Asset Building for Persons with Disabilities

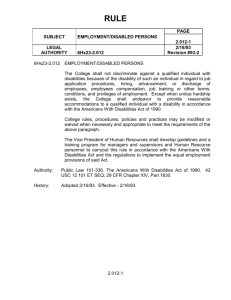

advertisement

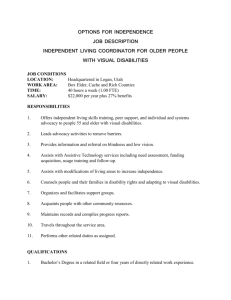

Asset Building for Persons with Disabilities April 12, 2007 Virtual Classroom Layout Presentation Slide Area Attendee List Chat Room Asset Building for Persons with Disabilities 2 Submitting Questions Enter questions into the Chat Room (located in lower left corner of the virtual classroom). To submit a question or comment, type the question in the text box and click the arrow button. Your name, the text “(Submitted Question)” and your question will appear in red on your screen, indicating successful submission. Questions are directly transmitted to presenters – other participants will not see your questions. Asset Building for Persons with Disabilities Chat Room Text Box Arrow Button 3 Practice In the chat room, please type the name of your organization, your location, and how many people are attending with you today. Asset Building for Persons with Disabilities 4 Access to Webinar Materials Materials and presentation slides used in this webinar will be available for download from the Research & Information section of the Workforce3 One Webspace. All webinars are recorded and available for viewing after the event. Recorded webinars will be posted to the Multimedia Information/ Self-Paced Learning section of the Workforce3 One Webspace. Asset Building for Persons with Disabilities 5 Presenters Presenters: Johnette Hartnett, Director of Research, National Disability Institute Don Dill, Senior Tax Analyst, Internal Revenue Service Sharon Brent, Director of Training, National Disability Institute Venessa Fairbairn, Disability Program Navigator Manager, Orange Park, FL Moderator: Laura Farah, Program Associate, Law Health, Policy & Disability Center, University of Iowa College of Law Michael Morris Asset Building for Persons with Disabilities 6 Overview Real Economic Impact Tour: Building healthy financial futures for Americans with disabilities – Johnette Hartnett, Director of Research, National Disability Institute Tax Benefits and Credits for Persons with Disabilities – Don Dill, Senior Tax Analyst, Internal Revenue Service Real Sense: Real Dollars for Real People −Venessa Fairbairn, Disability Program Navigator Manager, Orange Park, FL Asset Building for Persons with Disabilities 7 Real Economic Impact Building healthy financial futures for Americans with disabilities Formerly the TaxFacts+ Campaign Johnette Hartnett, Ed.D. Director of Research, National Disability Institute Washington, DC Asset Building for Persons with Disabilities 8 Real Economic Impact Mission To provide new century workers with disabilities access to mainstream financial and tax services and promote selfdetermination, economic advancement and social well being. Asset Building for Persons with Disabilities 10 Real Economic Impact Vision American citizens of all abilities will have access to a menu of financial and tax services, products and education that enhance income preservation and asset growth. Asset Building for Persons with Disabilities 11 Real Economic Impact Goals Increase number of tax filers with disabilities; Increase utilization of tax credits and deductions; Develop research-based tax and financial data that describes who tax filers are with disabilities; Develop research-based tax and financial education curricula; Asset Building for Persons with Disabilities 12 Real Economic Impact Goals Develop universal strategies of access and accommodation to financial institutions to increase disability customer base; Develop accessible financial and tax products; Increase local partnership network between disability and community-based organizations, the publicly funded One-Stop centers, and local tax and financial institutions; and Document real economic impact of persons with disabilities and related organization activity in selected cities nationwide. Asset Building for Persons with Disabilities 13 Real Economic Impact Why the Focus on Disability! One in five Americans have a disability One third of families have a member with a disability Higher drop-out rates for teen boys with disabilities Increased federal and state scrutiny of growing disability costs Enduring poverty and unemployment and underemployment 25% increase in disability Asset Building for Persons with Disabilities 14 Real Economic Impact Why Disability Focus is Important! Build economic security through income preservation and asset building Increase utilization of tax credits and deductions Reduce asset poverty Increase employment rate Build credit history Expand products and services that are accessible and useful Amend federal policy that will encourage not penalize positive financial behavior Asset Building for Persons with Disabilities 16 Real Economic Impact Why Disability Focus is Important! Increase familiarity and utilization of