(CbC) Reporting

advertisement

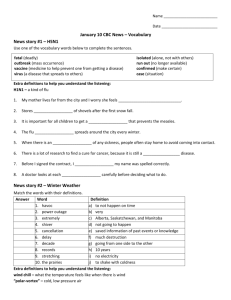

Complying with the new information reporting standards and getting comparable information for transfer pricing analysis Vienna, 13 -14 April 2015 Jeffrey Owens Table of Contents: • Country by Country Reporting: BEPS EU EITI Dodd Frank Act Technological Framework • • • • • • Transfer Pricing: Arm’s length Principle Conducting the Studies Databases Recent developments in Transfer Pricing Key Changes • • • • • • Conclusion SEITE 2 Country by Country (CbC) Reporting TP Master file CbC reporting: getting a good look inside What it is: Companies will have to provide tax authorities with countryspecific allocation of profits, revenues, employees and assets; worldwide adoption expected by 2017, though specific adoption deadlines will vary by country. What it is not: Not intended as a substitute for a full transfer pricing analysis, nor is it intended for use in formulary apportionment-based adjustments. But it will feed into tax audits. Next steps: CbC Reporting TP Local file CbC report Why this is an early focus: Because of the level of complexities involved with cross-border transactions, and data collection and management, many companies should begin preparing now, testing and validating processes and technologies. This will allow time to take mitigating steps – e.g., ensuring profit margin consistency (InterCompany Effectiveness) and minimizing potential controversy. Fully understand the requirements and how those requirements could be met with your current reporting efforts. Do a thorough analysis to understand what reporting gaps you might have and devise a strategic plan that allows enough time to ensure proper and accurate reporting. Country by Country (CbC) Reporting Key considerations How to source the data How to assess the data – the search for anomalies. For example: Rapid flow of new reporting and disclosure requirements have left both tax departments and software houses rushing to catch up Should parent company or local company GAAP be used as a basis for reporting? How can the company avoid misinterpretation of data, such as reporting ordinary profits in addition to profits after extraordinary items? Does the company have accurate information on global operations - including headcount, revenues and profits by country? Vendor market will catch up Moving from year 1 to sustainability – investment, integration, analytics Has the company identified features listed as potentially indicative of transfer pricing risk? Does the company have significant transactions with a low tax jurisdiction? Does the company have transfers of IP to related parties? Has the company experienced a business restructuring? Many companies approaching on a phased basis (Excel spreadsheet versus systems integration) OECD CbC template – main reporting table – country aggregated data Revenues Tax jurisdiction Unrelated party Related party Total Profit (loss) before income tax Cash tax paid (CIT and WHT) Current year tax accrual Stated capital Accumulated earnings 1. 2. 3. 4. 5. 6. 7. Etc. Notes: ► ► ► ► ► ► ► ► ► Aggregated rather than consolidated data Flexibility in data sources allowed Entity data aggregated on the basis of tax residence Revenue defined to include turnover, royalties, property, interest Revenue specifically excludes intercompany dividends Profit/loss before income tax includes extraordinary items Cash tax paid includes tax withheld by other parties on payments to the constituent entity Current year tax accrual is tax on current year operations only Number of employees may include external contractors Tangible assets other than cash and cash equivalents Number of employees OECD CbC template – table 2 – entity details 1. 2. 3. 1. 2. 3. Etc. Notes: ► ► Constituent entities rather than legal entities Multiple activities may be chosen Other Dormant Holding shares or other equity instruments Insurance Regulated financial services Internal group finance Provision of services to unrelated parties Admin., mgmt or support services Sales, mktg or distribution Mfg or production Purchasing or procurement Holding or managing IP Tax jurisdiction Constituent entities resident in the tax jurisdiction Tax jurisdiction of organization or incorporation if different from tax jurisdiction of residence R&D Main business activity(ies) Master file – information required Organizational structure Structure chart: ► Legal ownership ► Geographic location Intercompany financial activities Financial and tax positions Overall strategy description Financing arrangements for (related and unrelated) lenders Annual consolidated financial statements Supply chain of: ► Five largest products/ services by turnover ► Products/services generating more than 5% of sales List of important intangibles and legal owners Identification of financing entities List and description of existing unilateral APAs and other tax rulings Main geographic markets of above products List of important intangible agreements Details of financial transfer pricing policies List and brief description of important service arrangements R&D and intangible transfer pricing policies Functional analysis of principal contributions to value creation by individual entities Details of important transfers Business description Intangibles Important drivers of business profit Business restructuring/ acquisitions/divestitures during fiscal year Master file CbC report Local file Other analysis ► ► Global footprint by business activity Comparison of profit margins ► ► ► Income