Key words for the paper: service quality, passenger car industry

advertisement

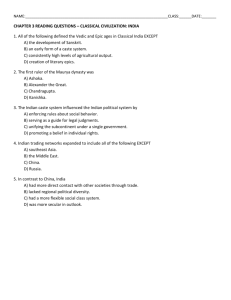

Title of the paper: Indian Passenger Car Industry and its service quality. The Name(s): 1. D.Muthukrishnaveni 2. Dr.D.Muruganandam Address(es): 1. Assistant professor(Sr.Gr), Department of management studies, Velalar College of Engineering and Technology, Thindal, Erode -638 012. 2. Associate professor, School of management studies, Kongu Engineering College, Perundurai, Erode- 638 052. Phone: 1. 9976661085 2. 9842552729 Fax numbers: - Email address(es): 1. muthukrishnaveni@gmail.com 2. muruganandam@kongu.ac.in Subject to be publish under: Management Key words for the paper: service quality, passenger car industry, service providers, consumers, perceptual problem. DECLARATION: The Manuscript has not been published or Submitted for publication elsewhere. INDIAN PASSENGER CAR INDUSTRY AND ITS SERVICE QUALITY 1. D.Muthukrishnaveni, Assistant professor (Sr.Gr), Department of management studies, Velalar College of Engineering and Technology, Thindal, Erode -638 012. 2. Dr.D.Muruganandam Associate professor, School of management studies, Kongu Engineering College, Perundurai, Erode- 638 052. ABSTRACT This study deals with the measurement of service quality of passenger car industry in India; it investigates the discrepancy between customers' expectations and perceptions towards the quality of services. The study was conducted using the SERVQUAL instrument. The results indicate that the sample population has perceptual problems with their companies providing services. Key words: service quality, passenger car industry, service providers, consumers, perceptual problem INTRODUCTION The Indian passenger car industry is zooming ahead with the price and fuel efficiency. Customers are driving the small and compact car segment. After a two-year cyclical slowdown, passenger car sales have started to accelerate. In the year 2003, India became the largest producer of small cars after Japan. It crossed the one million mark in FY 2004-2005. It is party time for Indian carmakers, specially the small and compact ear manufacturers, who achieved a growth rate of 20% in car sales in the domestic market and exports. Car sales in India is increasing at steady speed, in February 2009, monthly sales of passenger cars in India excelled 100000 units, which has crossed more 125000 unit sales in February 2010,With customers increasingly opting for quality, performance and features besides the price, the compact car segment has overtaken the small car segment. The small and compact cars together occupy around 80% of the Indian car industry, leaving the mid-segment and luxury care in terms of sales and volumes behind. The primary factor driving the car industry is THE RISING household income. This is fueled by the growth in the service sector. In economic terms, there is a strong correlation between car sales and GDP growth. With lucrative jobs being available to young people today, there is an increase in the disposable income, having more disposable income on hand, the aspiration of Indians to own a car is highest among the developing countries. Increasing urbanization and proportion of young people in the population coupled with improving consumer finance facilities with the entry of banks into car finance has come as a boon to the Indian car industry. Home car manufacturers too have started offering consumer finance facilities. These facilities are propelled by the reducing interest ratty in the economy. Reduction in the excise duties on cars has helped reduce their prices. At present, many models are available with the Indian car manufacturers at competitive prices and manufacturers are reducing the prices in the mid and compact segments to increase the sales volumes. Presently, there are 13 car manufacturers in the Indian Passenger car industry, most of them are MNCs, who entered India after the Indian economy opened up, Maruti is one of the few Indian manufacturers on the scene. Maruti occupies 50% of the market share in the mini and compact cars and is maintaining its share despite the stiff competition from manufacturers like Hyundai and Tata Motors, occupies over 20% of the market share in the small and compact car segment. The Indian car industry is dominated by Korean and Japanese automakers. Western carmakers such as Ford and GM have not been as successful as their