Discussion on Budget Updates – Service Tax

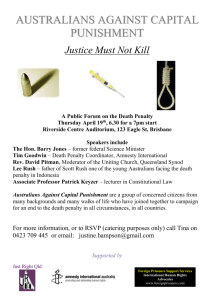

advertisement

Discussion on Budget Updates – Service Tax by CA Sri Harsha harsha@sbsandco.com Date: 18th March 2015 Overview of Discussion Changes in Negative List; Changes in Mega Exemption Notification; Changes in Valuation – Section 67; Changes in Recovery Provisions – Section 73; Changes in Penalties – Section 76, 78 & 80; Changes in Abatement Rates; Changes in Reverse/Partial Charge Provisions; Changes in Service Tax Rules, 1994; Changes in Cenvat Credit Rules, 2004; Miscellaneous Changes; 2 www.sbsandco.com Changes in Rates of Service Tax 12.36% to 14% shall take effect from the date yet to be notified. The said date shall be post to enactment of Finance Bill, 2015. Hence, till such date all services shall be taxed at 12.36% only Post such date, the education cess and secondary higher education cess shall be ceased to apply From a date to be notified, new cess called Swacch Bharath Cess @ 2% on value of taxable services shall be made applicable on all or any taxable services. Hence, effective rate of service tax shall be 16% and not 14.28% 3 www.sbsandco.com Changes in Negative List (1/4) Services Provided by Government to Business Entities: Earlier support services provided by Government to Business Entities were only covered in Negative List; ‘support services’ were defined and ‘Government’ not defined earlier – leading to restriction of services out of negative list; Now, with the deletion of phrase ‘support’ and providing for definition of ‘government’ – all services provided by Government are out of negative list; The said services are covered under the reverse charge obligation – where the service receiver has to pay 100% of service tax. 4 www.sbsandco.com Changes in Negative List (2/4) Any process amounting to manufacture or production of goods: The said entry specifically excludes the activity of services by way of alcoholic liquor for human consumption. Hence, the services provided by way of manufacture of alcoholic liquor in the capacity of job work are now taxable. All contract manufacturers of alcoholic liquor has to register and pay service tax on the job work charges. The relevant changes to the Entry 30 of Notification No 25/2012-ST dated 20.06.2012 has also been made to make the subject activity taxable. 5 www.sbsandco.com Changes in Negative List (3/4) Betting, Gambling and Lottery: The said entry excludes the main activity of betting, gambling and lottery. The changes made in this budget are insertion of an explanation. The explanation provides that the activities provided by lottery distributor or selling agent in relation to promotion, organizing, marketing and other incidental or ancillary services provided in relation to main activity are not covered under the ambit of negative list. The subject amendment was carried on to put an end to the decision of Future Gaming Solutions India Private Limited by the High Court of Sikkim – where the High Court has held that such activities mentioned above are not taxable. 6 www.sbsandco.com Changes in Negative List (4/4) Admission to Entertainment Events or access to Amusement Facilities: The said entry used to cover services provided by way of admission to entertainment events or access to amusement facilities. However, from the notified date the said entry is being omitted. Hence, the access to amusement facilities are fully covered under the tax net. However, admission to certain events where consideration is less than Rs 500/- has been provided. The same shall be discussed at the appropriate stage. 7 www.sbsandco.com Changes in Mega Exemption Notification (1/5) Services provided to Government, Local or Governmental Authority – Entry 12: Services provided by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of: a civil structure or any other original works meant predominantly for use other than for commerce, industry, or any other business or profession; a structure meant predominantly for use as (i) an educational, (ii) a clinical, or (iii) an art or cultural establishment; residential complex predominantly meant for self-use or the use of their employees or other persons specified. 