per head Tax rate comparison Related-party revenues ► ► Pie charts to illustrate “absolute amounts” Filters CbC Reporting under different frameworks: BEPS Under BEPS: Transmission process to occur via tax treaties; Slow Process, excludes developing countries with a small network CbC Reporting under different frameworks: EU Article 89 of Directive 2013/36/EU (CRD IV) introduces a new country-by-country public reporting obligation for banks and investment firms: Starting from 1 Jan 2015, these institutions will have to report annually, for each country in which they have an establishment, data on: (a) name(s), activities, geographical location (b) turnover (c) staff numbers (d) profit or loss before tax (e) tax on profit or loss and (f) public subsidies received. It also requires the Commission to conduct a general assessment as regards potential negative economic consequences of the public disclosure of country-bycountry data, including the impact on competitiveness, investment and credit availability and the stability of the financial system. CbC Reporting under different frameworks: EU ► EU: The Directive 2013/34/EU regulates how EU firms, including micro-companies, are to draw up their annual financial statements. It sets out new rules on: ► country-by-country reporting for the extractive (mining, oil, gas, etc) and logging sectors ► non-financial information to be provided by large EU companies. ► The 2002 International Accounting Standards Regulation and its implementing acts endorsing International Financial Reporting Standards stipulate that EU firms listed on regulated markets must prepare their consolidated financial statements in line with international standards designed by the IFRS. CbC Reporting under different frameworks: EITI Extractive Industry Transparency Initiative: The EITI requires the production of comprehensive EITI Reports that include full government disclosure of extractive industry revenues, and disclosure of all material payments to government by oil, gas and mining companies. Full disclosure of the taxes paid by licensed companies, as well as the corporate structure of the entity engaged in extractive industry is required. The Standard requires the disclosure of beneficial ownership information, and the maintenance of a “beneficial ownership registry” in the member jurisdiction. CbC Reporting under different frameworks: Dodd Frank Act Dodd Frank Act, Section 1504 requires all companies in the extractive industries to report all payments made to governments; Any oil, gas and mining company reporting to the SEC have to disclose payments: American and foreign companies Scope: Company branches; Consolidated entities of the covered company, including the company’s subsidiaries. “Entities under the control” of the covered company. For example, a joint venture in which the company has the right to control operations and policies. CbC Reporting under different frameworks: Dodd Frank Act Information published: Taxes (levied on profits, corporate income, and production) Royalties Fees (including license fees) Production Entitlements Bonuses Payments in kind Dividends Infrastructure Improvements (“ ex. building a road”) Disclosure of social payments encouraged Reportable payments: Payments made to: foreign government : including states, provinces, counties, districts, municipalities, territories, a department; agency; instrumentality; or a company owned by a foreign government. CbC Reporting under different frameworks: What does it mean? Multitude of systems increases compliance costs; Makes it more difficult to have a common technical platform; How to establish a single system of coordination to be shared by all the different players? Is one single reporting framework possible? CbC Reporting: The role of Technology Technology can help obtain grater synergies One single registry point to verify company’s substance and identify the members in a group? Cloud computing: Data could be fed into a cloud to store MNE’s information; New software base will have to be developed in order to support country files; How to guarantee that all this data will be stored over a long-term period without any leak? Safety is the biggest concern Transfer Pricing: The Arm’s Legnth Principle Comparability Factors Transfer Pricing Methods • Characteristics of property or services • Functional analysis • Contractual terms • Economic circumstances • Business strategies • Comparable Uncontrolled Price (“CUP”) Method • Resale Price method • Cost plus method • Transactional Net Margin Method (“TNMM”) • Profit Split Method SEITE 17 Conducting Transfer Pricing Study Identifying Inter-company Transactions • Goods Substantiation Transfer prices (documentation) • Services • Intangibles • Financial transactions Financial analysis Industrial analysis • Characteristics Company- and functional analysis Selection of Transfer Pricing method Comparability analysis • • • • • SEITE 18 Comparable Uncontrolled Price Resale price Cost Plus Transactional Net Margin Method Profit split Identification of Comparables Internal/external goods / services • Functions / risks / assets • Contractual terms • Economic circumstances • Business strategies Databases • OECD TP Guidelines 3.30 • “A common source of information is commercial databases, which have been developed by editors who compile accounts filed by companies with the relevant administrative bodies and present them in an electronic format suitable for searches and statistical analysis. They can be a practical and sometimes cost-effective