tax credits 83% never claimed a deduction related to employment or disability Less than half of homeowners with a disability claim home mortgage deductions 44% homeowners are persons with disabilities Less than 10% homeowners are people with intellectual disabilities Asset Building for Persons with Disabilities 17 Real Economic Impact Assumptions Ownership of assets creates good life outcomes Underutilization of tax credits is due to lack of information, access and outdated tax code Demographic studies predict rise in disability numbers and costs Asset Building for Persons with Disabilities Financial service products need retooling to meet growing needs of pwd Persons with disabilities living longer – life expectancy increase across several disabilities 18 Real Economic Impact Inputs and Infrastructure 2007 25 Mini grants to 54 cities to build community-based workgroups Mayor summit meeting in NYC with 11 cities November 2006 Cities creating disability kick-offs for tax filing season – reading Mayor Proclamation New Website going live March 2007 Disability Toolkit will be available March 2007 for cities to replicate best practices Disability Resource Network Team Asset Building for Persons with Disabilities 20 Four City Study Outcomes 732 long surveys filled out by people with disabilities Tax Preparation and Filing Positive experience at free tax site Simplify tax filing requirements 23% used free tax site 8% paid for RAL 25% received EITC in past 57% requested special accommodations Asset Building for Persons with Disabilities 25 Four City Study Outcomes Financial Service Profile 30% on SSI and 24% on SSDI 42% receive Medicaid 27% receive Medicare 66% have checking accounts 44% savings accounts 0% IDA participants 74% no money management training 16% use online banking Asset Building for Persons with Disabilities 26 Real Economic Change Emerging Best Practices Train tax preparers (volunteer and otherwise) on tax credits and provisions for people with disabilities on and off public benefits Provide participating free tax coalitions information and training about what makes a site accessible for people of all abilities. Host meetings between local disability and nonprofits involved in asset building and free tax preparation work. Establish disability workgroup with lead being a person with a disability. Asset Building for Persons with Disabilities 27 Real Economic Impact Invite disability organizations to be a free tax filing site and provide training for volunteer preparers. Present information about free tax filing to local disability boards. Invite people with disabilities to become volunteer tax preparers and greeters at sites. Identify accessible sites with disability symbols. Refer individuals with disabilities to local Disability Program Navigators who will help refer eligible customers to various asset building initiatives (IDAs, NeighborWorks, benefits screening, etc.). Asset Building for Persons with Disabilities 28 Real Economic Impact Links Private Sector Groups National Disability Institute www.nationaldisabilityinstitute.org Real Economic Impact Tour www.realeconomicimpact.org (going live early April 2007) The New America Foundation’s Asset Building Site www.assetbuilding.org The Corporation for Economic Development (CFED) www.cfed.org CFED’s IDA Network www.idanetwork.org World Institute on Disability www.wid.org Asset Building for Persons with Disabilities 29 Real Economic Impact Links Private Sector Groups, cont. The Center on Budget and Policy Priorities direct link to EITC Toolkit www.cbpp.org/eic2007 National Community Tax Coalition www.taxcoalition.org NCB Capital Impact www.ncbcapitalimpact.org Law, Health Policy, and Disability Center of the University of Iowa Disability.law.uiowa.edu One-Stop Toolkit www.onestoptoolkit.org Resources of the Week e-newsletter www.onestoptoolkit.org/resourceoftheweek.cfm The World Institute on Disability www.wid.org Equity e-Newsletter www.wid.org/publications/?page=equity Asset Building for Persons with Disabilities 30 Real Economic Impact Links Federal Government Sites The Internal Revenue Service − www.irs.gov − www.irs.gov/eitc − www.irs-eitc.info/SPEC The Federal Deposit Insurance Corporation www.fdic.gov The Money Smart Program www.fdic.gov/consumers/consumer/moneysmar t/index.html Asset Building for Persons with Disabilities 31 Communication Real Economic Impact Johnette T. Hartnett, Ed.D. And Director of Public Policy Law, Health Policy & Disability Director of Research Center National Disability Institute University of Iowa, 1667 K Street, Suite 640 College of Law Washington, DC 20006 http://www.university.uiowa.edu/law/ 202-296-2043 202-296-2047 Fax 202-236-0238 Cell Jhartnett@ndi-inc.org www.realeconomicimpact.org Asset Building for Persons with Disabilities 32 Work Incentives Training for Successful Employment Sharon Brent Director of Training, National Disability Institute sbrent@ndi-inc.org Asset Building for Persons with Disabilities 33 Building Blocks for Self Determination 1. A person has the Freedom to dream, make his or her own decisions and plan their own life. 2. A person has the Authority to control how money is spent for supports 3. A person has the Support needed from people they choose, i.e. family, friends, employees. 