8 www.sbsandco.com Changes in Mega Exemption Notification (2/5) Services provided to Port or Airport – Entry 14: Services provided by way of construction, erection, commissioning, installation of original works pertaining to port or airport were exempted. However, post amendment, the services provided to port or airport are taxable since such phrases has been omitted from such sub-entry. Hence, services provided shall be taxable. Services performed by Artists – Entry 16: Services by a performing artist in folk or classical art forms of (i) music, or (ii) dance, or (iii) theatre, excluding services provided by such artist as a brand ambassador. However, with effective from 01.04.2015, if the consideration charged for such performance is more than one lakh, the exemption shall not be applicable and accordingly taxable. 9 www.sbsandco.com Changes in Mega Exemption Notification (3/5) Services provided by transportation of goods by Rail or vessel – Entry 20: Services provided by way of transportation of foodstuff including flours, tea, coffee, jaggery, sugar, milk products, salt and edible oil, excluding alcoholic beverages were exempted. However, post amendment, above entry is replaced with ‘milk, salt and food grain including flours, pulses and rice’ are only covered. Hence, only transportation services provided in relation to such goods are only exempted and which were earlier exempted shall be taxable. Services performed by transportation of goods by Road – Entry 21: Same as above. This entry extends exemption to transportation carried on road. 10 www.sbsandco.com Changes in Mega Exemption Notification (4/5) Health Care services provided by way of clinical establishment were covered under the said entry. Health Care services include transportation of patient to and from a clinical establishment were only exempted. However, post amendment, transportation of patient in an ambulance other than provided by clinical establishments are exempted. That is to say all ambulance services are now exempted irrespective of the status of the service providers. Services by operator of Common Effluent Treatment Plant by way of treatment of effluent are exempted with effective from 01.04.2015; 11 www.sbsandco.com Changes in Mega Exemption Notification (5/5) Services by way of pre-conditioning, pre-cooling, ripening, waxing, retail packing, labelling of fruits and vegetables which do not change or alter the essential characteristics of the said fruits or vegetables are exempted with effective from 01.04.2015; Services by way of admission to a museum, national park, wildlife sanctuary, tiger reserve or zoo are exempted with effective from 01.04.2015. 12 www.sbsandco.com Changes in Valuation – Section 67 The scope of ‘consideration’ has been expanded to include the following: reimbursable expenditure or cost incurred by the service provider and charged, in the course of providing or agreeing to provide a taxable service, except in such circumstances and conditions as may be prescribe This amendment is to overcome the decision of the Delhi High Court in case of Intercontinental, where in it was held that Rule 5 is ultra vires. 13 www.sbsandco.com Changes in Recovery Provisions – Section 73 A new sub-section (1B) has been introduced to state that where the amount of service tax payable has been self-assessed in the service tax returns and not paid either in full or in part, the same shall be recovered along with interest in the modes specified vide Section 87 and without service of notice under Section 73(1). Sub-section (4A) has been omitted and hence there shall be no benefit of reduced penalty if true and complete details were available in the specified records. However, the above change is not harmful since the penalty provisions are streamlined as detailed in the subsequent paragraphs. 14 www.sbsandco.com Changes in Penalty Provisions – 76, 78 & 80 Section 76 – Cases where involvement of ingredients specified in Section 78 not existing: • penalty not to exceed ten per cent of Service Tax amount; • no penalty is to be paid if Service Tax and interest is paid within 30 days of issuance of notice under section 73 (1); • a reduced penalty equal to 25% of the penalty imposed to be paid if the Service Tax, interest and reduced penalty is paid within 30 days of such order; and 15 www.sbsandco.com Changes in Penalty Provisions – 76, 78 & 80 Section 78 – Cases where involvement of ingredients specified in Section 78 are existing: • penalty shall be 100% of Service Tax amount; • reduced penalty = 25% of Service Tax is to be paid if Service Tax and interest is paid within 30 days of issuance of notice under section 73 (1); • a reduced penalty equal to 25% of the penalty imposed to be paid if the Service Tax, interest and reduced penalty is paid within 30 days of such order; and 16 www.sbsandco.com Changes in Penalty Provisions – 76, 78 & 80 Section 80 has been omitted. Hence, there cannot be any power to plead for waiver of the penalty. 