in comparability determinations: – OPTION 1: Include a school in the grade span grouping with which the school has the most grades in common: • • • • A K-6 school could be compared within the K-5 grade span grouping. A K-8 school could be compared within the K-5 grade span grouping. A 6-12 school could be compared within the 9-12 grade span grouping. A K-12 school could be compared within the K-5 grade span grouping. Options for Schools Crossing Grade Span Groupings – OPTION 2: Divide the grades the school serves by the grade span groupings. Then include the school in each grade span grouping it crosses based on the grades: • A K-6 school could be compared within both the K-5 and 6-8 grade span groupings. – Grades K-5 would be compared within the K-5 grade span grouping. – Grade 6 would be compared within the 6-8 grade span grouping. • A K-8 school could be compared within both the K-5 and 6-8 grade span groupings. • A 6-12 school could be compared within both the 6-8 and 9-12 grade span groupings. • A K-12 school could be compared within the K-5, 6-8, and 9-12 grade span groupings. Options for Schools Crossing Grade Span Groupings – OPTION 3: If the LEA has multiple schools serving grades that cross more than one grade span grouping, and at least one of those schools is a Title I school, those schools may be compared as a separate grade span grouping. If all schools that serve grades crossing more than one grade span grouping are nonTitle I schools, option one or two must be used. Option three may not be used to exclude non-Title I schools from comparability determinations. Options for Schools Crossing Grade Span Groupings – OPTION 3: (cont.) Example for comparing multiple schools as a separate grade span grouping: • If the LEA has multiple K-8 schools, and at least one of those schools is a Title I school, the schools may be compared within a separate K-8 grade span grouping. • If none of the schools are Title I, option one or two must be used and the schools may not be compared as a separate grade span grouping. Grade Span Grouping Examples Example 1: – K-5 – 6-8 – 9-12 OR MAYBE Example 2: – K-5 – 6-8 – K-8 – 9-12 OR MAYBE Example 3: – K-6 – 7-8 – 9-12 • EXAMPLE 1: – All schools in the LEA are Title I schools. – The LEA has three K-5 schools, two 6-8 schools, and one 9-12 school, but also has one K-6 and one K-8 school. – Because the LEA has only one K-6 and one K-8 school, those schools cannot be separate grade span groupings, but must be compared within one of the three basic grade span groupings. Grade Span Grouping Examples Example 1: – K-5 – 6-8 – 9-12 OR MAYBE Example 2: – K-5 – 6-8 – K-8 – 9-12 OR MAYBE Example 3: – K-6 – 7-8 – 9-12 • EXAMPLE 2: – The LEA serves both Title I and non-Title I schools. – The K-5 and 6-8 schools are all served by Title I and one of two K-8 schools is served by Title I. There are two 9-12 non-Title I schools. – Because the LEA has multiple K-8 schools, and at least one of those schools is a Title I school, those schools may be compared as a separate K-8 grade span grouping. – Because none of the Title I schools in the LEA serve any grades 9-12, the high schools may be excluded from the calculations. Grade Span Grouping Examples Example 1: – K-5 – 6-8 – 9-12 OR MAYBE Example 2: – K-5 – 6-8 – K-8 – 9-12 OR MAYBE Example 3: – K-6 – 7-8 – 9-12 • EXAMPLE 3: – The LEA serves both Title I and non-Title I schools. – The LEA has four K-6 schools, three 7-8 schools, and two 9-12 schools, but also has one K-8 school and one 6-12 Title I school. – Because the LEA has only one K-8 and