4. A person is required to take Responsibility to do what he or she says they will do 5. Confirmation – the recognition that individuals themselves be a major part of the design of long term services and supports Asset Building for Persons with Disabilities 35 Checklist for Success When you call SSA (1-800-772-1213) keep a record: − Date − Name of person you spoke to − What you asked − What they told you Make copies of all documents you give to SSA: both forms you fill out and evidence you want them to have that are in your possession. Do not LOSE your copies!! Asset Building for Persons with Disabilities 37 Checklist for Success (Cont’d) Promptly open and read ALL mail sent by SSA. When SSA gives a deadline response date, compliance within that date is required. Seek help immediately for help. Keep ALL paperwork, letters, and mailing envelopes in your file. Do Not Lose!!!! You must report pay stubs each month to SSA. Be sure to report to correct field office (Zip Code of the payee is the key). Report by mail, and/or walk into the office. Keep wage records in your file. Asset Building for Persons with Disabilities 38 Checklist for Success (Cont’d) If a person receives SSI and/or Medicaid, remember to keep all resources/assets below $2,000/individual $3,000/couple in any month to maintain eligibility. Medicaid eligibility may vary from State to State. When a major life change occurs (address, marriage, employment, lose of job, divorce, children) report to SSA immediately, both to 1800-772-1213 and to local SSA field office. Asset Building for Persons with Disabilities 39 Definition of Disability The SSA defines disability for both SSI and SSDI programs as the inability to engage in Substantial Gainful Activity (SGA) by reason of any medical (physical and/or mental or blind) impairment. Disability must have lasted or be expected to last for a continuous period of not less than 12 months or result in death. Asset Building for Persons with Disabilities 46 Definition Substantial Gainful Activity SGA=A basic test used by SSA to establish disability status – SGA is the performance of significant mental and/or physical duties for profit. – It is usually determined to be gross earnings (before taxes) of an amount of money that is set January 1 of each calendar year based on the National Average Wage Index. – To meet this test a person must not be working, or if working earning less than the annual SGA level amount. Asset Building for Persons with Disabilities 47 Eligibility of Benefits Supplemental Security Income-SSI – Unearned Income (Not Wages) • SSDI, VA, Annuities – Income (Earned Wages) • 12 months no SGA income • SGA factor at initial eligibility • Once on SSI SGA is not at issue – Resources (NOT Wages or Unearned Income • $2,000/month/Individual • $3,000/month/Couple – Medical Eligibility • DDS (STATE) Determines Medical Eligibility • Medicaid (Medical Insurance) • SSI connected, State Administered Asset Building for Persons with Disabilities 49 Eligibility of Benefits Social Security Disability Insurance-SSDI – Required Work Credits in F.I.C.A – 5 Month Waiting Period + 12 months non SGA income – SGA • Initial Eligibility • During EPE and Beyond – Medical Eligibility • DDS (STATE) Determines Medical Eligibility – DAC –Disabled Adult Children • Disability Prior to Age 22 • Never Legally Married • Insufficient FICA • Parent: Retires, Dies, Becomes Disabled • Possible continuation of Medicaid – Medicare (Medical Insurance) • 24 months upon eligibility determination • Part A/Hospitalization-Part B or D-Medical Premium Asset Building for Persons with Disabilities 50 Trial Work Period-Twp SSDI Work Incentive Unless medical recovery is an issue, (SSDI) beneficiaries are entitled to a 9 month Trial Work Period (TWP) for testing work skills while maintaining the monthly cash benefits. During this TWP full benefit checks will continue regardless of the amount of money earned. The 9 months of TWP do not need to be earned in a row. – TWP months are counted when an individual earns a specific amount of income. (Determined January 1 each year by SSA) – The TWP ends only when an individual has 9 months of TWP within a 60 month consecutive period of time (5 years). – Once all 9 months of TWP have been earned within the 60 month window a person then enters Extended Period of Eligibility (EPE). Asset Building for Persons with Disabilities 55 Extended Period of Eligibility (EPE) SSDI Work Incentive At the conclusion of the 9 month TWP beneficiaries will immediately enter