way of identifying external comparables and may provide the most reliable source of information, depending on the facts and circumstances of the case.” • For example, Bureau van Dijk: public and private company data in comparable formats across 200 countries. Detailed financial data on 17 million companies across the globe and other functions. SEITE 19 Comparables Searches: Database Challenges • OECD TP Guidelines 3.31-3.34 • In practice, level of information on five comparability factors is less detailed for uncontrolled transactions • Limitation of databases - inaccuracy and incompleteness of trade descriptions, rigid format and limited information • Requirements for comparables (characterizations) - contract manufacturer, limited risk distributor, commissionaire, etc. • Database search versus other information and data sources (e.g. internet, trade/industry associations, industry guide) SEITE 20 Foreign Source Comparables • OECD TP Guidelines 3.35 • Taxpayers do not always perform searches for comparables on a country-by-country basis, e.g. in cases where there are insufficient data available at the domestic level. • Non-domestic comparables should not be automatically rejected just because they are not domestic. SEITE 21 Databases • The following databases are often used to search for external comparables: • TNMM (comparable companies): • • • Amadeus • Oriana, Orbis • US: Compustat, Mergent, OneSource • Russia: Ruslana External CUP – loan interest rates, guarantees: • LoanConnector / DealScan • Thomson Reuters • Moody’s RiskcalcTM External CUP – royalties: • SEITE 22 Power K, ktMINE, RoyaltyStat Amadeus • • • A database of comparable financial information for public and private companies across Europe Amadeus contains comprehensive information on around 19 million companies across Europe. What information does Amadeus contain? • Company information for both Western and Eastern Europe, with a focus on private company information • Company financials in a standard format so you can compare companies across borders • Financial strength indicators • Directors • Images of report and accounts for listed companies • Detailed corporate structures • Business and company-related news • M&A deals and rumors SEITE 23 Consider Before Starting the Research Who is the tested party (functions, risks, assets employed)? Which rejection criteria shall be used? Which factors drive revenue/profit? What are industry factors? Which database(s) should be searched? What about alternative data sources? Which ones are relevant? What verification of comparable data should be undertaken? What years should be included in analysis? SEITE 24 Recent Developments in Transfer Pricing ► 1. 2. 3. BEPS Action 8, 9 and 10 aim to assure that transfer pricing outcomes are in line with value creation. These include the development of: Rules to prevent BEPS by transferring risks among, or allocating excessive capital to, group members; Rules to prevent BEPS by engaging in transactions which would not, or would only very rarely, occur between third parties, including implementing transfer pricing rules or special measures to clarify the circumstances in which transactions can be recharacterized; and Transfer pricing rules or special measures for transfers of hard-tovalue intangibles. SEITE 25 Recent Developments in Transfer Pricing Key features of the proposed guidance include: ► Updated guidance on the identification of the commercial or financial relations; ► New guidance on identifying risks in commercial or financial relations; ► New guidance on the interpretation of the actual transaction; ► Updated guidance on re-characterization or nonrecognition of a transaction; and ► Options for potential special measures to reduce the possibilities for BEPS. SEITE 26 Key changes (1) Identify commercial or financial relations: use of comparability factors to accurately delineate the controlled transaction Actual transaction based on actual conduct Contractual terms versus factual substance Functional analysis: focus on activities and capabilities Allocation of risk: who is actually managing the risk Assumption of core risks – rooted in functions Risk management: (i) Decision making capacity to take on or decline a risk-bearing opportunity; (ii) Decision making capacity on whether and how to respond to risks; and (iii) the capability to mitigate risk. Examples: price risk raw materials, asset owning company SEITE 27 Key changes (2) Less emphasis on financial capacity Risk Transfers Limited for core risks Likely only if transferee is well or better placed to manage risks Non-recognition: lacking fundamental economic attributes each of parties reasonable expectation to enhance or protect their commercial or financial positions on risk-adjusted basis, compared to other opportunities realistically available to them SEITE 28 Summary Even with proposed changes certain BEPS risks may remain and transfer pricing outcomes may not be aligned with value creation. Main issues Information asymmetries between tax payers and tax administrations Relative ease of allocating capital to low taxed minimal functional entities Part II of the Draft presents five options for potential special measures to counter BEPS and align transfer pricing outcomes with value creation. No indication at this stage whether within or outside ALP Close interaction with action 3 (CFC) and action 4 (interest) SEITE 29 Thank you! THE AUTHOR WOULD LIKE TO THANK TATIANA SAMPAIO OCTAVIANO FALCAO FROM EY FOR HER HELP IN PREPARING THESE SLIDES SEITE 30