one 6-12 school, those schools cannot be separate grade span groupings, but must be compared within one of the three basic grade span groupings. Excluding Support Staff • If the LEA opts to exclude other personnel directly supporting instruction from comparability determinations, the exclusion must be consistent for all schools in the LEA. • Form III has been updated to provide a space for the LEA to indicate its intent to exclude all personnel directly supporting instruction from comparability. • The LEA must still submit Form III and note "EXCLUDED" in the space provided. Schools are Not Comparable • If the LEA is unable to demonstrate comparability by the October 31 deadline, the LEA must still upload all required forms by October 31 and a letter stating that the LEA was not able to demonstrate comparability and understands it must make necessary adjustments within the same school year. • If adjustments are required to demonstrate comparability, all new comparability forms and a letter stating what adjustments were made must be uploaded to ePlan no later than December 1 of the same school year. Uploading Files to ePlan • Forms I – IV are Excel files which must be completed and uploaded to the ePlan LEA Document Library / 2016 / Comparability folder. • Please do not print and scan Excel files. If Excel files are printed and scanned, the LEA will be requested to upload the completed Excel files. • Only Form V is to be printed, signed and scanned before it is uploaded to the ePlan LEA Document Library / 2016 / Comparability folder. Alternative Methods Documented • The standard method for demonstrating comparability is based on student/instructional staff ratio comparisons. • Any method approved must be one that does not compromise the intent of the law for demonstrating comparability. The October 31 deadline applies to all alternative methods. – – – – Alternative 1: Per Pupil Budgeted Instructional Expenditures Alternative 2: Student / Instructional Staff Salary Ratios Alternative 3: Large and Small Schools Alternative 4: High and Low Poverty • For assistance with alternatives, please contact CPM. Alternative Methods Documented • An alternative method may be considered with prior approval by TDOE. – Alternatives 1 & 2: Request for approval must be received by TDOE no later than October 15. – Alternatives 3 & 4: When requesting approval to use this alternative, the LEA must first submit all completed Forms I – V showing the results of the standard method. Request for approval must be received by TDOE no later than October 15. Comparability Support CPM Comparability Support • CPM Regional Consultants – Map of District Assignments 1) Corey Currie Corey.Currie@tn.gov (731) 234-5417 2) Janet (Michelle) Mansfield Janet.Mansfield@tn.gov (731) 225-3627 3) Bridgett Carwile Bridgett.Carwile@tn.gov (615) 626-3466 4) Courtney Woods Courtney.Woods@tn.gov (615) 864-5471 5) Deborah Thompson Deborah.Thompson@tn.gov (615) 864-5162 6) Jacki Wolfe Jacki.Wolfe@tn.gov (423) 262-3296 CPM & Finance Regional Consultant District Map STEWART OBION WEAKLEY HENRY MONTGOMERY GIBSON SCOTT HOUSTON WILSON DAVIDSON HUMPHREYS CARROLL CLAY MACON SUMNER JACKSON DICKSON DYER ROBERTSON SMITH OVERTO N WHITE WILLIAMSON HENDERSON MADISON TIPTON PERRY WARREN BEDFORD 1 FAYETTE Corey Currie, CPM Cindy Smith, Fiscal 120 200 240 350 360 380 390 490 550 570 680 792 840 Chester Decatur Fayette Hardeman Hardin Haywood Henderson 391 Lexington (PK-8) Lauderdale McNairy Madison Perry Shelby 793 Arlington 796 Germantown 794 Bartlett 798 Millington 795 Collierville 