into the 36 month EPE as long as the medical eligibility continues. The 36 month period begins in the month following the 9 month TWP whether a person is determined to be earning SGA or not. During EPE cash benefits continue only for months SGA is not earned. Any month SGA is earned the individual is not eligible for the cash benefit. The first month of SGA (grace months) benefits continue. Next two months are considered grace months and if SGA is earned benefits continue. When EPE is complete, a person earning gross wages below SGA will continue to receive a benefit check as long as medical eligibility continues. If a person is earning SGA or above and the EPE is completed, a person is no longer eligible for a cash benefit. Asset Building for Persons with Disabilities 56 Extended Period of Eligibility (EPE) SSDI Work Incentive (Cont’d) For self-employment, an individual determination of SGA will be established during EPE. An SSDI claims representative will look at hours and income when making SGA determination. If a person needs support in order to earn income document and record the time and activity of support in order to determine if earnings are actually SGA. (See Work Incentive Subsidies). Asset Building for Persons with Disabilities 57 Work Incentives Comparison Chart Supplemental Security Income Social Security Disability SSI Insurance SSDI Continuation of SSI Trial Work Period Student Earned Income Extended Period of Eligibility Exclusion Continuation of Medicare 1619 A and B Section 301 Section 301 Blind Work Expense Blind Work Expense Subsidies Subsidies Ticket To Work Ticket To Work Expedited Reinstatement Expedited Reinstatement Impairment Related WorkExpense Impairment Related Work Expense Property Essential for Self Support Plan for Achieving Self-Support60 Asset Building for Persons with Disabilities Tax Benefits and Credits for Persons with Disabilities Don Dill Senior Tax Analyst Internal Revenue Service Atlanta, GA Asset Building for Persons with Disabilities 81 Tax Benefits and Credits are Available to Persons with Disabilities The US Tax Code Provides Numerous Tax Benefits And Tax Credits Created For and/or That Contain Special Provisions For Persons With Disabilities. These Benefits And Credits Are Available To: Qualifying Taxpayers With Disabilities – Parents Of A Child (Or Children) With A Disability (Or Disabilities) • Employers Who Hire Employees With Disabilities • Businesses Or Other Entities Wishing To Accommodate People With Disabilities Asset Building for Persons with Disabilities 82 Tax Benefits and Credits are Available to Persons with Disabilities – For Taxpayers With Disabilities • Medical Expenses • Impairment-related Work Expenses • Credit For The Elderly Or Disabled – For Parents Of A Child With A Disability • Qualifying Child Regardless of Age • Medical Expenses • Child and Dependent Care Credit • Earned Income Tax Credit – For Employers And Businesses • Disabled Access Credit • Architectural/Transportation Tax Deduction • Work Opportunity Credit Asset Building for Persons with Disabilities 83 Tax Benefits and Credits are Available to Persons with Disabilities – Tax Benefits – Also Referred To As Expenses, Deductions And Exemptions. These Amounts Generally (Excluding Itemized Deductions) Are Used To Reduce A Taxpayer’s Taxable Income On A Dollar-for-dollar Basis. Once A Final Taxable Income Amount Is Determined, The Taxpayer’s Tax Liability (Before Consideration Of Payments And Tax Credits) Is Determined Based On The Taxable Income Amount. Asset Building for Persons with Disabilities 84 Tax Benefits and Credits are Available to Persons with Disabilities – Tax Credit – Tax Credits Are Used To Reduce A Taxpayer’s Tax Liability On A Dollar-by-dollar Basis. Generally, Tax Credits Can Be Used To The Extent Of An Existing Tax Liability (i.e. Reducing Tax Liability To Zero). In Special Situations, Including The Earned Income Tax Credit (Fully) And The Child Tax Credit (Partially) The Remaining Tax Credits Available After Taxable Liability Is Brought To Zero Can Be Refunded Directly To The Taxpayer. Asset Building for Persons with Disabilities 85 Earned Income Tax Credit The Earned Income Tax Credit (Or EITC) Is A Tax Credit Available To Individuals Who Work And Have Income Less Than $36,348 In 2006 ($38,348 For Taxpayers Married Filing Jointly) The Earned Income Tax Credit Is A Refundable Tax Credit! That Means If The Amount Of EITC An Individual Is Entitled To Is Greater Than Their Tax Liability, That Individual Would Receive A Refund From The IRS For The EITC In Excess Of Their Tax Liability – Example – If A Taxpayer Is Entitled To An EITC Of $1,700 And Has A Tax Liability Of $500, That Taxpayer Would Receive A Refund In The Amount Of $1,200 Asset Building for Persons with Disabilities 86 Earned Income Tax Credit The Amount Of Earned Income Tax Credit Available Is Dependent Upon The Amount