Asian counterparts like Hyundai and Suzuki in the Indian market. After understanding the Indian market and its consumers, GM entered in the small car market BMW and Volkswagen are scouting for locations in India to setup manufacturing facilities. The Indian car industry is still in the growth and evolution stage and is depending on the domestic and regional market. But management of after sales services and consumer satisfaction is also become important issue in passenger car segment. Because service quality has received extensive attention in the of many researcher in the literature, mostly studies being carried out in a wide variety of industries such as the hospitals(Medical), hospitality industry and tourism (Babakus and Mangold, 1992; Soliman, 1992, Saleh and Ryan, 1992; fick and Ritchie, 1991), where quality service is highly required. The purpose of this study is to understand the consumer's expectations, and its role in improving service quality. Service Quality Model The process of managing for improved quality begins with understanding the customer's expectations. Service quality is the difference between what a customer expects and what is provided. The expectations/ perceptions conceptualization has been extended to incorporate "desires" in evaluating customer's perception of service quality. In all the academic sources that were consulted on service quality, the SERVQUAL model was mentioned as the fundamental most appropriate method and instrument available to measure quality. There are several conceptual models that can he used to address the unique challenge, of service marketing. Two of these are the Services Marketing Triangle and the gap model of. service quality or SERVQUAL. Therefore, SERVQUAL was chosen based on the review of literature (Hussey and Hussey, 1997). Research Questions This study proposes to investigate the relationship between the perceived and expected service quality among passenger car users. Research Methodology Tills descriptive study utilized a cross-sectional survey design to investigate service quality perceptions and their competitive analysis in the Indian passenger car industry. The SERVQUAL model proposed by Zeithaml et al. (1 990} was used as the basis for a structured questionnaire. Questionnaires were distributed utilizing a convenience sampling to walk-in customers from Show rooms and service centers (fully computerized and offering whole bouquet of services) for each of the four car manufacturing companies Maruti-Suzuki, Tata motors, Hyundai and Skoda. The study was conducted in 10 districts of Tamilnadu state. The questionnaire was administered to 500 customers. The constraint of this study limited it to one interview per respondent at a specific point in time. It would be of value to conduct a series of interviews over a period of time. The study is limited to the car industry in India. The study is also limited to the measurement of customer service quality at specific show rooms and service stations. Results and Data Analysis As Table I shows, the Indian passenger car industry received strong ratings on the tangibles dimensions, particularly the employee's neat and professional appearance and low ratings on the empathy dimension, particularly service providers' interest differences. The tangible dimension has been shown to be an aspect of service quality that is extremely important to customers. This study used a seven point scale range from "strongly agree" (7) to "strongly disagree" (1) to assess all five dimensions of service. This study considers the maximum score of customer perceptions service quality as a basis for competitive assessment. Table I suggests that Maruti-Suzuki is the highest performing company. This comparison among companies offers several competitive insights. Maruti-Suzuki holds and advantage over others in the area of perceived tangible, reliability, responsiveness, and empathy dimensions. Tata Motors holds an advantage over others in the area of assurance. For the research question, comparing the results between customers' expectations and perceptions on service quality has interesting findings, especially the difference among the 21 statements ANOVA was used to determine if significant differences existed among the service quality dimensions. In general, there were highly significant differences. Table I : Competitive Service Quality Assessment (P Scores) Service Quality Item Skoda Tata