797 Lakeland Tipton 960 West TN School for Deaf HARDEMAN 2 McNAIRY HARDIN WAYNE Michelle Mansfield, CPM Brad Davis, Fiscal GILES LINCOLN Bridgett Carwile, CPM Rob Mynhier, Fiscal 3 COCKE 030 Benton 090 Carroll 092 Hollow RockBruceton 093 Huntingdon 094 McKenzie 095 South Carroll 097 West Carroll 170 Crockett 171 Alamo (PK-6) 172 Bells (PK-5) 230 Dyer 231 Dyersburg City 275 Gibson 271 Humboldt City 272 Milan SSD 273 Trenton 274 Bradford SSD 400 Henry 401 Paris SSD (K-8) 420 Houston 430 Humphreys 480 Lake 660 Obion 661 Union City 810 Stewart 920 Weakley 110 Cheatham 140 Clay 180 Cumberland 190 Davidson 210 DeKalb 220 Dickson 250 Fentress 440 Jackson 560 Macon 630 Montgomery 670 Overton 690 Pickett 710 Putnam 740 Robertson 800 Smith 830 Sumner 850 Trousdale 930 White 950 Wilson 951 Lebanon SSD (PK-8) 985 ASD 970 971 963 961 4 020 040 080 160 260 280 310 410 500 510 520 580 590 600 640 750 770 880 890 910 940 Dept of Children’s Serv. Dept of Corrections TN School for the Blind York Institute (9-12) SEVIER LOUDON COFFEE FRANKLIN JEFFERSON BLOUNT RHEA GRUNDY SHELBY KNOX CUMBERLAND ROANE MAURY LEWIS CARTER GREENE MORGAN HICKMAN HAYWOOD SULLIVAN HAWKINS UNION PUTNAM DEKALB CLAIBORNE CAMPBELL MARION Courtney Woods, CPM Brian Runion, Fiscal Bedford Bledsoe Cannon Coffee 161 Manchester (PK-8) 162 Tullahoma Franklin Giles Grundy Hickman Lawrence Lewis Lincoln 521 Fayetteville Marion 581 Richard City Marshall Maury Moore Rutherford 751 Murfreesboro (PK-6) Sequatchie Van Buren Warren Wayne Williamson 941 Franklin SSD (PK-8) McMINN MONROE Central Time Zone Eastern Time Zone POLK 5 Deborah Thompson, CPM Dustin Winstead, Fiscal 010 Anderson 011 Clinton (PK-6) 012 Oak Ridge 050 Blount 051 Alcoa City 052 Maryville 060 Bradley 061 Cleveland 070 Campbell 330 Hamilton 530 Loudon 531 Lenoir City 540 McMinn 541 Athens City (PK-9) 542 Etowah City (K-8) 610 Meigs 620 Monroe 621 Sweetwater (PK-8) 650 Morgan 700 Polk 720 Rhea 721 Dayton City (PK-8) 730 Roane 760 Scott 761 Onieda 6 Jacki Wolfe, CPM Jackie Broyles, Fiscal 100 Carter 101 Elizabethton 130 Claiborne 150 Cocke 151 Newport City (K-8) 290 Grainger 300 Greene 301 Greeneville 320 Hamblen 340 Hancock 370 Hawkins 371 Rogersville (K-8) 450 Jefferson 460 Johnson County 470 Knox 780 Sevier 820 Sullivan 821 Bristol 822 Kingsport 860 Unicoi Co 870 Union Co 900 Washington 901 Johnson City 964 East TN School for Deaf Revised 8/17/2015 Questions Feedback TASL Credit Keyword Questions? Feedback Survey • At the end of each day, please help us by providing feedback. • Today, please use the survey link below. – https://www.surveymonkey.com/r/2015-ESEA-Aug-26 TASL Credit • In order to receive 14 TASL credits for the 2015 ESEA Directors Institute, the participant must attend two full days, August 26 – 27. – Partial credit cannot be earned. – Use the form provided at the back of the agenda to collect keywords throughout the conference. – After the conference, go online to https://www.surveymonkey.com/r/2015-ESEATASL and enter your information. • You will not receive credit if you do not complete the online form by September 4, 2015. FRAUD, WASTE or ABUSE Citizens and agencies are encouraged to report fraud, waste or abuse in State and Local government. NOTICE: This agency is a recipient of taxpayer funding. If you observe an agency director or employee engaging in any activity which you consider to be illegal, improper or wasteful, please call the state Comptroller’s toll-free Hotline: 1-800-232-5454 Notifications can also be submitted electronically at: http://www.comptroller.tn.gov/hotline