Of Earned Income And Whether Or Not The Individual Has A Qualifying Child: – For An Individual (Or Couple) With Two Or More Qualifying Children, The Maximum Adjusted Gross Income Allowed Is $36,348 ($38,348 If Married Filing Jointly) And The Maximum Allowable Credit Is $4,536 – For An Individual (Or Couple) With One Qualifying Child, The Maximum Adjusted Gross Income Allowed Is $32,001 ($34,001 If Married Filing Jointly) And The Maximum Allowable Credit Is $2,747 – For An Individual (Or Couple) With No Qualifying Child Who Are Between The Ages Of 25 And 64, The Maximum Adjusted Gross Income Allowed Is $12,120 ($14,120 If Married Filing Jointly) And The Maximum Allowable Credit Is $412 Asset Building for Persons with Disabilities 87 Earned Income Tax Credit The Amount Of Earned Income Tax Credit Available Is Dependent Upon The Amount Of Earned Income And Whether Or Not The Individual Has A Qualifying Child: – For An Individual (Or Couple) With Two Or More Qualifying Children, The Maximum Adjusted Gross Income Allowed Is $36,348 ($38,348 If Married Filing Jointly) And The Maximum Allowable Credit Is $4,536 – For An Individual (Or Couple) With One Qualifying Child, The Maximum Adjusted Gross Income Allowed Is $32,001 ($34,001 If Married Filing Jointly) And The Maximum Allowable Credit Is $2,747 – For An Individual (Or Couple) With No Qualifying Child Who Are Between The Ages Of 25 And 64, The Maximum Adjusted Gross Income Allowed Is $12,120 ($14,120 If Married Filing Jointly) And The Maximum Allowable Credit Is $412 Asset Building for Persons with Disabilities 88 Earned Income Tax Credit Earned Income – Most Disability Related Benefits (Including Social Security Disability Insurance, SSI, Military Disability Pensions And Payments From Individually Purchased Disability Insurance Policies) Are Not Counted As Earned Income For Purposes Of The EITC. – Long-term, Employer-paid Disability Benefits Paid To An Individual Under The Minimum Retirement Age Qualifies As Earned Income For EITC Purposes, Even If The Individual Did Not Work During The Tax Year In Question. – Earned Income Can Be Earned By Only One Spouse To Qualify For The EITC and Can Be Generated By Parttime Or Full-time Employment Asset Building for Persons with Disabilities 89 Earned Income Tax Credit Impact Of Earned Income Tax Credit On Eligibility For Other Benefits – Federal Law Generally Excludes Counting EITC (As Well As The Child Tax Credit (CTC)) As Additional Income In Determining Eligibility For Other Federal Public Benefits, Including SSI, Medicaid, Veteran’s Benefits, Head Start, Etc. – EITC Refunds Are Not Considered Employment Income And Have No Impact On Substantial Gain Activity (SGA) Levels – For Resource Testing, Generally EITC And CTC Refunds If Saved Are Not Counted Toward Dollar Limits On Resources During The Month Received And The Following Month – For SSI Purposes, EITC And CTC Refunds Are Excluded From Resources For Nine Months Following The Month The Refund Is Received Asset Building for Persons with Disabilities 90 Venessa Fairbairn Disability Program Navigator Manager, Orange Park, FL Jacksonville Disability Outreach Initiative Asset Building for Persons with Disabilities 91 Collaborative Efforts Several information gathering meetings with the IRS Disability Initiative Manager with the DPN DPN joined the Real Sense Prosperity Campaign Steering Committee The Independent Living Center (CIL) was engaged to join the outreach effort Asset Building for Persons with Disabilities 92 Accessible “Money Smart” Disability specialists (ILRC), and the DPN became Certified “Money Smart” Trainers Money Smart Classes are offered in Jacksonville at the ILRC, targeting individuals with disabilities are totally accessible. The classes are also open to non-disabled individuals The IRLC will provide ASL Interpreters when requested. In St. Johns County, the DPN partnered with the NFCCA to teach the classes and provide ASL services to those who are Deaf Asset Building for Persons with Disabilities 93 Outreach The DPN conducts Disability Orientations in each center. Real Sense info is included, with emphasis on EITC for adults (25 + without children and who earn under 12k annually Info on the IDA program is explained, including that the funds are waived for those on SSI and can be used concurrent with the PASS Plan The DPN has given presentations to the First Coast Rehabilitation Council and the Job Opportunity Consortium on the Campaign. Information was shared at the University of North Florida Disability Awareness Fair, and at Tools for success (a Duval County Schools conference for parents and professional) Upon request, information sent to agency and individuals include: Asset Building for Persons with Disabilities 94 Outreach The Advocacy Center of Florida, the Florida School for the Deaf and the Blind A large service provider attended the Money Smart Class in St. Johns