17 www.sbsandco.com Changes in Abatement Rates – 26/2012 (1/2) For Transportation of Goods by Rail: The condition of non-availment of cenvat credit of input, input services and capital goods has been specified for availing the abatement. Hitherto, there was no condition for availing such abatement. For Transportation of Passengers by Rail: The condition of non-availment of cenvat credit of input, input services and capital goods has been specified for availing the abatement. Hitherto, there was no condition for availing such abatement. 18 www.sbsandco.com Changes in Abatement Rates – 26/2012 (2/2) For Transportation of Goods by Road: The taxable portion has been increased to 30% from 25%. For services provided in relation to Chit: The abatement has been withdrawn and accordingly full value of services provided by foreman becomes taxable. For Transport of Goods by Vessel: The taxable portion has been reduced from 40% to 30%. 19 www.sbsandco.com Changes in RCM/PCM– 30/2012 (1/2) In relation to services provided by a mutual fund agent or a distributor to a mutual fund or asset management company – the service receiver has to pay 100% of service tax - With effective from 01.04.2015; In relation to services provided by selling or marketing agent of lottery tickets to lottery distributor or selling agent – the service receiver has to pay 100% of service tax - With effective from 01.04.2015; In relation to manpower supply services – the service receiver has to be pay service tax at 100% instead of erstwhile 75% - with effective from 01.04.2015; 20 www.sbsandco.com Changes in RCM/PCM– 30/2012 (2/2) In relation to services provided by aggregator in any manner – the aggregator of service has to pay 100% - With effective from 01.03.2015. In case of provision of aggregator services using brand or trade name – the person providing such service shall be responsible for payment of service tax. 21 www.sbsandco.com Changes in Service Tax Rules, 1994 Registration can be obtained online at www.aces.gov.in – without visiting to the authorities. The following procedure has to be adopted: Application has to be made online at www.aces.gov.in; ST-2 shall be granted within 2 days based on trust; Documents have to be posted within 7 days to Superintendent; Premises visit only on necessity if approved by Addtl/Joint Commissioner; ST-2 may be revoked DC/AC after opportunity of being heard is granted; No Signed Copy of ST-2 is required – Download from ACES would suffice. 22 www.sbsandco.com Changes in Cenvat Credit Rules, 2004 (1/3) Rule 4 – 3rd Proviso – Time limit for availment of Cenvat Credit: Time limit for availment of Cenvat Credit has been extended from 6 months to 1 Year with effective from 01.03.2015; Rule 4(7) – Credit on Input Services in case of RCM/PCM and Others: The cenvat credit can be availed immediately after payment of service tax to the credit of central government in case of reverse and partial charge mechanism. The availment of credit after making payment to the vendor has been dispensed. The reversal within 3 months is made inapplicable to such cases. 23 www.sbsandco.com Changes in Cenvat Credit Rules, 2004 (2/3) Rule 14 – Recovery of Cenvat Credit: Where Cenvat Credit has been taken wrongly but not utilised, the same shall be recovered - Section 73 of Finance Act, 1994; Where Cenvat Credit has been taken and utilised wrongly, the same shall be recovered along with interest in terms of Section 75 of Finance Act, 1994; 24 Methodology for determining the credits: All credits taken during the month shall be deemed to have been taken on the last day of the month. Utilisation is as under: Opening Balance of the month has been utilised first; Credit admissible during the month has been utilised next; Credit inadmissible during the month has been utilised thereafter www.sbsandco.com Changes in Cenvat Credit Rules, 2004 (3/3) Rule 15 – Penalty: Cases where involvement of ingredients specified in Section 78 not existing – Penalty as laid down in Section 76 of Finance Act, 1994; Cases where involvement of ingredients specified in Section 78 existing – Penalty as laid down in Section 76 of Finance Act, 1994. 25 www.sbsandco.com SBS And Company LLP Chartered Accountants 6-3-900/6-9, Flat No. 103 & 104, Veeru Castle Durga Nagar Colony, Panjagutta, Hyderabad - 500 082 Telangana, India. Thanks for your patient hearing!!! CA Sri Harsha B.Com., A.C.A Our Presence in Telangana: Hyderabad (HO) Andhra Pradesh: Nellore, Kurnool, TADA (near Sri City), Vizag PH: +91 958100327 harsha@sbsandco.com +91-40-40183366 / +91-40-64584494 / +91-9246883366 Read our monthly e-Journal www.sbsandco.com/wiki