Hyundai Motors MarutiSUZUKI Tangible 4.856 5.185 5.190 5.394 Up-to-date equipment 5.023 5.236 5.336 5.338 Visually appealing facilities 4.970 5.057 5.292 5.431 appearance 5.061 5.732 5.628 5.681 Materials visually appealing 4.371 4.715 4.504 5.078 Reliability 4.944 5.047 5.129 5.209 Providing services as promised 5.061 5.122 5.177 5.250 Sincere in solving the problem 4.735 4.748 4.850 5.267 Employees have a neat and professional Performing service right the first time 4.742 5.041 4.973 5.069 Providing Service at the promised time 4.992 5.057 5.186 5.216 Maintaining error-free records 5.189 5.268 5.460 5.241 Responsiveness 4.157 4.157 4.128 4.409 Services will be performed 4.212 4.000 4.000 4.241 Providing prompt service to customers 4.152 4.301 4.186 4.474 Willing to help customers 4.083 4.146 4.319 4.466 request 4.182 4.179 4.009 4.457 Assurance 4.693 5.128 5.119 5.080 Employees instill confidence in customers 4.636 5024 4.903 4.879 with employees 4.636 4.854 4.920 4.983 Employees are consistently courteous 4.909 5.577 5.540 5.466 Customers' questions 4.591 5.057 5.115 4.991 Empathy 4.138 4.089 4.069 4.393 4.121 4.049 3.912 4.336 4.023 4.033 3.912 4.310 Keeping customers informed about when Always ready to respond to customers' Customers feel comfortable interacting Employees have the knowledge to answer Employees give customers individual attention Employees have the customers' best interest at heart Employees understand the needs of the customers 4.295 40.65 4.133 4.328 Business hours convenient to customer 4.053 4.106 4.230 4.500 Total 4.558 4.727 4.727 4.897 Note : Maximum score of each statement Table II: Comparison of Mean Responses for Expectation Perception and Gap Scores among users of passenger cars. Aspects of Quality Services Results E P Gap Priority Scores Scores Scores Tangible 5.547 5.147 -0.4 5 Up-to-date equipment 5.438 5.238 -0.2 19 Visually appealing facilities 5.878 5.178 -0.7 11 Employees have a neat and professional appearance 5.912 5.512 -0.4 17 Materials visually appealing 4.959 4.659 -0.3 18 Reliability 5.877 5.077 -0.8 1 Providing services as promised 5.849 5.149 -0.7 11 Sincere in solving the problem 5.893 4.893 -1.0 1 Performing service right the first time 5.750 4.950 -0.8 10 Providing Service at the promised time 5.907 5.107 -0.8 7 Maintaining error-free records 6.185 5.285 -0.9 3 Responsiveness 4.911 4.211 -0.7 3 Services will be performed 5.016 4.116 -0.9 5 Providing prompt service to customers 4.875 4.275 -0.6 14 Willing to help customers 4.946 4.246 -0.7 12 Always ready to respond to customers' request 5.007 4.207 -0.8 9 Assurance 5.696 4.996 -0.7 4 Employees instill confidence in customers 5.655 4.855 -0.8 8 employees 5.641 4.841 -0.8 6 Employees are consistently courteous 6.06 5.360 -0.7 13 Customers' questions 5.528 4.928 -0.6 15 Empathy 4.949 4.149 -0.8 2 Employees give customers individual attention 5.005 4.105 -0.9 4 Employees have the customers' best interest at heart 4.868 4.068 -0.8 8 Employees understand the needs of the customers 4.607 4.207 -0.4 16 Business hours convenient to customer 5.115 4.215 -0.9 2 Keeping customers informed about when Customers feel comfortable interacting with Employees have the knowledge to answer Note: E=Expectation, P=Perceptions. Priority is obtained based on the discrepancy between expectations and perceptions. The bigger the gap score, the more serious the service quality Shortfall from the consumer viewpoint. Table III : F Values for Mean Responses for the Five SERVQUAL Dimensions Priority Aspects of P E F Value Quality Services 5 Tangibles 5.8 6.2 3.95 1 Reliability 5.6 6.5 10.05 3 Responsiveness 5.4 6.2 18.10 4 Assurance 5.3 6.0 88.46 2 Empathy 5.3 6.1 25.19 Note: Significance level at p < 0.05. Table IV : Differences in Means between Perception and Expectation Levels of Service Quality Aspects of P E t-stat P Value Tangibles 5.8 6.2 -3.50 0.020; 0.039 Reliability 5.6 6.5 -18.74 0.000; 0.000 Responsiveness 5.4 6.2 -14.58 0.000; 0.001 Assurance 5.3 6.0 -13.41 0.000; 0.001 Empathy 5.3 6.1 -7.622 0.001; 0.002 Quality Services Note: Significance level at p < 0.05. Among the dimensions (Table III). Based on the results from Table II, the expectation level of quality service differed from their perception levels. Responses were computed by subtracting the expectation response from the perception response. A positive score would be recorded if the result or performance exceeded customer