and brought 8 customers with disabilities Information was shared at a recent VR/WorkSource meeting with 15 VR Counselors. Asset Building for Persons with Disabilities 95 Services A press release went out to all media regarding Money Smart in ASL and the following: A new VITA site has been established at the ILRC in Jacksonville (non disabled are served as well. They held a Deaf Services days where they hired ASL Interpreters all day to prepare tax returns for workers who are Deaf (9 have been served and more will come next week) St. Johns County recruited a Tax Prep Volunteer who is fluent in ASL ( 4 have been served so far, and more are scheduled) Asset Building for Persons with Disabilities 96 March 15, 2007 The RealSense Prosperity Campaign Provides Tax Assistance for People with Disabilities In 2007, the RealSense Prosperity Campaign announced increased outreach to workers with disabilities who may need accommodations for free tax preparation, information on Earned Income Tax Credit (EITC), financial literacy classes and matched savings accounts. Together with The IRS's Disability Initiative, The Real Economic Impact Tour, WorkSource, the ILRC (Independent Living Center), and the Northeast Community Action Agency, the RealSense Prosperity Campaign works to inform workers with disabilities about available accommodations, and an array of services and programs specifically for SSA Beneficiaries who also work. Asset Building for Persons with Disabilities 97 Adult Workers between the ages of 25 and 65 who earned lees than $12,120 in 2006 are eligible for EITC. This credit may be available even without a qualifying child or dependent. Adult Workers who receive SSI or SSDI whose earnings stay under Substantial Gainful Activity (SGA) which is $900.00 per month, are most often eligible for the tax credit. Asset Building for Persons with Disabilities 98 In St. Johns County, people who request tax assistance in American Sign Language (ASL) can set appointments for Fridays at WorkSource 525 State Road 16 in St. Augustine. In addition to offering free tax preparation, the site also offers financial education classes in ASL. In Jacksonville, The Independent Living Resource Center will provide tax preparation services and financial education classes. The RealSense Prosperity Campaign, a coalition of agencies, nonprofits and local businesses under the administrative guidance of United Way of Northeast Florida, works in partnership with the IRS to secure unclaimed Earned Income Tax Credit dollars for qualifying wage earners. Additionally, RealSense provides financial literacy training to help recipients save this money towards the purchase of a home, continuing education or starting a small business. Asset Building for Persons with Disabilities 99 For information, appointments, and accommodation requests, call 904 819-0231 Ext. 2001 TTY FRS 711 or email Venessa Fairbairn vfairbairn@worksourcefl.com.### Asset Building for Persons with Disabilities 100 Suggested Improvements Add “Equal Opportunity Program, Reasonable Accommodations will be given upon Request” Verbiage to all marketing materials Create an outreach piece specifically for workers with disabilities that included information on the IDAs Send such a piece to all disability list-serves and agencies Ensure, via training, that all with disabilities who visit One Stops get all of the information Asset Building for Persons with Disabilities 101 Question & Answer Period Please enter your questions into the Chat Room! Asset Building for Persons with Disabilities 102 Share Your Ideas With Your Peers! Simply log on to Workforce3 One and look for the “Share Content Icon” in red located on the left side of your screen. Share your demand-driven strategic plans, models, innovations, resources, and ideas! Submit your content to Workforce3 One at: http://www.workforce3one.org/members/sections/suggest/ Asset Building for Persons with Disabilities 103 Access to Webinar Materials Materials and presentation slides used in this webinar will be available for download from the Research & Information section of the Workforce3 One Webspace. All webinars are recorded and available for viewing after the event. Recorded webinars will be posted to the Multimedia Information/ Self-Paced Learning section of the Workforce3 One Webspace. Asset Building for Persons with Disabilities 104 Stay Informed, Get Connected! Workforce3 One: Communities of practice Live web-based events Register for updates! www.workforce3one.org For more information about the workforce investment system: Visit www.careeronestop.org Call 1-877-US2-JOBS Asset Building for Persons with Disabilities 105 Mark Your Calendars Workforce Innovations July 17-19, 2007 Kansas City Convention Center www.WorkforceInnovations.org Asset Building for Persons with Disabilities 106 www.workforce3one.org Asset Building for Persons with Disabilities 107