expectations. A positive score indicated an area of strength and a competitive advantage for the service provider. All 21 statements indicated that the quality of service fell short of the customers' expectations; customers were generally not satisfied with the service providers. Nevertheless, each aspect of the quality of service showed differences with respect to the size of gap score. The list of aspects of quality service could be ranked from the biggest score to the smallest score. Table III shows the mean gap scores by dimension for the total consumer sample. These unweighted gap scores among the five service quality dimensions indicated that the services provided by the four providers fell short of the customers' expectations on each dimension. Considering the unweighted gap score in Table II, the dimensions could be ranked according to the size of the gap. The bigger the gap is, the more important the dimensions from the customers' point of view, which could be ranked in the following, order: Reliability, empathy, responsiveness, assurance, and tangibles (Parasuraman et al., 1988). A simple t-test was conducted to determine whether there is a significant relationship between perception and expectation level of service quality. Title results art- given in Table IV Analysis of differences provided evidence that mean differences occurred between perceptions and expectations and perceptions among the consumers of banking services in India. Consumers' perception of service quality did not meet with their expectations. As given in Table II none of the service quality dimensions had a positive SERVQUAL" score, suggesting that the companies considered for this study did not meet or exceed consumer's expectations CONCLUSION AND RECOMMENDATION Findings from this study provide initial direction in determining the optimum service quality attributes to focus on in promoting services. What becomes clear from the analysis of the gap scores and rank ordering of dimensions is that there is a perceptual problem, for example, the respondents were not able to distinguish between expectation and perceived service level measures of the sample involved. No positive scores were found. The largest discrepancies were found along the "reliability" dimension. This is alarming since it was identified as the most important dimension in their overall perceptions (see Table-III). This indicates that the sample population appears not to be getting what they expect from their companies. However, service managers often need to consider the varying impact that both process and technical factors of a service have on perceived service quality. Since 1991, Lytle and Mokwa (1992) and Zenithal et al. (1993) all argue for the investigation of more comprehensive structures of customer satisfaction and quality and suggest that outcomes do have an effect on customer perceptions of quality and satisfaction. If the industry persists in measuring and monitoring the perceptual aspects of service quality, the complementary aspects of basic outcome must be tracked as well to ensure an appropriate and satisfactory customer experience. REFERENCES 1. Berry. L L and Parasuraman, A (1991), Marketing Services: Competing through Quality, The Free Press, New York, NY 2. Berry, L L, Parasuraman. A, Zeithaml, V and Adsit,, D (1994), "Improving Service Quality in America; Lessons Learned", the Academy of Management executive, Volume, 8, May, pp. 32-53, 3. Berry, L L and Bendapudi. N (2003), J. "Clueing in Customers", Harvard Business Review, Vol. 81, issue 2. February, pp, 100-107. 4. Hussey J. and Hussey, R (1997), Business Research, MacMillan, London, p. 109. 5. Lytle, R S and Mokwa, M P, (1992), "Evaluating Health Care Quality: The Moderating Role of Outcomes", Journal of Health Care Marketing, Vol. 12, March, pp. 4-14. 6. Parasurarman, A, Zeithaml, V A and Berry. L L (1985), "A Conceptual Model of Service Quality and its Implications for Future Research", Journal of Marketing, Vol. 49, No. 4, pp. 41- 51. 7. Parasuraman. A, Zeithaml, V A and Berry, L L (! 988),"SERVQUAL: A Multiple Item Scale tor 8. Measuring Customer Perception of Service Quality", Journal of Retailing, Vol. 64, spring, pp. 12-40. 9. Parasuraman, A Zeithaml, V A and Berry, L L (1994),"Alternative Scales for Measuring Service Quality: A Comparative Assessment Based on Psychometric and Diagnostic Criteria", Journal of Retailing, Vol. 70, fall, pp. 201-230.